b

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Name of Registrant as Specified In Its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Aimco CREATING VALUE INVESTOR PRESENTATION Nareit reitworld 2022 Annual Conference November 15-17,2022

Forward Looking Statement 2 This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding: Aimco’s business strategy, pipeline, and targeted opportunities. Forwardlooking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations. We caution investors not to place undue reliance on any such forward-looking statements. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: the effects of the coronavirus pandemic on Aimco’s business and on the global and U.S. economies generally, and the ongoing, dynamic and uncertain nature and duration of the pandemic, all of which heightens the impact of the other risks and factors described herein, and the impact on entities in which Aimco holds a partial interest, including its indirect interest in the partnership that owns Parkmerced Apartments, and the impact of coronavirus related governmental lockdowns on Aimco’s residents, commercial tenants, and operations; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which we operate and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions, dispositions, developments and redevelopments; expectations regarding sales of apartment communities and the use of proceeds thereof; insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of real estate presently or previously owned by Aimco; activities by stockholder activists, including a proxy contest; and such other risks and uncertainties described from time to time in filings by Aimco or the Separate Entities with the Securities and Exchange Commission (“SEC”).Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2021, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These forward-looking statements reflect management’s judgment as of this date, and Aimco assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances. Certain financial and operating measures found herein are used by management and are not defined under accounting principles generally accepted in the United States, or GAAP. These measures are reconciled to the most comparable GAAP measures at the end of this presentation. Definitions can be found in Aimco’s Earnings Release and Supplemental Schedules for the quarter ended September 30, 2022.Aimco CREATING VALUE

PRESENTATION OVERVIEW Key takeaways from the following presentation: 1. Aimco has created considerable shareholder value since the separation from AIR Communities as evidenced by Total Shareholder Return (TSR), significantly outpacing peers and major indices. 2. Aimco has substantial embedded value and growth opportunities in its deep development pipeline, and Aimco will continue to practice disciplined capital allocation while simplifying its business. 3. Aimco represents a compelling value proposition given the intrinsic value of its platform and its assets relative to the current share price; the Aimco Board and management team are committed to growing and unlocking shareholder value. 4. Aimco is an excellent corporate citizen, focused on sustainability, social responsibility, and strong corporate governance. Aimco CREATING

Aimco CREATING VALUE ABOUT AIMCO

AIMCO OVERVIEW Aimco is a diversified real estate investment company with a 28+ year history of growth and innovation in the multifamily sector. Since completing a strategic business separation in late 2020, the Aimco platform has been focused on a total return strategy that includes value add, opportunistic, and select alternative investments that offer the prospect of outsized returns on a risk-adjusted basis, while maintaining an allocation to stabilized properties. 15M sq ft AIMCO-CONTROLLED INVESTMENT PIPELINE NYSE: AIV WHERE AIMCO IS TRADED TARGET MARKETS Aimco CREATING VALUE

AIMCO MISSION To make real estate investments, primarily focused on the multifamily sector within targeted U.S. markets where outcomes are enhanced through our human capital and substantial value is created for investors, teammates, and the communities in which we operate. WHAT WE INVEST IN: Real estate assets and related businesses. Primarily focused on Value-Add investments in the Multifamily Sector. WHERE WE INVEST: Select U.S. Markets where barriers to entry are high, where target customers can be clearly defined, and where Aimco has a Comparative Advantage over others in the market; which may include local market knowledge from regional investment teams. HOW WE INVEST: Primarily through Direct Investment In The General Partner Position with occasional direct limited partner and indirect investments

