Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

03 August 2022 - 5:11PM

Edgar (US Regulatory)

Filed Pursuant

to Rule 424(b)(5)

Registration

No. 333-238729

PROSPECTUS SUPPLEMENT

(To Prospectus Supplement dated February 22, 2021

and Prospectus dated May 27, 2020)

$500,000,000

Common Stock

This prospectus

supplement is being filed to update, amend and supplement certain information in the prospectus supplement, dated and filed with the

Securities and Exchange Commission on February 22, 2021 (the “Original Prospectus Supplement”), and the base

prospectus dated May 27, 2020 (the “Prospectus”) related to the offer and sale of shares of our common stock having

an aggregate offering price of up to $500,000,000 from time to time, pursuant to separate at the market equity distribution

agreements, dated February 22, 2021 (collectively, the “ATM Equity Distribution Agreements”) with Raymond

James & Associates, Inc., (“Raymond James”), Robert W. Baird & Co. Incorporated

(“Baird”), Citigroup Global Markets Inc. (“Citigroup”), Jefferies LLC (“Jefferies”), J.P. Morgan

Securities LLC (“J.P. Morgan”), Stifel, Nicolaus & Company, Incorporated (“Stifel”), Wells

Fargo Securities, LLC (“Wells Fargo Securities”) and Capital One Securities, Inc. (“Capital One”), each

a sales agent and, collectively, the sales agents. This prospectus supplement is only intended to update, amend and supplement certain

information in the Original Prospectus Supplement to the extent set forth in the following paragraph. You should read this

prospectus supplement together with the Original Prospectus Supplement and Prospectus.

On August 3,

2022, we entered into Amendment No. 1 to the ATM Equity Distribution Agreements with each of Raymond James, Baird, Citigroup,

Jefferies, J.P. Morgan, Stifel, Wells Fargo and Capital One, as sales agents and forward purchasers (as defined in the Original

Prospectus Supplement), as applicable, under the program in order to reflect the appointment of Latham & Watkins LLP as

counsel for the sales agents and forward purchasers. Accordingly, the reference to “Hunton Andrews Kurth LLP” under “Legal

Matters” in the Original Prospectus Supplement shall hereafter be deemed to be deleted and replaced with reference to

“Latham & Watkins LLP.” As a result of the foregoing, all references in the Original Prospectus Supplement to

counsel to the sales agents and forward purchasers shall hereafter be deemed to mean Latham & Watkins LLP.

Investing in our common

shares involves a high degree of risk. See “Risk Factors” beginning on page S-5 of the Original Prospectus

Supplement and the information set forth under the caption “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and

our subsequent Quarterly Reports on Form 10-Q, as well as the other information set forth in our other filings under the Securities

Exchange Act of 1934, as amended, that are incorporated herein by reference.

Neither the Securities

and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if

this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Raymond James |

Baird |

Citigroup |

| |

|

|

| J.P. Morgan |

Jefferies |

Stifel |

| |

|

|

| Wells Fargo Securities |

|

Capital One Securities |

The date of this prospectus supplement is August 3,

2022.

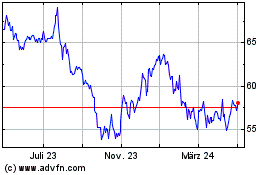

Agree Realty (NYSE:ADC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

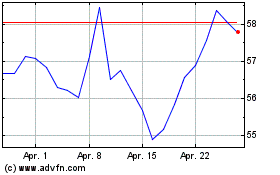

Agree Realty (NYSE:ADC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024