KKR, Global Infrastructure Partners Join Forces with Vodafone for Vantage Towers Stake -- Update

09 November 2022 - 12:35PM

Dow Jones News

By Ian Walker and Mauro Orru

KKR & Co. and Global Infrastructure Partners LLC have agreed

to form a joint venture with Vodafone Group PLC to steer Germany's

mobile-towers company Vantage Towers AG, leveraging Vodafone's

controlling stake in the firm and its extensive portfolio of

mobile-phone towers.

The U.K.-based telecommunications giant said Wednesday that the

joint venture will own its 81.7% stake in Vantage Towers. KKR and

Global Infrastructure Partners will build a stake of up to 50% in

the joint venture by acquiring shares from Vodafone in cash.

The partners will make a takeover proposal for the outstanding

shareholders of Vantage Towers at EUR32.00 per share, giving

Vantage Towers an equity value of 16.2 billion euros ($16.32

billion). Vodafone expects to make between EUR3.2 billion and

EUR7.1 billion depending on the take-up of the takeover proposal,

it said.

"We believe Vantage Towers' high-quality footprint and network

across the region ideally position it to meet the ever-growing

demand for mobile connectivity in Europe," said Vincent Policard,

partner and co-head of European Infrastructure at KKR.

"We have a shared goal of creating a pan-European telecoms

champion by continuing to grow and develop the business, leveraging

the consortium's significant telecoms infrastructure investment

experience and global resources," he said.

Founded in 2020, Vantage Towers listed in Frankfurt in March

2021. The company has a network of about 83,000 tower sites across

ten countries. Vantage Towers said it welcomed the partnership with

Vodafone and the infrastructure investors and recommended that

shareholders accept the takeover offer.

The telecommunications sector has seen a flurry of deal making

in recent years. Brookfield Infrastructure Partners LP and

DigitalBridge Group Inc. agreed in July to buy a stake in Deutsche

Telekom AG's tower business for roughly EUR6.6 billion.

The Vantage Towers deal, which is conditional on regulatory

clearances and is expected to close in the first half of 2023, has

the support of RRJ Capital, Vantage Towers' second largest minority

shareholder, owning 2.4% of shares.

"This transaction successfully delivers on Vodafone's stated

aims of retaining co-control over a strategically important asset,

deconsolidating Vantage Towers from our balance sheet to ensure we

can optimize its capital structure and generate substantial upfront

cash proceeds for the group to support our priority of

deleveraging," Vodafone Chief Executive Nick Read said.

Vodafone said it expects the deal to have a slightly dilutive

effect on its adjusted earnings per share and free cash flow. It

will use the money from the sale of its interest to reduce

debt.

Vodafone shares at 1054 GMT were down 1.5% at 104.69 pence;

Vantage Towers shares were up 11% at EUR32.50.

Write to Ian Walker at ian.walker@wsj.com and Mauro Orru at

mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

November 09, 2022 06:20 ET (11:20 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

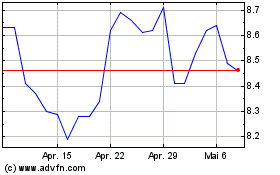

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

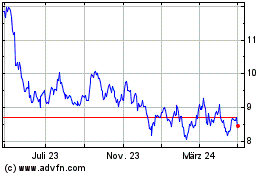

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024