It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Albertsons Companies, Inc. at 2:30 p.m. Mountain Daylight Time on Thursday, August 4, 2022.

The transformation journey at Albertsons Companies continued in fiscal 2021, and we are proud of the way our team continued to take care of our customers, while driving strong operating and

financial performance.

Our full year results exceeded our expectations, with identical sales down only 0.1% following the 16.9% identical sales growth we experienced in fiscal 2020. Total sales were $71.9 billion,

Adjusted EBITDA was $4.4 billion, and Adjusted EPS was $3.07 per fully diluted common share. Our digital sales grew 5% during the year and 263% on a two-year stacked basis, as we continued the expansion of our omni-channel capabilities.

Throughout the year, we consistently executed against our four strategic priorities:

While we will remain focused on these priorities, we are entering the next phase of our transformation, which we call, “Creating Customers for Life.” This strategy is focused on digitally

connecting and engaging all customers, differentiating our store experience, enhancing what we offer, modernizing our capabilities, and further embedding ESG throughout our operations.

Finally, I want to recognize the approximately 290,000 associates who have contributed to our success through their commitment to meet the needs of our customers and communities.

On behalf of our board of directors, thank you for your continued interest and investment in Albertsons Companies.

| PROPOSAL 3: |

| Advisory (Non-Binding) Vote to Approve the Company’s Named Executive Officer Compensation |

|

As required by Section 14A of the Exchange Act, we are providing stockholders with an opportunity to cast an advisory vote on the compensation of our named executive officers (the

“NEOs”) as disclosed in the Compensation Discussion & Analysis (“CD&A”), the compensation tables, narrative discussion, and related footnotes included in this proxy statement.

|

|

Our Board recommends a vote “FOR” this proposal.

SEE PAGE 43

|

In addition, we will conduct any other business that may properly come before the Annual Meeting. See “- Questions and Answers About the Annual Meeting and Voting” for more

information.

Board Nominees

The following table provides summary information about each director nominee.

| CC - Compensation Committee |

|

AC - Audit Committee |

|

GC - Governance, Compliance and ESG Committee |

|

|

Chair |

| TC - Technology Committee |

|

FC - Finance Committee |

|

|

|

|

Member |

|

+ |

Age of directors are as of June 7, 2022 |

Board Snapshot

Our Board leadership structure promotes balance between independence, stockholder representation, diversity, engaged oversight and extensive management,

strategic, financial, and operational expertise all of which drive value for our stockholders.

Relevant Skills & Experiences

Corporate Governance Highlights

Our core corporate governance practices are listed in the following table.

| Separation of CEO

and Chair role |

Co-Chair roles

promote better Board oversight and governance |

Our largest

stockholders have representation on our Board |

Directors regularly attend all Board and committee

meetings |

| Regular Board executive sessions |

Board committees with focus on Environmental, Social, and

Governance (“ESG”), finance, technology, and cybersecurity |

Annual Board and committee assessments |

Annual equity grants for non-employee directors |

| Directors subject to stock retention guidelines |

No term limits or mandatory retirement age allowing directors to

develop insight into the Company and its operations |

Annual director elections |

Limitation on other board service

|

ESG Highlights

Our corporate social responsibility practices are designed to help position Albertsons as an employer of choice to our existing and prospective employees, and a partner of choice in our

communities. Though our practices will evolve over time, we are focused on community outreach and support, our people and culture, and environmental stewardship.

During fiscal 2021, we pursued our ongoing commitment to ESG principles. Some of our achievements in this area were:

|

✓ |

Laying the foundation for our ESG strategy and initiatives for the future |

|

✓ |

Supporting our communities through our Nourishing Neighbors program and providing targeted donations and assistance to a variety of community projects |

|

✓ |

Increasing our diversity, equity and inclusion engagement throughout our Company |

|

✓ |

Improving our sustainability practices |

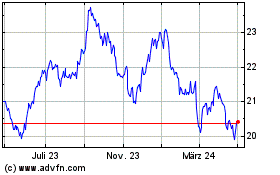

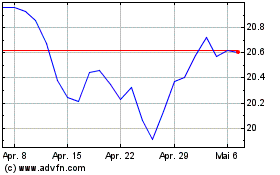

Company Financial Performance During Fiscal 2021

As noted by our CEO in his letter to stockholders, we have met or exceeded a number of our financial and operational goals in 2021. During fiscal 2021, we have achieved significantly

higher total returns as compared to the S&P 500 index and the S&P 500 retail index.

Compensation Highlights

The Board monitors emerging best practices in executive compensation to incorporate them into our compensation program and enhance value for our

stockholders. Through its commitment to strong governance, the Board has implemented the following compensation “best practices.”

| What We Do |

|

What We Don’t Do |

| |

|

|

|

✓ Provide competitive,

market-driven base salary

✓ Balance mix of pay components

✓ Utilize quantitative

performance targets based on Company financial and operating performance for a significant portion of total compensation

✓ Cap the amount of our annual

bonus at 2x of target

✓ Use a variety of equity

incentive structures to promote performance and retention

✓ Maintain robust stock

ownership guidelines

✓ Include a recoupment or

“clawback” policy in our compensation program

✓ Provide double trigger in

employment agreements for change in control

|

|

û Provide automatic salary increases

û Provide high levels of fixed

compensation

û Use metrics unrelated to our

operational goals

û Reward imprudent risk-taking

û Pay above market returns on any

deferred compensation plan

û Maintain defined benefit pension plans

for our executive officers

û Pay excessive perquisites

û Provide excise tax gross ups for

change in control payments

|

Compensation Design Summary and Changes

In line with our compensation philosophy of pay-for performance and to align further with stockholder interests, the Compensation Committee made the following changes to our executive

compensation program for fiscal 2021:

| Cash Bonus Plan |

|

Long-Term Equity Plan |

| |

|

|

|

• Bonuses paid based on quarterly and

annual results

• Targets and results based on

Company-wide performance for both annual and quarterly results, compared to division performance only for quarterly bonus in fiscal 2020

• Identical Sales (“ID Sales”) added

as an additional performance metric to promote same-store sales growth

• Payout weighted 60% on Adjusted

EBITDA* and 40% on ID Sales

• Payout capped at 200% of target

|

|

• Consists of 50% time-based restricted stock units

and 50% performance-based restricted stock units

• Added a return on invested capital modifier (“ROIC

Modifier”) to promote responsible use of the Company’s cash

• Performance stock units earned based on adjusted

earnings per share (“EPS”)* performance (0-160%) and ROIC Modifier (75% - 125%)

• Payout capped at 200% of target

|

|

* |

For a reconciliation of non-GAAP measures, please see pages 52-54 of our 2021 Form 10-K. |

General Information

Solicitation of Proxies

Our Board is soliciting proxies in connection with the Annual Meeting (and any adjournment thereof) to be held virtually on August 4, 2022, at 2:30 p.m. MDT. The approximate date on

which this proxy statement and the enclosed proxy are first being sent to stockholders is June 21, 2022.

Shares Outstanding and Voting Rights

As of the Record Date, 531,589,621 shares of Common Stock of the Company were outstanding. Holders of Common Stock are entitled to

one vote for each share so held.

In addition, each share of Series A preferred stock is entitled to vote on each matter to come before the Annual Meeting as if the shares of Series A preferred stock were converted into

shares of Common Stock as of the Record Date, meaning that each share of Series A preferred stock is entitled to approximately 58.064 votes on each matter to come before the Annual Meeting. As of the Record Date, there were 695,412 shares of Series A

preferred stock issued and outstanding, representing approximately 40,378,394 votes.

