Current Report Filing (8-k)

07 Dezember 2021 - 12:06PM

Edgar (US Regulatory)

0001569187false00015691872021-12-032021-12-030001569187us-gaap:CommonStockMember2021-12-032021-12-030001569187us-gaap:RedeemableConvertiblePreferredStockMember2021-12-032021-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2021

ARMADA HOFFLER PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-35908

|

|

46-1214914

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

222 Central Park Avenue

|

,

|

Suite 2100

|

|

|

|

Virginia Beach

|

,

|

Virginia

|

|

23462

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (757) 366-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

|

AHH

|

|

New York Stock Exchange

|

|

6.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

|

AHHPrA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 3, 2021, a wholly owned subsidiary of Armada Hoffler Properties, Inc. (the “Company”) entered into a membership interest purchase agreement (the “Agreement”) with an unrelated third party to acquire a 79% interest and an additional 11% economic interest in the mixed-use property known as the Exelon Building for a purchase price of approximately $92.2 million in cash and a loan to the seller of approximately $12.8 million (the “Exelon Acquisition”). In connection with the Exelon Acquisition, the Company will assume its proportionate share of the $156.3 million of debt secured by the Exelon Building, which the Company intends to refinance following the acquisition.

The Exelon Building is a mixed-use property located in Baltimore’s Harbor Point, and is comprised of a 23-story, 444,000 square foot Class A office building that serves as the regional headquarters for Exelon Corporation (“Exelon”), a Fortune 100 energy company, as well as (i) a multifamily component comprised of 103 units, which are approximately 96% occupied as of November 22, 2021, (ii) 750 parking spaces, 500 of which are leased by Exelon and (iii) 38,500 square feet of retail space anchored by West Elm. As of the date of this Current Report on Form 8-K, the office component of the Exelon Building is 100% leased by Exelon pursuant to a lease with a remaining term of 15 years and a three percent annual rent escalator.

The Exelon Acquisition is subject to customary closing conditions, including satisfactory due diligence, and the Company expects to close the Exelon Acquisition by the end of the first quarter of 2022. There can be no assurances that these conditions will be satisfied or that the Company will complete the Exelon Acquisition on the terms described herein or at all, or that the Company will realize the expected benefits of the Exelon Acquisition in part or at all.

Item 7.01. Regulation FD Disclosure.

On December 7, 2021 the Company issued a press release announcing entry into the Agreement. A copy of the press release is attached hereto as Exhibit 99.1 to this report and is incorporated in this Item 7.01 by reference.

The information contained in Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly provided by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements

Certain matters within this Current Report on Form 8-K are discussed using forward-looking language as specified in the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and other factors that may cause the actual results or performance to differ from those projected in the forward-looking statement. These forward-looking statements include comments relating to, among other things, the completion of the Exelon Acquisition and the satisfaction of conditions to closing of acquisitions and dispositions. For a description of factors that may cause the Company’s actual results or performance to differ from its forward-looking statements, please review the information under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, and other documents filed by the Company with the Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ARMADA HOFFLER PROPERTIES, INC.

|

|

|

|

|

Date: December 7, 2021

|

By:

|

/s/ Michael P. O’Hara

|

|

|

Michael P. O’Hara

|

|

|

Chief Financial Officer, Treasurer and Secretary

|

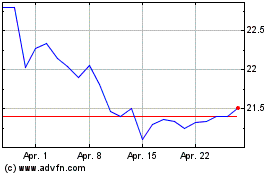

Armada Hoffler Properties (NYSE:AHH-A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Armada Hoffler Properties (NYSE:AHH-A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024