Initial Statement of Beneficial Ownership (3)

22 Januar 2022 - 12:27AM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

TPG GP A, LLC |

2. Date of Event Requiring Statement (MM/DD/YYYY)

1/12/2022

|

3. Issuer Name and Ticker or Trading Symbol

AfterNext HealthTech Acquisition Corp. [AFTR]

|

|

(Last)

(First)

(Middle)

C/O TPG INC, 301 COMMERCE STREET, SUITE 3300 |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

__X__ Director ___X___ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

FORT WORTH, TX 76102

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

___ Form filed by One Reporting Person

_X_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class F Ordinary Shares | (4) | (4) | Class A Ordinary Shares | 6050000 | (4) | I | See Explanation of Responses (1)(2)(3)(4)(6)(7) |

| Warrants (right to buy) | (5) | (5) | Class A Ordinary Shares | 4666667 | (5) | I | See Explanation of Responses (1)(2)(3)(5)(6)(7) |

| Explanation of Responses: |

| (1) | On January 12, 2022, in connection with TPG Inc.'s initial public offering, TPG Inc. engaged in certain transactions as part of a corporate reorganization. As a result of the reorganization, TPG GP A, LLC ("TPG GP A") replaced TPG Group Holdings (SBS) Advisors, Inc. as the managing member of TPG Group Holdings (SBS) Advisors, LLC and thus is replacing TPG Group Holdings (SBS) Advisors, Inc. as a Reporting Person for purposes of filings under Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), including as it relates to the securities of AfterNext HealthTech Acquisition Corp. (the "Issuer"). |

| (2) | TPG GP A is owned by entities owned by Messrs. David Bonderman, James G. Coulter and Jon Winkelried (together with TPG GP A, the "Reporting Persons"). Because of the relationship of Messrs. Bonderman, Coulter and Winkelried to TPG GP A, each of Messrs. Bonderman, Coulter and Winkelried may be deemed to beneficially own the securities of the Issuer held by AfterNext HealthTech Sponsor (as defined below). Messrs. Bonderman and Coulter previously disclosed their beneficial ownership of the securities of the Issuer on a Form 3 filed August 11, 2021. Mr. Winkelried does not directly own any securities of the Issuer. |

| (3) | TPG GP A is the managing member of TPG Group Holdings (SBS) Advisors, LLC, which is the general partner of TPG Group Holdings (SBS), L.P., which holds 100% of the shares of Class B common stock (which represents a majority of the combined voting power of the common stock) of TPG Inc., which is the controlling shareholder of TPG GP Co, Inc., which is the sole shareholder of TPG Holdings III-A, Inc., which is the general partner of TPG Holdings III-A, L.P., which is the sole member of TPG HealthTech Governance, LLC, which is the managing member of AfterNext HealthTech Sponsor, Series LLC ("AfterNext HealthTech Sponsor"), which directly holds 6,050,000 Class F Ordinary Shares, par value $0.0001 per share (the "Class F Shares") of the Issuer, and 4,666,667 warrants (the "Warrants"). |

| (4) | Pursuant to the Issuer's Memorandum and Articles of Association, as amended, the Class F Shares will automatically convert into Class A Ordinary Shares, par value $0.0001 per share ("Class A Shares"), of the Issuer at the time of the Issuer's initial business combination, subject to adjustment. |

| (5) | The Warrants may be exercised during the period (i) commencing on the later of (a) the date that is 30 days after the first date on which the Issuer completes a business combination and (b) August 16, 2022 (provided in each case that the Issuer has an effective registration statement under the Securities Act of 1933, as amended, covering the Class A Shares issuable upon exercise of the Warrants) and (ii) terminating on the earlier of (a) the date that is five years after the date on which the Issuer completes its initial business combination and (b) the liquidation of the Issuer if it fails to consummate a business combination. |

| (6) | Because of the relationship between the Reporting Persons and AfterNext HealthTech Sponsor, the Reporting Persons may be deemed to beneficially own the securities reported herein to the extent of the greater of their respective direct or indirect pecuniary interests in the profits or capital accounts of AfterNext HealthTech Sponsor. Each of AfterNext HealthTech Sponsor and each Reporting Person disclaims beneficial ownership of the securities reported herein, except to the extent of AfterNext HealthTech Sponsor's or such Reporting Person's pecuniary interest therein, if any. |

| (7) | Pursuant to Rule 16a-1(a)(4) under the Exchange Act, this filing shall not be deemed an admission that the Reporting Persons are, for purposes of Section 16 of the Exchange Act or otherwise, the beneficial owners of any equity securities in excess of their respective pecuniary interests. |

Remarks:

8. The Reporting Persons are jointly filing this Form 3 pursuant to Rule 16a-3(j) under the Exchange Act. 9. Gerald Neugebauer is signing on behalf of Mr. Winkelried pursuant to authorization and designation letter dated October 12, 2020, which was previously filed with the Securities and Exchange Commission. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

TPG GP A, LLC

C/O TPG INC

301 COMMERCE STREET, SUITE 3300

FORT WORTH, TX 76102 | X | X |

|

|

WINKELRIED JON

C/O TPG INC

301 COMMERCE STREET, SUITE 3300

FORT WORTH, TX 76102 | X | X |

|

|

Signatures

|

| /s/ Bradford Berenson, General Counsel, TPG GP A, LLC (8) | | 1/21/2022 |

| **Signature of Reporting Person | Date |

| /s/ Gerald Neugebauer on behalf of Jon Winkelried (8)(9) | | 1/21/2022 |

| **Signature of Reporting Person | Date |

AfterNext HealthTech Acq... (NYSE:AFTR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

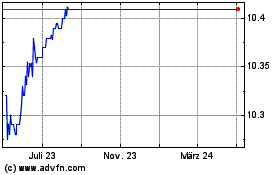

AfterNext HealthTech Acq... (NYSE:AFTR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024