Aimco CREATING VALUE AIMCO INVESTMENTS Aimco couples outsized growth prospects from opportunistic investments with the safety of a stable multifamily portfolio resulting in a nimble platform that can move the needle quickly. Investment in Value Add and Opportunistic Real Estate Provides outsized growth opportunities compared to a primarily stabilized apartment portfolio Aimco invests where it has the local knowledge and expertise that provides a comparative advantage over other developers and mitigates execution risk Maintain a portfolio of Core and Core Plus Real Estate Provides stability and safety compared to a pure development portfolio Aimco’s diversified portfolio of apartments in major U.S. markets provides additional certainty of performance through local economic cycles Flexibility to make Alternative Investments Provides the option to make limited investments with asymmetric upside and downside protection Aimco CREATING VALUE

ACCOMPLISHMENTS: EXECUTING ON AIMCO STRATEGY

EXECUTING ON STRATEGY Accomplishments Plan ESG Appendix Investment Thes Aimco has created substantial value for shareholders by executing its plan focused on: Since Separation1 45% (1%) 19% 11% 9% (1%) AIV Developer Peer Group FTSE Apartment Equity Index MSCI US REIT Index S&P 500 Russell 2000 Maximizing Real Estate Investment Performance Prudent and Opportunistic Capital Allocation Maintaining a Strong Balance Sheet and Accessing Capital Markets Accelerated Independence from AIR [1] Performance measured from the start of when-issued trading on December 14, 2020, through October 31, 2022. Developer Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K); represents simple average Accomplishments Plan ESG Appendix Investment

EXECUTING ON STRATEGY Thesis REAL ESTATE INVESTMENT PERFORMANCE Development and Redevelopment Expertise Since the separation from AIR: Aimco has successfully invested more than $400M of capital in development and major redevelopment projects Aimco executed 1,200 leases on newly constructed and delivered apartment homes at rental rates averaging ~115% of target The Fremont 256 Unit Development Prism 136 Unit Development 707 Leahy 110 Unit Major Redevelopment Flamingo Point North 366 Unit Major Redevelopment Aimco CREATING VALUE

EXECUTING ON STRATEGY Accomplishments Investment Thesis Plan ESG Appendix Active Project Summaries As of 3Q 2022 (dollars in millions) (unaudited) Number of units approved for development or redevelopment Land Cost/Leasehold Value Direct Investment PlannedTo-Date Remaining Expected NOI Stabilization[2] The Benson Hotel and Faculty Club106 $ 6.2 $ 63.8 $ 48.8$ 15.0 4Q 2026 Upton Place [1]689 92.8 260.0 128.8 131.2 4Q 2026 The Hamilton276 67.1 97.6 85.3 12.33Q 2024 Oak Shore246.147.115.931.22Q 2025[1] Planned direct investment for Upton Place at Aimco's 90% share is $234 million.[2] Timing of stabilization is subject to change and is based on the best estimate at this time.~$190 million of additional Aimco capital necessary to complete active projects of which 87% will be drawn on in place construction loans with capped interest rate exposure Current active projects are expected to produce $38 million of NOI when stabilized REAL ESTATE INVESTMENT PERFORMANCE The Benson Upton Place Oak Shore The Hamilton 11

EXECUTING ON STRATEGY Accomplishments Plan Investment Thesis ESG Appendix REAL ESTATE INVESTMENT PERFORMANCE Aimco owns a portfolio of 20 stabilized apartment communities with 5,542 apartment homes diversified by geography and price point. PORTFOLIO STATS64%26%10%Class B Class C+ Class A21.6%3Q Rent-to-Income Ratio $2,1733Q Avg Monthly Revenue per Home YTD 3Q 2022 RESULTS97.4%Average Daily Occupancy11.0%Revenue Growth15.8%NOI Growth ANNUALIZED RENT GROWTH (‘08/’09 & ’20) ‘08/’09 '20-2.1%-5.9%-2.6%-7.4% Class B Class A During the GFC and Covid, Class B rents, on average, were 20% more resilient than Class A rents. Source: Real Page, Green Street, and Company Records Class A refers to apartment communities with rents >120% of local market average Class B refers to apartment communities with rents between 90% and 120% of local market average Class C refers to apartment communities with rents less than 90% of local market average 12