Only stockholders of record as of the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting.

|

PROPOSAL 1:

Election of Directors

|

|

Controlled Company Status

Cerberus Capital Management, L.P. (“Cerberus”), Klaff Realty, L.P. (“Klaff Realty”), Schottenstein Stores Corp. (“Schottenstein Corp.”),

Lubert-Adler Partners, L.P. (“Lubert-Adler“) and Kimco Realty Corporation (“Kimco Realty”) (collectively, the “Sponsors”), as a group, control a majority of our outstanding voting securities. Under the corporate governance standards of the New

York Stock Exchange (“NYSE”), a company of which more than 50% of the voting power is held by an individual, group, or another company is deemed to be a “controlled company” which may elect not to comply with certain NYSE corporate governance

requirements, including that:

• a majority of the Board consist of independent directors;

• the nominating and corporate governance committee consist entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities;

• the compensation committee consist entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

• the nominating and corporate governance committee and the compensation committee conduct an annual performance evaluation.

We currently utilize certain of these exemptions. Our Board does not have a majority of independent directors and our Governance Committee and Compensation Committee do

not consist entirely of independent directors. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the NYSE corporate governance requirements. If we cease to be a controlled

company within the meaning of the NYSE corporate governance requirements, we will be required to comply with the requirements after specified transition periods.

We currently have a fully independent Audit Committee, and all Board committees operate pursuant to respective written charters addressing

the committee’s purpose and responsibilities.

|

|

Our Board recommends that stockholders vote “FOR” each nominee |

Board Composition

Our business and affairs are currently managed by our Board. Our Certificate of Incorporation and our Amended and Restated Bylaws (our “bylaws”) provide that the number of members on our

Board shall be determined by our Board from time to time. At the 2021 annual meeting, the stockholders approved an amendment to our Certificate of Incorporation which permits the Board to be comprised of a maximum of 17 members. Our Board currently has

14 members.

We are bound by certain contractual provisions under agreements with our Sponsors and holders of preferred stock which gives them the right to designate directors and observers to our

Board. Pursuant to the stockholders’ agreement, dated June 25, 2020 (the “Stockholders' Agreement”) and the investment agreement, dated May 20, 2020, as amended and restated on June 9, 2020 (the “Investment Agreement”), the rights are as follows:

Sponsor and Holder of

Preferred Stock |

Common Share Beneficial Ownership Percentage |

Number of Director or Observer Designation

Rights |

| Cerberus |

at least 20% |

4 directors |

| at least 10% |

2 directors |

| at least 5% |

1 director and 1 observer |

| Klaff Realty |

at least 5% |

1 director |

| Schottenstein Corp. |

at least 5% |

1 director |

| |

|

|

| Kimco Realty |

at least 5% |

1 observer |

| Lubert-Adler |

at least 5% |

1 observer |

HPS Investment Partners,

LLC (“HPS”)(1) |

at least 25% |

1 director |

|

(1) |

Pursuant to the Investment Agreement. |

Annual Meeting Slate

At our Annual Meeting, stockholders will elect 14 directors to hold office for one year, until our 2023 annual meeting of stockholders, and serve until their successors have been duly

elected and qualified or until any such director’s earlier resignation or removal. Nominees were approved and recommended for nomination by our Governance Committee and our Board nominated them for re-election. At this time, we have no reason to

believe that any nominee will be unable or unwilling to serve if elected. However, should any of them become unavailable or unwilling to serve before the Annual Meeting, your proxy card authorizes us to vote for a replacement nominee if the Board names

one. The following biographical information is furnished as to each nominee for election as a director as of June 7, 2022.

| |

|

|

|

Sharon Allen

Former U.S. Chairman of Deloitte LLP

Age: 70

Director Since: 2015

|

| Committees: |

Governance Committee

(Chair); Compensation Committee

Independent Director |

|

PROFESSIONAL HIGHLIGHTS

•

Ms. Allen served in various leadership roles at Deloitte Touche Tohmatsu Limited (“Deloitte”) for nearly 40 years including serving as U.S. Chairman of Deloitte LLP

from 2003 until her retirement from that position in May 2011.

•

She served as a member of the Global Board of Directors, Chair of the Global Risk Committee and U.S. Representative of the Global Governance Committee of Deloitte

from 2003 to May 2011.

•

Among her other leadership roles at Deloitte, Ms. Allen was partner and regional managing partner responsible for audit and consulting services for a number of

Fortune 500 and large privately held companies.

•

Ms. Allen is a Certified Public Accountant (Retired).

OTHER BOARD ENGAGEMENT

•

Ms. Allen has served on the board of Bank of America Corporation, a multinational investment bank and financial services holding company, since 2012.

•

Ms. Allen served on the board of First Solar, Inc., a manufacturer of solar panels and a provider of utility-scale PV power plants and supporting services, from

2013 to 2022.

SKILLS AND QUALIFICATIONS

Ms. Allen’s extensive accounting and audit experience broadens the scope of our Board’s oversight of our financial performance and reporting. Additionally, her leadership and

corporate governance experience with large public companies is valuable to our Board’s governance, strategic planning, and risk management insight.

|

| |

|

|

|

Shant Babikian

Managing Director at HPS

Age: 37

Director Since: 2020

|

| Committees: |

Finance Committee |

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Babikian is a Managing Director at HPS, holder of our Series A preferred stock, and a leading global investment firm.

•

Prior to joining HPS in 2014, Mr. Babikian was Vice President at Oaktree Capital Management, a global asset management firm, where he focused on investing in

privately structured debt and equity transactions.

•

Prior to joining Oaktree, Mr. Babikian was an Analyst in JPMorgan’s Syndicated and Leveraged Finance Group.

OTHER BOARD ENGAGEMENT

•

Mr. Babikian serves on private company boards.

SKILLS AND QUALIFICATIONS

Mr. Babikian brings to the Board substantial experience in the financial industry and in private equity and finance transactions. His experience is a valuable resource to the

Company in our efforts to allocate capital, which helps us implement our business strategies and financial planning and provides insight to our Board’s understanding of the Company’s financial performance.

|

| |

|

|

|

Steven Davis

Former Chairman and CEO of Bob Evans Farms, Inc.

Age: 63

Director Since: 2015

|

| Committees: |

Audit Committee; Finance Committee (Chair)

Independent Director

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Davis served as the former Chairman and CEO of Bob Evans Farms, Inc. (“Bob Evans Farms”), a food service and consumer products company, from May 2006 to

December 2014.

•

Prior to joining Bob Evans Farms, Mr. Davis served in a variety of leadership positions in the restaurant and consumer packaged goods industry, including President

of Long John Silver’s LLC and A&W Restaurants, Inc.

•

Mr. Davis has also held senior executive and operational positions at Yum! Brands, Inc.’s Pizza Hut division and at Kraft General Foods Inc.

OTHER BOARD ENGAGEMENT

•

Mr. Davis has served on the board of PPG Industries, Inc., a manufacturer and distributor of paints, coatings, and specialty materials, since 2019, Marathon

Petroleum Corporation, a petroleum refiner, marketer, retailer, and transporter, since 2013 and American Eagle Outfitters, a global apparel and accessories retailer, since 2020.

•

Mr. Davis served on the board of The Legacy Acquisition Corporation, an acquirer of companies in the retail and restaurant sectors, from November 2017 to November

2020 and Sonic Corp., a quick service drive-thru restaurant chain, from January 2017 until its sale to private equity in December 2019.

