Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259427

Prospectus Supplement No. 7

(To Prospectus dated September 29, 2021 as amended by

Prospectus Supplement No. 1 dated October 5, 2021

Prospectus Supplement No. 2 dated October 12, 2021

Prospectus Supplement No. 3 dated October 13, 2021

Prospectus Supplement No. 4 dated October 26, 2021

Prospectus Supplement No. 5 dated November 8, 2021 and

Prospectus Supplement No. 6 dated November 17, 2021)

ASHFORD HOSPITALITY TRUST, INC.

This is Prospectus Supplement No. 7 (this “Prospectus Supplement”) to our Prospectus, dated September 29, 2021, as amended by Prospectus Supplement No. 1, dated October 5, 2021, Prospectus Supplement No. 2, dated October 12, 2021, Prospectus Supplement No. 3, dated October 13, 2021, Prospectus Supplement No. 4, dated October 26, 2021, Prospectus Supplement No. 5, dated November 8, 2021, and Prospectus Supplement No. 6, dated November 16, 2021 (the “Prospectus”), relating to the offer and sale of up to 6,040,888 shares of common stock, par value $0.01 (“Common Stock”), of Ashford Hospitality Trust, Inc. (the “Company”), by M3A LP. Terms used but not defined in this Prospectus Supplement have the meanings ascribed to them in the Prospectus.

We have attached to this Prospectus Supplement our current report on Form 8-K filed November 23, 2021. The attached information updates and supplements, and should be read together with, the Prospectus, as supplemented from time to time.

Investing in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 15 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is November 23, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 19, 2021

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-31775

|

|

86-1062192

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS employer identification number)

|

|

|

|

|

|

|

|

14185 Dallas Parkway, Suite 1200

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriated box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AHT

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

AHT-PD

|

|

New York Stock Exchange

|

|

Preferred Stock, Series F

|

|

AHT-PF

|

|

New York Stock Exchange

|

|

Preferred Stock, Series G

|

|

AHT-PG

|

|

New York Stock Exchange

|

|

Preferred Stock, Series H

|

|

AHT-PH

|

|

New York Stock Exchange

|

|

Preferred Stock, Series I

|

|

AHT-PI

|

|

New York Stock Exchange

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

As previously announced in our current report on Form 8-K filed on January 15, 2021, Ashford Hospitality Trust, Inc. (“Ashford Trust” or the “Company”) and Ashford Hospitality Limited Partnership, an indirect subsidiary of the Company (the “Borrower”) entered into a Credit Agreement (as amended, the “Credit Agreement”) with certain funds and accounts managed by Oaktree Capital Management, L.P. (the “Lenders”) and Oaktree Fund Administration, LLC, as administrative agent (the “Administrative Agent”). Also as previously announced in our current report on Form 8-K filed on October 13, 2021, Ashford Trust and the Borrower entered into Amendment No. 1 to the Credit Agreement (“Amendment No. 1”) with the Lenders and the Administrative Agent.

On November 19, 2021, Ashford Trust and the Borrower entered into that certain Limited Waiver to Credit Agreement (the “Limited Waiver”) with the guarantors party thereto, the Lenders party thereto, and the Administrative Agent. Pursuant to the Limited Waiver, the Lenders and the Administrative Agent waived Ashford Trust’s obligation to comply with the negative covenant set forth in Section 7.06(b) of the Credit Agreement insofar as such negative covenant prohibits the declaration of any Restricted Payment (as defined in the Credit Agreement) constituting current or accrued dividends on Company Preferred Stock (as defined in the Credit Agreement) on or before November 30, 2021. As a result of the Limited Waiver, effective November 19, 2021, the Company is permitted to declare current and accrued dividends on Company Preferred Stock so long as such declared dividends are not made or paid until after November 30, 2021, and (i) no PIK Principal (as defined in the Credit Agreement) is then outstanding, and (ii) the aggregate amount of Unrestricted Cash (as defined in the Credit Agreement), after giving effect to such Restricted Payment constituting current and accrued dividends on Company Preferred Stock, is not less than an amount equal to the sum of (x) $100,000,000 plus (y) the aggregate principal amount of delayed draw term loans advanced prior to the date thereof or contemporaneously therewith.

