Q1 Consolidated Net Revenues Up 8% to a Record

$8.7 Billion Q1 Comparable Store Sales Up 5% Globally; Up 10% in

the U.S; Up Double Digits Internationally, Excluding China Q1 GAAP

EPS $0.74; Non-GAAP EPS $0.75; Performance Materially Impacted by

Headwinds in China Q1 Active U.S. Starbucks® Rewards Membership

Reaches 30.4 Million, Up 15% Over Prior Year, Up 6% Sequentially Q1

Card Loads Reaches a Record $3.3 Billion; Ranking as #2 U.S. Brand

in Holiday Gift Card Activations Company Reaffirms 2023 Full Year

Guidance

Starbucks Corporation (Nasdaq: SBUX) today reported financial

results for its 13-week fiscal first quarter ended January 1, 2023.

GAAP results in fiscal 2023 and fiscal 2022 include items that are

excluded from non-GAAP results. Please refer to the reconciliation

of GAAP measures to non-GAAP measures at the end of this release

for more information.

Q1 Fiscal 2023

Highlights

- Global comparable store sales increased 5%, primarily driven by

a 7% increase in average ticket, partially offset by a 2% decline

in comparable transactions

- North America and U.S. comparable store sales increased 10%,

driven by a 9% increase in average ticket and a 1% increase in

comparable transactions

- International comparable store sales decreased 13%, driven by a

12% decline in comparable transactions and a 1% decline in average

ticket; China comparable store sales decreased 29%, driven by a 28%

decline in comparable transactions and a 1% decline in average

ticket

- The company opened 459 net new stores in Q1, ending the period

with 36,170 stores globally: 51% company-operated and 49% licensed

- At the end of Q1, stores in the U.S. and China comprised 61% of

the company’s global portfolio, with 15,952 stores in the U.S. and

6,090 stores in China

- Consolidated net revenues up 8%, to a record $8.7 billion,

inclusive of approximately 3% unfavorable impact from foreign

currency translation

- GAAP operating margin of 14.4% decreased from 14.6% in the

prior year, primarily driven by previously committed investments in

labor including enhanced store partner wages and benefits,

inflationary pressures and sales deleverage in China, partially

offset by strategic pricing in North America and sales leverage

across markets outside of China

- Non-GAAP operating margin of 14.5% decreased from 15.1% in the

prior year

- GAAP earnings per share of $0.74 grew 7% over prior year,

including an estimated $0.06(1) of dilutive impact from China

- Non-GAAP earnings per share of $0.75 grew 4% over the prior

year, including an estimated $0.06(1) of dilutive impact from

China

- Starbucks Rewards loyalty program 90-day active members in the

U.S. increased to 30.4 million, up 15% year-over-year

“Starbucks performance in Q1 demonstrates the strength and

resilience of our business and accelerating demand for Starbucks

Coffee all around the world," said Howard Schultz, interim ceo. “We

posted today's strong results despite challenging global consumer

and inflationary environments, a soft quarter for retail overall

and the unprecedented, COVID-related headwinds that unfolded in

China in Q1,” Schultz added.

“I am very proud of what we achieved in Q1, with nearly every

business segment contributing to our strong performance,” commented

Rachel Ruggeri, chief financial officer. “And I’m pleased to share

that our fiscal 2023 guidance remains unchanged, despite the

headwinds from China,” Ruggeri added.

(1) In this release, we estimate the impact of headwinds from

China by comparing actual results to our previous forecasts and

excluding the impact of foreign currency translation. These

forecasts were created prior to Q1 FY23 and were based on

information available at the time and on a variety of assumptions

which we believe were reasonable, some or all of which may prove

not to be accurate.

Q1 North America

Segment Results

Quarter Ended

Change (%)

($ in millions)

Jan 1, 2023

Jan 2, 2022

Change in Comparable Store Sales (1)

10%

18%

Change in Transactions

1%

12%

Change in Ticket

9%

6%

Store Count

17,381

16,888

3%

Revenues

$6,551.3

$5,732.3

14%

Operating Income

$1,212.4

$1,083.1

12%

Operating Margin

18.5%

18.9%

(40) bps

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude the

effects of fluctuations in foreign currency exchange rates and

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours due to the COVID-19 pandemic remain in

comparable store sales.

