Form 8-K - Current report

05 November 2024 - 10:41PM

Edgar (US Regulatory)

0000007084falsetrue00000070842024-11-042024-11-040000007084us-gaap:CommonStockMember2024-11-042024-11-040000007084us-gaap:DebtSecuritiesMember2024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 4, 2024

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 1-44 | 41-0129150 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| 77 West Wacker Drive, Suite 4600 | | |

| Chicago, | Illinois | | 60601 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (312) 634-8100

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value | ADM | NYSE |

| 1.000% Notes due 2025 | | NYSE |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02: Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On November 4, 2024, the Board of Directors (the “Board”) of Archer-Daniels-Midland Company (the “Company”), after discussion with management of the Company and following the Company’s ongoing dialogue with the staff of the United States Securities and Exchange Commission, concluded that the Company will amend its fiscal year 2023 Form 10-K (the “FY2023 Form 10-K”) and Form 10-Qs for the first and second quarters of 2024 (collectively, the “Q1 and Q2 2024 Form 10-Qs”) to restate the segment information disclosure (Note 17 included in the FY2023 Form 10-K and Note 13 included in the Q1 and Q2 2024 Form 10-Qs) for each of the periods included in those filings, including fiscal years 2021, 2022 and 2023 in the FY2023 Form 10-K and each of the quarterly and year-to-date periods included in the Q1 and Q2 2024 Form 10-Qs (collectively, the “Prior Filings”). The Prior Filings should no longer be relied upon because of errors identified in such financial statements, as described below.

As previously disclosed in Note 17, Segment and Geographic Information, to the Company’s consolidated financial statements included in the FY2023 Form 10-K, the Company identified and corrected certain intersegment sales amounts that either (i) were not in accordance with prior disclosures about presenting such sales at amounts approximating market or (ii) included intrasegment sales (resulting from sales within the segment) and should have included exclusively intersegment sales (resulting from sales from one segment to the other). In connection with the error corrections, the Company identified a material weakness in its internal control over financial reporting related to its accounting practices and procedures for intersegment sales. The Company put in place a plan to remediate this material weakness, as disclosed in the FY2023 Form 10-K and Q1 and Q2 2024 Form 10-Qs.

In the course of testing new controls implemented as part of the Company’s material weakness remediation plan in the third quarter of 2024, the Company identified additional misclassified intersegment transactions. These newly identified errors concern additional intersegment sales for each of its Ag Services and Oilseeds, Carbohydrate Solutions and Nutrition segments that included certain intrasegment sales and should have included exclusively intersegment sales. The Company also identified some intersegment transactions between Ag Services and Oilseeds and Carbohydrate Solutions that were not accounted for consistently in accordance with revenue recognition and segment reporting standards and should not have been reported as intersegment sales.

The restatements of the Prior Filings are not expected to result in any material impact on the Company’s Consolidated Statements of Earnings, Consolidated Statements of Comprehensive Income (Loss), Consolidated Balance Sheets, Consolidated Statements of Cash Flow or Consolidated Statements of Shareholders’ Equity as of and for the periods presented therein. The restated Prior Filings will include corrections for the newly identified errors related to intersegment sales (described in the paragraph immediately above), will reflect the previously-corrected errors related to intersegment sales, and other segment disclosure corrections.

The Company is working to complete these restatements as soon as reasonably practical. The Company is evaluating its remediation measures and is continuing to focus on implementing enhancements to its internal controls to remediate its previously identified material weakness, taking action to enhance its integrity and accuracy within internal controls and financial reporting related to intersegment sales. Among other things, the design and documentation of the execution of pricing and measurement and reporting controls for segment disclosure purposes and projected financial information used in impairment analyses have been enhanced, and testing of these controls will continue throughout the balance of the year. Further, training for relevant personnel on the measurement of intersegment sales and application of relevant accounting guidance to intersegment sales has been provided and remains ongoing.

The Company’s management and the Chair of the Company’s Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, Ernst & Young LLP.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements, other than statements of historical fact included in this Current Report on Form 8-K, are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “outlook,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, statements regarding the timing of the restatement of the financial statements in the Company’s Prior Filings, the impact of the Company’s restatements of the Prior Filings, the proposed remediation measures with respect to the identified material weakness in the Company’s internal control over financial reporting, and the timing of the remediation of the identified material weakness in the Company’s internal control over financial reporting are forward-looking statements. All forward-looking statements are subject to significant risks, uncertainties and changes in circumstances that could cause actual results and outcomes to differ materially from the forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, assumptions and uncertainties, including, without limitation, those that are described in Item 1A, “Risk Factors” included in the FY2023 Form 10-K and in other documents that the Company files or furnishes with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Except to the extent required by law, the Company does not undertake, and expressly disclaims, any duty or obligation to update publicly any forward-looking statement whether as a result of new information, future events, changes in assumptions or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ARCHER-DANIELS-MIDLAND COMPANY |

| | | | | | | | | | | | | | |

| Date: | November 5, 2024 | | By | /s/ R. B. Jones |

| | | | R. B. Jones |

| | | | Senior Vice President, General Counsel, and Secretary |

v3.24.3

Cover Page Cover Page

|

Nov. 04, 2024 |

| Class of Stock [Line Items] |

|

| Entity Central Index Key |

0000007084

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity Registrant Name |

ARCHER-DANIELS-MIDLAND CO

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-44

|

| Entity Tax Identification Number |

41-0129150

|

| Entity Address, Address Line One |

77 West Wacker Drive, Suite 4600

|

| Entity Address, City or Town |

Chicago,

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60601

|

| City Area Code |

312

|

| Local Phone Number |

634-8100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Class of Stock [Line Items] |

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

ADM

|

| Security Exchange Name |

NYSE

|

| Debt Securities [Member] |

|

| Class of Stock [Line Items] |

|

| Title of 12(b) Security |

1.000% Notes due 2025

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_ClassOfStockLineItems |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_DebtSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

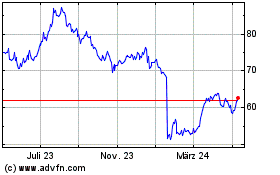

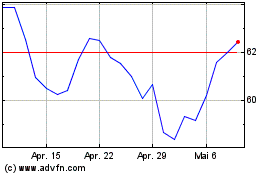

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024