Accomplishments Plan Investment ESG AppendixThesis$1Bn of Asset Dispositions at Favorable Pricing•$669Mofleasehold development assets monetized at more than $750k per unit•$265M from the sale of three assets at a premium to our internal NAV estimate and by selling a partial interest in our passive IQHQ investment, generating >50% IRR Accessed the Capital Markets•$781M of fixed rate non-recourse property debt locked in significantly below today’s potential refinancing levels•$360M of programmatic capital with the Alaska Permanent Fund Corporationto fund up to $1Bn of Aimco led multifamily development projects with third party management fees and potential for incentive income to add to existing JVs Expand Investment Pipeline •Aimco has tripledits investment pipeline since the separation from AIR and now has the opportunity to develop 15 million square feet EXECUTING ON STRATEGY13PRUDENT AND OPPORTUNISTIC CAPITAL ALLOCATIONUSED CAPITAL TOSOURCED CAPITAL FROM Fortify Aimco’s Balance Sheet•$1Bn of near-term liabilities retired or refinanced, eliminating substantially all floating rate exposure Return Capital to Shareholders•>1.4M shares repurchased at ~$6.47 per share

SIMPLIFYING THE RELATIONSHIP WITH AIR Accomplishments Plan Investment Thesis ESG AppendixEXECUTING ON STRATEGY14AIR Transition / Relationship Items Separation Now Notes Payable to AIR$534M @ 5.2% due Jan 2024Paid in full AIR Lease Liabilities Four leases for $469MOne lease for $6.1MPurchase option/ROFOPurchase option on any stabilized asset Aimco brings into its portfolio Right of first offer on any development or redevelopment that Aimco chooses to bring to market within one year from its stabilization Reimbursements and Consulting Services~$6M per year for consulting with respect to strategic growth, direction, and advice Expires at year end 2022Since the separation in December 2020, Aimco has simplified the relationship with AIR through the early repayment of the $534 million purchase money note, the reduction of leasehold liabilities from $469 million down to $6.1 million, and the amendment of key provisions of the master leasing agreement with AIR. Aimco maintains less material contracts with AIR such as property management and transition services. Slide 15Accomplishments Plan Investment ESG Appendix Thesis EXECUTING ON STRATEGY15IMPROVING THE BALANCE SHEET Since the separation from AIR, Aimco proactively fortified its balance sheet ahead of what appeared to be worsening conditions in the debt markets. As of September 30, 2022, Aimco had: Lowered total leverage1from $1.5Bn2to $1.1BnHedged 100% of its floating rate exposure Reduced leverage maturing through 2024 by $1Bn (from $1.2Bn to $0.2Bn)A favorable mark-to-market on its leverage, inclusive of interest hedges, of ~$150M[1] Total leverage includes property-level debt and lease liabilities.[2] Calculated post-separation as of 1/1/2021.Nearly doubled its weighed average term to maturity

Accomplishments Plan Investment ESG Appendix Thesis EXECUTING ON STRATEGY15 IMPROVING THE BALANCE SHEET Since the separation from AIR, Aimco proactively fortified its balance sheet ahead of what appeared to be worsening conditions in the debt markets. As of September 30, 2022, Aimco had: Lowered total leverage1from $1.5Bn2to $1.1BnHedged 100% of its floating rate exposure Reduced leverage maturing through 2024 by $1Bn (from $1.2Bn to $0.2Bn)A favorable mark-to-market on its leverage, inclusive of interest hedges, of ~$150M[1] Total leverage includes property-level debt and lease liabilities.[2] Calculated post-separation as of 1/1/2021.Nearly doubled its weighed average term to maturity