SKILLS AND QUALIFICATIONS

Mr. Davis brings to our Board extensive strategic, operational, marketing, branding, financial and general management leadership experience. In particular, Mr. Davis’ leadership

roles at retail, food service, pharmacies and industrial companies provide our Board with valuable insight relevant to our business, strategic plan and financial performance.

|

| |

|

|

|

James Donald

Former President and CEO of the Company

Age: 68

Director Since: 2019

|

| Committees: |

N/A

Co-Chairman of the Board

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Donald served as our President and CEO from September 2018 to April 2019 and, prior to that, served as our President and Chief Operating Officer (“COO”) from

March 2018 to September 2018.

•

Before joining the Company, Mr. Donald served as CEO and Director of Extended Stay America, Inc., a large North American owner and operator of hotels, and its

subsidiary, ESH Hospitality, Inc. (together with Extended Stay America, Inc., “ESH”).

•

Prior to joining ESH, Mr. Donald served as President, CEO and Director of Starbucks Corporation, a multinational chain of coffeehouses and roastery reserves,

President and CEO of regional food and drug retailer, Haggen Food & Pharmacy, Chairman, President and CEO of regional food and drug retailer Pathmark Stores, Inc., and in a variety of other senior and executive roles at Wal-Mart Stores,

Inc., Safeway Inc. and Albertson’s, Inc.

•

Mr. Donald began his grocery and retail career in 1971 with Publix Super Markets, Inc.

OTHER BOARD ENGAGEMENT

•

Mr. Donald has served on the board of Nordstrom, Inc. (“Nordstrom”), a leading fashion retailer, since 2020.

SKILLS AND QUALIFICATIONS

Mr. Donald’s depth of experience in the retail industry, his expertise across real estate and operations, his decades of leadership roles at consumer-focused companies and his

intimate familiarity with the Company makes him a valuable member of our Board.

|

| |

|

|

|

Kim Fennebresque

Former Senior Advisor to Cowen Group Inc.

Age: 72

Director Since: 2015

|

| Committees: |

Compensation Committee (Chair); Audit Committee

Independent Director

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Fennebresque served as a senior advisor to Cowen Group Inc., a diversified financial services firm, from 2008 to 2020, where he also served as its Chairman,

President, and CEO from 1999 to 2008.

•

He has also served as head of the corporate finance and mergers and acquisitions departments at UBS, a global firm providing financial services, and general partner

and co-head of investment banking at Lazard Frères & Co., a leading financial advisory and asset management firm.

•

From 2010 to 2012, Mr. Fennebresque served as chairman of Dahlman Rose & Co., LLC, an investment bank.

•

Mr. Fennebresque has also held various positions at First Boston Corporation, an investment bank acquired by Credit Suisse.

OTHER BOARD ENGAGEMENT

•

Mr. Fennebresque has served on the boards of Ally Financial Inc., a financial services company, since 2009 and BlueLinx Holdings Inc., a distributor of building

products, since 2013, including its chairperson since 2016.

•

Mr. Fennebresque served on the boards of Ribbon Communications Inc., a provider of network communications solutions, from October 2017 to February 2020, Delta

Tucker Holdings, Inc. (the parent of DynCorp International), a provider of defense and technical services and government outsourced solutions, from May 2015 to July 2017 and Rotor Acquisition Corp., a special purpose acquisition company, from

November 2020 to June 2021.

SKILLS AND QUALIFICATIONS

Mr. Fennebresque’s extensive experience as a director of several public companies and history of leadership in the financial services industry brings corporate governance expertise

and a diverse viewpoint to the deliberations of our Board. In addition, Mr. Fennebresque’s deep experience in the financial services industry provides our Board valuable insight into the Company’s risk management, financial performance, and

strategic plan.

|

| |

|

|

|

Chan Galbato

CEO of Cerberus Operations and Advisory Company, LLC

Age: 59

Director Since: 2021

|

| Committees: |

N/A

Co-Chairman of the Board

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Galbato is the CEO of Cerberus Operations, the operations platform of Cerberus. He oversees the platform’s operating executives and functional experts to

integrate operating expertise within Cerberus’ portfolio companies and investment strategies.

•

Prior to joining Cerberus in 2009, Mr. Galbato served as President and CEO of the Controls Division of Invensys plc, a multinational engineering and information

technology company headquartered in London, United Kingdom, and President of Professional Distribution and Services at The Home Depot, the largest home improvement retailer in the United States.

•

Mr. Galbato also served as President and CEO of Armstrong Floor Products and prior to that, was the CEO of Choice Parts.

•

He spent 14 years with General Electric, serving in several operating and finance leadership positions within their various industrial divisions as well as holding

the role of President and CEO of Coregis, a GE Capital company.

OTHER BOARD ENGAGEMENT

•

Mr. Galbato has served on the board of Blue Bird Corporation (“Blue Bird”), the leading independent designer and manufacturer

of school buses, since February 2015.

•

Mr. Galbato served on the boards of KORE Group Holdings, Inc., a pioneer in delivering IoT solutions and services, from September 2021 to February 2022 and AutoWeb,

Inc., an automotive media and marketing services company, from January 2019 to May 2022.

SKILLS AND QUALIFICATIONS

Mr. Galbato’s proven track record as an executive and leader in multiple operational and strategic roles at a variety of public and private companies qualifies him to serve as the

Co-Chair of the Board. In particular, Mr. Galbato provides our Board with valuable insights into the Company’s operational and organizational strategy and effectiveness.

|

| |

|

|

|

Allen Gibson

Chief Investment Officer of Centaurus Capital LP

Age: 56

Director Since: 2018

|

| Committees: |

Governance Committee; Technology Committee (Co-Chair); Finance

Committee

Independent Director |

|

PROFESSIONAL HIGHLIGHTS

•

Since April 2011, Mr. Gibson has served as the Chief Investment Officer of Centaurus Capital LP (“Centaurus”), a private investment partnership with interests in

oil and gas, private equity, structured finance, and the debt capital markets.

•

He has also served as the Investment Manager for the Laura and John Arnold Foundation since 2011.

•

Prior to Centaurus, Mr. Gibson served as Senior Vice President in institutional asset management at Royal Bank of Canada from February 2008 to April 2011.

OTHER BOARD ENGAGEMENT

•

Mr. Gibson serves on private company boards.

SKILLS AND QUALIFICATIONS

Mr. Gibson’s knowledge of capital markets enhances the ability of our Board to make prudent financial judgments and provides our Board insight into and understanding of our

financial performance and plan.

|

| |

|

|

|

Hersch Klaff

CEO of Klaff Realty

Age: 68

Director Since: 2010

Committees: Finance Committee

|

| |

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Klaff serves as the CEO of Klaff Realty, an investment firm that engages in real estate and private equity transactions focused on the United States and Latin

America, which he formed in 1984.

•

Mr. Klaff began his career as a Certified Public Accountant with the public accounting firm of Altschuler, Melvoin and Glasser.

OTHER BOARD ENGAGEMENT

•

Mr. Klaff served on the board of Energy Vault Holdings, Inc. (formerly Novus Capital Corporation II), a leader in sustainable, grid-scale energy storage solutions,

from September 2020 to 2022.

SKILLS AND QUALIFICATIONS

Mr. Klaff’s real estate, accounting and investment experience, as well as his extensive knowledge of our Company, broadens the scope of our Board’s oversight of our financial

performance and strategic planning.

|

| |

|

|

|

Vivek Sankaran

CEO and Director of ACI

Age: 59

Director Since: 2019

Committees: N/A

|

| |

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Sankaran has served as our CEO and Director since September 2021, and our CEO, President and Director since April 2019.

•

Prior to joining the Company, Mr. Sankaran served since 2009 in various leadership and executive positions at PepsiCo, Inc. (“PepsiCo”), a multinational food,

snack, and beverage corporation.

•

From January to March 2019, he served as CEO of PepsiCo Foods North America, a business unit within PepsiCo, where he led PepsiCo’s snack and convenient foods

business.