Net revenues for the North America segment grew 14% over Q1 FY22

to $6.6 billion in Q1 FY23, primarily driven by a 10% increase in

company-operated comparable store sales, driven by a 9% increase in

average ticket and a 1% increase in transactions, net new store

growth of 3% over the past 12 months and strength in our licensed

store sales.

Operating income increased to $1.2 billion in Q1 FY23 compared

to $1.1 billion in Q1 FY22. Operating margin of 18.5% contracted

from 18.9% in the prior year, primarily driven by previously

committed investments in labor including enhanced store partner

wages and benefits, as well as higher commodity and supply chain

costs due to inflationary pressures. This contraction was partially

offset by strategic pricing and sales leverage.

Q1 International

Segment Results

Quarter Ended

Change (%)

($ in millions)

Jan 1, 2023

Jan 2, 2022

Change in Comparable Store Sales (1)

(13)%

(3)%

Change in Transactions

(12)%

2%

Change in Ticket

(1)%

(5)%

Store Count

18,789

17,429

8%

Revenues

$1,680.1

$1,875.9

(10)%

Operating Income

$240.4

$299.6

(20)%

Operating Margin

14.3%

16.0%

(170) bps

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude the

effects of fluctuations in foreign currency exchange rates and

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours due to the COVID-19 pandemic remain in

comparable store sales while stores identified for permanent

closure have been removed.

Net revenues for the International segment declined 10% over Q1

FY22 to $1.7 billion in Q1 FY23, primarily driven by approximately

13% unfavorable impact from foreign currency translation, as well

as a 13% decline in comparable store sales, primarily attributable

to suppressed mobility in China. These decreases were partially

offset by growth in our licensed store revenue including higher

product sales and royalty revenues, as well as net new store growth

of 8% over the past 12 months.

Operating income decreased to $240.4 million in Q1 FY23 compared

to $299.6 million in Q1 FY22. Operating margin of 14.3% contracted

from 16.0% in the prior year, primarily driven by sales deleverage

in China. This contraction was partially offset by sales leverage

across markets outside of China, lapping amortization expenses and

business mix.

Q1 Channel

Development Segment Results

Quarter Ended

Change (%)

($ in millions)

Jan 1, 2023

Jan 2, 2022

Revenues

$478.2

$417.1

15%

Operating Income

$226.3

$183.2

24%

Operating Margin

47.3%

43.9%

340 bps

Net revenues for the Channel Development segment grew 15% over

Q1 FY22 to $478.2 million in Q1 FY23, driven by growth in the

Global Coffee Alliance and global ready-to-drink business.

Operating income increased to $226.3 million in Q1 FY23 compared

to $183.2 million in Q1 FY22. Operating margin of 47.3% expanded

from 43.9% in the prior year, primarily due to strength in our

North American Coffee Partnership joint venture income.

Fiscal 2023 Financial

Targets

The company will discuss fiscal year 2023 financial targets

during its Q1 FY23 earnings conference call starting today at 2:00

p.m. Pacific Time. These items can be accessed on the company's

Investor Relations website during and after the call. The company

uses its website as a tool to disclose important information about

the company and comply with its disclosure obligations under

Regulation Fair Disclosure.

Company Updates

- In October, the company hosted a District Manager+ Leadership

Experience in Seattle, WA, a two-day gathering that welcomed over

2,000 retail leaders from across the U.S. and Canada. The gathering

was designed to elevate the leadership excellence required to lead

our stores and store partners through the company's

Reinvention.

- In November, the company opened the Starbucks Reserve® store

Empire State Building® store. Spanning 23,000 square feet and three

floors, this unique store serves as celebration of our brand,

through innovative coffee experiences and service, including

immersive hands-on workshops, guided tasting flights, as well as

new beverage and food offerings only available at this

location.

