UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

|

(Name of Registrant as Specified In Its Charter)

|

| |

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

LAND & BUILDINGS GP LP

L&B OPPORTUNITY FUND, LLC

L&B TOTAL RETURN FUND LLC

L&B MEGATREND FUND

L&B SECULAR GROWTH

LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC

JONATHAN LITT

COREY LORINSKY

MICHELLE APPLEBAUM

JAMES P. SULLIVAN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Land & Buildings Investment

Management, LLC (“Land & Buildings Investment Management”), together with the other participants named herein (collectively,

“Land & Buildings”), has filed a preliminary proxy statement and accompanying BLUE universal proxy card with the US Securities

and Exchange Commission (the “SEC”) to be used to solicit votes for the election of two highly-qualified director nominees

at the 2022 annual meeting of stockholders (the “Annual Meeting”) of Apartment Investment and Management Company, a Maryland

corporation (the “Company” or “Aimco”).

On October 18, 2022, Jonathan

Litt of Land & Buildings presented at the 13D Monitor Active-Passive Investor Summit, which included a discussion and presentation

about the Company. A written transcript of the discussion is included below and a copy of the presentation is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

Welcome everyone. Just

make sure my slides are working.

Slides.

Okay, great. My name's

Jon Litt. I'm the founder and CIO of Land & Buildings. We are a fund which invests in publicly traded real estate stocks. I thought

I'd start by telling a story about an older couple, Maurice and Stella.

They've been going to a

county fair for 20 years and they walk around the fair every year, and they go by this one event, which was a stunt plane, and there was

a pilot there, and they would sit there and Maurice would say, how much he wants to do this stunt plane. Maurice and Stella would say,

but it's 50 bucks and 50 bucks is 50 bucks and so for 20 years they didn't do it… and then they're getting older now, late seventies,

they're there and the pilot overhears them talking about it, and he comes over and he goes, You know what? I've heard you guys talking

about this for 20 years, I'm gonna make you a deal. If you go on the plane and you don't say a word, you don't scream, nothing you can

have the ride for free, but if you say anything, it's gonna be 50 bucks. And they talked to each other, and they said, okay, we can do

this. So they get in the plane and they take-off, pilot is trying to do everything he can to make them scream. He's doing loop-de-loops,

he's doing nose dives, he's getting the plane upside-down. Not a peep comes outta the plane. They land, they get out of the plane. The

pilot's standing there, Maurice is standing there. And Maurice, the pilot, says, Maurice, where’s Stella? And Maurice says, Oh,

she fell out on the first loop-de-loop and he goes, Why didn't you say anything? He said, 50 bucks is 50 bucks.

I've been investing in

and analyzing REITs for 30 years. It took me 20 years to realize that not every board and management knows more than I do or talented

and can figure out how to unlock value. As in all walks of life, you have high performers, average performers, and you have underperformers.

And we set about to work

on those underperforming companies and undertake activism. We've been involved in about 40 activist campaigns. We've completed 35. We've

made very good returns for our investors the last 10 plus years, and we've had the spectrum of outcomes you would expect an activist to

have. Board members, management team changes, mergers, spin-outs, companies sold, turnarounds and it's been quite rewarding and by and

large it's been collaborative with the boards and management teams. It is remarkably refreshing when we walk into a board, we've done

our [inaudible] and we're like, you know, we think there's some things you can do here.

And we had one this year,

which was really a terrific outcome. And then again, we know there's a problem, we're trying to figure out how to fix it. We’ve

been very involved in the residential real estate space, doing six, six or so transactions. And this one company, and I'm gonna, I think

I'm getting ahead of myself here on the presentation. Here's the different campaigns we've had in residential space. This one is American

Campus Communities. They own student housing. We bought the stock. I knew the company; I knew many of the board members for 17 years since

the IPO. They had underperformed badly before the pandemic and we thought we understood what it had to do. The board was quite receptive.

We got three new people on the board, we got a capital allocation committee, and we sat about working with the board, and we were of the

view, we can fix this or we can sell. We had a pretty clear view on what the value was and we spent probably a year working with the board

on it and ultimately the value was still well below where it would trade in the private market. And the company was sold. The board came

to that decision. We were, you know, being particularly aggressive here. It was a good board, a good management team, and they made a

good decision. We made almost a double on the stock in the year plus that we were invested.

That takes us to the current

opportunity, which is an apartment REIT, it's called Aimco. I've known this company since its IPO in 1994 and it was run by a gentleman

who is still involved with the company and had a really poor track record relative to other apartment companies and, in the fall of 2020,

the board and leadership team decided to spin out 90% of the assets into a new entity. Effectively taking all the best assets and creating

a new track record and dispensing with the old track record. It was horribly tax-inefficient for all of the shareholders and we protested

and said, hey, this doesn't make sense. Why don't you ask shareholders what they think and we got on nearly 50% of the shareholders that

agreed to call a special meeting, which was well above the threshold we needed.

