Apartment Investment and Management Company (“Aimco”) (NYSE:

AIV) announced today second quarter results for 2022 and provided

highlights on recent activities.

Wes Powell, Aimco President and Chief Executive Officer,

comments: “Aimco has accomplished a great deal during 2022 and we

are well positioned for continued success. The early monetization

of our four development assets leased from AIR Communities ("AIR")

highlights our team's ability to execute and will lead to $100

million dollars of value creation for Aimco shareholders.

"Our diversified portfolio of income producing properties

continues to yield strong results, with net operating income up

14.9% during the first half of 2022.

"During the year we sold two stabilized multifamily assets above

the values used in our internal Net Asset Value ("NAV") estimate

and also added multi-phase development opportunities in South

Florida and Washington, D.C. Through opportunities directly sourced

by the Aimco team, our future development pipeline has nearly

tripled since the start of 2021, and now, in total, has the

potential for more than 15 million square feet of residential and

mixed-use development.

"We have agreements in place that will retire or refinance more

than $1.0 billion of near-term liabilities and in doing so improved

our balance sheet which is now comprised of primarily fixed-rate

debt with an average term to maturity of 8.4 years."

Mr. Powell continued, "I am pleased with the ongoing value

creation being delivered by the Aimco team but also recognize that

Aimco shares have traded at sizable discounts to our most recently

published NAV. As such, in the first half of the year Aimco

repurchased nearly 750,000 shares and, in July, Aimco’s Board of

Directors updated the authorization for the purchase of up to 15

million additional shares.

"I am thankful to the Aimco team for their dedication and good

work, and to the Aimco Board of Directors for their engagement and

guidance, as we execute on our shared commitment to building, and

unlocking, value for Aimco shareholders.”

Financial Results and Recent

Highlights

- Net income attributable to common stockholders per share, on a

fully dilutive basis, was $1.57 for the quarter ended June 30,

2022, compared to net income per share of $(0.13) for the same

period in 2021, due primarily to the recognition of income

resulting from the agreement to terminate the AIR leases and gains

related to the sale of Pathfinder Village.

- As of July 31, 2022, total shareholder return ("TSR") since the

December 15, 2020 separation from AIR was 65.1% and year-to-date

was 7.8%.

- Second Quarter 2022 Revenue and NOI from Aimco’s Stabilized

Operating Properties were up 11.2% and 14.4%, respectively, year

over year, with occupancy of 97.7%, up 20 basis points year over

year.

- Aimco reached an agreement with AIR that will result in more

than $100 million of realized Value Creation, net of costs for

Aimco shareholders and eliminate the $469 million obligation

related to the four leased properties from AIR.

- Aimco completed the early repayment of the $534 million of

notes due to AIR, originally scheduled to mature in January 2024

and carrying an annual rate of 5.2%, with proceeds from property

level financings, the sales of Pathfinder Village and Cedar Rim,

and the placement of preferred equity secured by a portfolio of

stabilized properties.

Value Add, Opportunistic &

Alternative Investments:

Development and Redevelopment

Aimco generally seeks development and redevelopment

opportunities where barriers to entry are high, target customers

can be clearly defined, and Aimco has a comparative advantage over

others in the market. Aimco’s Value Add and Opportunistic

investments may also target portfolio acquisitions, operational

turnarounds, and re-entitlements.

As of June 30, 2022, Aimco had eight active development and

redevelopment projects located in five U.S. markets, in varying

phases of construction and lease-up. These projects remain on

track, as measured by budget, lease-up metrics, and current market

valuations. During the second quarter, Aimco invested $62.5 million

in development and redevelopment activities. Updates include:

- As previously announced, following the successful development

and lease-up of 707 Leahy in Redwood City, California, Prism in

Cambridge, Massachusetts, Flamingo Point North Tower in Miami

Beach, Florida, and The Fremont on the Anschutz Medical Campus in

Aurora, Colorado, Aimco and AIR have agreed to cancel Aimco’s

leasehold interest in each property on September 1, 2022. In return

for the termination of the leases, Aimco will receive $200 million,

resulting in Value Creation, net of costs, of approximately $100

million, which will be realized about 18 months sooner than

originally anticipated.

