Current Report Filing (8-k)

01 Dezember 2021 - 12:05PM

Edgar (US Regulatory)

False000152937700015293772021-11-302021-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_____________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 30, 2021

ARES COMMERCIAL REAL ESTATE CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-35517

|

|

45-3148087

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

245 Park Avenue,

|

42nd Floor,

|

New York,

|

NY

|

10167

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (212) 750-7300

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

ACRE

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On November 30, 2021, ACRC Lender C LLC (“ACRC Lender C”), a subsidiary of Ares Commercial Real Estate Corporation, entered into an amendment to the Master Repurchase Agreement (the “Citi Facility”) with Citibank, N.A. The purpose of the amendment is to extend the current facility expiration date and funding availability period of the Citi Facility to January 13, 2022, in order to facilitate documenting a multi-year extension of the facility expiration date and funding availability period of the Citi Facility. There is no assurance that the multi-year extension will be consummated. The facility expiration date continues to be subject to two 12-month extensions, each of which may be exercised at ACRC Lender C’s option assuming no existing defaults under the Citi Facility and applicable extension fees being paid, which, if both were exercised, would extend the maturity date of the Citi Facility to December 13, 2023.

The foregoing description of the amendment to the Citi Facility is only a summary of certain material provisions of the amendment and is qualified in its entirety by reference to a copy of such amendment, which is filed herewith as Exhibit 10.1 and by this reference incorporated herein.

Forward-Looking Statements

Certain statements contained in this Current Report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities and Exchange Act of 1934, as amended. Such statements, which relate to future events or the Company’s future performance or financial condition, including a potential multi-year extension of the Citi Facility, are intended to be covered by the safe harbor provided by such rules. These statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results could differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking statements made herein, whether as a result of new information, future events or otherwise, except as required by law.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information required by Item 2.03 contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

Fifth Amendment to Master Repurchase Agreement, dated as of November 30, 2021, by and among, ACRC Lender C LLC, as seller, Ares Commercial Real Estate Corporation, as guarantor, and Citibank, N.A., as buyer.

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARES COMMERCIAL REAL ESTATE CORPORATION

|

|

|

|

|

|

|

Date:

|

December 1, 2021

|

By:

|

/s/ Anton Feingold

|

|

|

|

Name:

|

Anton Feingold

|

|

|

|

Title:

|

General Counsel, Vice President and Secretary

|

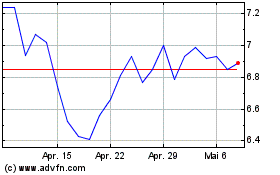

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

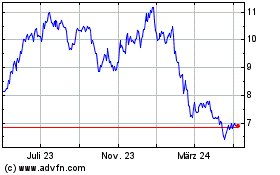

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024