Notice of Exempt Solicitation Pursuant to Rule 14a6(g) (px14a6n)

27 Februar 2023 - 12:04PM

Edgar (US Regulatory)

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Starbucks Corporation

NAME OF PERSON RELYING ON EXEMPTION: SOC Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1900 L Street, N.W. Suite 900, Washington, D.C. 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

___________________________________________________________________________________________________________________________________________________________________________________________

February 24, 2023

Dear Fellow Starbucks Shareholder:

We urge you to vote FOR Proposal 6 on the Starbucks proxy or at the Annual General Meeting of Shareholders on March 23, 2023. Proposal 6 requests that the Board adopt a more robust policy regarding CEO succession planning.

Succession planning is one of the primary responsibilities of a board of directors. A robust succession planning process, executed in a timely and measured fashion, ensures business continuity, aligns leadership with strategic direction, and supports long-term shareholder value.1 We filed this proposal at Starbucks out of concern that the Board is not taking its succession planning responsibilities seriously. The abrupt announcement of former CEO Kevin Johnson’s retirement, Howard Shultz’s return to the helm for a third time, the lack of any internal candidates, and the roll-out of the “Reinvention Plan” prior to Incoming CEO Laxman Narasimhan’s hire are all indicators of shortcomings in succession planning and the leadership pipeline. While we are pleased that the Board decided to adopt most of components of the proposal, we were surprised that the company did not recommend that shareholders vote in favor. We urge shareholders to support the proposal because the adoption of a minimum three-year timeframe for planned departures is considered best practice and to signal to the Board that investors expect more vigorous succession planning in the future.2

The SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center, a coalition of unions representing millions of members, to enhance long term shareholder value through active ownership. These funds have over $250 billion in assets under management and are substantial Starbucks shareholders. We previously engaged with the company on the proposal in fall of 2022. Company representatives indicated that the Board might be willing to make some of the requested changes to the Succession Planning Policy, but did not communicate with us again beyond sending us the Opposition Statement.

Starbucks’ bumpy CEO transition points to a lack of preparation and a weak planning process.

We understand that when hired as CEO in 2017, Mr. Johnson told the Board that he planned to stay in the position for approximately five years, a timeframe he kept with. Despite this advance notice, the Board said that it began “working to advance its planning” for the succession in 2021 after Johnson “signaled” that he would be retiring soon.3 We believe that this late start led to the Board’s inability to find a suitable successor in a timelier manner. Instead, Mr. Schultz stepped in as Interim CEO while the Board searched for a permanent choice. The Board’s decision to inform investors just three weeks prior to Mr. Johnson’s pending retirement and its need for an Interim CEO, generated market consternation. Major news outlets reported that “some were caught by surprise that the board knew Johnson planned to retire a year before publicly discussing a transition or a successor.”4 As one commentator remarked, “[F]or a company the size and stature of Starbucks not to have a solid succession plan is surprising,”5 while another reacted more bluntly: “The red flag is that they weren’t ready.”6 As one investor stated, “Having Schultz on speed dial and counting on him to ride in and save the day is not strategic planning

for CEO succession. One would expect Starbucks, like many excellent companies, would have a clear CEO succession plan in place, one that actually begins when a new CEO is named.”7

Howard Schultz’s comments two months after stepping in as Interim CEO acknowledged the Board’s failure in ensuring the company has a robust leadership pipeline. He told the Wall Street Journal that, “for the future of the company, we need a domain of experience and expertise in a number of disciplines that we don’t have now. It requires a different type of leader.” 8 Yet it is under Mr. Schultz, the “old guard,” that Starbucks launched its “Reinvention Plan;” not under Incoming CEO Narasimhan, who is presumably the “different type of leader” Starbucks needs. We are concerned that the Board’s lack of preparedness regarding succession planning may have long term implications on the company’s strategy.

Succession planning is a key responsibility of the board.

Starbucks itself notes that succession planning is a primary responsibility of the board.9 A properly managed succession plan can help companies make more efficient turnover decisions and may experience less costly management transitions.10 One study found that longer lead time is associated with more favorable cumulative stock performance and firm operating performance around an outgoing CEO’s departure.11 The opposite is true when successions are poorly managed. Analysts, investment banks, rating agencies and others were found to have increasingly downgraded companies that failed to give succession planning their full attention at both board and management levels.12 According to one analysis, the amount of market value wiped out by badly managed CEO and C-suite transitions in the S&P 1500 is close to $1 trillion a year.13

Further, robust succession planning allows for better talent and leadership development within a company. Internal candidates provide the strongest cultural fit, an important criterion given research that supports the competitive advantage of organizational culture.14 Research also shows that firms with internal successions achieve higher post-turnover accounting performance, higher long-term stock returns, and lower volatility.15 A deep internal bench also reduces risks from emergency successions. For these reasons, it is not surprising that in 2020, 71 percent of S&P 500 companies that replaced their CEOs hired an internal candidate.16 While there may be circumstances where an external candidate is the best fit, a scramble by the Board to hire externally due to a shortened time frame can also incur additional costs.17

A minimum 3-year planning process reflects best practice.