- At The Hamilton in Miami, Florida, Aimco now expects to welcome

the first residents into redesigned and fully renovated units in

August 2022. As of July 31, 2022, 61 units were leased or

pre-leased at rental rates more than 20% ahead of

underwriting.

- Construction continues on schedule and on budget at Upton Place

in Northwest Washington, D.C., the Benson Hotel and Faculty Club on

the Anschutz Medical Campus in Aurora, Colorado, and at our

single-family home development project, Oak Shore, in Corte Madera,

California.

Alternative Investments

Aimco makes alternative investments where it has special

knowledge or expertise relevant to the venture and opportunity

exists for positive asymmetric outcomes. Aimco’s current

alternative investments include a mezzanine loan secured by a

stabilized multifamily property with an option to participate in

future multifamily development as well as three passive equity

investments. Updates include:

- The borrower on Aimco’s $354.4 million mezzanine loan, which is

secured by the Parkmerced stabilized multifamily property plus

phases two through nine of the site's future development

opportunity, remains current on its first mortgage obligations. The

neighboring San Francisco State University is expected to return to

full in-person learning this fall, with hybrid options, increasing

the demand for the apartments that serve as collateral for the

Aimco loan. Due to the relative size of Aimco’s investment and

alternative accretive uses of capital, Aimco recently initiated a

marketing effort to explore potential opportunities to monetize all

or a portion of its investment.

- Aimco redeemed 22% of its passive equity investment in IQHQ

Inc., a life sciences developer. In July, Aimco received proceeds

of $16.5 million from the sale resulting in a greater than 50%

internal rate of return over the hold period for this portion of

its investment. Aimco retains 2.4 million shares worth $59.7

million and the opportunity to collaborate with IQHQ on future

development opportunities that include a multifamily component.

Investment Activity

Aimco is focused on development and redevelopment, funded

through joint ventures. Aimco will also consider opportunistic

investments in related activities. Updates include:

- In May, Aimco executed a joint venture agreement to act as a

co-GP on the development of a phased multifamily community in

Bethesda, Maryland. The project is fully entitled and includes

approvals for over 2,200 units in six phases. Aimco will

participate in the first two multifamily phases totaling 574 units

with an expected Aimco investment of approximately $18 million.

Aimco also has rights to increase our investment and to choose to

participate in future phases of development.

- In June, July, and August, Aimco closed on the purchase of

three development parcels it contracted to acquire, for $100

million, in February 2022. The nine-acre assemblage is located in

the rapidly growing Flagler Village neighborhood of Fort

Lauderdale, Florida, and allows for approximately three million

square feet of phased, mixed-use development, which could contain

up to 1,500 residential units, more than 300 hotel keys, and more

than 100,000 square feet of retail space at full build-out. Aimco

intends to execute the planned development activity through joint

venture financing.

Operating Property

Results

Aimco owns a diversified portfolio of operating apartment

communities located in ten major U.S. markets with average rents in

line with local market averages. Aimco also owns one commercial

office building that is part of an assemblage with an adjacent

apartment building.

Aimco’s operating properties produced solid results for the

quarter ended June 30, 2022.

Second Quarter

Year-to-Date

Stabilized Operating Properties

Year-over-Year

Sequential

Year-over-Year

($ in millions)

2022

2021

Variance

1Q 2022

Variance

2022

2021

Variance

Average Daily Occupancy

97.7%

97.5%

0.2%

98.5%

(0.8%)

98.1%

97.6%

0.5%

Revenue, before utility reimbursements

$33.1

$29.8

11.2%

$32.2

2.7%

$65.3

$59.0

10.7%

Expenses, net of utility

reimbursements

10.4

9.9

4.8%

10.2

1.7%

20.7

20.1

2.6%

Net operating income (NOI)

22.7

19.8

14.4%

22.0

3.2%

44.7

38.9

14.9%

*Excluded from the table above is one, 40-unit apartment

community that Aimco’s ownership includes a partnership share.

- Revenue in the second quarter 2022 was $33.1 million, up 11.2%

year-over-year, resulting from a $203 increase in average monthly

revenue per apartment home to $2,039, and a 20-basis point increase

in Average Daily Occupancy to 97.7%.

- New lease rents increased 17.4% and renewal lease rents

increased 16.8% in the second quarter and 62.4% of residents were

retained over the past twelve months.

- The median annual household income of new residents was more

than $115,000 in the second quarter 2022, representing a rent to

income ratio of 20.2%.