•

Prior to that position, Mr. Sankaran served as President and COO of Frito-Lay North America, a subsidiary of PepsiCo, from April 2016 to December 2018, its COO from

February to April 2016 and Chief Commercial Officer, North America, of PepsiCo from 2014 to February 2016, where he led PepsiCo’s cross divisional performance across its North American customers.

•

Prior to joining PepsiCo in 2009, Mr. Sankaran was a partner at McKinsey and Company, where he served various Fortune 100 companies, bringing a strong focus on

strategy and operations.

OTHER BOARD ENGAGEMENT

•

Mr. Sankaran serves on private company boards.

SKILLS AND QUALIFICATIONS

Mr. Sankaran’s decades of experience in the food and beverage industry, as well as his management and leadership experience, provides our Board with expertise relevant to our

business and our operational, financial and strategic plan.

|

| |

|

|

|

Jay Schottenstein

Chairman of the Board and CEO of Schottenstein Corp.

Age: 67

Director Since: 2006

Committees: Compensation Committee; Technology Committee

|

| |

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Schottenstein has served as Chairman of the Board of American Eagle Outfitters, Inc., a global specialty retailer, since March 1992 and as its CEO since

December 2015, a position in which he previously served from March 1992 to December 2002.

•

He has also served as Chairman of the Board and CEO of Schottenstein Corp. since March 1992 and as President since 2001.

OTHER BOARD ENGAGEMENT

•

Mr. Schottenstein has served as Executive Chairman of the Board of Designer Brands, Inc. (formerly DSW Inc.), a footwear and accessories retailer, since 2005, and

as Chairman of the Board of American Eagle Outfitters, Inc. since March 1992.

SKILLS AND QUALIFICATIONS

Mr. Schottenstein has deep knowledge of the Company and the retail industry in general. His extensive experience as a chief executive officer and a director of other major publicly

owned retailers, and his expertise across operations, real estate, development, brand building and team management, gives him and our Board valuable knowledge and insight to oversee our operations.

|

| |

|

|

|

Alan Schumacher

Former Member of the Federal Accounting Standards Advisory Board

Age: 75

Director Since: 2015

|

| Committees: |

Audit Committee (Chair); Governance Committee

Independent Director |

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Schumacher worked for 23 years at American National Can Corporation and American National Can Group, where he served as Executive Vice President and Chief

Financial Officer (“CFO”) from 1997 until his retirement in 2000, and Vice President, Controller and Chief Accounting Officer from 1985 until 1996.

•

Mr. Schumacher served as a member of the Federal Accounting Standards Advisory Board from 2002 through June 2012.

OTHER BOARD ENGAGEMENT

•

Mr. Schumacher has served on the boards of Warrior Met Coal, Inc. (“Warrior Met Coal”), a leading producer and exporter of metallurgical coal for the global steel

industry, since April 2017, Evertec Inc. (“Evertec”), a leading electronic transactions and technology company in Latin America, since 2015 and Blue Bird since 2008.

Mr. Schumacher serves on the audit committees of Warrior Met Coal, Evertec and Blue Bird. Our Board has determined that simultaneous service on more than three audit

committees of public companies by Mr. Schumacher does not impair his ability to serve on our Audit Committee nor does it represent or in any way create a conflict of interest for the Company.

•

Mr. Schumacher served on the board of BlueLinx Holdings Inc., a distributor of building products, from May 2004 to May 2021.

SKILLS AND QUALIFICATIONS

Mr. Schumacher’s experience as a board member of several public companies including his deep understanding of accounting principles and his experience in risk management, expands

the breadth of our Board’s expertise in accounting and financial reporting oversight and risk management.

|

| |

|

|

|

Brian Kevin Turner

Former CEO of Core Scientific and COO of Microsoft Corporation

Age: 57

Director Since: 2020

|

| Committees: |

Compensation Committee; Technology Committee (Co-Chair)

Former Senior Advisor to our CEO

Vice Chairman of the Board

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Turner served as President and CEO of Core Scientific, an emerging leader in blockchain and artificial intelligence infrastructure, hosting, transaction

processing and application development, from July 2018 to May 2021.

•

He served as Vice Chairman and Senior Advisor to our CEO from August 2017 to February 2020.

•

From August 2016 to January 2017, Mr. Turner served as CEO of Citadel Securities and Vice Chairman of Citadel LLC (“Citadel”), global financial institutions.

•

Prior to Citadel, Mr. Turner served as COO of Microsoft Corporation, an American multinational technology corporation, from 2005 to 2016, and as CEO and President

of Sam’s Club, an American chain of membership-only retail warehouse clubs owned and operated by Walmart Inc., from 2002 to 2005.

•

Between 1985 and 2002, Mr. Turner held several positions of increasing responsibility with Wal-Mart, including Executive Vice President and Global Chief Information

Officer from 2001 to 2002.

OTHER BOARD ENGAGEMENT

•

Mr. Turner was a member of the board of Nordstrom from 2010 to May 2020.

SKILLS AND QUALIFICATIONS

Mr. Turner’s strategic and operational leadership skills and expertise in online worldwide sales, global operations, supply chain, merchandising, branding, marketing, information

technology and public relations provide our Board with valuable insight relevant to our business.

|

| |

|

|

|

Mary Elizabeth West

Senior Advisor with McKinsey & Company

Age: 59

Director Since: 2020

|

| Committees: |

Compensation Committee; Governance Committee

Independent Director |

|

PROFESSIONAL HIGHLIGHTS

•

Ms. West serves as a Senior Advisor with McKinsey & Company.

•

Ms. West served as the Senior Vice President and Chief Growth Officer of The Hershey Company (“Hershey”), one of the largest chocolate manufacturers in the world,

from May 2017 to January 2020. She drove Hershey’s growth and marketing strategies as well as communication, disruptive innovation, research and development, and mergers and acquisitions. Ms. West ignited the transformation of the company’s

offerings beyond chocolate into snack categories.

•

Prior to Hershey, Ms. West was at J.C. Penny Company, Inc., an American department store chain, after having served on its board from November 2005 to May 2015.

•

From 2012 to 2014, Ms. West served as Executive Vice President, Chief Category and Marketing Officer of Mondelez International, Inc., the snack foods division spun

off from Kraft Foods, Inc. (“Kraft Foods”) in 2012.

•

Ms. West began her career at Kraft Foods and served in various capacities over the course of 21 years and was named its Chief Marketing Officer in 2007. During her

tenure at Kraft Foods, Ms. West was involved with some of the food industry’s most iconic brands such as Kraft Macaroni and Cheese, Oreo, and Maxwell House coffee.

OTHER BOARD ENGAGEMENT

•

Ms. West has served on the boards of Hasbro, Inc. a global play and entertainment company, since June 2016 and Lowe’s Inc., a home improvement retailer, since April

2021.

SKILLS AND QUALIFICATIONS

Ms. West’s proven track record of innovation and transformation across myriad facets of retail brings to our Board extensive food and retail industry experience. Ms. West provides

our Board with expertise in marketing, brand building and strategic and operational planning for consumer-focused companies.

|

| |

|

|

|

Scott Wille

Senior Managing Director and Head of Consumer and Retail Private Equity at Cerberus

Age: 41

Director Since: 2020

Committees: Governance Committee; Finance Committee

|

| |

|

|

PROFESSIONAL HIGHLIGHTS

•

Mr. Wille serves as Senior Managing Director and Head of Consumer and Retail Private Equity at Cerberus, which he joined in 2006.

•

Since 2016, Mr. Wille has served as a member of Cerberus’ Private Equity Investment Committee.

•

Mr. Wille previously served as a director of the Company from January 2015 to June 2020.

