March 24, 2022

ABBOTT LABORATORIES

Please Support Proposal for Report on Lobbying Spending and Governance

To Abbott Laboratories Shareholders:

The Unitarian Universalist Common Endowment Fund LLC is urging shareholders to vote

FOR Item 7 at the Abbott Laboratories (“Abbott”) shareholder meeting on April 29, 2022.

This notice of exempt solicitation is being provided on a voluntary basis.

The proposal asks Abbott to prepare an annual report on the governance, management

oversight, policies and expenditures related to federal and state lobbying.

Resolved, the shareholders of Abbott request the preparation

of a report, updated annually, disclosing:

| 1. | Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications. |

| 2. | Payments by Abbott used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the

amount of the payment and the recipient. |

| 3. | Abbott’s membership in and payments to any tax-exempt organization that writes and endorses model legislation. |

| 4. | Description of management’s and the Board’s decision-making process and oversight for making payments described in sections

2 and 3 above. |

Transparency and accountability in corporate spending to influence public policy

are in the best interests of Abbott shareholders. Without a clear system ensuring accountability, corporate assets can be used to promote

public policy objectives which can pose reputational and misalignment risks to the detriment of shareholder value.

Proponent has reached out to the company on multiple occasions over the last several

years to invite dialogue on lobbying disclosure. Finally in 2022, a conversation took place with in-house counsel to “assess whether

further conversation with public policy staff was warranted.” There was no further communication from the company.

Abbott’s missing disclosures

The Company’s current disclosures around its lobbying expenditures and oversight

does not address the requests in this proposal. Below are the four asks in this proposal and Abbott’s responses:

| 1. | Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications. |

| · | Abbott only discloses those responsible for the management and oversight of lobbying, not the actual policy and procedures that guide

the process. |

| 2. | Payments by Abbott used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the

amount of the payment and the recipient. |

| · | Abbott does not report the amounts spent for indirect lobbying or grassroots communications. |

| · | Company reports direct lobbying expenditures to the required offices in the Senate and House of Representatives. In other words, Abbott

obeys the law. Since we would expect any company in which we invest to be law abiding, this is a low bar for performance. |

| 3. | Abbott’s membership in and payments to any tax-exempt organization that writes and endorses model legislation. |

| · | The Company is silent about whether it supports such organizations. |

| 4. | Description of management’s and the Board’s decision-making process and oversight for making payments described in sections

2 and 3 above. |

| · | Nothing is reported on the decision-making process by management or the framework for oversight by the board. |

Summary analysis

| 1. | Abbott Laboratories expends a significant amount of money on lobbying, $4.3 million in 2021.1 |

| 2. | Shareholders are paying increasing attention to corporate lobbying. Lobbying related resolutions have recently received majority votes

at Exxon, FedEx, Norfolk Southern, Netflix and Geo Group. |

| 3. | Abbott’s peers provide lobbying disclosure consistent with that requested in this proposal. |

| 4. | The Company points to its rating on the CPA-Zicklin Index as evidence that its lobbying disclosure is best practice. But the Zicklin

Index rates election spending disclosure, not lobbying disclosure. |

| 5. | The lack of transparency and clear accountability around corporate lobbying creates risks to the company and its investors: potential

damage to reputation and misalignment between lobbying efforts and company strategy and values. |

1. Abbott’s spending on lobbying is significant

Nationally, according to several studies2, corporate spending on lobbying

represents at least ten times corporate election spending. And Abbott’s spending on lobbying is substantial.

_____________________________

1 https://www.opensecrets.org/federal-lobbying/clients/summary?id=D000000383

2 Political activity of firms: The role of firm-lobbying networks and

industry trade associations, Indraneel Chakraborty, Richard Evans and Rüdiger Fahlenbrach; https://www.depts.ttu.edu/rawlsbusiness/about/finance/research-seminar/documents/Lobbying_CEF_01Apr2015.pdf;

Adam Bonica, “Avenues of Influence: On the Political Expenditures of Corporations and Their Directors and Executives,”

December 3, 2013

Federal lobbying

Abbott is among the top three medical device companies in lobbying spending.

| · | Abbott spent $8,390,000 in 2020 and 2021 on federal lobbying activities. |

| · | Since 2010, Abbott has spent $46.1 million on federal lobbying. |

| · | Abbott was one of the top three lobbying medical device companies for the previous five years,3 while

a new study published by JAMA found that Abbott spent $96.6 million on its lobbying efforts from 1999 to 2018.4 |

State lobbying

Abbott’s spending at the state level is likely significant, but information

difficult to find. Obtaining comprehensive information on lobbying at the state level is described by one expert as “nearly impossible”

given “the ‘Byzantine’ manner in which the data is captured and made available online” which effectively buries

information at many states.5

| · | Abbott’s state-level lobbying spending is likely significant, reportedly lobbying in 37 states.6 |

| · | In California, where disclosure is mandated, Abbott spent $1,116,882 from 2010 to 2021 on lobbying.7 |

