Post-effective Amendment Filed Solely to Add Exhibits to a Registration Statement (pos Ex)

01 Juni 2022 - 10:35PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on June 1, 2022

Securities Act File No. 333-262875

Investment Company Act File No. 811-22591

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-2

Registration Statement

under

|

|

|

| the Securities Act of 1933 |

|

☒ |

| Pre-Effective Amendment No. |

|

☐ |

| Post-Effective Amendment No. 1 |

|

☒ |

and/or

Registration Statement

Under

|

|

|

| the Investment Company Act of 1940 |

|

☒ |

| Amendment No. 8 |

|

☒ |

Apollo Tactical Income Fund Inc.

(Exact Name of Registrant as Specified In Charter)

9 West 57th

Street

New York, NY 10019

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code:

212-515-3200

Joseph Moroney

Apollo Tactical Income Fund Inc.

9 West 57th Street

New

York, NY 10019

(Name and Address of Agent For Service)

Copies of information to:

P. Jay Spinola, Esq.

Neesa P. Sood, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New

York, New York 10019

Approximate Date of Commencement of Proposed Public Offering: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following

box ☐

If any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the

Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan, check the following box ☒

If this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto, check the following box ☒

If this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ☐

It is proposed that this filing will become effective (check appropriate box):

| ☐ |

when declared effective pursuant to Section 8(c) of the Securities Act |

If appropriate, check the following box:

| ☐ |

This [post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement]. |

| ☐ |

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

| ☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

| ☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

Check each box that appropriately characterizes the Registrant:

| ☒ |

Registered Closed-End Fund

(closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)). |

| ☐ |

Business Development Company (closed-end company that intends or has

elected to be regulated as a business development company under the Investment Company Act). |

| ☐ |

Interval Fund (Registered Closed-End Fund or a Business Development

Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| ☒ |

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

| ☐ |

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ☐ |

Emerging Growth Company (as defined by Rule 12b-2 under the Securities

and Exchange Act of 1934). |

| ☐ |

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. |

| ☐ |

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing). |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE

A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS

THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File Nos. 333-262875 and 811-22591) of Apollo Tactical Income Fund Inc. (the

“Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this

Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not modify

any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 1 shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of the

Registration Statement are hereby incorporated by reference.

PART C

OTHER INFORMATION

Item 25. Financial Statements and Exhibits

1. Financial Statements

Included in Part A: Financial

highlights for the fiscal years ended December 31, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014 and 2013.

Incorporated into Parts A and B by

reference:

The audited financial statements included in the Fund’s annual

report for the fiscal year ended December 31, 2021, together with the report of Deloitte & Touche LLP, on Form N-CSR, filed February 25, 2022 (File No. 811-22591).

The financial highlights included in the Fund’s

annual report for the fiscal year ended December 31, 2016 on Form N-CSR, filed March 6, 2017 (File

No. 811-22591).

2. Exhibits

|

|

|

| (a) |

|

Articles of Amendment and Restatement is incorporated herein by reference to Exhibit (a)(3) to Pre-Effective

Amendment No. 2 to the Fund’s Registration Statement on Form N-2 (File No. 333-175832), filed on January 17,

2013. |

|

|

| (b) |

|

Amended and Restated Bylaws is incorporated herein by reference to Exhibit 5.03 to the Fund’s Form 8-K, filed on November 24, 2020. |

|

|

| (c) |

|

Not applicable |

|

|

| (d) |

|

The rights of security holders are defined in the Registrant’s Articles of Amendment and Restatement (Article IV) and

the Registrant’s Amended and Restated Bylaws (Article II). |

|

|

| (e) |

|

Dividend Reinvestment Plan is incorporated herein by reference to Exhibit (e) to Pre-Effective Amendment No. 1 to the Fund’s Registration

Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (f) |

|

Not applicable |

|

|

| (g) |

|

Form of Investment Advisory and Management Agreement is incorporated herein by reference to Exhibit (g) to Pre-Effective Amendment No. 4 to the Fund’s Registration Statement on Form N-2 (File No.