But the company was determined

to go ahead with the spin and they jammed it through before we could get to a vote on the transaction. The RemainCo, which is Aimco traded

horribly. The company itself says the value of this company is in the 12 dollar range. We agree that it's in the 12 dollar range, trading

at 6 dollars and 68 cents.

And they've done almost

nothing to unlock value. So the market's gotten more difficult, as we all know the capital markets, but apartments continue to be a highly

sought-after asset class. Financing for this business is still robust. Fannie and Freddy are financing. They’ve allocated an enormous

amount of money to apartments, to residential and that doesn't exist in most parts of the M&A market today.

The business is very strong.

People with 7% mortgage rates are forced to rent because they can't buy. The problem here is why does this trade with 80% upside to NAV?

That we calculate, that the company calculates, and we think it's because there's deep concerns by investors about the leadership of the

company.

It has no analyst coverage.

Two years after it was spun out or the rest of the company is spun out, they've had no earnings conference calls. They don't participate

in any investor conferences. In response to us in the fall of ‘20, they staggered the board. This is like a cardinal sin in my view

and they're a Maryland REIT, mean really you could do anything in Maryland.

And most REITs that are

in Maryland have opted out of the ability to stagger their board, which they did not do, and they obviously staggered the board and they

delayed their annual meeting from your typical second quarter to December. Really the last possible moment. The failure to take actions

to maximize value for shareholders, I believe, is why this company trades at a substantial discount.

We think, as we do with

most companies we're involved with, that there are clear ways to fix the company, and if you can't fix it, then you need to evaluate selling

it.

In August, a company called

Westdale filed a 13D on Aimco. Westdale is a large owner of apartments, about five or six billion worth of apartments. Prior to the spin,

they made an offer to buy Aimco pre-spin and we believe they and others would be highly interested in this portfolio of real estate if

the company is unsuccessful at closing the gap to net asset value.

Couple of things, which

we believe that they've done wrong and I've discussed these. The pre-spin Board has disenfranchised shareholders by staggering the board

and delaying the meeting. They've overseen decades of underperformance. This is an orphan stock with zero sell-side coverage. Its earnings

calls, no investor conferences.

The asset quality is much

better than perceived. I'm gonna talk about that in a moment. And Terry Considine, the one that oversaw the poor performance before the

spin continues to be on the board. He wanted to be the CEO and we protested. He's still on the board. He shouldn’t be on the board

here. And we think that's one of the impediments to investors getting behind the stock.

I don't know if Ken Griffin

was speaking today or is here, but we're gonna bring his presence here to explain where we see real hidden jewels in this company.

It's a good portfolio of

real estate. I'm not gonna have you read all this, 5,000 units in good markets. Okay, so this company before the pandemic bought an apartment

complex in Brickell, Miami. You can see that there's the Yacht Club that's actually apartments. You see the one above it? 1001 Brickell

Bay is an office building. These are older buildings. They need a healthy rehab, good value. A lot's happened since the pandemic. Florida's

gotten pretty hot. A lot of financial firms are going there, but one in particular, Citadel, just bought that parking lot in the bottom

right for $363 million. A hundred and forty bucks, 140 million bucks an acre. That's remarkable, right? So Citadel's gonna have their

headquarters, I'm gonna suspect there's gonna be some high paying jobs that are gonna be located in that building and they're gonna need

places to stay. And this company owns an apartment building on the water and an office building and apartment on the water, which both

are gonna be renovated.

The South Florida portfolio

of Aimco is the crown jewel of this company. 30% of the asset value, the value's gone up materially and we think it's gonna continue to

go up and we think there's matters like this, which are missed as the investors are looking at it.

We think it's easy to unlock

the value. Obviously a sale of the company, this is a bite size, three or four billion. There's many investors that we believe would buy

this portfolio today. Probably the values above where we're assigning it. We're trying to be conservative in light of what's happening

in the capital markets.

But what we've asked the

company to do, and we've had zero response from them, is de-stagger the board now. Opt out of MUTA now, that is the inability to re-stagger

the board. Move the annual meeting back to May. Remove Terry Considine, who has been a point of consternation for investors from the board.

Refresh the board with independent board members. And while many of these board members haven't been here long, they're all handpicked

by the old board. Have a robust investor outreach program. Pretty simple. Start with an earnings call. Start with reaching out to the

traditional investors in the real estate space. Accelerate the pace of asset sales and monetizations and aggressively buy back stock.

To demonstrate to investors that you want to get this stock to net asset value and explore all strategic alternatives.