•

Prior to joining Cerberus, Mr. Wille was with the leveraged finance group at Deutsche Bank Securities Inc. from 2004 to 2006.

OTHER BOARD ENGAGEMENT

•

Mr. Wille has served on the board of NexTier Oilfield Solutions Inc., a provider of hydraulic fracturing, wireline technologies and drilling services, since March

2011.

•

Mr. Wille served on the board of Tower International, Inc., a leading manufacturer of engineered automotive structural metal components and assemblies, from

September 2010 to October 2021.

SKILLS AND QUALIFICATIONS

Mr. Wille’s experience in the financial and private equity industries, and his in-depth knowledge of the Company and industry, are valuable to our Board’s understanding of the

Company, its strategic plan, and its financial performance.

|

Corporate Governance

Director Nomination Process

The Governance Committee is responsible for facilitating director assessments, identifying skills and expertise that candidates should possess, and screening, selecting, and recommending

candidates for approval by our Board, including nominees submitted by stockholders. Although our Board retains ultimate responsibility for approving candidates for election, the Governance Committee conducts the initial screening and evaluation. In

evaluating director candidates, the Governance Committee follows the director qualification standards laid out in the Corporate Governance Guidelines of our Board. The Board has not established any minimum qualifications that must be met by a director

candidate or identified any set of specific qualities or skills that it deems to be mandatory. In evaluating any nomination, the Governance Committee seeks to achieve a balance of knowledge, experience, and capability on the Board. Some of the factors

that are taken into consideration in evaluating the suitability of individual Board member candidates are experience in corporate governance (such as an officer or former officer of a publicly-held company), experience as a board member of another

publicly-held company, familiarity with the Company, expertise in a specific area of the Company’s operations, expertise in financial markets, education and professional background and existing commitments to other businesses, including other boards of

directors. Each candidate nominee must also possess fundamental qualities of intelligence, honesty, demonstrated character and good judgment, high ethics and standards of integrity, fairness and responsibility.

In determining whether to recommend a director for re-election, the Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to

the activities of the Board.

The Governance Committee will consider candidates recommended by other members of the Board, management and stockholders and may also retain professional search firms to identify

candidates. All candidates, including candidates recommended by stockholders, are evaluated on the basis of the same criteria described above.

Nomination Rights and Support Obligations under Certain Agreements

Right to Nominate Directors under the Stockholders’ Agreement

Under the terms of our Stockholders’ Agreement, the Sponsors have the right to designate directors to our Board based on their levels of ownership of our Common Stock. See “- Board

Composition” for a discussion of the rights of Sponsors to designate directors to our Board. Additionally, each Sponsor votes the Common Stock owned by them in favor of each other Sponsor’s nominees to the Board.

The current Sponsor nominees are Chan Galbato, Allen Gibson, Hersch Klaff, Jay Schottenstein, Brian Kevin Turner and Scott Wille.

Right to Designate Observers under the Investment Agreement

Under the terms of our Investment Agreement, HPS Investors, as defined in the Investment Agreement, have the right to nominate directors and observers to our Board based on their level of

ownership of our preferred stock. See “- Board Composition” for a discussion of the designation rights of the HPS Investors. Mr. Babikian is the current nominee of the HPS Investors.

Board Leadership

Separation of the Roles of Chairmen of the Board and CEO

Although our Board does not have a formal policy on separation of the roles of the CEO and Chairman, those roles are separate on our Board. Our Board has two Co-Chairs. The Co-Chairs,

Messrs. Donald and Galbato, perform all duties typically performed by a board Chair including presiding over meetings and approving the agendas and schedules of meetings of the Board. Pursuant to our Corporate Governance Guidelines, since neither of

our Board Co-Chairs are members of management, we do not have a Lead Director.

Separation of the Chairman and CEO roles allows us to develop and implement corporate strategy that is consistent with the Board’s oversight role, while facilitating strong day-to-day

executive leadership by the CEO. Through the role of the Co-Chairmen, the Board’s committees, and the regular use of executive sessions of the non-management directors, the Board can maintain independent oversight of risks to our business, our

long-term strategies, annual operating plan, and other corporate activities. Our Board has determined that the current structure ensures a full and free discussion of issues that are important to our stockholders and provides an appropriate oversight

over management that serves the interests of our stockholders.

Separate Sessions of Non-Management Directors

Pursuant to our Corporate Governance Guidelines and the rules of the NYSE, our non-management directors periodically meet in executive sessions with no members of management present. Our

Board Co-Chairs chair the meetings, and in their absence, the non-management directors will select a director present at the meeting to chair the meeting.

Board Independence

As discussed above, we are a controlled company. As such, the majority of our Board is not independent, and we utilize exemptions permitted under the NYSE corporate governance requirements

for purposes of the composition of our Compensation and Governance Committees.

The Board, in coordination with our Governance Committee, and with assistance of the Company’s General Counsel, followed the applicable NYSE tests to determine the independence of the

Board members. On the basis of this review, the Board affirmatively determined that (a) Mmes. Allen and West and Messrs. Davis, Fennebresque, Gibson and Schumacher are independent directors under the applicable rules of the NYSE and as such term is

defined in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (b) each of Messrs. Davis, Fennebresque and Schumacher meet all applicable requirements for membership in the Audit Committee, and (c) each of

Messrs. Davis, Fennebresque and Schumacher qualifies as “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC, and satisfy the NYSE’s financial experience requirements.

Director Qualifications

Our Corporate Governance Guidelines contain Board membership criteria which are set as broad tenets rather than as specific weighted criteria. To carry out its responsibilities and to set

the appropriate tone at the top, our Board is keenly focused on its leadership structure, and the character, integrity, and qualifications of its members. Our directors have a proven record of accomplishment and an ability to exercise sound and

independent judgment in a collegial manner.

|

CORE ATTRIBUTES OF OUR DIRECTORS

ü High ethics and

standards of integrity, fairness, and responsibility

ü Demonstrated character

and good judgment

ü Fundamental qualities

of intelligence and honesty

ü Proven leadership and

management skills

ü Commitment to Board participation and contribution, including regularly attending Board meetings

|

Our directors complement each other in their mix of skills by bringing to the Board

expertise and experience in the retail industry, capital markets, financial management, real estate, cybersecurity, technology, strategic planning, and corporate governance. Additionally, in selecting Board members, our Governance Committee

follows applicable regulations to ensure that our Board includes members who are independent and possess financial literacy and expertise. |

We believe that each of our directors meet the criteria set forth in our Corporate Governance Guidelines. As noted in the director biographies, our directors have experience,

qualifications, and skills across a wide range of public and private companies, possessing a broad spectrum of experience both individually and collectively. The following matrix summarizes the core competencies of each nominee’s strengths and

contributions to the Board.

Board Diversity

Our Board broadly construes diversity to mean diversity of backgrounds, experience, qualifications, skills, age and expertise, among other factors, which when taken together best serve

our Company and our stockholders. In selecting board members, our Board considers, in addition to the core attributes, the range of talents, experience and expertise that are needed and would complement those that are currently represented on the

Board. The Board seeks to achieve a mix of members whose experience and backgrounds are relevant to the Company’s strategic priorities and the scope and complexity of our business.

The following presentation highlights some of the diversity metrics of our Board.

