UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

Dated

April 1, 2022

Commission

File Number: 001-10086

VODAFONE

GROUP

PUBLIC

LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨ No

x

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____.

This

Report on Form 6-K contains the following:-

| 1. | A

Stock Exchange Announcement dated 1 March 2022 entitled ‘TOTAL

VOTING RIGHTS AND CAPITAL’. |

| 2. | A

Media Announcement dated 7 March 2022 entitled ‘M-PESA - AFRICA'S LEADING FINTECH

PLATFORM - MARKS 15 YEARS OF TRANSFORMING LIVES’. |

| 3. | A

Stock Exchange Announcement dated 15 March 2022 entitled ‘TRANSACTION IN OWN SECURITIES

- TOTAL VOTING RIGHTS AND CAPITAL’. |

RNS

Number : 0986D

Vodafone Group

Plc

01

March 2022

VODAFONE

GROUP PLC

TOTAL

VOTING RIGHTS AND CAPITAL

In conformity

with Disclosure Guidance and Transparency Rule 5.6.1R, Vodafone Group Plc ("Vodafone") hereby notifies the market that,

as at 28 February 2022:

Vodafone's

issued share capital consists of 28,817,627,868 ordinary shares of US$0.20 20/21 of

which 1,866,646,633 ordinary shares are held in Treasury.

Therefore,

the total number of voting rights in Vodafone is 26,950,981,235. This figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in,

Vodafone under the FCA's Disclosure Guidance and Transparency Rules.

This

announcement does not constitute, or form part of, an offer or any solicitation of an offer for securities in any jurisdiction.

END

RNS

Number : 7916D

Vodafone

Group Plc

07

March 2022

7

March 2022

M-PESA

- AFRICA'S LEADING FINTECH PLATFORM - MARKS 15 YEARS OF TRANSFORMING LIVES

| ● | Launched

on 6 March 2007, originally as an idea part-funded by the UK Department for International

Development in partnership with Vodafone, M-Pesa - Africa's first mobile payments service

- has been a major driver of financial inclusion, and now has 51 million customers across

seven countries |

| ● | M-Pesa

Africa has grown to become a full financial services provider. The 'Super App' - launched

in 2021 - is already being used by 9 million customers to access a broader range of services

including savings, insurance and credit |

| ● | M-Pesa

is now working with software developers to create 'mini apps', where businesses can create

their own platforms within the M-Pesa Super Apps. |

Vodafone,

and its African subsidiaries Vodacom and Safaricom, today marked the 15th anniversary

of M-Pesa, the service launched in March 2007 to enable money transfers between people using 2G feature phones. From its beginning

in Kenya, M-Pesa has grown to serve more than 51 million customers and 465,000 businesses. The service is provided by 600,000 agents

across Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt. M-Pesa processes more than 61 million

transactions a day, making it Africa's largest fintech provider, and it has attracted 42,000 external developers to create additional

services for the platform.

With

more people across the African continent shifting to smartphones, and using 3G and 4G broadband, M-Pesa is evolving to become a digital

financial services provider. In 2021, M-Pesa Africa launched the M-Pesa Super App and M-Pesa Business Super App which enables any business

on the service to run a virtual storefront providing their services through M-Pesa Mini Apps.

Nick

Read, Chief Executive Officer, Vodafone Group said: "As the original mobile money service, M-Pesa has been the most significant

driver of financial inclusion in Africa over the past 15 years. It is the continent's largest fintech platform and provides access to

financial services for more than 50m people - in a secure, affordable, and convenient way. M-Pesa is a great example of how a regional

platform can evolve and grow to meet and anticipate customer needs using smartphone technology - from peer-to-peer money transfer, to

payment of utility bills, to enabling the payroll of businesses, and to financial services such as micro-loans."

The

M-Pesa Super App is designed to be a customer's lifestyle companion connecting them to services they need in a typical day including

shopping, restaurants and food delivery, transport services, government services and much more. More than 9 million customers and 320,000

businesses have downloaded the M-Pesa Super App since its launch.