- In December, the company resumed the company's Origin

Experience, in which select partners who completed the company's

Coffee Masters training visit Hacienda Alsacia, the company's farm

in Costa Rica. The Origin Experience immerses partners in the

company's coffee heritage, C.A.F.E. (Coffee and Farmer Equity)

practices and farm innovation.

- In December, the company launched Starbucks OdysseyTM Beta

experience, powered by Web3 technology, to a group of waitlist

Starbucks Rewards members and partners in the U.S., unlocking

access to exciting new benefits and experiences through a series of

entertaining, interactive activities called “Journeys”.

- In January, the company announced the expansion of a

partnership with DoorDash, Inc. providing a new delivery service in

Northern California, Texas, Georgia, Florida and other select

markets. Starbucks delivery with DoorDash will expand to additional

markets over the coming months, with the goal of full nationwide

availability in all 50 states by March 2023.

- In Q1 fiscal 2023, the company resumed its share repurchase

program, repurchasing 1.9 million shares of common stock valued at

$191.4 million; approximately 50.6 million shares remain available

for purchase under the current authorization. As Reinvention

accelerates, the company expects to return approximately $20

billion to shareholders by the end of fiscal 2025 between our

dividends and share repurchases.

- The Board of Directors declared a cash dividend of $0.53 per

share, payable on February 24, 2023, to shareholders of record on

February 10, 2023. The company had 51 quarters of consistent

dividend payouts with a CAGR greater than 20%.

Conference Call

Starbucks will hold a conference call today at 2:00 p.m. Pacific

Time, which will be hosted by Howard Schultz, interim ceo, and

other members of Starbucks executive leadership team. The call will

be webcast and can be accessed at http://investor.starbucks.com. A

replay of the webcast will be available until end of day Friday,

March 3, 2023.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to

ethically sourcing and roasting high-quality arabica coffee. Today,

with more than 36,000 stores worldwide, the company is the premier

roaster and retailer of specialty coffee in the world. Through our

unwavering commitment to excellence and our guiding principles, we

bring the unique Starbucks Experience to life for every customer

through every cup. To share in the experience, please visit us in

our stores or online at stories.starbucks.com or

www.starbucks.com.

Forward-Looking

Statements

Certain statements contained herein and in our investor

conference call related to these results are “forward-looking”

statements within the meaning of applicable securities laws and

regulations. Generally, these statements can be identified by the

use of words such as “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “feel,” “forecast,” “intend,” “may,”

“outlook,” “plan,” “potential,” “predict,” “project,” “seek,”

“should,” “will,” “would,” and similar expressions intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. These

statements include statements relating to trends in or expectations

relating to the effects of our existing and any future initiatives,

strategies, investments and plans, including our Reinvention plan,

as well as trends in or expectations regarding our financial

results and long-term growth model and drivers; our operations in

the U.S. and China; our environmental, social and governance

efforts; our partners; economic and consumer trends, including the

impact of inflationary pressures; impact of foreign currency

translation; strategic pricing actions; the conversion of certain

market operations to fully licensed models; our plans for

streamlining our operations, including store openings, closures and

changes in store formats and models; the success of our licensing

relationship with Nestlé, of our consumer packaged goods and

foodservice business and its effects on our Channel Development

segment results; tax rates; business opportunities, expansions and

new initiatives, including Starbucks Odyssey; strategic

acquisitions; our dividends programs; commodity costs and our

mitigation strategies; our liquidity, cash flow from operations,

investments, borrowing capacity and use of proceeds; continuing

compliance with our covenants under our credit facilities and

commercial paper program; repatriation of cash to the U.S.; the

likelihood of the issuance of additional debt and the applicable

interest rate; the continuing impact of the COVID-19 pandemic on

our financial results and future availability of governmental

subsidies for COVID-19 or other public health events; our ceo

transition; our share repurchase program; our use of cash and cash

requirements; the expected effects of new accounting pronouncements

and the estimated impact of changes in U.S. tax law, including on

tax rates, investments funded by these changes and potential

outcomes; and effects of legal proceedings. Such statements are

based on currently available operating, financial and competitive

information and are subject to various risks and uncertainties.