Age/Gender/Racial

Role of Board in Risk Oversight

The Board maintains overall responsibility for overseeing and managing the Company’s risks including financial and non-financial risk, reputational harm, regulatory compliance, risks

related to ESG policies, succession planning, food safety and information and cybersecurity. In furtherance of its responsibility, the Board has delegated specific risk-related responsibilities to its committees. Our Audit Committee oversees management

of enterprise risks as well as, along with our Finance Committee, financial risks. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements and the incentives created

by the compensation awards it administers. Our Governance Committee oversees risks associated with corporate governance, compliance, and non-financial regulatory risks as well as risks associated with our sustainability and ESG practices. Our

Technology Committee is responsible for overseeing the management of our IT structure and risks associated with information technology and cybersecurity. Management regularly reports to the applicable committee or the Board as appropriate, on material

risks. Each committee also provides a report to the full Board at every meeting regarding the issues discussed and actions taken at the preceding committee meeting.

|

Board

Our full Board has the ultimate oversight responsibility of our risk management process.

|

|

|

AUDIT COMMITTEE

Oversees the quality and integrity of our financial reporting including compliance with legal and financial regulatory requirements.

COMPENSATION COMMITTEE

Responsible for overseeing the management of risks related to our executive compensation plans and arrangements and the incentives created by the compensation awards it

administers.

TECHNOLOGY COMMITTEE

Responsible for overseeing the management of our IT structure and risks associated with IT and cybersecurity.

|

GOVERNANCE COMMITTEE

Oversees risks associated with corporate governance, the Company’s non-financial regulatory, ethics and compliance programs and ESG practices.

FINANCE COMMITTEE

Oversees management of financial risks.

|

|

|

Management

Management regularly reports on applicable risks to the relevant committee or the Board, as appropriate, with additional review or follow-up as needed or as requested by

the committees or the Board.

|

Board Meetings

During fiscal 2021, our Board met 10 times. All directors attended more than seventy-five percent (75%) of all meetings held by committees on which such director served. Except for Mr.

Schottenstein, all directors attended at least seventy-five percent (75%) of all Board meetings.

Pursuant to our Corporate Governance Guidelines, each director is expected to attend in person our annual meeting of stockholders, absent extraordinary circumstances. The 2021 annual

meeting was virtual-only, and eight directors attended virtually.

Corporate Governance Policies and Charters

The following documents make up our corporate governance framework:

|

• Corporate Governance Guidelines

• Audit and Risk

Committee Charter (“Audit Committee Charter”)

|

• Governance, Compliance and ESG

Committee Charter

(“Governance Committee Charter”)

• Compensation

Committee Charter

(“Compensation Committee Charter”)

|

• Finance Committee Charter

(“Finance Committee Charter”)

• Technology Committee Charter

(“Technology Committee Charter”)

|

Current copies of the above policies and guidelines are available publicly on our website at https://www.albertsonscompanies.com/investors

under the “Governance” tab.

Code of Business Conduct and Ethics

We have also adopted a Code of Business Conduct and Ethics, which applies to directors, executive officers and employees. The Code of Business Conduct and Ethics sets forth our policies

on critical issues such as conflicts of interest, insider trading, protection of our property, business opportunities and proprietary information. We will post on our website any amendment to, or a waiver from, a provision of the Code of Business

Conduct and Ethics for executive officers and directors that has been approved by our Board. The Code of Business Conduct and Ethics is available on our website at https://albertsonscompanies.com/investors under the “Governance” tab and is also

available in print to any stockholder upon request.

Board Committees

Our Board currently has five committees – Audit Committee, Compensation Committee, Governance Committee, Technology Committee and the Finance Committee. The current composition of each

of the committees is set forth below.

| Board Members |

|

Audit |

|

Compensation |

|

Gov/Compliance/ESG |

|

Technology |

|

Finance |

| Sharon Allen* |

|

|

|

|

|

|

|

|

|

|

| Shant Babikian |

|

|

|

|

|

|

|

|

|

|

| Steven Davis* |

|

|

|

|

|

|

|

|

|

|

James Donald

Board Co-Chair |

|

|

|

|

|

|

|

|

|

|

| Kim Fennebresque* |

|

|

|

|

|

|

|

|

|

|

Chan Galbato

Board Co-Chair |

|

|

|

|

|

|

|

|

|

|

| Allen Gibson* |

|

|

|

|

|

|

|

|

|

|

| Hersch Klaff |

|

|

|

|

|

|

|

|

|

|

| Vivek Sankaran |

|

|

|

|

|

|

|

|

|

|

| Jay Schottenstein |

|

|

|

|

|

|

|

|

|

|

| Alan Schumacher* |

|

|

|

|

|

|

|

|

|

|

| Brian Kevin Turner |

|

|

|

|

|

|

|

|

|

|

| Mary Beth West* |

|

|

|

|

|

|

|

|

|

|

| Scott Wille |

|

|

|

|

|

|

|

|

|

|

| |

|

Chairperson |

|

|

Member |

|

* |

Independent Director |

| Audit Committee |

Members: |

Number of Meetings Held |

| Alan Schumacher (Chair) |

During Fiscal 2021: 7 |

| Steven Davis |

|

| Kim Fennebresque |

|

|

The Audit Committee assists our Board in its oversight responsibilities relating to the integrity of our financial statements, our compliance with legal and regulatory requirements

(to the extent not otherwise handled by our Governance Committee), our independent auditor’s qualifications and independence and the establishment and performance of our internal audit function and the performance of the independent auditor.

Our Board has affirmatively determined that each of the three members of the Audit Committee qualify as an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC. Each of the Audit

Committee members satisfies the standards for independence of the NYSE and the SEC as they relate to audit committees.

The Audit Committee is governed by the Audit Committee Charter which sets forth the purpose and responsibilities of this committee.

FUNCTIONS

Some of the key functions of the Audit Committee are the following:

• assisting the Board in its oversight responsibilities regarding (1) the reliability and integrity of our

financial accounting policies and financial reporting processes, (2) performance of our internal audit function, (3) enterprise risk management, including major financial risk exposure, (4) our systems of internal control and (5) our accounting

and auditing processes generally;

• appointing, retaining, compensating, evaluating, and replacing our independent registered public accountant;

• approving audit and non-audit services to be performed by the independent registered public accountant; and

• establishing procedures for the receipt, retention, and resolution of complaints regarding accounting,

internal control or auditing matters submitted confidentially and anonymously by employees through the whistleblower hotline.

The Audit Committee meets on a quarterly basis with Company management and Deloitte and Touche to discuss, among other items, the earnings press release related to the quarter and

the year (as applicable), the Company’s financial statements for the applicable period and any changes in significant accounting policies and its impact on the Company’s financial statements. The Audit Committee also meets regularly with

Deloitte and Touche in executive sessions without the presence of members of management.

The Board has also delegated its authority to approve related party transactions to the Audit Committee. The Company’s written policy regarding approval of related party

transactions provides that management must present to the Audit Committee all potential related party transactions including the related party’s interest in the transaction, nature of the transaction, material terms and the maximum dollar value

of the transaction. The Audit Committee approves related party transactions based upon the determination of whether the transaction is fair and in the best interest of the Company. See “- Certain Relationships and Related Party Transactions”

for further details on the approval of related party transactions.

|

Approval of Audit and Non-Audit Services

The Audit Committee approves all audit and permissible non-audit services above a de-minimis threshold (including the fees and terms of the services) performed for the Company by

Deloitte and Touche prior to the time that those services are commenced. The Audit Committee may, when it deems appropriate, form and delegate this authority to a sub-committee consisting of one or more Audit Committee members, including the authority

to grant pre-approvals of audit and permitted non-audit services. The decision of such sub-committee is presented to the full Audit Committee at its next meeting. The Audit Committee pre-approved all fees for fiscal 2021 noted in the table below.