Accomplishments Plan Investment ESG Appendix Thesis UTILIZING 3rdPARTY EQUITY TO FUND PROJECTS AND SCALEEXECUTING ON STRATEGY16Hypothetical Project Example Aimco 100% of Development Equity Aimco 20% GP with80% LP Capital Uses Amico Land Basis$35$35Development Costs$180$180Development Fee (3%)$5$5Closing Costs (2%)$4$4Accrued Interest$16$16Total Development Cost$240$240SourcesConstruction Debt (50% LTC)$120$120Aimco Equity$120$243rd Party Equity N/A$96Total Sources$240$240Return on Equity NOI During Hold Period$14$14Stabilized Value$307$307Construction Debt Payoff($121)($121)Total Proceeds / Equity Value$201$201LP Partner Value / Proceeds N/A$146LP Partner Multiple on Equity N/A1.5xLP Levered IRRN/A18.0%Aimco Pro Rata Development FeeN/A$4Aimco Pro Rata Return Distribution N/A$40Aimco Promoted Distribution N/A$9Aimco Total Proceeds$201$53Multiple on Aimco Equity1.6x2.2xLevered IRR to Aimco20.9%35.1%BALANCE INCREMENTAL FINANCIAL LEVERAGE WITH DIVERSIFICATION OF AIMCO CAPITAL Aimco plans to diversify its capital invested and limit the incremental amount of Aimco capital needed, by using 3rdparty equity sourced from JV partners and construction debt to fund the build out of its investment pipeline when conditions are right. Aimco expects to monetize certain developments when prudent and retain ownership of phased developments.

PLAN: OPTIMIZING GROWTH

OPTIMIZIN GGROWTH Accomplishments Plan Investment Thesis ESG Appendix ALLOCATE AIMCO CAPITAL ACCRETIVELY INVEST CAPITAL PRUDENTLY balancing growth, opportunistic share repurchases, while maintaining balance sheet stability DEVELOPMENT FUNDING selectively advance pipeline projects RETURN OF CAPITAL TO SHAREHOLDERS share repurchases and dividend payments DEBT REDUCTION providing reduced costs and optionality 18

Accomplishments Plan Investment ESG Appendix Thesis OPTIMIZING GROWTH 19 0% 10% 20% 30% 40% 50% 60% 70% 80% Value Add &Opportunistic Real Estate Core & Core Plus Real Estate Alternative Investments Cash, Hedges, &Other Net Assets Current Target AIMCO TARGET ALLOCATION BY SEGMENT & SECTOR Approximate Current Allocation Target Allocation Target Leverage Avg. Annualized Project-Level Return on Equity [2] Value Add & Opportunistic Real Estate 25% 40% -60% 65% ~18% Core & Core Plus Real Estate [1] 55% 35% -45% 50% ~9% Alternative Investments 10% 0% -5% 0% ~15% Cash, Hedges, & Other Net Assets 10% 5% -10% 0% 0% [1] Includes covered land, or properties that earn a current return as we wait for the land to appreciate and timing to be right for redevelopment or monetization. [2] Individual project-level return on equity is subject to specific investment risk profiles and market dynamics, a range of outcomes is likely. Total Expected Annualized Returns on Equity 12% -16%

Accomplishments Plan Investment ESG Appendix Thesis Benson Hotel and Faculty Club Flying Horse Fitzsimons 4Fitzsimons add’l phases Oak Shore Upton Place Strathmore Phase 1Strathmore Phase 2Strathmore add'l phases The Hamilton Hamilton House300 Broward One Edgewater3333 Biscayne Flagler Village Phase 1Flagler Village add'l phases Brickell Assemblage OPTIMIZINGGROWTH 20 EXECUTE ON PIPELINE INVESTMENTS Aimco Investments Estimated Size (sq ft) Timing (subject to market conditions and capital allocation opportunities) Active Construction 1,900,000 Stabilizing over next 2 –4 years Near Term 2,400,000 Ready for vertical construction within 12 months Mid Term 5,300,000 Ready for vertical construction between 12 and 24 months Long Term 5,900,000 Ready for vertical construction beyond 24 months Total 15,500,000 Aimco Target Markets See Appendix pages 31-36 for additional details.