Actual future results and trends may differ materially depending on

a variety of factors, including, but not limited to: the continuing

impact of COVID-19 on our business; regulatory measures or

voluntary actions that may be put in place to limit the spread of

COVID-19, including restrictions on business operations or social

distancing requirements, and the duration and efficacy of such

restrictions; the resurgence of COVID-19 infections and the

circulation of novel variants of COVID-19; fluctuations in U.S. and

international economies and currencies; our ability to preserve,

grow and leverage our brands; the ability of our business partners

and third-party providers to fulfill their responsibilities and

commitments; potential negative effects of incidents involving food

or beverage-borne illnesses, tampering, adulteration, contamination

or mislabeling; potential negative effects of material breaches of

our information technology systems to the extent we experience a

material breach; material failures of our information technology

systems; costs associated with, and the successful execution of,

the Company’s initiatives and plans; new initiatives and plans or

revisions to existing initiatives or plans; our ability to obtain

financing on acceptable terms; the acceptance of the Company’s

products by our customers, evolving consumer preferences and tastes

and changes in consumer spending behavior; partner investments,

changes in the availability and cost of labor including any union

organizing efforts and our responses to such efforts; failure to

attract or retain key executive or employee talent or successfully

transition executives; significant increased logistics costs;

inflationary pressures; the impact of competition; inherent risks

of operating a global business including any potential negative

effects stemming from the Russian invasion of Ukraine; the prices

and availability of coffee, dairy and other raw materials; the

effect of legal proceedings; and the effects of changes in tax laws

and related guidance and regulations that may be implemented,

including the Inflation Reduction Act of 2022 and other risks

detailed in our filings with the Securities and Exchange

Commission, including in the “Risk Factors” and “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” sections of the company’s most recently filed periodic

reports on Form 10-K and Form 10-Q and subsequent filings.

A forward-looking statement is neither a prediction nor a

guarantee of future events or circumstances, and those future

events or circumstances may not occur. You should not place undue

reliance on the forward-looking statements, which speak only as of

the date of this release. We are under no obligation to update or

alter any forward-looking statements, whether as a result of new

information, future events or otherwise.

Key Metrics

The company's financial results and long-term growth model will

continue to be driven by new store openings, comparable store sales

growth and operating margin management. We believe these key

operating metrics are useful to investors because management uses

these metrics to assess the growth of our business and the

effectiveness of our marketing and operational strategies.

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF

EARNINGS

(unaudited, in millions, except

per share data)

Quarter Ended

Quarter Ended

Jan 1, 2023

Jan 2, 2022

% Change

Jan 1, 2023

Jan 2, 2022

As a % of total net

revenues

Net revenues:

Company-operated stores

$

7,083.5

$

6,722.4

5.4

%

81.3

%

83.5

%

Licensed stores

1,119.5

850.8

31.6

12.8

10.6

Other

510.9

477.2

7.1

5.9

5.9

Total net revenues

8,713.9

8,050.4

8.2

100.0

100.0

Product and distribution costs

2,810.2

2,526.9

11.2

32.2

31.4

Store operating expenses

3,665.3

3,400.0

7.8

42.1

42.2

Other operating expenses

129.3

101.7

27.1

1.5

1.3

Depreciation and amortization expenses

327.1

366.0

(10.6

)

3.8

4.5

General and administrative expenses

580.9

525.8

10.5

6.7

6.5

Restructuring and impairments

5.8

(7.5

)

nm

0.1

(0.1

)

Total operating expenses

7,518.6

6,912.9

8.8

86.3

85.9

Income from equity investees

57.8

40.3

43.4

0.7

0.5

Operating income

1,253.1

1,177.8

6.4

14.4

14.6

Interest income and other, net

11.6

(0.1

)

nm

0.1

0.0

Interest expense

(129.7

)

(115.3

)

12.5

(1.5

)

(1.4

)