333-175832), filed on February 25, 2013. |

|

|

| (h) |

|

ATM Sales Agreement between the Fund and Virtu Americas LLC* |

|

|

| (i) |

|

Not applicable |

|

|

| (j) |

|

Custody Agreement by and between the Fund and U.S. Bank National Association is incorporated herein by reference to Exhibit (9)(a) to the Fund’s

Form N-14 (File No. 333-254419), filed on May 14, 2021. |

|

|

| (k)(1) |

|

Transfer Agency and Registrar Services Agreement by and between the Fund and American Stock Transfer

& Trust Company, LLC is incorporated herein by reference to Exhibit (13)(a) to the Fund’s Form N-14 (File No. 333-254419), filed on May

14, 2021. |

|

|

| (k)(2) |

|

Fund Administration Servicing Agreement by and between the Fund and U.S. Bancorp Fund Services, LLC is incorporated herein by reference to

Exhibit (13)(b) to the Fund’s Form N-14 (File No. 333-254419), filed on May 14, 2021. |

|

|

| (k)(3) |

|

Form of Administrative Services and Reimbursement Agreement by and between the Fund and the Adviser is incorporated herein by reference to Exhibit

(k)(3) to Pre-Effective Amendment No. 4 to the Fund’s Registration Statement on Form N-2 (File

No. 333-175832), filed on February 25, 2013. |

|

|

| (k)(4) |

|

Form of License Agreement is incorporated herein by reference to Exhibit (k)(4) to Pre-Effective Amendment

No. 4 to the Fund’s Registration Statement on Form N-2 (File No. 333-175832), filed on February 25,

2013. |

|

|

|

| (k)(5) |

|

Second Amended and Restated Loan and Security Agreement by and between the Fund and Sumitomo Mitsui Banking Corporation is incorporated herein

by reference to Exhibit (k)(5) to Pre-Effective Amendment No. 1 to the Fund’s Registration Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (k)(6) |

|

First Amendment to Second Amended and Restated Loan and Security Agreement by and between the Fund and Sumitomo Mitsui Banking Corporation is

incorporated herein by reference to Exhibit (k)(6) to Pre-Effective Amendment No. 1 to the Fund’s Registration Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (l) |

|

Opinion and Consent of Miles & Stockbridge P.C.* |

|

|

| (m) |

|

Not applicable |

|

|

| (n) |

|

Consent of Independent Registered Public Accounting Firm is incorporated herein by reference to Exhibit (n) to Pre-Effective Amendment No. 1

to the Fund’s Registration Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (o) |

|

Not applicable |

|

|

| (p) |

|

Certificate of Initial Stockholder is incorporated herein by reference to Exhibit (p)

to Pre-Effective Amendment No. 4 to the Fund’s Registration Statement on Form N-2 (File No.

333-175832), filed on February 25, 2013. |

|

|

| (q) |

|

Not applicable |

|

|

| (r)(1) |

|

Code of Ethics of the Fund is incorporated herein by reference to Exhibit (r)(1) to Pre-Effective Amendment No. 1 to the Fund’s Registration

Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (r)(2) |

|

Code of Ethics of the Adviser is incorporated herein by reference to Exhibit (r)(2) to Pre-Effective Amendment No. 1 to the Fund’s Registration

Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (s)(1) |

|

Calculation of Filing Fee Tables is incorporated herein by reference to Exhibit (s) to Pre-Effective Amendment No. 1 to the Fund’s

Registration Statement on Form N-2 (File No. 333-262875), filed on May 24, 2022. |

|

|

| (s)(2) |

|

Calculation of Filing Fee Tables (Final Prospectus dated June 1, 2022).* |

|

|

| (t) |

|

Power of Attorney is incorporated herein by reference to Exhibit (t) to the Fund’s Registration Statement on Form N-2 (File No. 333-262875) filed on February 18, 2022. |

Item 26. Marketing Arrangements

The information contained under the heading “Plan of Distribution” on page 78 of the prospectus is incorporated by reference, and any information

concerning any underwriters will be contained in the accompanying prospectus supplement, if any.

Item 27. Other

Expenses of Issuance and Distribution

The following table sets forth the expenses to be incurred in connection with the offer described in this

Registration Statement:

|

|

|

|

|

| Registration and Filing Fees |

|

$ |

4,635 |

|

| FINRA Fees |

|

|

8,000 |

|

| New York Stock Exchange Fees |

|

|

13,747 |

|

| Costs of Printing and Engraving |

|

|

21,000 |

|

| Accounting Fees and Expenses |

|

|

20,000 |

|

| Legal Fees and Expenses |

|

|

253,000 |

|

|

|

|

|

|

| Total |

|

$ |

320,382 |

|

|

|

|

|

|

- 2 -

Item 28. Persons Controlled by or under Common Control with

Registrant

None.

Item 29. Number of Holders of Securities

Set forth below is the number of record holders as of March 18, 2022, of each class of securities of the Registrant:

|

|

|

|

|

| Title of Class |

|

Number of

Record

Holders |

|

| Shares of Common Stock, par value $0.001 per share |

|

|

13,054 |

|

Item 30. Indemnification

Maryland law permits a Maryland corporation to include a provision in its charter eliminating the liability of its directors and officers to the corporation

and its stockholders for money damages, except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty that is established by a final judgment

and is material to the cause of action. The Fund’s charter contains a provision that eliminates its directors’ and officers’ liability to the maximum extent permitted by Maryland law and the Investment Company Act of 1940 (the

“1940 Act” or “Investment Company Act”).