In

addition to the Super App, M-Pesa Africa is revamping the M-Pesa platform to support additional digital services, faster development

of new products, and to achieve increased stability and reliability. The platform revamp includes expansion of the M-Pesa APIs to provide

developers with even deeper access to the service enabling them to deploy more innovations on the service.

-

ends -

Note

to Editors

About

M-Pesa

Launched

in 2007, M-Pesa is Africa's largest fintech providing financial services to more than 51 million customers every month. The service empowers

customers to transact- send and receive money, make payments, as well as save and access credit all from the convenience of a mobile

phone.

M-Pesa

has connected tens of millions of customers with access to financial services, contributing to a more than a three-fold growth in formal

financial inclusion across Africa. It has equally transformed the standard of living in rural areas and empowered women with access and

control over their finances. Tapped by many to power the digital economy, M-Pesa has contributed to youth empowerment through entrepreneurship

especially in e-commerce.

Socioeconomically,

M-Pesa has provided a lifeline for millions of people facilitating direct disbursements from governments and non-government organisations

to refugees, patients accessing health care, economically vulnerable persons amongst other groups.

It

continues to be an innovation trailblazer through services such as Fuliza - the world's first mobile overdraft, M-Shwari which pioneered

mobile only banking, the Pochi La Biashara wallet, and the M-Pesa Bill Manager among others.

M-Pesa

is run by Safaricom and Vodacom in Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt. It provides

customers with access to the widest agent network across the continent at more than 600,000 agent outlets and to cashless payments at

more than 465,000 businesses.

For

further information:

Vodafone

Group |

| Media

Relations |

Investor

Relations |

| GroupMedia@vodafone.com |

IR@vodafone.co.uk |

RNS

Number : 8335E

Vodafone

Group Plc

15

March 2022

VODAFONE

GROUP PLC

TRANSACTION

IN OWN SECURITIES - TOTAL VOTING RIGHTS AND CAPITAL

In

March 2019, Vodafone Group Plc ('Vodafone') issued a two-tranche mandatory convertible bond, the second and final tranche

of which (£1,720,000,000 1.50 per cent. Subordinated Mandatory Convertible Bonds; ISIN XS1960589668) matured on Saturday, 12 March 2022.

As a result of the maturity, £1,720,000,000 in aggregate principal amount of the Bonds were mandatorily converted into Vodafone's

ordinary shares in accordance with the terms and conditions of the Bonds. All conversions were satisfied by Vodafone transferring treasury

shares.

In

conformity with Listing Rule 12.6.4R, Disclosure Guidance and Transparency Rule 5.5.1R and Disclosure Guidance and Transparency

Rule 5.6.1R, Vodafone hereby notifies the market of the following details of the transfer of treasury shares:

Date:

14 March 2022

Number

of ordinary shares transferred: 1,518,629,693

Conversion

price: £1.1326

Following

this transfer, Vodafone's issued share capital consists of 28,817,627,868 ordinary shares of US$0.20 20/21 of

which 393,004,244 ordinary shares are held in treasury.

Therefore,

the number of ordinary shares excluding those held in treasury, and the total number of voting rights in Vodafone, is 28,424,623,624.

This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, Vodafone under the FCA's Disclosure Guidance and Transparency Rules.

This

announcement does not constitute, or form part of, an offer or any solicitation of an offer for securities in any jurisdiction.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

| |

|

VODAFONE

GROUP |

| |

|

PUBLIC

LIMITED COMPANY |

| |

|

(Registrant) |

| |

|

|

| Dated: April 1,

2022 |

By: |

/s/

R E S MARTIN |

| |

|

Name:

Rosemary E S Martin |

| |

|

Title:

Group General Counsel and Company Secretary |

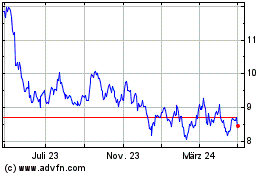

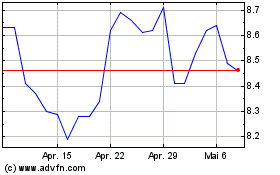

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024