Earnings before income taxes

1,135.0

1,062.4

6.8

13.0

13.2

Income tax expense

279.8

246.3

13.6

3.2

3.1

Net earnings including noncontrolling

interests

855.2

816.1

4.8

9.8

10.1

Net earnings attributable to

noncontrolling interests

—

0.2

nm

0.0

0.0

Net earnings attributable to

Starbucks

$

855.2

$

815.9

4.8

9.8

%

10.1

%

Net earnings per common share -

diluted

$

0.74

$

0.69

7.2

%

Weighted avg. shares outstanding -

diluted

1,152.9

1,176.6

Cash dividends declared per share

$

0.53

$

0.49

Supplemental Ratios:

Store operating expenses as a % of

company-operated store revenues

51.7

%

50.6

%

Effective tax rate including

noncontrolling interests

24.6

%

23.2

%

Segment Results

(in millions)

North America

Jan 1, 2023

Jan 2, 2022

% Change

Jan 1, 2023

Jan 2, 2022

Quarter

Ended

As a % of North

America

total net revenues

Net revenues:

Company-operated stores

$

5,870.6

$

5,214.1

12.6

%

89.6

%

91.0

%

Licensed stores

680.0

515.9

31.8

10.4

9.0

Other

0.7

2.3

(69.6

)

0.0

0.0

Total net revenues

6,551.3

5,732.3

14.3

100.0

100.0

Product and distribution costs

1,917.6

1,629.4

17.7

29.3

28.4

Store operating expenses

3,031.4

2,702.4

12.2

46.3

47.1

Other operating expenses

65.6

48.2

36.1

1.0

0.8

Depreciation and amortization expenses

216.9

200.0

8.5

3.3

3.5

General and administrative expenses

102.3

76.7

33.4

1.6

1.3

Restructuring and impairments

5.1

(7.5

)

nm

0.1

(0.1

)

Total operating expenses

5,338.9

4,649.2

14.8

81.5

81.1

Operating income

$

1,212.4

$

1,083.1

11.9

%

18.5

%

18.9

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

51.6

%

51.8

%

International

Jan 1, 2023

Jan 2, 2022

% Change

Jan 1, 2023

Jan 2, 2022

Quarter

Ended

As a % of

International

total net revenues

Net revenues:

Company-operated stores

$

1,212.9

$

1,508.3

(19.6

)%

72.2

%

80.4

%

Licensed stores

439.5

334.9

31.2

26.2

17.9

Other

27.7

32.7

(15.3

)

1.6

1.7

Total net revenues

1,680.1

1,875.9

(10.4

)

100.0

100.0

Product and distribution costs

593.6

615.8

(3.6

)

35.3

32.8

Store operating expenses

633.9

697.6

(9.1

)

37.7

37.2

Other operating expenses

50.7

39.2

29.3

3.0

2.1

Depreciation and amortization expenses

81.5

133.1

(38.8

)

4.9

7.1

General and administrative expenses

80.5

91.3

(11.8

)

4.8

4.9

Total operating expenses

1,440.2

1,577.0

(8.7

)

85.7

84.1

Income from equity investees

0.5

0.7

(28.6

)

0.0

0.0

Operating income

$

240.4

$

299.6

(19.8

)%

14.3

%

16.0

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

52.3

%

46.3

%

Channel Development

Jan 1, 2023

Jan 2, 2022

% Change

Jan 1, 2023

Jan 2, 2022

Quarter

Ended

As a % of

Channel Development

total net revenues

Net revenues:

$

478.2

$

417.1

14.6

%

Product and distribution costs

294.2

258.8

13.7

61.5

%

62.0

%

Other operating expenses

13.0

11.4

14.0

2.7

2.7

General and administrative expenses

2.0

3.3

(39.4

)

0.4

0.8

Total operating expenses

309.2

273.5

13.1

64.7

65.6

Income from equity investees

57.3

39.6

44.7

12.0

9.5

Operating income

$

226.3

$

183.2

23.5

%

47.3

%

43.9

%

Corporate and Other

Jan 1, 2023

Jan 2, 2022

% Change

Quarter

Ended

Net revenues

$

4.3

$

25.1

(82.9

)%

Product and distribution costs

4.8

22.9

(79.0

)