Fees Paid to Independent Registered Public Accounting Firm

We paid the following fees (in thousands) to Deloitte and Touche and its affiliates for professional services rendered by them during the 2021 and 2020 fiscal years, respectively:

| Fees |

|

Fiscal

2021 |

|

Fiscal

2020

|

| Audit(1) |

|

$ |

5,490 |

|

$ |

5,400 |

| Audit Related(2) |

|

$ |

335 |

|

$ |

800 |

| Tax(3) |

|

$ |

575 |

|

$ |

1,500 |

| Other(4) |

|

$ |

- |

|

$ |

30 |

| Total |

|

$ |

6,400 |

|

$ |

7,730 |

|

(1) |

Fees for professional services rendered for the audit of the Company’s consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports. Also includes audit services provided in

connection with other statutory and regulatory filings. |

|

(2) |

Fees for mergers and acquisitions due diligence, accounting consultations and employee benefit plans. |

|

(3) |

Fees related to professional services rendered in connection with tax compliance and preparation related to tax returns and tax audits, as well as for tax consulting and tax planning. |

|

(4) |

Fees for services other than the services reported above. |

Certain Relationships and Related Party Transactions

The following discussion is a brief summary of certain material arrangements, agreements and transactions we have with related parties during fiscal 2021. We

enter into transactions with our Sponsors and other entities owned by, or affiliated with, our Sponsors in the ordinary course of business. These transactions include, amongst others, professional advisory, consulting and other corporate services.

Our Board has adopted a written policy (the “Related Party Policy”) and procedures for the review, approval or ratification of “Related Party Transactions” by the

Audit Committee. For purposes of the Related Party Policy, a “Related Party Transaction” is any transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including the incurrence or issuance of any

indebtedness or the guarantee of indebtedness) in which (1) the aggregate amount involved will or may be reasonably expected to exceed $120,000 in any fiscal year, (2) we or any of our subsidiaries is a participant and (3) any related party has or will

have a direct or indirect material interest.

Management presents any proposed related party transaction at an Audit Committee meeting for review and approval. If management becomes aware of a proposed or existing related party transaction that has not been presented or pre-approved by the Audit Committee, management shall

promptly notify the Chair and the Audit Committee. If it is not practicable for management to wait for the Audit Committee to consider the matter, the

Chairman will consider whether the Related Party Transaction should be ratified or rescinded, or other action should be taken. The Chairman will report to the Audit Committee at the next regularly

scheduled meeting. The Audit Committee will also review all of the facts and circumstances pertaining to the failure to report the Related Party Transaction to the Audit Committee and will take, or recommend to the Board, any action the Audit Committee deems appropriate.

Stockholders’ Agreement and Investment Agreement

See “- Corporate Governance-Director Nomination Process-Nomination Rights and Support Obligations under Certain Agreements” above for more information.

Transactions with Cerberus

We paid Cerberus Technology Solutions, an affiliate of Cerberus, fees totaling approximately $7.0 million for fiscal 2021 for information technology advisory and implementation services in

connection with modernizing our information systems.

We paid Cerberus Operations and Advisory Company, LLC, an affiliate of Cerberus, fees totaling approximately $0.2 million for fiscal 2021 for consulting services

provided in connection with improving the Company's operations.

Transactions with Kimco Realty

We entered into an amendment to a shopping center lease with Ingleside, LLC (“Ingleside”), an affiliate of Kimco Realty. The term of the lease was extended to November 30, 2027, with four

5-year options. In addition to other lease terms related to percentage rent and remodeling that are favorable to us, the annual rent for the period ending in November 2027 was reduced from $0.7 million to $0.5 million to bring the rent more in line

with market. Concurrently, we entered into an amendment to a shopping center pad lease adjacent to the store with terms similar to the shopping center lease. There was no change in rent or monetary consideration.

Transactions with Schottenstein Corp.

We engage SB Capital Group II LLC and its affiliates (“SB Capital Group”), an entity owned by Mr. Schottenstein, to provide fixture and equipment deployment and relocation services between

various Company stores and warehouse facilities and to provide fixture and equipment cleanout services at some of our store locations. SB Capital Group also provides inventory store closing sale services at various Albertsons locations. We paid

approximately $0.37 million to SB Capital Group during fiscal 2021.

|

PROPOSAL 2:

Ratification of the Appointment of the Independent Registered Public Accounting Firm

The Audit Committee has appointed, and our Board has ratified the appointment of Deloitte and Touche to serve as our independent registered public accounting firm for the

fiscal year ending February 25, 2023. We are not required by our bylaws or applicable law to submit the appointment of Deloitte and Touche for stockholder approval. However, as a matter of good corporate governance, we are seeking stockholder

ratification of the appointment of Deloitte and Touche. If the stockholders do not ratify the appointment of Deloitte and Touche, the Audit Committee may consider the appointment of another independent registered public accounting firm. Even if

the selection is ratified, the Audit Committee, in its discretion, may appoint a different independent registered public accounting firm if it believes that such a change would be in the best interests of the Company and our stockholders.

One or more representatives of Deloitte and Touche are expected to attend the Annual Meeting. They will have the opportunity to make a statement if they so desire and

will be available to answer appropriate questions. See ”-Fees Paid to Independent Registered Public Accounting Firm” for the fees paid to Deloitte and Touche during fiscal years 2020 and 2021.

Required Vote

The affirmative vote of a majority of votes cast is required to ratify the appointment of Deloitte and Touche as our independent registered public accounting firm for the

fiscal year ending February 25, 2023.

|

|

Our Board recommends that stockholders vote “FOR” the proposal |

|

PROPOSAL 3:

Advisory (Non-Binding) Vote to Approve the Company’s Named Executive Officer Compensation

As required by Section 14A of the Exchange Act, the Company is providing stockholders with an opportunity to cast an advisory vote on the compensation of our NEOs as

disclosed in the CD&A, the compensation tables, narrative discussion, and related footnotes included in this Proxy Statement.

While the vote is advisory, and therefore non-binding on the Company, the Compensation Committee values the opinions of our stockholders and will take into account the

outcome of the vote when considering future executive compensation decisions.

As discussed in more detail in the CD&A, our executive compensation program is designed to attract and retain a talented team of executives who can deliver on our

commitment to build long-term stockholder value. The Compensation Committee believes our program is competitive in the marketplace and links pay to performance.

Accordingly, the Board recommends that you vote in favor of the following resolution:

RESOLVED, that the compensation paid to the NEOs, as disclosed in this proxy statement pursuant to the SEC’s executive compensation disclosure rules (which disclosure

includes the CD&A, the compensation tables and the narrative discussion that accompanies the compensation tables), is hereby approved.

Required Vote

The affirmative vote of a majority of votes cast is required to approve, on an advisory (non-binding) basis, the compensation of the NEOs as disclosed in this proxy

statement pursuant to Item 402 of Regulation S-K under the Exchange Act, including the CD&A, the compensation tables and narrative discussion that accompanies the compensation tables.

|

|

Our Board recommends that stockholders vote “FOR” the proposal |

Compensation Discussion and Analysis

To assist our stockholders in locating important information regarding our executive compensation program, the CD&A is organized as follows:

The CD&A provides a description of the material elements of our executive compensation program, as well as perspective and context for decisions made regarding the compensation of our

NEOs, which includes our CEO, CFO, former CFO and three other most highly compensated executive officers for the year ended February 26, 2022. These executive officers and their current positions are as follows:

| Name |

|

Position |

| Vivek Sankaran |

|

Chief Executive Officer; Director |

| Sharon McCollam |

|

President and Chief Financial Officer |

| Robert Dimond(1) |

|

Former Executive Vice President and Chief Financial Officer |

| Anuj Dhanda |

|

Executive Vice President and Chief Information Officer |

| Susan Morris |

|

Executive Vice President and Chief Operations Officer |

| Christine Rupp |

|

Executive Vice President and Chief Customer and Digital Officer |

|

(1) |

Mr. Dimond retired as CFO effective September 7, 2021, and retired from the Company on February 26, 2022. |

2021 Say-on-Pay Result

We request an annual say-on-pay vote for our executive compensation program. At our annual meeting held in 2021, approximately 97.5% of the votes cast approved our executive compensation

programs and policies for fiscal 2020. The Compensation Committee reviewed the results of the say-on-pay vote. In spite of the high approval rate, the Compensation Committee made certain changes to our executive

compensation program as discussed further below.