Rather than a constraint, as suggested by the Company, a minimum 3-year planning increases the probability that the Board will plan for an anticipated transition with foresight and a thorough due diligence process. Stated as a minimum standard, the provision in our resolved clause is not inconsistent with the Board’s expressed desire for an ongoing process that is longer than 3 years. Rather, it is designed to encourage the Board to follow best practice to commence succession planning as early as possible in the event of a planned departure. As stated by one leading advisor: “Under no circumstances should an organization wait until succession is inevitable and a reactive solution needed.”18 In a study of more than 50 Chairmen and CEOs of major companies headquartered in France, Germany, the UK and the US, interviewees from best practice companies cited reluctance to plan for CEO succession “too soon” as a roadblock to success.19 A 3-year period minimally allows sufficient time for the Board to

identify the key attributes and skills of a successor appropriate for the company’s near-term strategic needs, and to identify and develop a sustainable pipeline of high-potential internal candidates.20 Indeed, some view 3 years as a minimum. According to one leading advisory firm, Boards should expect to invest 5 years on average to train internal candidates.21

Lastly, our proposal reflects best practice that a robust succession planning policy should require that the Board develop appropriate standards and metrics to support annual evaluation of the succession planning process. These metrics might include the percent of leaders with a “ready now” successor, promotion rates, career path ratio, and diversity rates.22

Conclusion

In conclusion, supporting this proposal sends a message to the Starbucks Board that it needs to meet its core responsibility to make CEO succession planning a priority by adopting a robust and sufficiently timely process.

THIS IS NOT A PROXY SOLICITATION AND NO PROXY CARDS WILL BE ACCEPTED

Please execute and return your proxy card according to Starbucks’ instructions

1 See for example 1) Cathy Anterasian and Robert Stark.”Too Important to Fail: Four New Rules for CEO Succession Planning.” Spencer Stuart. The Future of Leadership. 2021. Available at https://www.spencerstuart.com/-/media/2021/june/toobigtofail/too_important_to_fail.pdf; 2) Pwc Governance Insights Center. How the best boards approach CEO succession planning. September 2021. Available at https://www.pwc.com/us/en/governance-insights-center/publications/assets/pwc-how-the-best-boards-approach-ceo-succession-planning.pdf; and 3) Dr. Andreas Zehnder. “CEO succession planned well in advance: the Board perspective”. KPMG Board Leadership News. Edition 01/2021. Available at https://assets.kpmg.com/content/dam/kpmg/ch/pdf/blc-news-ceo-succession.pdf.

2Bonnie W. Gwin and Jeffrey S. Sanders. Heidrick & Struggles. “The clock is ticking on CEO succession: is your board ready?” Available at https://www.heidrick.com/en/insights/boards-governance/the_clock_is_ticking_on_ceo_succession_is_your_board_ready 3Starbucks Corporation 2022 Annual Meeting – Transcript. Pg. 4 Available at https://investor.starbucks.com/events-and-presentations/current-and-past-events/event-details/2022/Annual-Meeting-of-Shareholders/default.aspx

4 Jacqueline Corba and Amelia Lucas. “Starbucks CEO Kevin Johnson is retiring, and Howard Schultz is returning as interim chief”

CNBC.com. March 16, 2022. Available at https://www.cnbc.com/2022/03/16/starbucks-ceo-kevin-johnson-is-retiring-howard-schultz-returns-as-interim-chief.html.

| 5 |

Ibid. |

| 6 |

GeorgeBradt.“WhyStarbucksNamingHowardSchultzasInterimCEOisaHugeRedFlag” Forbes.March16,2022.Available |

at https://www.forbes.com/sites/georgebradt/2022/03/16/why-starbucks-naming-howard-schultz-as-interim-ceo-is-a-hugered-flag/?sh=9059d3420f3d.

7 StrategyDoc. “Starbucks: Not a Well-Conceived Strategy Plan”. Seeking Alpha.com. June 13, 2022. Accessed February 16, 2023 at https://seekingalpha.com/article/4518015-starbucks-not-well-conceived-ceo-succession-plan.