Maryland law requires a Maryland corporation (unless its charter provides otherwise, which

the Fund’s charter does not) to indemnify a director or officer who has been successful in the defense of any proceeding to which he or she is made or threatened to be made a party by reason of his or her service in that capacity. Maryland law

permits a Maryland corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which

they may be made or threatened to be made a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding

and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any

criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. A Maryland corporation may not indemnify a director or officer who has been adjudged liable in a suit by or on behalf of the

corporation or in which the director or officer was adjudged liable on the basis that a personal benefit was improperly received. A court may order indemnification if it determines that the director or officer is fairly and reasonably entitled to

indemnification, even though the director or officer did not meet the prescribed standard of conduct or was adjudged liable on the basis that personal benefit was improperly received; however, indemnification for an adverse judgment in a suit by or

on behalf of the corporation, or for a judgment of liability on the basis that personal benefit was improperly received, is limited to expenses.

In

addition, Maryland law permits a Maryland corporation to advance reasonable expenses to a director or officer upon the corporation’s receipt of (a) a written affirmation by the director or officer of his or her good faith belief that he or

she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined

that the standard of conduct was not met.

The Fund’s charter authorizes it to obligate itself, and its Bylaws require it, to the maximum extent

permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any present or former director or officer or any individual who, while a director or officer of the Fund and at the request of the Fund, serves or has served

another corporation, real estate investment trust, partnership, joint venture, limited liability company, trust, employee benefit plan or other enterprise as a director, officer, partner, manager, managing member or trustee, from and against any

claim or liability to which that individual may become subject or which that

- 3 -

individual may incur by reason of his or her service in any of the foregoing capacities and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding,

without requiring a preliminary determination of the ultimate entitlement to indemnification. The Fund’s charter and Bylaws also permit it to indemnify and advance expenses to any individual who served any predecessor of the Fund in any of the

capacities described above and any employee or agent of the Fund or any predecessor of the Fund.

In accordance with the Investment Company Act, the Fund

will not indemnify any person for any liability to which such person would be subject by reason of such person’s willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office.

Advisory Agreement Indemnification. Please refer to Section

13 of the Investment Management and Advisory Agreement (“Advisory Agreement”) between the Fund and the Adviser. In Section 13 of the

Advisory Agreement, the Fund agrees to indemnify the Adviser (and its officers, managers, partners, agents, employees, controlling persons, members and any person or entity affiliated with the Adviser), against certain liabilities arising in

connection with Adviser’s performance as an investment adviser to the Fund.

Administrative Services and Reimbursement Agreement. Please refer

to Section 3 of the Administrative Services and Reimbursement Agreement (the “Services Agreement”) between the Fund and the Adviser. In

Section 3 of the Services Agreement, the Fund agrees to indemnify the Adviser, as administrator, (and its officers, managers, partners, agents, employees, controlling persons, members and any person or entity affiliated with the Adviser),

against certain liabilities arising in connection with Adviser’s provision of services under the Services Agreement.

Indemnification Agreement

Indemnification. Reference is made to an Indemnification Agreement between the Fund and each Director and Officer of the Fund. Under the Indemnification Agreement, the Fund agrees to indemnify each Director and Officer for certain liabilities

arising in connection with their duties as Directors or Officers, as applicable, of the Fund.

Insofar as indemnification for liabilities arising under

the Securities Act of 1933, as amended (the “Securities Act”) may be permitted to directors, officers and controlling persons of the Fund, pursuant to the foregoing provisions or otherwise, the Fund has been advised that in the opinion of

the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Fund of expenses

incurred or paid by a director, officer or controlling person of the Fund in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Fund will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the

Securities Act and will be governed by the final adjudication of such issue.

Item 31. Business and other Connections

of Investment Adviser

The description of the Adviser under the caption “Management of the Fund” in the prospectus, which forms part of

this registration statement, is incorporated by reference herein. Information as to the directors and officers of the Adviser together with information as to any other business, profession, vocation or employment of a substantial nature engaged in

by the directors and officers of the Adviser in the last two years, is included in its application for registration as an investment adviser on Form ADV (File No. 801-72098) filed under the Investment

Advisers Act of 1940, as amended, and is incorporated herein by reference. The Adviser’s principal business address is 9 West 57th Street, 43rd Floor, New York, NY 10019.

Item 32. Location of Accounts and Records

Omitted pursuant to Instruction to Item 32 of Form N-2.