Other operating expenses

—

2.9

nm

Depreciation and amortization expenses

28.7

32.9

(12.8

)

General and administrative expenses

396.1

354.5

11.7

Restructuring and impairments

0.7

—

nm

Total operating expenses

430.3

413.2

4.1

Operating loss

$

(426.0

)

$

(388.1

)

9.8

%

Corporate and Other primarily consists of our unallocated

corporate operating expenses and Evolution Fresh prior to the sale

in Q4 FY22.

STARBUCKS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(unaudited, in millions, except

per share data)

Jan 1, 2023

Oct 2, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

3,186.5

$

2,818.4

Short-term investments

123.9

364.5

Accounts receivable, net

1,162.9

1,175.5

Inventories

2,088.1

2,176.6

Prepaid expenses and other current

assets

373.5

483.7

Total current assets

6,934.9

7,018.7

Long-term investments

283.6

279.1

Equity investments

330.5

311.2

Property, plant and equipment, net

6,699.5

6,560.5

Operating lease, right-of-use asset

8,133.8

8,015.6

Deferred income taxes, net

1,811.8

1,799.7

Other long-term assets

527.6

554.2

Other intangible assets

151.4

155.9

Goodwill

3,383.0

3,283.5

TOTAL ASSETS

$

28,256.1

$

27,978.4

LIABILITIES AND SHAREHOLDERS'

EQUITY/(DEFICIT)

Current liabilities:

Accounts payable

$

1,348.2

$

1,441.4

Accrued liabilities

2,089.6

2,137.1

Accrued payroll and benefits

664.6

761.7

Current portion of operating lease

liability

1,257.5

1,245.7

Stored value card liability and current

portion of deferred revenue

2,137.0

1,641.9

Short-term debt

—

175.0

Current portion of long-term debt

1,749.3

1,749.0

Total current liabilities

9,246.2

9,151.8

Long-term debt

13,176.7

13,119.9

Operating lease liability

7,635.4

7,515.2

Deferred revenue

6,263.2

6,279.7

Other long-term liabilities

600.5

610.5

Total liabilities

36,922.0

36,677.1

Shareholders' deficit:

Common stock ($0.001 par value) —

authorized, 2,400.0 shares; issued and outstanding, 1,148.5 and

1,147.9 shares, respectively

1.1

1.1

Additional paid-in capital

67.2

205.3

Retained deficit

(8,203.2

)

(8,449.8

)

Accumulated other comprehensive

income/(loss)

(538.9

)

(463.2

)

Total shareholders’ deficit

(8,673.8

)

(8,706.6

)

Noncontrolling interests

7.9

7.9

Total deficit

(8,665.9

)

(8,698.7

)

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY/(DEFICIT)

$

28,256.1

$

27,978.4

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited and in millions)

Quarter Ended

Jan 1, 2023

Jan 2, 2022

OPERATING ACTIVITIES:

Net earnings including noncontrolling

interests

$

855.2

$

816.1

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

342.5

386.4

Deferred income taxes, net

15.8

(0.3

)

Income earned from equity method

investees

(56.9

)

(46.6

)

Distributions received from equity method

investees

45.7

44.9

Stock-based compensation

85.2

95.8

Non-cash lease costs

263.7

330.4

Loss on retirement and impairment of

assets

21.1

50.7

Other

6.7

(4.9

)

Cash provided by/(used in) changes in

operating assets and liabilities:

Accounts receivable

42.0

(91.6

)

Inventories

108.5

(36.0

)

Accounts payable

(117.3

)

84.0

Deferred revenue

461.0

461.3

Operating lease liability

(281.4

)

(363.3

)

Other operating assets and liabilities

(198.6

)

144.0

Net cash provided by operating

activities

1,593.2

1,870.9

INVESTING ACTIVITIES:

Purchases of investments

(10.5

)

(61.0

)

