Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

21 November 2022 - 10:36PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

|

(Name of Registrant as Specified In Its Charter)

|

| |

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

LAND & BUILDINGS GP LP

L&B OPPORTUNITY FUND, LLC

L&B TOTAL RETURN FUND LLC

L&B MEGATREND FUND

L&B SECULAR GROWTH

LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC

JONATHAN LITT

COREY LORINSKY

MICHELLE APPLEBAUM

JAMES P. SULLIVAN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Land & Buildings Investment

Management, LLC (“Land & Buildings Investment Management”), together with the other participants in its solicitation (collectively,

“Land & Buildings”), has filed a definitive proxy statement and accompanying BLUE universal proxy card with the US Securities

and Exchange Commission (the “SEC”) to be used to solicit votes for the election of two highly-qualified director nominees

at the 2022 annual meeting of stockholders (the “Annual Meeting”) of Apartment Investment and Management Company, a Maryland

corporation (the “Company” or “Aimco”).

Item 1: On November 21, 2022,

Land & Buildings issued the following press release:

Land

& Buildings Issues Presentation Detailing Urgent Need for Change at Aimco

Believes Company Must Improve

Stewardship and Begin Earning Shareholders’ Trust to Unlock Trapped Value and Fulfill Its Potential

Sees Recent Governance

Maneuvers as Transparently Self-Serving – Especially Given That Aimco Instituted Terrible Governance Practices Just Two Years Ago

to Push Through a Spin-Out Without Shareholder Input

Views New Independent Directors

as Sorely Needed to Oversee Critical Decision-Making as Company Embarks on More than $2.5 Billion Development Pipeline and Critical Capital

Allocation Decisions are Made

Encourages Shareholders

to Vote the BLUE Universal Proxy Card to Elect Highly Qualified Nominees Michelle Applebaum and Jim Sullivan

STAMFORD, Conn. –

November 21, 2022 – Land & Buildings Investment Management, LLC (together with its affiliates, “Land & Buildings”,

“us” or “we”), a large shareholder of Apartment Investment and Management Company (NYSE: AIV) (“Aimco”

or the “Company”), today announced that it has issued a presentation outlining why

it believes change is needed in the Company’s boardroom. Land & Buildings has nominated two highly qualified director

candidates – Michelle Applebaum and James (“Jim”) P. Sullivan – for election to Aimco’s ten-person Board

of Directors (the “Board”) at the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) scheduled to

be held on December 16, 2022.

The presentation is available

at: https://aimhighaiv.com/aim-higher-improving-stewardship-to-reverse-underperformance-and-unlock-trapped-value/.

Key takeaways from the

presentation include:

| · | Aimco has a troubling track record of apparent disregard for shareholders. In December 2020, the

Company ignored a clear message from its shareholders and spun out 90% of its assets in a taxable transaction (the “Spin”)

without holding a Special Meeting, despite Land & Buildings receiving support from holders of nearly 50% of the Company’s shares

to call the meeting. |

| · | The Company has instituted and maintained archaic corporate governance practices, in Land & Buildings’

view. The Board used the Spin as an opportunity to install a classified board structure under the Maryland Unsolicited Takeover Act

(“MUTA”), an action universally regarded as terrible corporate governance, and to delay its annual meeting timeframe, typically

taking place in the spring, to December. |

| · | The Company has underperformed for years and has been undervalued both pre- and post-Spin. Pre-Spin,

Aimco was a persistent underperformer based on total shareholder returns (“TSR”) compared to its apartment peers, and consistently

traded well below net asset value (“NAV”). Post-Spin, Aimco continues to trade at a deep discount to its own stated NAV, yet

is pursuing a large-scale acquisition and development growth plan that requires an effective cost of capital the Company does not possess.