8 Heather Haddon. “Howard Schultz Says Starbucks Is Seeking Fresh Blood in CEO Search.” June 6, 2022. The Wall Street Journal. Available at https://www.wsj.com/articles/howard-schultz-says-starbucks-is-seeking-fresh-blood-in-ceo-search-11654488060.

9 DEF14A, p. 27. Available at https://www.sec.gov/Archives/edgar/data/829224/000082922423000007/a2023proxystatementfinal.htm

10 Dragana Cvijanovic, Nickolay Gantchev and Sunwoo Hwang. Changing of the Guards: Does Succession Planning Matter? May 2018. Available at https://clsbluesky.law.columbia.edu/2016/12/07/does-ceo-succession-planning-matter/.

11Mia L. Rivolta. Does Lead Time in CEO Succession Matter? Evidence From Planned Versus Unexpected CEO Departures. International Journal of Financial Research. Vol. 9, No. 3; 2018. Available at https://doi.org/10.5430/ijfr.v9n3p1.

12 Bruce Sherman. How Better Succession Planning Leads to Favorable Evaluations. Chief Executive. Available at https://chiefexecutive.net/how-better-succession-planning-leads-to-favorable-evaluations/.

13 Claudio Fernandez-Araoz, Gregory Nagel, and Carrie Green. The High Cost of Poor Succession Planning. Harvard Business Review. May-June 2021. Available at https://hbr.org/2021/05/the-high-cost-of-poor-succession-planning.

14 John R. Graham, Jillian Grennan, Campbell R. Harvey, and Shivram Rajgopal. Corporate Culture: Evidence from the Field. April 26, 2022. Journal of Financial Economics (forthcoming). Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2805602 15Ran Tao and Hong Zhao. “Passing the Baton”: The effects of CEO succession planning on firm performance and volatility. Corporate Governance An International Review. Volume 27 Issue 1. P 61-78. January 2019. Available at https://onlinelibrary.wiley.com/doi/10.1111/corg.12251.

16 Spencer Stuart. 2020 CEO Transitions. 2021. Available at https://www.spencerstuart.com/-/media/2021/april/ceotransitions_2020/ceo_transitions_2020.pdf.

17 A 2012 study by the Wharton School at the University of Pennsylvania found that outside management hires at all levels typically receive 18 to 20 percent higher compensation despite lower performance ratings and higher exit rates than long-tenured internal managers. Mathew Bidell. “Paying More to Get Less: The Effects of External Hiring versus Internal Mobility.” Administrative Science Quarterly. Volume 56. Issue 3. December 27, 2011. Available at https://doi.org/10.1177/0001839211433562.

18 Dr. Andreas Zehnder, Ibid.

19 EgonZehnder. CEO Succession Study. 2013. Available at https://www.egonzehnder.com/what-we-do/ceo-search-succession/insights/ceo-succession-study-we-should-have-started-earlier.

20Bonnie W. Gwin and Jeffrey S. Sanders. “The clock is ticking on CEO succession: is your board ready?” Heidrick & Struggles CEO & Board Practice. 2020. Available at https://www.heidrick.com/-/media/heidrickcom/publications-and-reports/the_clock_is_ticking_on_ceo_succession.pdf.

21 Russell Reynolds and Associates. Definitive Guide to CEO Succession Planning. Available at https://www.russellreynolds.com/en/capabilities/leadership-search-succession/ceo-succession/succeeding-with-succession. See also Elena Lytkina Botelho, Shoma Chatterjee Hayden and BJ Wright. “Beware the Transition from an Iconic CEO”. Harvard Business Review. February 1, 2023. Available at https://hbr.org/2023/02/beware-t he-transition-from-an-iconic-ceo. 22 Phil Schrader. Key Metrics for Succession Planning. February 17, 2022. Available at https://www.onemodel.co/blog/succession-planning-metrics. See also Muhamad Tasyrif Ghazali and Syamsul Azri. Measuring the Success Metric for Effective Succession Planning: The Conceptual Perspective. International Journal of Human Resource Studies. February 2022. Available at https://www.researchgate.net/publication/358696302_Measuring_the_Success_Metric_for_Effective_Succession_Planning_Th e_Conceptual_Perspective/link/620f8d5b6c472329dcf215d6/download.

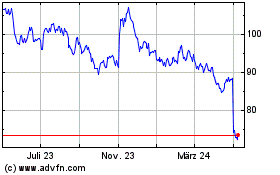

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

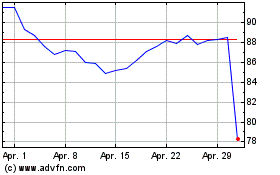

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024