Sales of investments

0.8

72.6

Maturities and calls of investments

253.3

45.6

Additions to property, plant and

equipment

(516.8

)

(416.8

)

Other

(6.1

)

(41.4

)

Net cash used in investing activities

(279.3

)

(401.0

)

FINANCING ACTIVITIES:

Net proceeds/(payments) from issuance of

commercial paper

(175.0

)

200.0

Proceeds from issuance of common stock

45.9

41.3

Cash dividends paid

(608.3

)

(576.0

)

Repurchase of common stock

(191.4

)

(3,520.9

)

Minimum tax withholdings on share-based

awards

(79.0

)

(113.6

)

Net cash provided by/(used in) financing

activities

(1,007.8

)

(3,969.2

)

Effect of exchange rate changes on cash

and cash equivalents

62.0

13.0

Net increase/(decrease) in cash and cash

equivalents

368.1

(2,486.3

)

CASH AND CASH EQUIVALENTS:

Beginning of period

2,818.4

6,455.7

End of period

$

3,186.5

$

3,969.4

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Interest, net of capitalized interest

$

116.7

$

108.3

Income taxes

$

106.2

$

161.4

Supplemental

Information

The following supplemental information is provided for

historical and comparative purposes.

U.S. Supplemental

Data

Quarter Ended

Change (%)

($ in millions)

Jan 1, 2023

Jan 2, 2022

Revenues

$6,110.2

$5,314.4

15%

Change in Comparable Store Sales (1)

10%

18%

Change in Transactions

1%

12%

Change in Ticket

9%

6%

Store Count

15,952

15,500

3%

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours due to the COVID-19 pandemic remain in

comparable store sales.

China

Supplemental Data

Quarter Ended

Change (%)

($ in millions)

Jan 1, 2023

Jan 2, 2022

Revenues

$621.7

$897.2

(31)%

Change in Comparable Store Sales (1)

(29)%

(14)%

Change in Transactions

(28)%

(6)%

Change in Ticket

(1)%

(9)%

Store Count

6,090

5,557

10%

(1)

Includes only Starbucks® company-operated stores open 13 months

or longer. Comparable store sales exclude the effects of

fluctuations in foreign currency exchange rates, stores identified

for permanent closure and Siren Retail stores. Stores that are

temporarily closed or operating at reduced hours due to the

COVID-19 pandemic remain in comparable store sales while stores

identified for permanent closure have been removed.

Store Data

Net stores opened/(closed) and

transferred during the period

Quarter Ended

Stores open as of

Jan 1, 2023

Jan 2, 2022

Jan 1, 2023

Jan 2, 2022

North America:

Company-operated stores

40

39

10,256

9,900

Licensed stores

46

23

7,125

6,988

Total North America

86

62

17,381

16,888

International:

Company-operated stores

97

213

8,134

7,485

Licensed stores

276

209

10,655

9,944

Total International

373

422

18,789

17,429

Total Company

459

484

36,170

34,317

Non-GAAP Disclosure

In addition to the GAAP results provided in this release, the

company provides certain non-GAAP financial measures that are not

in accordance with, or alternatives for, generally accepted

accounting principles in the United States. Our non-GAAP financial

measures of non-GAAP general and administrative expenses (G&A),

non-GAAP operating income, non-GAAP operating income growth,

non-GAAP operating margin, non-GAAP effective tax rate and non-GAAP

earnings per share exclude the below-listed items and their related

tax impacts, as they do not contribute to a meaningful evaluation

of the company’s future operating performance or comparisons to the

company's past operating performance. The GAAP measures most

directly comparable to non-GAAP G&A, non-GAAP operating income,

non-GAAP operating income growth, non-GAAP operating margin,

non-GAAP effective tax rate and non-GAAP earnings per share are

general and administrative expenses, operating income, operating

income growth, operating margin, effective tax rate and diluted net

earnings per share, respectively.

Non-GAAP

Exclusion

Rationale

Restructuring and impairment costs

Management excludes restructuring and

impairment costs for reasons discussed above. These expenses are

anticipated to be completed within a finite period of time.