International lobbying

| · | Abbott also lobbies abroad, reportedly spending between €200,000 – €299,000 on lobbying in Europe for 2020.8 |

2. Investor support for lobbying transparency

Because of the reputational risk and potential damage to shareholder value, there

is growing investor support worldwide for lobbying transparency from their portfolio companies.

| · | In the fall of 2019, 200 institutional investors with a combined $6.5 trillion in assets under management issued a report entitled

“Investor Expectations on Climate Lobbying” that called on companies to disclose their “direct and indirect lobbying

on climate change policies” and “The company’s membership in, or support for, third party organizations that engage

on climate change issues.”9 |

_____________________________

3 https://www.nbcnews.com/health/health-care/medical-device-makers-spend-millions-lobbying-loosen-regs-d-c-n940351

4 https://www.medtechdive.com/news/advamed-medtronic-among-top-20-pharma-and-health-product-lobbyists-of-the/573362/

5 “Wal-Mart Improves Lobbying Disclosure after Shareholder Push,”

Reuters, May 13, 2015, https://www.reuters.com/article/us-wal-mart-stores-disclosure-lobbying-e/exclusive-wal-mart-improves-lobbying-disclosure-after-shareholder-push-idUSKBN0NY0AH20150513.

6 https://publicintegrity.org/politics/state-politics/here-are-the-interests-lobbying-in-every-statehouse/

7 https://cal-access.sos.ca.gov/Lobbying/Employers/Detail.aspx?id=1146891&session=2021&view=activity.

8 https://ec.europa.eu/transparencyregister/public/consultation/displaylobbyist.do?id=578132036311-72.

9 https://www.ceres.org/news-center/press-releases/200-investors-call-us-companies-align-climate-lobbying-paris-agreement

| · | The International Corporate Governance Network (ICGN) representing more than $18 trillion in assets, supports lobbying disclosure

and political spending disclosure as best practice, and supports disclosure of any payments over $10,000.10 |

| · | Last year, support for shareholder proposals on corporate political activity reached record levels (43% in 2021 versus 36% in 2020)

11 including 14 majority votes.12 This is unprecedented and reflects growing investor concerns about the risks inherent

in corporate lobbying on public policy issues. |

| · | In 2022, some 46 shareholder proposals requesting enhanced lobbying transparency have been filed and 18 withdrawn by March 14 after

proponents came to agreement with companies.13 |

3. Other companies are reporting on significant lobbying and public policy issues

Corporate best practice on lobbying disclosure is evolving, both on spending transparency

and consistency of public policy positions.

| · | Companies have begun producing reports which assess the alignment between company positions, including on climate change, and the

positions and lobbying of their key trade associations.14 Examples of companies producing reports include BP15,

CSX, Ford Motor Company, GM and Shell.16 |

| · | Abbott’s trade association disclosure lags many of its peer group members which disclose their trade associations payments and

the amounts used for lobbying, including 3M, Becton Dickinson, Boston Scientific, Bristol-Myers Squibb, Johnson & Johnson, Medtronic,

Merck and United Technologies.17 |

4. The board statement of opposition confuses lobbying and election spending

This proposal specifically addresses the Company’s lobbying activities, not

its involvement in elections and campaigns for political office. In fact, Abbott has been recognized for its election spending disclosure

by the Center for Political Accountability (CPA). Its annual Zicklin Index, prepared in collaboration with the Wharton School, places

Abbott among the 148 first tier companies. This is to be commended, but it does not in any way address lobbying, the subject of this proposal.

In the Board’s statement of opposition, it conflates electoral and lobbying spending and implies that the CPA recognition is for

lobbying disclosure as well as election spending. It is not. To so state is misleading.

_____________________________

10

https://www.icgn.org/sites/default/files/ICGN%20Political%20Lobbying%20%26%20Donations%202017.pdf

11

https://www.conference-board.org/blog/environmental-social-governance/Record-Support-Political-Activity-SHPs

12

https://www.asyousow.org/press-releases/2021/6/24/record-breaking-year-for-environmental-social-and-sustainable-governance-shareholder-resolutions

13

https://ceres.org/news-center/press-releases/shareholders-escalate-campaign-pressing-companies-walk-their-talk

14 https://www.washingtonpost.com/climate-environment/2020/02/25/bp-pull-out-trade-groups-over-climate-policies/

15

https://www.bp.com/en/global/corporate/news-and-insights/bp-magazine/bp-releases-trade-associations-report.html

16

https://www.shell.com/media/news-and-media-releases/2019/shell-publishes-reports-on-industry-associations-sustainability.html

17 3M, Becton Dickinson, Bristol-Myers Squibb and Merck disclose their

trade association payments used for lobbying. Boston Scientific, Johnson & Johnson, Medtronic, and United Technologies disclose also

disclose their trade association payments, as well as the amounts of those payments used for lobbying.

