Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

23 Juli 2024 - 11:30PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D/A |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 1)* |

| |

|

Luna Innovations

Incorporated |

| (Name of Issuer) |

| |

|

Common stock, par

value $0.001 per share |

| (Title of Class of Securities) |

| |

|

550351100 |

| (CUSIP Number) |

| |

| David J. Chanley |

| c/o White Hat Capital Partners LP |

| 520 Madison Avenue, 33rd Floor |

| New York, New York 10022 |

| (212) 257-5940 |

| |

| With a copy to: |

| |

|

Eleazer Klein, Esq.

David A. Curtiss, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

July 19, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. [ ]

(Page 1 of 13 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 2 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Lightning Opportunity LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

813,168 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (as defined in Item 4 below) (including 149,253 shares of Common Stock issuable upon

conversion of shares of Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s) (as defined in Item 4))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

813,168 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

813,168 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.3%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

*The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker (as defined in Item 4 below). The number of shares of Common Stock in rows (8), (10) and (11) and the

percentage set forth in row (13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page,

however, the ability to convert such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to

the beneficial ownership of the Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 3 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

WH Lightning GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

813,168 shares of Common Stock issuable upon conversion

of the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

813,168 shares of Common Stock issuable upon conversion

of the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

813,168 shares of Common Stock issuable upon conversion

of the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.3%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to

convert such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership

of the Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 4 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Strategic Partners II LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

1,219,756 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

1,219,756 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,219,756 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.4%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to

convert such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership

of the Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 5 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat SP GP II LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

1,219,756 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

1,219,756 shares of Common Stock issuable upon

conversion of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of

shares of Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,219,756 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Series

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.4%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to

convert such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership

of the Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 6 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Structured Opportunities LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

*The conversion of the shares of Series B Convertible Preferred Stock

reported herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10)

and (11) show the number shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 7 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

WHSO GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

8,131,694 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 8 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Capital Partners LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 9 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

David J. Chanley |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 10 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

Mark R. Quinlan |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,164,615 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,67 shares of Common Stock issuable upon conversion of shares of

Series B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 11 of 13 Pages |

The following constitutes Amendment No. 1 (“Amendment

No. 1”) to the Schedule 13D filed by the undersigned with the Securities and Exchange Commission on December 27, 2023 (the “Original

Schedule 13D” and the Original Schedule 13D as amended by this Amendment No. 1, the “Schedule 13D”). This

Amendment No. 1 amends the Schedule 13D as specifically set forth herein. Capitalized terms used

herein and not otherwise defined in this Amendment No. 1 have the meanings set forth in the Schedule 13D.

| Item 4. |

PURPOSE OF TRANSACTION |

| Item 4 of the Schedule 13D is hereby amended and supplemented to include the following: |

| |

On July 19, 2024 (the “Closing

Date”), certain funds affiliated with the Investment Manager (each, a “Lender” and collectively, the

“Lenders”) entered into a Loan Agreement (the “Loan Agreement”), with the Issuer, as borrower,

Luna Technologies, Inc. and General Photonics Corp. as guarantors (together with the Issuer, the “Loan Parties”),

and White Hat Lightning Opportunity LP, as agent (the “Agent”). The Loan Agreement provides for a delayed-draw term

loan facility in an aggregate principal amount of up to $15.0 million (the “Loan Facility”), which may be drawn

in a series of term loan borrowings (each, a “Term Loan” and collectively, the “Term Loans”).

Of the Loan Facility, $9.0 million was drawn on the Closing Date. Up to an additional $3.0 million may be drawn beginning August 16,

2024, with the remaining $3.0 million available beginning October 1, 2024, in each case, subject to, among other conditions, the

Issuer’s continued pursuit of a Sale Transaction (as defined in the Loan Agreement). The Loan Facility will mature on the

earlier of (i) December 31, 2024, subject to possible extension to April 30, 2025 if the Issuer meets certain milestones related to

a Sale Transaction, and (ii) the date on which a Sale Transaction closes. The obligations under the Loan Agreement are secured by a

second priority lien on substantially all of the assets of the Loan Parties. The Loan Agreement contains customary events of

default, representations, warranties and covenants of the parties.

The foregoing description of the Loan Agreement does

not purport to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement. For further information

regarding the Loan Agreement, reference is made to the full text of the Loan Agreement, which has been filed as Exhibit 99.4 hereto

and incorporated by reference herein. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| Items 5(a) and (b) of the Schedule 13D are hereby amended and restated in their entirety: |

| (a) |

See

rows (11) and (13) of the cover pages to this Schedule 13D/A for the aggregate number of shares of Common Stock and percentages of

shares of Common Stock beneficially owned by each of the Reporting Persons, which includes accumulated dividends through July 19,

2024. The percentages used in this Schedule 13D/A are calculated based upon an aggregate of 34,697,019 shares

of Common Stock outstanding as of December 20, 2023, as described in the Subscription Agreement, and

assumes the conversion of the shares of Series B Convertible Preferred Stock held by

the White Hat Funds, subject to the Blocker. |

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 12 of 13 Pages |

| (b) |

See

rows (7) through (10) of the cover pages to this Schedule 13D/A for the number of shares of Common Stock as to which each Reporting Person

has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition, which includes

accumulated dividends through July 19, 2024. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| Item 6 of the Schedule 13D is hereby amended and supplemented to include the following: |

| |

The information set forth in Item 4 of Amendment No. 1 is hereby incorporated by reference. |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| Item 7 of the Schedule 13D is hereby amended and supplemented to include the following: |

| Exhibit 99.4 |

Loan Agreement, dated as of July 19, 2024 (incorporated by reference to Exhibit 10.1 of the Issuer’s Current Report on Form 8-K filed with the SEC on July 23, 2024). |

| CUSIP No. 550351100 | SCHEDULE 13D/A | Page 13 of 13 Pages |

SIGNATURES

After reasonable inquiry and to the best of his

or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| DATE: July 23, 2024 |

/s/ David J. Chanley |

| |

DAVID J. CHANLEY, (i) individually, (ii) as Managing Member of: (a) WH Lightning GP LLC, (x) for itself and (y) as General Partner of White Hat Lightning Opportunity LP, (b) White Hat SP GP II LLC, (x) for itself and (y) as General Partner of White Hat Strategic Partners II LP, (c) WHSO GP LLC, (x) for itself and (y) as General Partner of White Hat Structured Opportunities LP and (d) White Hat Capital Partners GP LLC, as General Partner of White Hat Capital Partners LP. |

| |

|

| |

/s/ Mark R. Quinlan |

| |

MARK R. Quinlan, individually |

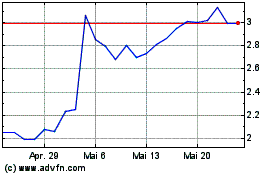

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

Von Okt 2024 bis Dez 2024

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024