Transaction and integration-related

costs

Management excludes transaction and

integration costs, primarily amortization, of the acquired

intangible assets for reasons discussed above. Additionally, we

incur certain costs associated with certain divestiture activities.

These costs are expected to be recognized over a finite period of

time.

Non-GAAP G&A, non-GAAP operating income, non-GAAP operating

income growth, non-GAAP operating margin, non-GAAP effective tax

rate and non-GAAP earnings per share may have limitations as

analytical tools. These measures should not be considered in

isolation or as a substitute for analysis of the company’s results

as reported under GAAP. Other companies may calculate these

non-GAAP financial measures differently than the company does,

limiting the usefulness of those measures for comparative

purposes.

STARBUCKS CORPORATION

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES

(unaudited, in millions except

per share data)

Quarter Ended (1)

Consolidated

Jan 1, 2023

Jan 2, 2022

Change

General and administrative expenses, as

reported (GAAP)

$

580.9

$

525.8

10.5

%

Transaction and integration-related

costs

—

(0.1

)

Non-GAAP G&A

$

580.9

$

525.7

10.5

%

Non-GAAP G&A as a % of total net

revenues

6.7

%

6.5

%

Operating income, as reported (GAAP)

$

1,253.1

$

1,177.8

6.4

%

Restructuring and impairment costs (2)

5.8

(7.5

)

Transaction and integration-related costs

(3)

0.3

42.8

Non-GAAP operating income

$

1,259.2

$

1,213.1

3.8

%

Operating margin, as reported (GAAP)

14.4

%

14.6

%

(20) bps

Restructuring and impairment costs (2)

0.1

(0.1

)

Transaction and integration-related costs

(3)

0.0

0.6

Non-GAAP operating margin

14.5

%

15.1

%

(60) bps

Diluted net earnings per share, as

reported (GAAP)

$

0.74

$

0.69

7.2

%

Restructuring and impairment costs (2)

0.01

(0.01

)

Transaction and integration-related costs

(3)

0.00

0.05

Income tax effect on Non-GAAP adjustments

(4)

0.00

(0.01

)

Non-GAAP EPS

$

0.75

$

0.72

4.2

%

(1)

Certain numbers may not foot due to

rounding convention.

(2)

Represents costs associated with our

restructuring efforts.

(3)

The first quarter of fiscal 2023 includes

transaction-related expenses related to the sale of our Seattle's

Best Coffee brand. The first quarter of fiscal 2022 includes

amortization expense of acquired intangible assets associated with

the acquisition of East China.

(4)

Adjustments were determined based on the

nature of the underlying items and their relevant jurisdictional

tax rates.

Q1 QTD FY23 NON-GAAP

DISCLOSURE DETAILS

(in millions and before income

taxes)

Q1 QTD FY23

North America

International

Channel Development

Corporate and Other

Consolidated

Statement of Earnings Line Item

Restructuring and Impairment

Costs

Transaction and

Integration-Related Costs

Transaction and

Integration-Related Costs

Transaction and

Integration-Related Costs

Restructuring and Impairment

Costs

Total Non-GAAP

Adjustment

Other operating expenses

$

—

$

—

$

0.3

$

—

$

—

$

0.3

Restructuring and impairments

5.1

—

—

—

0.7

5.8

Total impact to operating income

$

(5.1

)

$

—

$

(0.3

)

$

—

$

(0.7

)

$

(6.1

)

Non-Operating gain

Interest income and other, net

$

0.4

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230202005045/en/

Starbucks Contact, Investor Relations: Tiffany Willis

investorrelations@starbucks.com

Starbucks Contact, Media: Reggie Borges

press@starbucks.com 206-240-2953

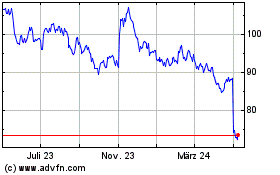

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

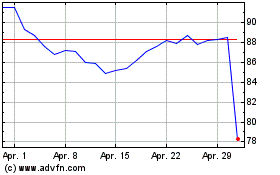

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024