In our view, Aimco’s TSR also badly lagged peers post-Spin until Land & Buildings and others began accumulating large stakes

in the Company earlier this year. |

| · | Aimco seems to prefer to hide from shareholders. In what appears to us as an effort to escape investor

scrutiny, the Company holds no earnings conference calls, does not provide earnings guidance and has no investor outreach program to speak

of. Not surprisingly, Aimco also has no Wall Street analyst coverage. |

| · | Land & Buildings believes recent self-serving and reactive governance maneuvers are too little,

too late. Aimco’s November 15, 2022 announcement that it would de-stagger the Board in 2023, opt out of MUTA and move the 2024

Annual Meeting back to the first half of the year should be seen for what it is: a transparently self-serving set of moves, rather than

a sincere effort to improve corporate governance. In our view, the fact that these changes do not take effect immediately underscores

the Board’s lack of sincerity and reinforces the question: how can shareholders believe that Aimco will suddenly shift course

and begin acting in anyone’s best interests other than the Board’s without outside change? Shareholders deserve directors

that will take proactive measures. |

| · | We see an opportunity to unlock substantial value at Aimco, to the tune of an approximate 60% upside

to NAV – but change is needed urgently. Land & Buildings believes it is critical to improve stewardship and oversight at

the Board level now, as Aimco embarks on an ambitious >$2.5B development pipeline, while making substantial capital allocation decisions

over the next year that will have long-lasting impact on shareholder value. Land & Buildings’ analysis aligns with the Company’s

own stated year-end 2022 NAV of $12/share, yet Aimco trades at a 9% implied cap rate today and will need to make serious improvements

to reach its NAV goals. In our view, independent oversight is needed now to execute on Aimco’s vague promise to evaluate a “broad

range of options to enhance stockholder value.” |

| · | Land & Buildings believes its independent and exceptionally well qualified and experienced nominees

– Michelle Applebaum and Jim Sullivan – are the right individuals needed to help maximize shareholder value and realize Aimco’s

true potential. Ms. Applebaum has been a shareholder advocate for more than 30 years and is well-positioned to help Aimco improve

its corporate governance, make smarter investment decisions, and regain credibility among the investment community. Mr. Sullivan has been

a highly respected REIT analyst for more than 25 years and can help improve Aimco’s capital allocation, overall strategy, and investor

outreach. |

“Troubling corporate governance practices, underperformance

against peers and a stark disregard for shareholders have characterized Aimco for far too long, in our view,” said Land & Buildings

Founder and Chief Investment Officer, Jonathan Litt. “Further, we believe the Company’s latest announcement around corporate

governance ‘enhancements’ rings hollow when considering Aimco’s track record. It is clear to us that the incumbent Board

utterly lacks credibility and cannot be relied upon to represent shareholders’ best interests. We believe that Board change –

with the addition of directors who shareholders can trust – is essential for the Company to succeed at this critical time. We urge

shareholders to support our independent candidates to bring true accountability, improved oversight and independent perspectives to the

Board as it works to maximize value.”

WE STRONGLY URGE AIMCO SHAREHOLDERS

TO VOTE THE BLUE UNIVERSAL PROXY CARD TODAY FOR THE ELECTION OF BOTH

OF LAND & BUILDINGS’ HIGHLY QUALIFIED AND EXPERIENCED NOMINEES

Media Contact

Longacre Square Partners

Dan Zacchei

dzacchei@longacresquare.com

Investor Contact

Saratoga Proxy Consulting

John Ferguson

(212) 257-1311

Item 2: Also on November 21, 2022,

Land & Buildings uploaded the following materials to https://aimhighaiv.com/:

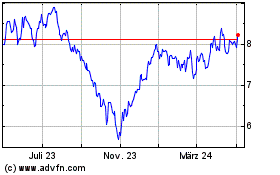

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

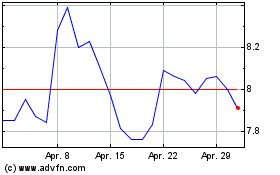

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024