- 4 -

Item 33. Management Services

Not applicable.

Item 34. Undertakings

(1) Not applicable.

(2) Not applicable.

(3)

Registrant undertakes:

| |

(a) |

to file, during any period in which offers or sales are being made, a post-effective amendment to this

Registration Statement: |

| |

(1) |

to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(2) |

to reflect in the prospectus any facts or events after the effective date of the Registration Statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement; and |

| |

(3) |

to include any material information with respect to the plan of distribution not previously disclosed in the

Registration Statement or any material change to such information in the Registration Statement. |

| |

(4) |

if (i) it determines to conduct one or more offerings of the Fund’s common shares (including rights

to purchase its common shares) at a price below its net asset value per common share at the date the offering is commenced, and (ii) such offering or offerings will result in greater than a 15% dilution to the Fund’s net asset value

per common share. |

| |

(b) |

that for the purpose of determining any liability under the Securities Act, each post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; |

| |

(c) |

to remove from registration by means of a post-effective amendment any of the securities being registered which

remain unsold at the termination of the offering; |

| |

(d) |

that, for the purpose of determining liability under the Securities Act to any purchaser:

|

| |

(1) |

if the Registrant is relying on Rule 430B: |

| |

(A) |

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the

registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| |

(B) |

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in

|

- 5 -

| |

the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the

registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that

no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the

registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or

made in any such document immediately prior to such effective date; or |

| |

(2) |

if the Registrant is relying on Rule 430C: each prospectus filed pursuant to Rule 424(b) under the Securities

Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration

statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated

by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

| |

(e) |

that for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in

the initial distribution of securities: |

The undersigned Registrant undertakes that in a primary offering of securities

of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

| |

(1) |

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be

filed pursuant to Rule 424 under the Securities Act; |

| |

(2) |

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used

or referred to by the undersigned Registrant; |

| |

(3) |

the portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act

relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and |

| |

(4) |

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

(4) Registrant undertakes:

| |

(a) |

that, for the purpose of determining any liability under the Securities Act the information omitted from the

form of prospectus filed as part of the Registration Statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant under Rule 424(b)(1) under the Securities Act will be deemed to be a part of the Registration

Statement as of the time it was declared effective. |

| |

(b) |

that, for the purpose of determining any liability under the Securities Act, each post-effective amendment that

contains a form of prospectus will be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of the securities at that time will be deemed to be the initial bona fide offering thereof.

|

- 6 -

(5) The undersigned Registrant hereby undertakes that, for purposes of determining any

liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference into the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(6) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and

controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(7) Registrant undertakes to send by first-class mail or other means designed to ensure equally prompt delivery, within two business days of

receipt of a written or oral request, any prospectus or Statement of Additional Information.

- 7 -

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, Registrant has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York and the State of New York on the 1st day of June, 2022.

|

|

|

| APOLLO TACTICAL INCOME FUND INC. |

|

|

| BY: |

|

/S/

JOSEPH MORONEY |

| Name: |

|

Joseph Moroney |

| Title: |

|

President |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed

below by the following persons in the capacities and on June 1, 2022.

|

|

|

| Signature |

|

Title |

|

|

| /s/ JOSEPH MORONEY

JOSEPH MORONEY |

|

President (Principal Executive Officer) |

|

|

| /s/ KENNETH SEIFERT

KENNETH SEIFERT |

|

Chief Financial Officer

(Principal Financial and Accounting Officer) |

|

|

| BARRY COHEN*

BARRY COHEN |

|

Director |

|

|

| ROBERT L. BORDEN*

ROBERT L. BORDEN |

|

Director |

|

|

| GLENN N. MARCHAK*

GLENN N. MARCHAK |

|

Director |

|

|

| CARL J. RICKERTSEN*

CARL J. RICKERTSEN |

|

Director |

|

|

| TODD J. SLOTKIN*

TODD J. SLOTKIN |

|

Director |

|

|

| ELLIOT STEIN, JR.*

ELLIOT STEIN, JR |

|

Director |

|

|

|

| *By: |

|

/s/

JOSEPH D. GLATT |

|

|

(Joseph D. Glatt, Attorney-In-Fact) |

SCHEDULE OF EXHIBITS

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (h) |

|

ATM Sales Agreement |

|

|

| (l) |

|

Opinion and Consent of Miles & Stockbridge P.C. |

|

|

| (s)(2) |

|

Calculation of Filing Fees Tables (Final Prospectus Dated June 1, 2022) |

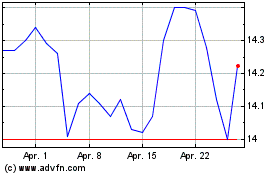

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024