Poor Claims Experiences Could Put Up to $170B of Global Insurance Premiums at Risk by 2027, According to New Accenture Research

03 August 2022 - 6:01AM

Business Wire

Artificial intelligence technologies such as

machine learning and data analytics could transform the claims

value chain and improve customer outcomes

Up to $170 billion of insurance premiums could be at risk in the

next five years due to poor claims experiences, with process

inefficiencies in underwriting potentially costing the industry

another $160 billion over the same period, according to a new

report from Accenture (NYSE: ACN).

The report, “Why AI in Insurance Claims and Underwriting?”, is

based on surveys of more than 6,700 policyholders across 25

countries; more than 120 claims executives in 12 countries; and

more than 900 US-based underwriters. It explores how the insurance

industry is responding to the latest market dynamics, pressure from

new competitors, challenges facing underwriters, and the growing

demand for seamless customer experiences — as well as how

artificial intelligence (AI) technologies can be applied to satisfy

and retain customers and transform the underwriting function.

The report found that one-third (31%) of the claimants were not

fully satisfied with their home and auto insurance claims-handling

experiences over the past two years. Of this 31%, six in 10 (60%)

cited settlement speed issues and 45% cited issues with the closing

process.

Dissatisfaction around the claims experience is a key reason

driving customers to switch insurers. Nearly one-third (30%) of

dissatisfied claimants said they had switched carriers in the past

two years, and another 47% said they were considering doing so.

Overall, the consumers who reported not being fully satisfied could

represent up to $34 billion in premiums annually, or up to $170

billion over the next five years.

The report states that AI technologies could improve the claims

process. For instance, four in five (79%) of the claims executives

surveyed said they believe that automation, AI and data analytics

based on machine learning can bring value across the entire claims

value chain — from flagging fraudulent claims, to damage assessment

and loss estimation, reserving, adjusting, processing optimization,

and subrogation. However, the adoption of these technologies has

been slow to date, with only about one-third (35%) of claims

executives reporting that their organizations are advanced in their

use of these technologies. This could change, though, as nearly

two-thirds (65%) of insurance companies plan to invest $10 million

or more in these technologies over the next three years,

prioritizing AI-based applications and automation technologies,

according to the claims executives surveyed.

The report also found that insurers could reduce underwriting

operating costs through the adoption of AI technologies, making up

to $160 billion in efficiency gains by 2027. As underwriters

currently grapple with ageing systems and inefficient processes,

the research found that up to 40% of their time is spent on

non-core and administrative activities — an annual efficiency loss

of between $17 billion and $32 billion. More than half (60%) of the

underwriters surveyed believe that improvements could be made to

the quality of their organizations’ processes and tools.

“AI is no longer a technology of the future, but an established

capability that many insurance innovators are already putting to

work to deliver better customer experiences and empower their

workforce,” said Kenneth Saldanha, who leads Accenture’s Insurance

industry group globally. “As humans and AI collaborate ever more

closely in insurance, companies will be able to reshape how they

operate, becoming more efficient, fluid and adaptive. Those that

are already moving to leverage AI will be able to create sustained

competitive advantage.”

Read the full report, “Why AI in Insurance Claims and

Underwriting?” to understand how to drive AI at scale in

insurance.

Methodology The report is based on four surveys across

insurance claims and underwriting, analyzing both customer and

employee experiences and how insurers are responding:

- A survey of 6,754 insurance policyholders in 25 countries on

their most recent experiences in filing auto and property insurance

claims;

- A survey of 128 insurance claims executives in 12 countries

regarding the strategies of their claims organizations;

- A survey of 434 US-based property and casualty insurance

underwriters, conducted in conjunction with The Institutes, a

provider of insurance education; and

- A survey of 500 US-based life insurance underwriters regarding

technology adoption.

To arrive at the $170 billion premiums-at-risk figure, Accenture

used modelling in conjunction with survey data of 6,700 insurance

claimants, analyzing the global personal auto and property

insurance market to calculate the yearly premium volume and the

percentage of people who make a claim annually. This was used in

conjunction with the consumer survey data pertaining to the

percentage of people who reported that they were not fully

satisfied with their claims experience and those who said they

have, as a result of their dissatisfaction, changed carriers or

will do so over the next five years. Accenture used a similar

approach to calculate the $160 billion efficiency gains in

underwriting figure — taking into account personal, commercial and

life yearly premium volumes and costs spent on underwriting

employees to determine an underwriting expense ratio. Efficiency

gains were calculated to be 0.5-1 percentage points of the expense

ratio, representing between $9 billion and $15 billion globally per

year.

About Accenture Accenture is a global professional

services company with leading capabilities in digital, cloud and

security. Combining unmatched experience and specialized skills

across more than 40 industries, we offer Strategy and Consulting,

Technology and Operations services and Accenture Song — all powered

by the world’s largest network of Advanced Technology and

Intelligent Operations centers. Our 710,000 people deliver on the

promise of technology and human ingenuity every day, serving

clients in more than 120 countries. We embrace the power of change

to create value and shared success for our clients, people,

shareholders, partners and communities. Visit us at

accenture.com.

Copyright © 2022 Accenture. All rights reserved. Accenture and

its logo are trademarks of Accenture.

This content is provided for general information purposes and is

not intended to be used in place of consultation with our

professional advisors. This document refers to marks owned by third

parties. All such third-party marks are the property of their

respective owners. No sponsorship, endorsement or approval of this

content by the owners of such marks is intended, expressed or

implied.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220802005844/en/

Victoria Ancell Accenture +44 7446 27759

v.ancell@accenture.com

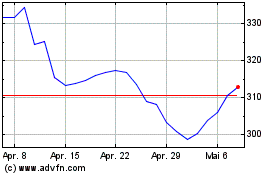

Accenture (NYSE:ACN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024