Current Report Filing (8-k)

09 Mai 2023 - 1:59PM

Edgar (US Regulatory)

FALSE000100069400010006942023-05-092023-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2023

NOVAVAX, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-26770 | | 22-2816046 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

21 Firstfield Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices, including Zip Code)

(240) 268-2000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which

registered |

| Common Stock, Par Value $0.01 per share | | NVAX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

First Quarter Financial Results

On May 9, 2023, Novavax, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended March 31, 2023. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 2.05. Costs Associated with Exit or Disposal Activities.

As previously announced, a near-term priority for the Company includes reducing its annual combined research and development and selling, general and administrative spend. In connection with those plans, on May 8, 2023, the Board of Directors of the Company approved an approximately 25% reduction of its global workforce, comprised of an approximately 20% reduction in the Company’s full-time employees and the remainder comprised of contractors and consultants. The Company expects the full annual impact of the cost savings to be realized in 2024 and approximately half of the annual impact, excluding one-time charges, to be realized in 2023 due to timing of implementing the measures, and the applicable laws, regulations, and other factors in the jurisdictions in which it operates. The Company is expected to record a charge of approximately $10 million to $15 million related one-time employee severance and benefit costs, the majority of which is expected to be incurred in the second quarter of 2023 and it is evaluating the anticipated cost related to the consolidation of facilities and infrastructure.

Item 7.01. Regulation FD Disclosure.

On May 9, 2023, the Company issued a press release announcing results of the Company’s Phase 2 clinical trial for combination COVID-influenza, standalone influenza, and high-dose COVID vaccines. A copy of this press release is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information in Items 2.02, 7.01 and 9.01 of this Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

This Current Report on Form 8-K includes forward-looking statements including the Company’s priorities, the size and timing of the Company’s workforce reduction, the amount and timing of the charges and cash expenditures resulting from the workforce reduction, and the expected timing and impact of cost savings from the global restructuring and cost reduction plan. Generally, forward-looking statements can be identified through the use of words or phrases such as “believe,” “may,” “could,” “will,” “would,” “possible,” “can,” “estimate,” “continue,” “ongoing,” “consider,” “anticipate,” “intend,” “seek,” “plan,” “project,” “expect,” “should,” “would,” “aim,” or “assume,” the negative of these terms, or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve estimates, assumptions, risks, and uncertainties that could cause actual results or outcomes to differ materially from those expressed or implied in any forward-looking statements, and, therefore, you should not place considerable reliance on any such forward-looking statements. Such risks and uncertainties include, among others, that the workforce reduction may be larger than currently anticipated, the Company may incur additional costs not currently contemplated, and other risks and uncertainties are identified under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in any subsequent filings with the Securities and Exchange Commission. Further, any forward-looking statement speaks only as of the date when it is made, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. New factors emerge from time to time, and it is not possible for the Company to predict which factors will arise. In addition, the Company cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | NOVAVAX, INC. |

| | | |

Date: May 9, 2023 | By: | /s/ John A. Herrmann III |

| | Name: | John A. Herrmann III |

| | Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

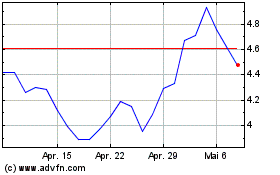

Novavax (NASDAQ:NVAX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Novavax (NASDAQ:NVAX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024