And digging more deeply into the Zicklin ratings tells a different story. Most of

the indicators with the highest potential scores relate directly to elections – e.g. spending on candidates, parties, 527 groups,

and independent expenditures – but on indicators that do overlap with lobbying – trade associations and 501(c)4 groups –

Abbott scores 3 of 6 on the former and 0 on the latter. In other words, in these specific areas, CPA agrees that Abbott’s disclosure

is lacking.

5. Lack of transparency on lobbying creates risk

Corporations make payments to trade associations that are used lobby indirectly on

their behalf without specific disclosure or accountability. Since the trade associations represent that they speak for their member companies,

there can be misalignment between trade association positions and company policy positions. Reputational damage stemming from this misalignment

between general policy positions and actual direct and indirect lobbying efforts may harm long-term shareholder value.

Abbott shareholders face a trade association blind spot, as Abbott fails to disclose

all of its trade association memberships, and does not disclose its trade association payments, nor the portions of these payments used

for lobbying.

| · | Abbott currently lists 2020 memberships18 in 14 trade associations, including the Business Roundtable (BRT), National Association

of Manufacturers and the Chamber of Commerce. Together these three trade associations spent over $108 million on federal lobbying for

2020,19 yet shareholders have no way to know how much of this is comprised of Abbott’s payments, nor can they see how

much of the Company’s trade association payments go towards lobbying. |

| · | Abbott serves on the board of the Advanced Medical Technology Association (AdvaMed)20 and belongs to the Medical Device

Manufacturers Association, which have drawn scrutiny for lobbying to weaken mandatory disclosure of medical device incidents, as well

as lobbying on decreasing taxes on devices, increasing insurance coverage and reimbursement and the FDA’s approval process for bringing

a device to market.21 |

Further, Abbott doesn’t

disclose 501(c)(4) social welfare organizations spending (aka dark money), including all payments used for lobbying, as requested by the

proposal. Social welfare groups can engage in lobbying. Proponents and other supporters of this resolution are asking Abbott to

illustrate its commitment to corporate political responsibility by disclosing ALL payments to third-party groups that use our dues money

to influence policy (‘dark money payments’).

| · | "Phony Grassroots” Campaigns - There are multiple examples of pharmaceutical industry’s involvement in campaigns

which solicit criticism from outside groups, some of which it finances or staffs, to create the impression

of a broad-based support for positions. |

| · | Abbott supports social welfare groups like the Alliance for Aging Research, which lobbies and ran Facebook ads opposing drug pricing

legislation.22 |

_____________________________

18

https://www.abbott.com/investors/governance/corporate-political-participation.html.

19 OpenSecrets.org, (Business Roundtable

- $16,970,000; National Association of Manufacturers - $9,268,000; U.S. Chamber of Commerce - $81,910,000), accessed March 11, 2022.

20

https://www.advamed.org/members/board-directors

21 https://www.nbcnews.com/health/health-care/medical-device-makers-spend-millions-lobbying-loosen-regs-d-c-n940351

22

https://www.prwatch.org/news/2020/01/13525/ex-pharma-lobbyist-embedded-white-house-tanked-drug-pricing-bill-while-his-former.

Abbott has its lobbying information and could easily report it to shareholders

Abbott claims that “[p]reparing and maintaining the report … would have

added cost and effort but not increased shareholder value.” and “[r]ehashing existing disclosures would needlessly waste corporate

resources.” But these arguments are disingenuous, as Abbott is required to report its federal and state lobbying and already has

all of this information. In fact, elsewhere in the statement of opposition, it says “every year, the Board's Public Policy Committee

reviews a report of Abbott's major trade association memberships, the amount of dues, and the amount used for lobbying.” In other

words, the report already exists and could easily be provided to shareholders.

For all of the above reasons, we believe that Abbott’s current lobbying disclosures

are inadequate to protect shareholder interests. We urge you to vote FOR Item 7, the shareholder proposal requesting a report on the Company’s

lobbying expenditures.

Sincerely,

Tim Brennan

Special Advisor on Responsible Investing

Unitarian Universalist Association

This is not a solicitation of authority to vote your proxy. Please DO NOT send

us your proxy card; the Unitarian Universalist Association is not able to vote your proxies, nor does this communication contemplate

such an event. The Unitarian Universalist Association urges shareholders to vote for Item 4 following the instructions provided

on management’s proxy mailing.

6

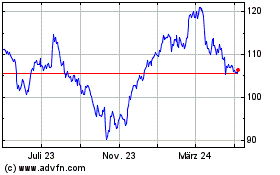

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

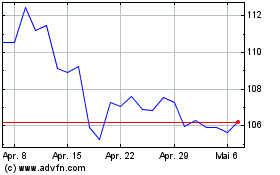

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024