That's not what they're

doing. They're putting their head in the sand. They're going about business the way they have and they need to change. And they have a

staggered board, we're gonna continue to work at it over the next several years, but we think there's a tremendous amount of value to

unlock here.s

Thank you.

ADDITIONAL INFORMATION CONCERNING THE PARTICIPANTS

Land & Buildings has filed

a preliminary proxy statement and accompanying BLUE universal proxy card with the US Securities and Exchange Commission (the “SEC”)

to be used to solicit votes for the election of two highly-qualified director nominees at the Annual Meeting.

LAND & BUILDINGS STRONGLY

ADVISES ALL AIMCO SHAREHOLDERS TO READ THE SOLICITATION STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE SOLICITATION STATEMENT WITHOUT CHARGE, WHEN AVAILABLE,

UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The Participants in the solicitation

are Land & Buildings Capital Growth Fund, LP (“L&B Capital”), Land & Buildings GP LP (“L&B GP”),

Land & Buildings Opportunity Fund, LLC (“L&B Opportunity”), L&B Total Return Fund LLC (“L&B Total Return”),

L&B Megatrend Fund (“L&B Megatrend”), L&B Secular Growth (“L&B Secular”), Land & Buildings

Investment Management, Jonathan Litt, Corey Lorinsky, Michelle Applebaum and James P. Sullivan.

As of the date hereof, L&B

Capital directly owns 1,221,250 shares of Aimco’s Class A Common Stock (the “Common Stock”). As of the date hereof,

L&B Opportunity directly owns 566,040 shares of Common Stock. As of the date hereof, 4,163,590 shares of Common Stock were held in

a certain account managed by Land & Buildings Investment Management (the “Managed Account”). L&B GP, as the general

partner of L&B Capital, may be deemed the beneficial owner of the 1,221,250 shares of Common Stock owned by L&B Capital. As of

the date hereof, L&B Total Return directly owns 1,333,401 shares of Common Stock. As of the date hereof, L&B Megatrend directly

owns 38,423 shares of Common Stock. As of the date hereof, L&B Secular directly owns 18,510 shares of Common Stock. Land & Buildings

Investment Management, as the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend

and L&B Secular and as the investment advisor of the Managed Account, may be deemed the beneficial owner of an aggregate of 7,341,214

shares of Common Stock owned by L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B Secular and

held in the Managed Account. Mr. Litt, as the managing principal of L&B Management, which is the investment manager of each of L&B

Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B Secular and the investment advisor of the Managed Account,

may be deemed the beneficial owner of an aggregate of 7,341,214 shares of Common Stock owned by L&B Capital, L&B Opportunity,

L&B Total Return, L&B Megatrend and L&B Secular and held in the Managed Account. As of the date hereof, L&B Capital and

L&B Management, through the Managed Account, have entered into notional principal amount derivative agreements (the “Derivative

Agreements”) in the form of cash settled swaps with respect to 236,892 and 4,044,169 shares of Common Stock, respectively (representing

economic exposure comparable to approximately 0.16% and 2.66% of the outstanding shares of Common Stock, respectively). Collectively,

the Derivative Agreements held by such parties represent economic exposure comparable to an interest in approximately 2.82% of the outstanding

shares of Common Stock. The Derivative Agreements provide L&B Capital and L&B Management, through the Managed Account, with economic

results that are comparable to the economic results of ownership but do not provide them with the power to vote or direct the voting

or dispose of or direct the disposition of, call for the delivery of or otherwise exercise any rights in respect of, the shares of Common

Stock that are referenced in the Derivative Agreements (such shares, the “Subject Shares”). Each of L&B Capital, L&B

Management, on behalf of itself and the Managed Account, and the other Participants disclaim any beneficial and other ownership in the

Subject Shares. As of the date hereof, L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend, L&B Secular

and L&B Management, through the Managed Account, have a short interest in 586,920 shares of Common Stock, 224,074 shares of Common

Stock, 223,879 shares of Common Stock, 15,208 shares of Common Stock, 7,324 shares of Common Stock and 2,124,258 shares of Common Stock,

respectively. As of the date hereof, Mr. Lorinsky directly owns 9 shares of Common Stock. As of the date hereof, Ms. Applebaum directly

owns 5,500 shares of Common Stock. As of the date hereof, Mr. Sullivan does not own any securities of the Company. Each Participant disclaims

beneficial ownership of the shares of Common Stock he, she or it does not directly own.

This regulatory filing also includes additional resources:

ex991dfan14a10432030_101822.pdf

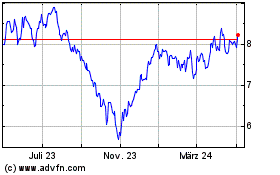

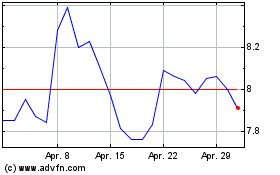

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024