Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

02 Dezember 2021 - 12:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2021

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ¨ No ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ¨ No ý

On December 1, 2021, Aspen Insurance Holdings Limited (the “Company”) and seven of its wholly-owned (directly or indirectly) subsidiaries (collectively, with the Company, the “Borrowers”) entered into a Third Amended and Restated Credit Agreement with Barclays Bank plc, as administrative agent, the several lenders and other financial institutions party thereto (the “Credit Agreement”), which amends and restates the Second Amended and Restated Credit Agreement, dated as of March 17, 2017, among the Company, certain subsidiaries thereof, Barclays Bank plc, as administrative agent, the several lenders and other financial institutions party thereto, as amended from time to time (the “Existing Credit Agreement”). The Credit Agreement will be used by the Borrowers to finance the working capital needs of the Company and its subsidiaries and for general corporate purposes. Initial availability under the facility is $300,000,000 and the Company has the option (subject to the terms of the Credit Agreement) to increase the total commitments under the (the “Credit Agreement”) by up to $100,000,000. The facility is due to expire on December 1, 2026.

On the closing date for the facility, $100,000,000 was outstanding under the Existing Credit Agreement. The fees and interest rates on the loans and the fees on the letters of credit payable by the Borrowers under the Credit Agreement are based upon the credit ratings for the Company’s long-term unsecured senior debt by Standard & Poor’s Ratings Services and Moody’s Investors Service, Inc. In addition, the fees for a letter of credit vary based upon whether the applicable Borrower has provided collateral (in the form of cash or qualifying debt securities) to secure its reimbursement obligations with respect to such letter of credit.

The Credit Agreement requires the Company to maintain a minimum consolidated tangible net worth and subjects the Company to a specified percentage limit on total consolidated debt to total consolidated capitalization, subject to certain limitations and exceptions. In addition, the Credit Agreement contains certain customary affirmative and negative covenants, including limitations with respect to the incurrence of certain types of indebtedness and liens, certain types of transactions, and certain fundamental changes. Amounts due under the Credit Agreement may be accelerated upon an “event of default,” as defined in the Credit Agreement, such as failure to pay amounts owed thereunder when due, breach of a covenant, material inaccuracy of a representation, or occurrence of bankruptcy or insolvency, subject in some cases to cure periods or collateralization rights.

The foregoing description of the Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the Credit Agreement, which is attached as Exhibit 99.1.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASPEN INSURANCE HOLDINGS LIMITED

|

|

|

|

|

|

|

Dated: December 2, 2021

|

|

|

|

By:

|

|

/s/ Christopher Coleman

|

|

|

|

|

|

Name:

|

|

Christopher Coleman

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

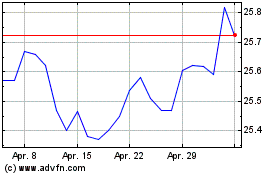

Aspen Insurance (NYSE:AHL-C)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Aspen Insurance (NYSE:AHL-C)

Historical Stock Chart

Von Apr 2023 bis Apr 2024