The foregoing description of the Credit Agreement, Amendment No. 1 and the Limited Waiver and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Credit Agreement, Amendment No. 1 and the Limited Waiver, copies of which are attached hereto as Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, and are incorporated by reference herein.

ITEM 7.01 REGULATION FD DISCLOSURE.

The disclosure set forth under Item 1.01 of this Form 8-K is incorporated herein by reference.

Declaration of Preferred Share Dividends

On November 23, 2021, the Company issued a press release (the “Press Release”) announcing that its board of directors (the “Board”) declared cash dividends on the Company’s 8.45% Series D Cumulative Preferred Stock, 7.375% Series F Cumulative Preferred Stock, 7.375% Series G Cumulative Preferred Stock, 7.50% Series H Cumulative Preferred Stock, and 7.50% Series I Cumulative Preferred Stock reflecting accrued and unpaid dividends for the quarters ending June 30, 2020, September 30, 2020, December 31, 2020, March 31, 2021, June 30, 2021, and September 30, 2021 (the “Accrued Preferred Share Dividends”). The Company will pay a cash dividend of $3.1686 per Series D preferred share, $2.7654 per Series F preferred share, $2.7654 per Series G preferred share, $2.8125 per Series H preferred share, and $2.8125 per Series I preferred share. These preferred share dividends are payable December 10, 2021, to shareholders of record as of December 1, 2021. The aggregate amount of the Accrued Preferred Share Dividends is approximately $18.6 million.

The Company also announced in the Press Release that its Board:

a)declared a dividend for the fourth quarter ending December 31, 2021, of $0.5281 per diluted share, for the Company’s 8.45% Series D Cumulative Preferred Stock. This dividend is payable January 14, 2022, to shareholders of record as of December 31, 2021;

b)declared a dividend for the fourth quarter ending December 31, 2021, of $0.4609 per diluted share, for the Company’s 7.375% Series F Cumulative Preferred Stock. This dividend is payable January 14, 2022, to shareholders of record as of December 31, 2021;

c)declared a dividend for the fourth quarter ending December 31, 2021, of $0.4609 per diluted share, for the Company’s 7.375% Series G Cumulative Preferred Stock. This dividend is payable January 14, 2022, to shareholders of record as of December 31, 2021;

d)declared a dividend for the fourth quarter ending December 31, 2021, of $0.46875 per diluted share, for the Company’s 7.50% Series H Cumulative Preferred Stock. This dividend is payable January 14, 2022, to shareholders of record as of December 31, 2021; and

e)declared a dividend for the fourth quarter ending December 31, 2021, of $0.46875 per diluted share, for the Company’s 7.50% Series I Cumulative Preferred Stock. This dividend is payable January 14, 2022, to shareholders of record as of December 31, 2021.

Prepayment of PIK Principal Outstanding Under the Credit Agreement

Pursuant to the Credit Agreement, prepayment of all PIK Principal outstanding under the Credit Agreement is a condition precedent to the Company’s ability to pay current and accrued dividends on Company Preferred Stock. Accordingly, the Company intends to prepay in full all PIK Principal outstanding under the Credit Agreement prior to the payment of the preferred share dividends announced in the Press Release. As of the date of this Form 8-K, PIK Principal outstanding under the Credit Agreement totals approximately $23.5 million.

Payment of Deferred Advisory Fees

Pursuant to Amendment No. 1, so long as (i) there is no PIK Principal is outstanding, (ii) there are no accrued dividends on Company Preferred Stock, and (iii) the aggregate amount of Unrestricted Cash exceeds the amount of (x) all loans outstanding under the Credit Agreement, (y) the PIK Principal outstanding and (z) an amount equal to pay any premiums (including the Prepayment Premium (as defined in the Credit Agreement)) and fees (excluding the exit fee), in each case, that would then be owing if all loans and PIK Principal were prepaid and the Credit Agreement was terminated, the Company’s obligation to defer certain fees due under the Company’s advisory agreement with Ashford Inc. (the “Advisory Agreement”) shall be suspended. Following the Company’s payment of the Accrued Preferred Share Dividends and the PIK Principal outstanding under the Credit Agreement, the Company believes that all other conditions to the Company’s obligation to subordinate fees due under the Advisory Agreement will be satisfied. Accordingly, following such payments, the Company intends to pay all deferred advisory fees under the Advisory Agreement to Ashford Inc. As of the date of this Form 8-K, such deferred advisory fees total approximately $6.6 million.

