Vodafone Sets New EUR1 Billion Costs-Saving Target as Macroeconomic Environment Worsens -- Update

15 November 2022 - 9:28AM

Dow Jones News

By Kyle Morris

Vodafone Group PLC on Tuesday reported a rise in pretax profit

and revenue for the first half of fiscal 2023, but updated its

guidance for the full year amid the challenging macroeconomic

environment and set a new costs-savings target of more than 1

billion euros ($1.03 billion).

Chief Executive Nick Read said the company is taking a number of

steps to mitigate the economic backdrop of high energy costs and

rising inflation, including pricing action in Europe.

The U.K.-based telecommunications company said pretax profit for

the six months to Sept. 30 was 1.73 billion euros ($1.79 billion)

compared with EUR1.28 billion a year prior.

Adjusted earnings before interest, taxes, depreciation and

amortization--which strips out exceptional and other one-off

items--was EUR7.24 billion from EUR7.57 billion, down 2.6% on an

organic basis. The drop was driven by a material prior-year legal

settlement and commercial underperformance in Germany, it said.

Revenue for the first half was EUR22.93 billion compared with

EUR22.49 billion.

In Germany, total revenue increased 2.2% to EUR6.6 billion,

driven by equipment sales, but adjusted Ebitda declined 7.4%,

reflecting a fall in service revenue, one-off settlements in the

year-prior period and higher customer acquisition costs. On an

organic basis, service revenue declined 0.8%, primarily reflecting

broadband losses related to the implementation of new sector

legislation. Fixed service revenue declined 1.6% and the cable

broadband customer base decreased 45,000. The TV customer base fell

165,000.

The company updated its guidance for fiscal 2023 as the global

macroeconomic climate has worsened, with energy costs and inflation

hitting performance. Vodafone sees adjusted Ebitda of EUR15.0

billion-EUR15.2 billion, from EUR15.0 billion-EUR15.5 billion

previously. Adjusted free cash flow is now seen at around EUR5.1

billion, from around EUR5.3 billion.

The board declared an interim dividend of 4.50 European cents

for the period, flat on year.

"In the context of a challenging macroeconomic environment, we

are delivering a resilient performance this year, alongside making

good progress with our operational and portfolio priorities," Mr.

Read said.

The company's Vantage Towers transaction helped to deliver

monetization and deconsolidation whilst retaining co-control of the

strategically important assets, he added.

On Nov. 9, it said that it had agreed to form a new

jointly-owned company with Global Infrastructure Partners LLC and

KKR & Co. that will own its 81.7% stake in Vantage Towers

AG.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

November 15, 2022 03:13 ET (08:13 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

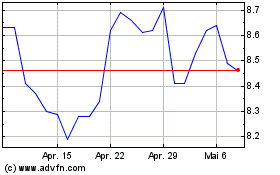

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

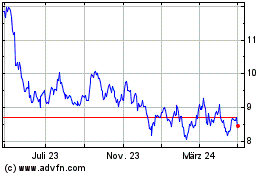

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024