Current Report Filing (8-k)

28 Dezember 2021 - 10:37PM

Edgar (US Regulatory)

0001232582false00012325822021-12-272021-12-270001232582us-gaap:CommonStockMember2021-12-272021-12-270001232582us-gaap:SeriesDPreferredStockMember2021-12-272021-12-270001232582us-gaap:SeriesFPreferredStockMember2021-12-272021-12-270001232582us-gaap:SeriesGPreferredStockMember2021-12-272021-12-270001232582us-gaap:SeriesHPreferredStockMember2021-12-272021-12-270001232582aht:SeriesIPreferredStockMember2021-12-272021-12-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): December 27, 2021

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-31775

|

|

86-1062192

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS employer identification number)

|

|

|

|

|

|

|

|

14185 Dallas Parkway, Suite 1200

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AHT

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

AHT-PD

|

|

New York Stock Exchange

|

|

Preferred Stock, Series F

|

|

AHT-PF

|

|

New York Stock Exchange

|

|

Preferred Stock, Series G

|

|

AHT-PG

|

|

New York Stock Exchange

|

|

Preferred Stock, Series H

|

|

AHT-PH

|

|

New York Stock Exchange

|

|

Preferred Stock, Series I

|

|

AHT-PI

|

|

New York Stock Exchange

|

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES.

From October 8, 2021 through December 27, 2021, Ashford Hospitality Trust, Inc. (the “Company”) entered into privately negotiated exchange agreements with certain holders of its 8.45% Series D Cumulative Preferred Stock, par value $0.01 per share (the “Series D Preferred Stock”), 7.375% Series F Cumulative Preferred Stock, par value $0.01 per share (the “Series F Preferred Stock”), 7.375% Series G Cumulative Preferred Stock, par value $0.01 per share (the “Series G Preferred Stock”), 7.50% Series H Cumulative Preferred Stock, par value $0.01 per share (the “Series H Preferred Stock”) and 7.50% Series I Cumulative Preferred Stock, par value $0.01 per share (the “Series I Preferred Stock”, and together with the Series D Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock and the Series H Preferred Stock, the “Preferred Stock”) in reliance on Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”). During this period, the Company exchanged a total of 703,003 shares of its common stock, par value $0.01 per share (the “Common Stock”) for an aggregate of 366,174 shares of Preferred Stock. Such amounts were exchanged in addition to the totals previously reported by the Company under Item 3.02 on (i) the Current Report on Form 8-K dated December 29, 2020; (ii) the Current Report on Form 8-K dated January 19, 2021; (iii) the Current Report on Form 8-K dated January 29, 2021; (iv) the Current Report on Form 8-K dated February 22, 2021; (v) the Current Report on Form 8-K dated March 1, 2021; (vi) the Current Report on Form 8-K dated March 9, 2021; (vii) the Current Report on Form 8-K dated March 30, 2021; (viii) the Current Report on Form 8-K dated April 7, 2021; (ix) the Current Report on Form 8-K dated April 15, 2021; (x) the Current Report on Form 8-K dated May 7, 2021; (xi) the Current Report on Form 8-K dated May 28, 2021; and (xii) the Current Report on Form 8-K dated October 7, 2021. Inclusive of amounts previously reported, from December 8, 2020 through December 27, 2021, the Company has exchanged 8,055,394 shares of Common Stock for 9,190,882 shares of Preferred Stock in reliance on Section 3(a)(9) of the Securities Act. The last transaction conducted in reliance on Section 3(a)(9) of the Securities Act was November 5, 2021 and there have been no subsequent transactions through the date of this filing.

The Company did not receive any cash proceeds as a result of the exchange of the Preferred Stock for the Common Stock, and the shares of Preferred Stock exchanged have been retired and cancelled. The issuance of the shares of the Common Stock was made by the Company pursuant to the exemption from the registration requirements of the Securities Act contained in Section 3(a)(9) of such act on the basis that these offers constituted an exchange with existing holders of the Company’s securities, and no commission or other remuneration was paid to any party for soliciting such exchange. This current report on Form 8-K does not constitute an offer to exchange any securities of the Company for the Common Stock, the Preferred Stock or other securities of the Company.

As previously disclosed, the Company’s board of directors approved a reverse stock split of the Company’s issued and outstanding Common Stock at a ratio of 1-for-10. Effective as of the close of business on July 16, 2021, the reverse stock split converted every ten issued and outstanding shares of Common Stock into one share of Common Stock. All Common Stock data reported herein reflect a retroactive application of the reverse stock split to all privately negotiated exchange agreements entered in reliance on Section 3(a)(9) of the Securities Act that were entered into by the Company prior to the effective date of the reverse stock split.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ASHFORD HOSPITALITY TRUST, INC.

|

|

|

|

|

|

Dated: December 28, 2021

|

By:

|

/s/ Alex Rose

|

|

|

|

Alex Rose

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

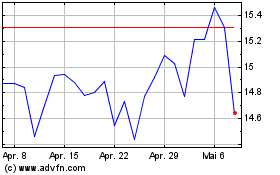

Ashford Hospitality (NYSE:AHT-D)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ashford Hospitality (NYSE:AHT-D)

Historical Stock Chart

Von Apr 2023 bis Apr 2024