Amended Statement of Beneficial Ownership (sc 13d/a)

09 August 2021 - 10:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

AENZA S.A.A.

(Formerly Graña

y Montero S.A.A.)

(Name of Issuer)

Common Shares,

par value S/ 1.00 per share

(Title of

Class of Securities)

00776D 103**

(CUSIP Number)

**CUSIP number

of the American Depositary Shares (“ADSs”) listed on the New York Stock Exchange. Each ADS represents five common shares.

The common shares are listed on the Lima Stock Exchange and the CINS Identifier is PEP736581005.

Andrew Cunningham

Director

IG4 Capital Infrastructure GP Limited

50 La Colomberie, St. Helier, Jersey, JE2 4QB

+44.1534.844234

(Name, Address

and Telephone Number of Person Authorized to

Receive Notices and Communications)

August 6,

2021

(Date of Event

Which Requires Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e), 13d-1(f) or 13d-1(g) check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See § 240.13d-7(b) for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 00776D 103

|

13D

|

Page 2 of 7 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

IG4 Capital Infrastructure Investments LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) o

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Scotland

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

219,144,510

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

107,198,601

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

219,144,510

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

25.1% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

PN

|

|

|

|

|

|

|

|

|

|

(1)

|

The calculation of this percentage is based on an aggregate 871,917,855

Common Shares outstanding as of June 30, 2021, as set forth in the Form 6-K filed by the Company with the Securities and Exchange Commission

(the “SEC”) on July 26, 2021.

|

|

CUSIP No. 00776D 103

|

13D

|

Page 3 of 7 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

IG4 Capital Infrastructure GP Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) o

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Jersey, Channel Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

219,144,510

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

107,198,601

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

219,144,510

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

25.1% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

HC

|

|

|

|

|

|

|

|

|

|

(1)

|

The calculation of this percentage is based on an aggregate 871,917,855

Common Shares outstanding as of June 30, 2021, as set forth in the Form 6-K filed by the Company with the SEC on July 26, 2021.

|

|

CUSIP No. 00776D 103

|

13D

|

Page 4 of 7 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

IG4 Capital Partners Holding Investments LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) o

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

219,144,510

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

107,198,601

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

219,144,510

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

25.1% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

HC

|

|

|

|

|

|

|

|

|

|

(1)

|

The calculation of this percentage is based on an aggregate 871,917,855

Common Shares outstanding as of June 30, 2021, as set forth in the Form 6-K filed by the Company with the SEC on July 26, 2021.

|

This Amendment No. 1 (the “Amendment”)

amends and supplements the Schedule 13D filed by the Reporting Persons on July 12, 2021 (the “Initial Schedule 13D”

and together with the Amendment, the “Schedule 13D”) with respect to the Company. Capitalized terms used in this Amendment

and not otherwise defined have the same meanings ascribed to them in the Initial Schedule 13D. Unless specifically amended hereby, the

disclosure set forth in the Initial Schedule 13D remains unchanged.

|

|

Item 3.

|

Source and Amount of Funds or other Consideration.

|

The information contained in Item 3 of the Initial

Schedule 13D is hereby amended and supplemented to include the following information:

As described in more detail in Items 4 and 5

below, as of August 6, 2021 the Reporting Persons may be deemed to beneficially own: (i) 107,198,601 Common Shares, representing approximately

12.29% of the then outstanding Common Shares, as a result of the consummation of the Offers (the “Accepted Shares”)

and (ii) 111,945,909 Common Shares, representing approximately 12.8% of the then outstanding Common Shares, as a result of the arrangements

made pursuant to the Amended GH Syndication Agreement, the Amended HG Syndication Agreement and the MA Syndication Agreement and the Trust

Agreement, as disclosed in the Initial Schedule 13D.