OPTIMIZING GROWTH Accomplishments Plan Investment Thesis ESG Appendix SIMPLIFYING THROUGH GEOGRAPHIC FOCUS Aimco will focus new investment activity within three target markets where fundamentals are sound, the opportunity set is large and Aimco has local market expertise offering a comparative advantage.Washington D.C. Metro Population 6.4 million DenverMetro Population 3.0 million Southeast Florida Population 6.1 million Green Street Market Score:A- Green Street Market Score:A Green Street Market Score:A- Median household income:$110k (1.5x US) Median household income:$91k (1.3x US) Median household income: $64k (0.9x US) Median home value:$498k (1.5x US) Median home value:$520k (1.8x US) Median home value:$363k (1.3x US) Educational attainment:53.4% (1.5x US) Educational attainment:47.8% (1.4x US) Educational attainment:35.3% (1.0x US) Source: U.S. Census Bureau 2021 MSA Data, Green Street Market Score (D.C. Metro, Denver, and the average of Miami and Fort Lauderdale) 21

INVESTMENT THESIS: VALUE PROPOSITION

VALUE PROPOSITION Accomplishments Plan Investment Thesis ESG Appendix SHARE PRICE RELATIVE TO NAV SHARE PRICE RELATIVE TO NAV Aimco provides a significant value proposition given the intrinsic value of its platform and its assets relative to the current share price.Month End Share Price Since Separation Aimco’s 50-day moving average=$8.05 pershare1 The Aimco board and management team are committed to narrowing the gap and unlocking shareholder value. NAV Estimate2 $14 $13 $12 $11 $10 $9 $8 $7 $6 $5 $4 $3 $2 $1 Dec-20 Feb-21 Apr-21 Jun-21 Aug-21 Oct-21 Dec-21 Feb-22 Apr-22 Jun-22 Aug-22 Oct-22 [1] Source: NYSE as of 11/02/2022 [2] Previous forecast of 2022 year end NAV per share published during 1Q 2022 including developments at cost.

ESG: EXCELLENT CORPORATE CITIZENSHIP

EXCELLENT CORPORATE CITIZENSHIP Accomplishments Plan Investment Thesis ESG Appendix ENVIRONMENTAL STEWARDSHIP: COMMITMENT TO CONSERVATION & SUSTAINABILITY BUILDING COMMUNITIES THROUGH DESIGN AND PLANNING LEADERSHIP IN ENERGY & ENVIRONMENTALDESIGN LEED GOLD 2021 LEADERSIP IN ENERGY & ENVIRONMENTAL DESIGN LEED SILVER 2021 Every development and redevelopment project is built with conservation, sustainability, resilience, and climate-related risks and opportunities in mind, including respected environmental certifications. Further, we have implemented a number of measures throughout our portfolio to reduce our environmental footprint, including innovative technologies. KEYLESS ENTRY LED LIGHTING RESIDENT & OFFICE RECYCLING SMART THERMOSTATS WATER SENSORS Inaugural Reporting to Task Force on Climate-Related Financial Disclosures (TCFD) in 2022 Corporate Responsibility Report In 2022, Aimco conducted climate-risk assessments for each of its assets and land and building acquisitions. 25

EXCELLENT CORPORATE CITIZENSHIP Accomplishments Plan Investment Thesis ESG Appendix ENVIRONMENTAL STEWARDSHIP: CASE STUDY THE HAMILTON MIAMI, FL REDEVELOPMENT OF THE HAMILTON IN MIAMI, FL Retained the building's original footprint,significantly reducing construction waste Converted enclosed atrium to an open-air lobby with extensive plantings Waterproofed building using high impact glass throughout the building Installed modernized fixtures and systems; including, low–flow plumbing fixtures to increase water conservation and LED lighting, high efficiency appliances and HVAC units to reduce energy usage Waterproofed the existing below-grade parking garage and proactively wired it for EV charging Installed native landscaping Rebuilt the property’s sea wall to provide protection for weather events including long-term sea-level rise and creating a habitat for marine life 26