* * * * *

A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Item 7.01 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

Certain statements and assumptions in this Current Report contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this Current Report include, among others, statements about the Company’s strategy and future plans. These forward-looking statements are subject to risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside the Company’s control.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: the impact of COVID-19, and the rate of adoption and efficacy of vaccines to prevent COVID-19, on our business and investment strategy; the timing and outcome of the SEC’s investigation; our ability to regain S-3 eligibility; our ability to repay, refinance or restructure our debt and the debt of certain of our subsidiaries; anticipated or expected purchases or sales of assets; our projected operating results; completion of any pending transactions; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our operations and business; general volatility of the capital markets and the market price of our common stock and preferred stock; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the markets in which we operate, interest rates or the general economy; and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this Current Report are only made as of the date of this Current Report. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future

performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. Investors should not place undue reliance on these forward-looking statements. The Company can give no assurance that these forward-looking statements will be attained or that any deviation will not occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations, or otherwise, except to the extent required by law.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit Number Description

10.1* Credit Agreement, dated as of January 15, 2021, by and among Ashford Hospitality Trust, Inc., Ashford Hospitality Limited Partnership, OPPS AHT Holdings, LLC, ROF8 AHT PT, LLC, Oaktree Phoenix Investment Fund AIF (Delaware), L.P., and Oaktree Fund Administration, LLC, as administrative agent (incorporated by reference to Exhibit 10.1 to the Registrant’s Form 8-K, filed on January 15, 2021) (File No. 001-31775).

10.2 Amendment No. 1 to Credit Agreement, dated as of October 12, 2021, by and among Ashford Hospitality Trust, Inc., Ashford Hospitality Limited Partnership, OPPS AHT Holdings, LLC, ROF8 AHT PT, LLC, The Lenders Phoenix Investment Fund AIF (Delaware), L.P., and Oaktree Fund Administration, LLC, as administrative agent (incorporated by reference to Exhibit 10.2 to the Registrant’s Form 8-K, filed on October 13, 2021) (File No. 001-31775).

10.5 Subordination and Non-Disturbance Agreement, dated as of January 15, 2021, by and among Oaktree Fund Administration, LLC as the Administrative Agent and collateral agent on behalf of the Lenders, Ashford Inc., Ashford Hospitality Advisors LLC, Ashford Hospitality Trust, Inc., Ashford Hospitality Limited Partnership, Ashford TRS Corporation, Remington Lodging & Hospitality, LLC, Premier Project Management, LLC and Lismore Capital II LLC (incorporated by reference to Exhibit 10.3 to the Registrant’s Form 8-K, filed on January 15, 2021) (File No. 001-31775).

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

* Certain of the schedules to the Credit Agreement have been omitted from this filing pursuant to Item 601(a)(5) of Regulation S-K. The Company will furnish copies of any such schedules to the Securities and Exchange Commission upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 23, 2021

|

|

|

|

|

|

|

|

|

|

|

|

ASHFORD HOSPITALITY TRUST, INC.

|

|

|

|

|

|

|

By:

|

/s/ Alex Rose

|

|

|

|

Alex Rose

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

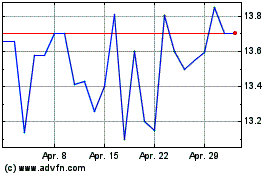

Ashford Hospitality (NYSE:AHT-H)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ashford Hospitality (NYSE:AHT-H)

Historical Stock Chart

Von Apr 2023 bis Apr 2024