On August 10, 2021, the settlement date of the

Offers, Purchaser will pay the aggregate purchase price of S/ 201,533,370 for the Accepted Shares. Based on the average Peruvian Sol/U.S.

dollar interbank exchange rate (tipo de cambio interbancario promedio) reported by the Central Reserve Bank of Peru at 2:00 p.m., Lima

time, on August 6, 2021, the last full trading day prior to the publication of this Amendment, the aggregate purchase price payable by

Purchaser upon the consummation of the Offers would be approximately U.S. $49,240,952.40. The funds to be used to purchase the Accepted

Shares were provided to Purchaser by IG4. The Offers are being financed with funds from IG4 Capital Private Equity Fund II, additional

capital from co-investors and existing liquidity.

|

|

Item 4.

|

Purpose of Transaction.

|

The information contained in Item 4 of the Initial

Schedule 13D is hereby amended and supplemented to include the following information:

The information set forth in Items 3 and 5

of this Amendment is hereby incorporated by reference in this Item 4.

The Offers expired on August 5, 2021.

On August 6, Purchaser filed a Schedule TO-T/A

announcing the final results of the Offers, including the results of the application of proration.

On August 6, 2021, Purchaser accepted for payment

the Accepted Shares at S/ 1.88 per Common Share.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

The information contained in Item 5 of the Initial

Schedule 13D is hereby amended and supplemented to include the following information:

The information set forth in Item 4 of this

Amendment and the responses of the Reporting Persons to Rows (11) through (13) of the cover pages of this Amendment are incorporated herein

by reference.

(a) – (b)

The calculation of this percentage is based

on an aggregate 871,917,855 Common Shares outstanding as of June 30, 2021, as set forth in the Form 6-K filed by the Company with the

SEC on July 26, 2021.

Each Reporting Person may be deemed to share

the power to (i) vote or to direct the vote of 219,144,510 Common Shares in the aggregate, representing approximately 25.13% of the outstanding

Common Shares as a result of the consummation of the Offers and the arrangements made pursuant to the Amended GH Syndication Agreement,

the Amended HG Syndication Agreement and the MA Syndication Agreement and the Trust Agreement (as disclosed in the Initial Schedule 13D)

and (ii) dispose or direct the disposition of 107,198,601 Common Shares in the aggregate, representing approximately 12.29% of the outstanding

Common Shares.

Except as disclosed in the Schedule 13D, none

of the Reporting Persons nor, to the best of their knowledge, any of the other persons identified in Item 2, has the power to vote or

to direct the vote or to dispose or direct the disposition of any of the Common Shares which it may be deemed to beneficially own.

(c)

As described in more detail in Item 4 above,

on August 6, 2021, Purchaser accepted for payment the Accepted Shares. The information set forth in Item 4 is hereby incorporated by reference.

Except for the foregoing, no other transactions

in the Common Shares were effected by the Reporting Persons, nor, to the best of their knowledge, any of the other persons identified

in Item 2, during the sixty (60) days prior to the date of this Schedule 13D.

SIGNATURE

After reasonable inquiry and to the best of

my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 9, 2021

|

|

IG4 CAPITAL INFRASTRUCTURE INVESTMENTS LP

|

|

|

|

|

|

|

By: IG4 Capital Infrastructure GP Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

IG4 CAPITAL INFRASTRUCTURE GP LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

|

|

IG4 CAPITAL PARTNERS HOLDING INVESTMENTS LP

|

|

|

By: IG4 Capital Partners Holding General Partner Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Gustavo Nickel Buffara de Freitas

|

|

|

Name:

|

Gustavo Nickel Buffara de Freitas

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Paulo Todescan Lessa Mattos

|

|

|

Name:

|

Paulo Todescan Lessa Mattos

|

|

|

Title:

|

Director

|

[Signature page to Schedule 13D/A]

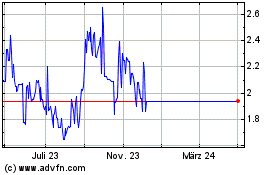

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024