EXCELLENT CORPORATE CITIZENSHIP Accomplishments Plan Investment Thesis ESG Appendix SOCIAL RESPONSIBILITY: COMMITMENT TO OUR TEAMMATES, CUSTOMERS & COMMUNITIES INVESTMENTS IN TEAMMATES & COMPANY CULTURE… Workplace flexibility Parental leave –16 weeks paid leave Healthy work environments …SHOWING TANGIBLE RESULTS HIGHLY ENGAGED TEAM Record 4.52 (out of 5 stars) team engagement for 2022: 92% employee response rate A WORKFORCE RICH WITH DIVERSE BACKGROUNDS, PERSPECTIVES LEADS TO IMPROVED OUTCOMES AIMCO’S HUMAN CAPITAL COMPOSITION AT A GLANCE SUPPORTING OUR COMMUNITIES WITH PARTNERSHIPS, OPPORTUNITIES FOR TEAMMATES TO VOLUNTEER Providing teammates with 15 hours of paid volunteer hours through AimcoCares Partnership with Camillus House in 2022, pledging $1M over four years for expansion of Camillus House’s workforce development programs 67% Women in executive management 43% Women and racial/ethnic minorities in senior leadership positions (all officers) 53% Women and racial/ethnic minorities company-wide South Florida Business Journal’s HEALTHIEST EMPLOYERS 20222 2022 Metro Denver’s HEALTHIEST EMPLOYERS 27

EXCELLENT CORPORATE CITIZENSHIP Accomplishments Plan Investment Thesis ESG Appendix STRONG GOVERNANCE: HIGHLY REGARDED AND RECONSTITUTED BOARD Eight of ten Aimco directors are independent, six of which were appointed within the past 2 years Quincy L. AllenCO-FOUNDER AND MANAGING PARTNER,ARC CAPITAL PARTNERS Appointed 2020 Terry Considine CEO, APARTMENT INCOME REIT CORP. CHAIRMAN AND CEO, AIMCO 1994-2020 Appointed 1994 Patricia L. Gibson FOUNDING PRINCIPAL AND CEO,BANNER OAK CAPITAL PARTNERS Appointed 2020 Jay Paul Leupp CO-FOUNDER, MANAGING PARTNER AND SENIOR PORTFOLIO MANAGER, REAL ESTATE SECURITIES, TERRA FIRMA ASSET MANAGEMENT Appointed 2020 Robert A. Miller CHAIRMAN OF THE BOARD SINCE 2020 Appointed 2007 Wesley Powell PRESIDENT, CHIEF EXECUTIVE OFFICER Appointed 2020 Deborah Smith CO-FOUNDER AND CEO, THE CENTERCAP GROUP Appointed 2021 Michael A. Stein FORMER CFO ICOS CORPORATION, NORDSTROM, INC., & MARRIOTT INTERNATIONAL, INC. Appointed 2004 R. Dary Stone CEO, R. D. STONE INTERESTS Appointed 2020 Kirk A. Sykes CO-MANAGING PARTNER, ACCORDIA PARTNERS, LLC Appointed 2020 28