- Net operating income in the second quarter 2022 was $22.7

million, up 14.4% year-over-year.

1001 Brickell Bay Drive, a waterfront office building in Miami,

Florida, is owned as part of a larger assemblage with substantial

development potential. In the first half of 2022, Aimco executed

leases on over 60,000 square feet of office space, at rates per

square foot 20% higher than leases executed in the first half of

2021. At the end of the second quarter 2022, the building was 85%

occupied, up from 73% at the same time last year.

Property Dispositions

- In May, Aimco sold Pathfinder Village, a 246-unit apartment

community located in Fremont, California, for $127.0 million.

Proceeds, net of the repayment of the existing property debt and

transaction related costs, were $71.8 million.

- In July, subsequent to quarter end, Aimco sold Cedar Rim, a

104-unit apartment community located in Renton, Washington, for

$53.0 million. The property was owned free and clear of debt prior

to the sale.

- Aimco is under contract to sell 2900 on First, a 135-unit

apartment community with 14,000 square feet of retail located in

Seattle, Washington for $69.0 million. This sale of this property

is expected to close in August.

- These properties sold, or are under contract to sell, for more

than the values used in Aimco's internal NAV estimate.

Balance Sheet and Financing

Activity

Aimco is highly focused on maintaining a strong balance sheet,

including having at all times ample liquidity. As of June 30, 2022,

Aimco had access to $215.5 million, including $81.8 million of cash

on hand, $12.5 million of restricted cash, and the capacity to

borrow up to $121.2 million on its revolving credit facility.

Aimco’s net leverage as of June 30, 2022, was as follows:

as of June 30, 2022

as of June 30, 2022 (proforma

the final payoff of the notes payable to AIR)

Proportionate, $ in thousands

Amount

Weighted Avg. Maturity

(Yrs.)

Amount

Weighted Avg. Maturity

(Yrs.)

Total non-recourse property debt

$

798,492

8.4

$

798,492

8.4

Total non-recourse construction loan

debt

203,395

1.9

203,395

1.9

Notes payable to AIR

147,039

1.6

-

Cash and restricted cash

(94,308

)

(94,308

)

Net Leverage

$

1,054,618

$

907,579

Debt Refinancings

- Aimco reached agreement with AIR for the accelerated repayment

of $534 million in notes, which carried a rate of 5.2%, prior to

their maturity in January 2024. The early payoff, including $17

million of spread maintenance costs, was completed in July with

proceeds generated from:

- The financing of $575 million of property level loans with a

weighted average term of 9.4 years and a weighted average fixed

interest rate, net of monetized swaption proceeds, of 4.37%. Aimco

received $337 million of proceeds, net of the repayment of existing

property debt balances and prepayment penalties;

- The sale of Pathfinder Village in Fremont, California for $127

million in May, and Cedar Rim in Renton, Washington for $53 million

in July. Proceeds, net of the repayment of the existing property

debt and transaction related costs, were $122 million; and

- A $102 million, 8% preferred equity financing placement on a

portfolio of stabilized assets with an institutional equity

partner.

Construction Lending

- In the second quarter 2022, Aimco secured a $23 million

non-recourse construction loan to fund the development of Oak Shore

in Corte Madera, California.

Private Equity Financing

- In July, Aimco closed a $102 million, 8% preferred equity

financing on a portfolio of 14 stabilized assets with an

institutional equity partner. The financing has a seven-year term

but is fully pre-payable after 48 months.

Public Market Equity

Common Stock Repurchases

- In the second quarter, Aimco repurchased 539,764 shares of its

common stock at a weighted average price of $5.73 per share, an

approximate 45% discount to its most recently published estimated

NAV. Year to date, Aimco has repurchased 742,164 shares of its

common stock at a weighted average price of $5.93 per share.

- In July, Aimco's Board of Directors updated the authorization

to repurchase up to 15 million additional shares.

Special Dividend

- On July 27, 2022, Aimco's Board of Directors declared a special

cash dividend of $0.02 per share payable on September 30, 2022, to

Aimco shareholders of record on September 14, 2022.

Supplemental Information

The full text of this Earnings Release and the Supplemental

Information referenced in this release are available on Aimco’s

website at investors.aimco.com.

