Current Report Filing (8-k)

21 November 2022 - 11:16PM

Edgar (US Regulatory)

0001000694

false

0001000694

2022-11-18

2022-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): November 18, 2022

NOVAVAX, INC.

(Exact name of registrant as specified

in charter)

| Delaware |

|

0-26770 |

|

22-2816046 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

21 Firstfield Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices,

including Zip Code)

(240) 268-2000

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, Par Value $0.01 per share |

|

NVAX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.02. Termination

of a Material Definitive Agreement.

On November 18, 2022, Novavax, Inc. (the “Company”)

delivered written notice to the Gavi Alliance (“Gavi”) to terminate, effective immediately, the Advance Purchase Agreement,

dated May 5, 2021, by and between the Company and Gavi (the “APA”) on the basis of Gavi’s material breach of the APA

due to Gavi’s failure to procure the purchase of 350 million doses of NVX-CoV2373 from the Company as required by Section 2.1 of

the APA and Gavi’s inability to cure such failure.

The Company has not incurred any termination

penalties in connection with the termination of the APA. Under the APA, the Company received a non-refundable advance payment of $350

million from Gavi in 2021 and an additional non-refundable advance payment of $350 million in 2022 related to the Company’s achieving

World Health Organization Emergency Use Listing. The Company’s position is that Gavi has no right to recover any portion of these

advance payments due to Gavi’s failure to meet its obligation to procure the purchase of the 350 million doses required by Section

2.1 of the APA. As of November 18, 2022, the Company had only received orders under the APA for approximately 2 million doses.

A summary of the material terms of the APA was

included in the Company’s Quarterly Report on Form 10-Q filed on May 10, 2021, which is qualified in its entirety by reference to

the full text of the APA (filed as Exhibit 10.5 to the Company’s Quarterly Report on Form 10-Q filed on August 5, 2021 and incorporated

herein by reference).

Cautionary Note Regarding Forward-Looking

Statements.

This Current Report on Form 8-K contains forward-looking statements

about the APA. Forward-looking statements include all statements that are not solely historical facts and can be identified by terms such

as “may,” “should,” or similar expressions. Investors are cautioned not to place undue reliance on these forward-looking

statements, which are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed

or implied by such statements, including any potential claim by Gavi that a breach of the APA has not yet occurred and, consequently,

that termination of the APA is not effective and/or that Gavi should be entitled to payments from Novavax; the inherent uncertainty in

predicting the outcome of any disagreement between the Company and Gavi with respect to the APA; and those other risks listed under the

heading “Risk Factors” and elsewhere in Novavax’ Annual Report on Form 10-K for the year ended December 31, 2021, in

addition to the risk factors that are listed from time to time in Novavax’ Quarterly Reports on Form 10-Q and any subsequent filings

with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date of this Current Report on

Form 8-K and the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances occurring

after this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Novavax, Inc. |

| |

|

|

| |

|

|

| Date: November 21, 2022 |

By: |

/s/ John A. Herrmann III |

| |

Name: |

John A. Herrmann III |

| |

Title: |

Executive Vice President, Chief Legal Officer and Corporate Secretary |

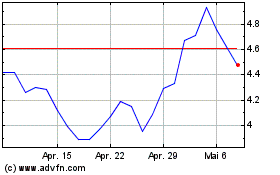

Novavax (NASDAQ:NVAX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Novavax (NASDAQ:NVAX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024