APPENDIX

SENIOR LEADERSHIP TEAM Accomplishments Plan Investment Thesis ESG Appendix Jennifer Johnson EVP, CHIEF ADMINISTRATIVE OFFICER, GENERAL COUNSEL 18 Years with Aimco Wes Powell PRESIDENT & CHIEF EXECUTIVE OFFICER 18 Years with Aimco Lynn Stanfield EVP & CHIEF FINANCIAL OFFICER 21 Years with Aimco Lee Hodges SENIOR VICE PRESIDENTSOUTHEAST REGION 7 Years with Aimco Previously with: Peebles Development The Related Group Matt Konrad SVP EASTERN REGION & NATIONAL TRANSACTIONS 5 Years with Aimco Previously with: Brandywine Realty Akridge Elizabeth (Tizzie) Likovich SENIOR VICE PRESIDENTCENTRAL REGION 2 Year with Aimco Previously with: UDR Wells Fargo Tom Marchant SENIOR VICE PRESIDENTACCOUNTING, TAX, & FP&A 8 Years with Aimco Previously with:Extra Space Storage Deloitte John Nicholson SENIOR VICE PRESIDENT DEBT & CAPITAL MARKETS 18 Years with Aimco Derek Ullian SENIOR VICE PRESIDENTWESTERN REGION 6 Years with Aimco Previously with: Benchmark RE Group Hellmuth, Obata + Kassabaum

PIPELINE DETAILS Accomplishments Plan Investment Thesis ESG Appendix BRICKELL ASSEMBLAGEMIAMI / FL Acres: 4.25• GSF of Development: ~3,000,000• Green Street Submarket Grade: A+• Aimco’s Financial Interest: Aimco is sole owner of Yacht Club Apartments and 1001 Brickell Bay Drive. 31

PIPELINE DETAILS Accomplishments Plan Investment Thesis ESG Appendix EDGEWATER ASSEMBLAGEMIAMI / FL Acres: 8.3• GSF of Development: ~2,300,000• Green Street Submarket Grade: A-• Aimco’s Financial Interest: Aimco is sole owner of The Hamilton and the adjacent land which can accommodate ~1.3M sf. Aimco has a 20% interest in the remaining assemblage. 32

PIPELINE DETAILS Accomplishments Plan Investment Thesis ESG Appendix FLAGLER VILLAGEFORT LAUDERDALE / FL Acres: 8.8• GSF of Development: ~3,000,000• Green Street Submarket Grade: A-• Aimco’s Financial Interest: Aimco is the sole owner. 33

PIPELINE DETAILS Accomplishments Plan investment ESG Appendix BROWARDFORT LAUDERDALE / FL Acres: 4.2• GSF of Development: ~2,000,000• Green Street Submarket Grade: A-• Aimco’s Financial Interest: Aimco owns 51% of the venture. 34

PIPELINE DETAILS Accomplishments Plan Investment Thesis ESG Appendix STRATHMORE SQUAREBETHESDA / MD Acres: 8.0 • GSF of Development: ~1,500,000• Green Street Submarket Grade: A++• Aimco’s Financial Interest: Aimco has a 50% interest in the first two of six phases of development with options to increase participation 35.

PIPELINE DETAILS Accomplishments Plan Investment Thesis ESG Appendix FITZSIMONSANSCHUTZ MEDICAL CAMPUS AURORA / CO Acres: 5.2• GSF of Development: ~1,500,000• Green Street Submarket Grade: B+• Aimco’s Financial Interest: Aimco is the sole owner of options to purchase the only multifamily parcels on the campu. 36