Aimco added a new Supplemental Schedule that presents the

components of Aimco’s NAV to its Second Quarter 2022 Earnings

Release and Supplemental Information. This information can be found

in Supplemental Schedule 8, on page 19 of this release.

Glossary & Reconciliations of

Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release

and the Supplemental Information include certain financial measures

used by Aimco management that are measures not defined under

accounting principles generally accepted in the United States, or

GAAP. Certain Aimco terms and Non-GAAP measures are defined in the

Glossary in the Supplemental Information and Non-GAAP measures

reconciled to the most comparable GAAP measures.

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic, and alternative investments, targeting

the U.S. multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through our human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit our website www.aimco.com.

Team and Culture

Aimco has a national presence with corporate headquarters in

Denver, Colorado and Bethesda, Maryland. Our investment platform is

managed by experienced real estate professionals based in four

regions of the United States: West Coast, Central and Mountain

West, Mid-Atlantic and Northeast, and Southeast. The experience and

in-depth local market knowledge of the Aimco team is essential to

the execution of our mission and realization of our vision.

Above all else, Aimco is committed to a culture of integrity,

respect, and collaboration.

Forward-Looking

Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations, including,

but not limited to, the statements in this document regarding our

2022 plans and goals, including our 2022 pipeline investments and

projects, our plans to eliminate certain near term debt maturities,

our estimated value creation and potential, our timing, scheduling

and budgeting, our plans to form joint ventures, and the return to

in-person activities. We caution investors not to place undue

reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,”

“seek(s)” and similar expressions, or the negative of these terms,

are intended to identify such forward-looking statements. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the control of Aimco that could

cause actual results or outcomes to differ materially from those

discussed in the forward-looking statement. Important factors,

among others, that may affect actual results or outcomes include,

but are not limited to: (i) the risk that the 2022 plans and goals

may not be completed, as expected, in a timely manner or at all,

(ii) the inability to recognize the anticipated benefits of the

pipeline investments and projects, and (iii) changes in general

economic conditions, including, increases in interest rates and as

a result of the COVID-19 pandemic. Although we believe that the

assumptions underlying the forward-looking statements are

reasonable, we can give no assurance that our expectations will be

attained.

Readers should carefully review Aimco’s financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended

December 31, 2021, and subsequent Quarterly Reports on Form 10-Q

and other documents Aimco files from time to time with the SEC.

These filings identify and address important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

These forward-looking statements reflect management’s judgment

and expectations as of this date, and Aimco assumes no (and

disclaims any) obligation to revise or update them to reflect

future events or circumstances.

Consolidated

Statements of Operations

(in thousands, except per share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2022

2021

2022

2021

REVENUES:

Rental and other property revenues

$

50,697

$

40,418

$

100,691

$

80,222

OPERATING EXPENSES:

Property operating expenses

19,708

16,403

38,929

33,345

Depreciation and amortization [1]

34,863

20,639

57,981

41,356

General and administrative expenses

[2][3]

8,961

7,383

18,433

13,694

Total operating expenses

63,532

44,425

115,343

88,395

Interest expense

(41,546

)

(12,638

)

(56,147

)

(25,315

)

Mezzanine investment income, net

8,330

7,551

16,567

15,018

Realized and unrealized gains (losses) on

interest rate options

20,017

(16,970

)

38,795

8,377

Realized and unrealized gains (losses) on

equity investments [4]

26,630

875

22,297

875

Gain (Loss) on the disposition of real

estate

94,598

-

94,465

-

Lease modification income [1]

205,387

-

205,387

-

Other income (expenses), net

(1,413

)

2,043

(1,488

)

2,406

Income before income tax

benefit

299,168

(23,146

)

305,224

(6,812

)

Income tax benefit (expense)

(45,957

)

2,760

(41,901

)

7,860

Net income

253,211

(20,386

)

263,323

1,048

Net (income) loss attributable to

redeemable noncontrolling interests in consolidated real estate

partnerships

(1,069

)

(66

)

(2,539

)

86

Net (income) loss attributable to

noncontrolling interests in consolidated real estate

partnerships

(346

)

(275

)

(344

)

(566

)

Net (income) loss attributable to common

noncontrolling interests in Aimco Operating Partnership

(12,659

)

1,037

(13,094

)

(44

)

Net income (loss) attributable to

Aimco

$

239,137

$

(19,690

)