Fiscal 2021 Financial and Operational Highlights

As a newly public Company on a transformation journey, we are proud of how we have delivered on our operational and financial goals while continuing to serve our communities. In

particular, we are proud of the compassion, humility, and passion for excellence that our associates have shown in an exceptionally challenging environment.

Our fiscal 2021 financial and operating results demonstrated how we continue to be more than just a great grocer. We expanded our team with growth and transformational leaders, continued

to drive in-store excellence, invested in technology to allow our customers to shop where they want and when they want, pursued strategies to align with a new shopping environment and launched the Albertsons Media Collective to reach our

customers better.

Our fiscal 2021 accomplishments illustrate our continued commitment to our priorities of:

| Drive in-store excellence. |

Accelerate our digital

and omni-channel

capabilities. |

Enhance our

productivity to reinvest

cash in the business,

help offset inflation and

drive earnings growth. |

Add talent to the best

team in the business and focus on our culture. |

Additional financial and operating highlights for fiscal 2021 include:

| Identical sales growth of 16.8% on a two-year stacked basis and nearly $72 billion in total sales |

Completed 236 store remodels and opened 10 new stores |

Added

837 new items to our Own Brands portfolio |

| Reduced net debt ratio from 1.5x to

1.2x |

Increased

dividend paid per common share to $0.12 from $0.10 |

Membership in our just for U loyalty

program increased more than 18%, reaching 29.9 million members |

| Digital sales growth of 263% on a

two-year stacked basis |

Net income per

Class A common share of $2.70 and Adjusted net income per Class A common share of $3.07*; Adjusted EBITDA of $4,398 million* |

Completed ESG materiality assessment |

| The Albertsons Companies Foundation and the Company gave $200 million in

food and financial support, including approximately $40 million through our Nourishing Neighbors Program |

Operating cash flows of $3,513 million |

Improved our competitive position in several labor markets through the negotiation of

new contracts with unions |

|

* |

For a reconciliation of non-GAAP measures, please see pages 52-54 of our 2021 Form 10-K. |

Overview of Fiscal 2021 Executive Compensation

The following chart summarizes the components and associated objectives of our executive compensation program for fiscal 2021:

| Element |

Overview of Element |

Objective of

Element |

Performance

Metric and Payout |

| Base

Salary |

Fixed amount of cash compensation |

Set market competitive base compensation to retain

talent and influence target for annual bonus |

Individual performance and market competitiveness |

Corporate

Management

Bonus Plan

(Annual Cash

Bonus Program) |

Both quarterly and annual bonus based on Company

performance |

Encourage performance for the Company on a

quarter-by-quarter basis |

Pre-established targets

Weighted 60% Adjusted EBITDA and 40% ID Sales

Payout capped at 200% of target

|

| Encourage strategic performance initiatives for the Company as a whole

and drive overall Company performance |

Long-Term

Incentive

Award Program |

Time-Based RSU Awards |

Align NEO interests with stockholder interests and

promote retention |

Increase in value of Common Stock

Time-based; 1/3 vest annually

|

| Performance-Based RSU Awards |

Align NEO interests with stockholder interests and promote long-term

value creation |

Pre-established targets

Payout capped at 200% Awards earned based on annual Company performance; vests after 3 years

|

Additionally, some of our executives, including our NEOs, have certain severance protection pursuant to their employment agreements. See “- Potential Payments Upon Termination of

Employment” for amounts payable to the NEOs under certain termination scenarios. Consistent with standard business practice, our NEOs also receive business-related

perquisites, and benefits that are provided to all employees, including healthcare benefits, life insurance, retirement savings plans and disability plans. We also occasionally provide

cash bonuses or equity awards to reflect superior individual performance or new roles and responsibilities, to attract new hires or to compensate new hires for amounts forfeited from their previous employer.

Our Compensation Philosophy

Our executive compensation program is structured to attract, motivate, reward, and retain high caliber talent who will lead the Company to increase our competitive advantage and deliver

sustainable profitability. This includes building a solid foundation for long-term growth while consistently achieving near-term results. The Compensation Committee takes a holistic view of pay and performance and ensures that there is appropriate

alignment with Company performance, overall business strategy and culture. We hire high caliber executives who can determine our strategy to execute our long-term vision while continuing to deliver our mission of ‘locally great, nationally strong.’

To ensure that our key executives are incentivized appropriately to deliver our mission and vision, the Compensation Committee has designed an executive compensation program that strongly

aligns with the interests of stockholders by directly linking pay to Company performance. The guiding principles of our compensation program are as follows:

Our Compensation Philosophy

| 1 |

2 |

| Pay for performance by tying a

significant portion of each executive's compensation to quantifiable performance goals over various periods |

Use performance metrics that directly relate to

our financial and business performance and stakeholder interests |

| 3 |

4 |

| Provide competitive pay to help attract, retain and motivate exceptional

leaders with proven experience in a dynamic and competitive market |

Align executive officer interests with the long-term interests of our stakeholders

through an increasing proportion of equity-based incentives as one attains higher levels of responsibility |

Executive Compensation Best Practices

The Compensation Committee monitors emerging best practices in executive compensation to incorporate them into our compensation program. The chart below lists some of our compensation

“best practices” and those we do not follow:

| What We Do |

|

What We Don’t Do |

| |

|

|

|

✓ Provide competitive,

market-driven base salary

✓ Balance mix of pay components

✓ Utilize quantitative

performance targets based on Company financial and operating performance for a significant portion of total compensation

✓ Cap the amount of our annual

bonus at 2x of target

✓ Use a variety of equity

incentive structures to promote performance and retention

✓ Maintain robust stock

ownership guidelines

✓ Include a recoupment or

“clawback” policy in our compensation program

✓ Provide double trigger in

employment agreements for change in control

|

|

û Provide automatic salary increases

û Provide high levels of fixed

compensation

û Use metrics unrelated to our

operational goals

û Reward imprudent risk-taking

û Pay above market returns on any

deferred compensation plan

û Maintain defined benefit pension plans

for our executive officers

û Pay excessive perquisites

û Provide excise tax gross ups for

change in control payments

|

Design of Our Executive Compensation Program

The design of our executive compensation program is consistent with our compensation philosophy noted above. We use various compensation elements to provide an overall competitive total

compensation and benefits package to the NEOs that is tied to creating value, commensurate with our results, and aligns with our business strategy. Set forth below are the key elements of the compensation program for the NEOs for fiscal 2021:

|

• |

Long-term equity incentive awards |

Base Salary

We provide our NEOs with a base salary to compensate them for services rendered during the fiscal year. In alignment with our pay for performance philosophy, base salary represents the

smallest portion of annual total compensation.

The base salary component of our compensation program is designed to attract and retain key talent and is determined by the Compensation Committee based on a variety of factors including:

|

• |

Nature and responsibility of the position; |

|

• |

Expertise of the executive and competition in the market for the executive’s services; |

|

• |

Potential for driving the Company’s success in the future; |

|

• |

Peer group compensation data; |

|

• |

Performance reviews and recommendations of the CEO (except in the case of his own compensation); and |

|

• |

Other judgmental factors deemed relevant by the Compensation Committee. |