ASSET LIST Accomplishments Plan Investment Thesis ESG Appendix Operating Apartment Communities Operating Office Building Property Name Location Apartment Homes Property Name Location Square Feet118-122 West 23rd Street New York, NY 42 1001 Brickell Bay Drive Miami, FL 300k173 E. 90th Street New York, NY 72 237-239 Ninth Avenue New York, NY 36 Active Projects1045 on the Park Apartments Homes Atlanta, GA 30 Property Name Location Approved Units2200 Grace Lombard, IL 72 The Benson Hotel & faculty Club Denver, CO 106Bank Lofts Denver, CO 125 The Hamilton Miami, FL 276Bluffs at Pacifica, The Pacifica, CA 64 Oak Shore Corte Madera, CA 24Eldridge Townhomes Elmhurst, IL 58 Upton Place Washington, DC 689Elm Creek Elmhurst, IL 400 Evanston Place Evanston, IL 190 Development Land Hillmeade Nashville, TN 288 Property Name Location Acres Hyde Park Tower Chicago, IL 155 Broward Assemblage Fort Lauderdale, FL 4.2Plantation Gardens Plantation ,FL 372 Edgewater Assemblage Miami, FL 8.3Royal Crest Estates Warwick, RI 492 Fitzsimons Aurora, CO 5.2Royal Crest Estates Nashua, NH 902 Flagler Village Fort Lauderdale, FL 8.8Royal Crest Estates Marlborough, MA 473 Flying Horse Colorado Springs, CO 7.5Waterford Village Bridgewater, MA 588 Strathmore Square Bethesda, MD 8.0Wexford Village Worcester, MA 264 Willow Bend Rolling Meadows, IL 328 Alternative Investments Yacht Club at Brickell Miami, FL 357 Investment Name Investment Type Yorktown Apartments Lombard, IL 292 IQHQ Passive Equity Parkmerced Mezzanine Loan Partnership Owned RE Tech Funds Passive Equity Casa del Hermosa La Jolla, CA 41 Casa del Mar La Jolla, CA 30 Casa del Norte La Jolla, CA 34 Casa del Sur La Jolla, CA 37 St. George Villas St. George, SC 40 37

NON-GAAP RECONCILIATION Accomplishments Plan ESG Appendix Investment Thesis PROPERTY NET OPERATING INCOME (NOI): NOI is defined by Aimco as total property rental and other property revenues less direct property operating expenses, including real estate taxes. NOI does not include: property management revenues, primarily from affiliates; casualties; property management expenses; depreciation; or interest expense. NOI is helpful because it helps both investors and management to understand the operating performance of real estate excluding costs associated with decisions about acquisition pricing, overhead allocations, and financing arrangements. NOI is also considered by many in the real estate industry to be a useful measure for determining the value of real estate. Reconciliations of NOI as presented in this report to Aimco’s consolidated GAAP amounts are provided below. Due to the diversity of its economic ownership interests in its apartment communities in the periods presented, Aimco evaluates the performance of the apartment communities in its segments using Property NOI, which represents the NOI for the apartment communities that Aimco consolidates and excludes apartment communities that it does not consolidate. Property NOI is defined as rental and other property revenue less property operating expenses. In its evaluation of community results, Aimco excludes utility cost reimbursement from rental and other property revenues and reflects such amount as a reduction of the related utility expense within property operating expenses. The following table presents the reconciliation of GAAP rental and other property revenue to the revenues before utility reimbursements and GAAP property operating expenses to expenses, net of utility reimbursements as presented on Supplemental Schedule 6 of Aimco’s Third Quarter 2022 Earnings Release and Supplemental Schedules Segment NOI Reconciliation Nine Months Ended (in thousands)September 30, 2022 September 30, 2021 Total Real Estate Operations Revenues, Before Utility Reimbursements Expenses, Net of Utility Reimbursements Revenues, Before Utility Reimbursements Expenses, Net of Utility Reimbursements Total (per consolidated statements of operations) $ 148,375 $ 56,384 $ 123,115 $ 51,500 Adjustment: Utilities reimbursement (4,221) (4,221) (3,719) (3,719)Adjustment: Other Real Estate (13,619) (4,085) (9,783) (3,251)Adjustment: Non-stabilized and other amounts not allocated (30,533) (17,204) (19,486) (14,104)Total Stabilized Operating (per Schedule 6) $ 100,002 $ 30,874 $ 90,127 $ 30,426 38

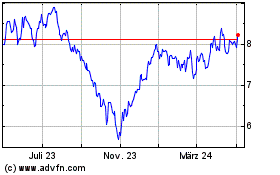

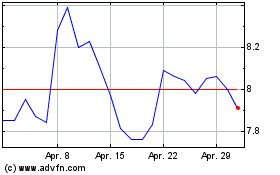

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024