$

247,346

$

524

Net income (loss) attributable to common

stockholders per share – basic [5]

$

1.58

$

(0.13

)

$

1.63

$

0.00

Net income (loss) attributable to common

stockholders per share – diluted [5]

$

1.57

$

(0.13

)

$

1.62

$

0.00

Weighted-average common shares outstanding

– basic

149,600

149,166

149,694

149,082

Weighted-average common shares outstanding

– diluted

150,423

149,166

150,660

149,442

[1] In the three months ended June 30, 2022, as a result of the

lease termination agreement with AIR Communities (AIR) and in

accordance with GAAP, Aimco accelerated $13.9 million of

depreciation on the associated leasehold improvements. The

remaining $66.1 million of depreciation will be recognized over the

remaining lease terms ending September 1, 2022. Also, in accordance

with GAAP, Aimco reduced the right-of-use lease assets associated

with these properties to zero and recognized lease modification

income of $205.4 million. Per the terms of the lease termination

agreement, Aimco will receive $200 million of cash payments from

AIR in exchange for the return of the properties from Aimco to AIR,

in the three months ended June 30, 2022, Aimco received $10 million

of these payments in the form of a nonrefundable deposit. [2]

General and administrative expense includes $1.0 million and $2.0

million of expenses to be reimbursed to AIR, per agreement upon

separation, for consulting services, with respect to strategic

growth, direction, and advice, in the three and six months ended

June 30, 2022, respectively. This agreement is expected to conclude

at year end. [3] General and administrative expense for the three

months and six months ended June 30, 2021 was prior to the full

build out of Aimco’s platform and are not representative of Aimco’s

anticipated expenses. [4] Realized and unrealized gains (losses) on

equity investments increased due primarily to the change in the

fair market value of Aimco's investment in IQHQ, a life science

real estate developer. In the three months ended June 30, 2022,

Aimco realized a gain of $5.7 million in conjunction with the

redemption of 22% of its investment in IQHQ. [5] See Note 6 of

Aimco's Second Quarter 2022 SEC Form 10-Q, filed August 4, 2022,

for additional details.

Consolidated

Balance Sheets

(in thousands) (unaudited)

June 30,

December 31,

2022

2021

Assets

Buildings and improvements

$

1,269,624

$

1,257,214

Land

601,757

534,285

Total real estate

1,871,381

1,791,499

Accumulated depreciation

(519,868

)

(561,115

)

Net real estate

1,351,513

1,230,384

Cash and cash equivalents

81,799

233,374

Restricted cash

12,510

11,208

Mezzanine investments

354,365

337,797

Interest rate options

51,286

25,657

Right-of-use lease assets

130,532

429,768

Receivable from lease termination

186,318

—

Other assets, net

251,089

165,913

Total assets

$

2,419,412

$

2,434,101

Liabilities and Equity

Non-recourse property debt, net

$

801,434

$

483,137

Construction loans, net

199,715

163,570

Notes payable to AIR

147,039

534,127

Total indebtedness

1,148,188

1,180,834

Deferred tax liabilities

136,950

124,747

Lease liabilities

123,785

435,093

Accrued liabilities and other

133,653

97,400

Total liabilities

1,542,576

1,838,074

Redeemable noncontrolling interests in

consolidated real estate partnership

51,814

33,794

Equity:

Common Stock

1,492

1,498

Additional paid-in capital

515,065

521,842

Retained earnings (accumulated

deficit)

224,567

(22,775

)

Total Aimco equity

741,124

500,565

Noncontrolling interests in consolidated

real estate partnerships

44,665

35,213

Common noncontrolling interests in Aimco

Operating Partnership

39,233

26,455

Total equity

825,022

562,233

Total liabilities and equity

$

2,419,412

$

2,434,101

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005935/en/

Matt Foster, Sr. Director, Capital Markets and Investor

Relations Investor Relations 303-793-4661, investor@aimco.com

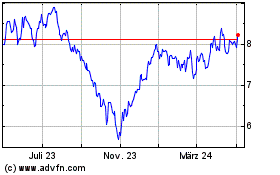

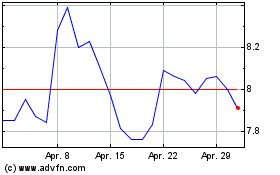

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024