UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the Appropriate Box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Under Rule 14a-12 |

iSUN,

INC.

(Name

of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| |

|

|

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| |

(1) |

Amount

Previously paid: |

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed |

| |

|

|

| |

|

|

iSun,

Inc.

400

Avenue D, Suite 10

Williston,

VT 05495

Dear

Stockholder:

You

are cordially invited to attend a Special Meeting of the Stockholders (the “Meeting”) of iSun, Inc., a Delaware corporation

(the “Company”). Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health

and well-being of our employees and stockholders, the Special Meeting of Stockholders will be a completely “virtual meeting.”

The Meeting will be held exclusively online via live audio-only webcast on January 24, 2023 at 2:00 p.m. (Eastern Time). The Company

will be holding the Special Meeting as a virtual meeting via live audio-only webcast.

There

will not be a physical meeting location. The Meeting can be accessed by visiting https://www.virtualshareholdermeeting.com/ISUN2023SM,

where you will be able to attend the Meeting live, have an opportunity to submit questions, and vote online. We encourage you to allow

ample time for online check-in which begins at 1:45 P.M. Eastern Time. Please note that you will not be able to attend the Meeting in

person.

The

principal business of the Meeting will be:

1.

to approve, for the purposes of Listing Rule 5635 of The Nasdaq Stock Market (“Nasdaq”), the issuance of shares of the Company’s

Common Stock under the Senior Secured Convertible Notes issued by the Company on November 4, 2022 (“Proposal 1” or the “Convertible

Note Proposal”).

2.

to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient

votes at the time of the Special Meeting to approve the other proposal (“Proposal 2” or the “Adjournment Proposal”).

The

details of this transaction are outlined in this Notice and Proxy and other public filings we have made.

The

record date for the Meeting is December 12, 2022. Only stockholders of record at the close of business on that date may vote at

the Meeting or any adjournment thereof. We hope you will be able to attend the Meeting. Whether you plan to attend the Meeting or not,

it is important that your shares are represented. Therefore, you are urged to vote by proxy by following the instructions contained in

the Proxy Statement. This will ensure your proper representation at the Meeting, whether or not you can attend.

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

Jeffrey Peck |

| |

Jeffrey

Peck |

| |

Chairman |

iSun,

Inc.

400

Avenue D, Suite 10

Williston,

VT 05495

NOTICE

OF VIRTUAL SPECIAL MEETING OF STOCKHOLDERS

To

Be Held On January 24, 2023

To

the Stockholders of iSun, Inc.:

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Meeting”) of iSun, Inc., a Delaware corporation (the “Company,”

“we,” “our,” or “us”) will be held exclusively online via live audio-only webcast at 2:00 p.m. Eastern

Time on January 24, 2023, or such later date or dates as such Meeting may be adjourned. A Proxy Statement and a Proxy Card are enclosed.

The

Meeting will be held virtually and there will not be a physical meeting location. The Meeting can be accessed by visiting https://www.virtualshareholdermeeting.com/ISUN2023SM,

where you will be able to attend the Meeting live, have an opportunity to submit questions, and vote online. We encourage you to allow

ample time for online check-in, which begins at 1:45 P.M. Eastern Time. Please note that you will not be able to attend the Meeting in

person. We are holding the Meeting for the purpose of considering and taking action on the following proposals:

| |

1. |

to

approve, for the purposes of Listing Rule 5635 of The Nasdaq Stock Market (“Nasdaq”), the issuance of shares of the Company’s

Common Stock upon conversion of the Senior Secured Convertible Notes issued by the Company on November 4, 2022. |

| |

|

|

| |

2. |

to

approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient

votes at the time of the Special Meeting to approve the other proposal. |

| |

|

|

| |

3. |

To

transact such other business as may be properly brought before the Meeting and any adjournments thereof. |

These

matters are more fully described in the Proxy Statement accompanying this Notice.

Our

Board of Directors (the “Board”) has fixed the close of business on December 12, 2022 as the record date (the “Record

Date”) for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournment thereof. A list

of stockholders eligible to vote at the Meeting will be available for review during our regular business hours at our principal offices

in Williston, Vermont for the 10 days prior to the Meeting for review for any purposes related to the Meeting.

THE

iSUN 2023 SPECIAL MEETING CAN BE ACCESSED BY VISITING HTTPS://WWW.VIRTUALSHAREHOLDERMEETING.COM/ISUN2023SM, WHERE YOU WILL BE ABLE TO

LISTEN TO THE MEETING LIVE, HAVE AN OPPORTUNITY TO SUBMIT QUESTIONS AND VOTE ONLINE. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING,

TO ENSURE YOUR REPRESENTATION AT THE MEETING WE URGE YOU TO SUBMIT A PROXY TO VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE BY (1) VISITING

THE INTERNET SITE LISTED ON THE ENCLOSED iSUN PROXY CARD, (2) CALLING THE TOLL-FREE NUMBER LISTED ON THE ENCLOSED iSUN PROXY CARD OR

(3) SUBMITTING YOUR ENCLOSED iSUN PROXY CARD BY MAIL BY USING THE PROVIDED SELF-ADDRESSED, STAMPED ENVELOPE.

Submitting

a proxy will not prevent you from attending the Meeting by means of remote communication and voting at the Meeting, but it will help

to ensure that a quorum is present and avoid added solicitation costs. Any holder of record of iSun Common Stock as of the Record Date

who attends the Meeting may vote virtually at the Meeting, thereby revoking any previous proxy. In addition, a proxy may also be revoked

in writing before the Meeting in the manner described in the accompanying Proxy Statement. If your shares are held in the name of a bank,

brokerage firm or other nominee/agent, please follow the instructions on the voting instruction form furnished by your bank, brokerage

firm or other nominee/agent.

Williston,

Vermont

Dated:

December 12, 2022

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

Jeffrey Peck |

| |

Jeffrey

Peck |

| |

Chairman |

iSun,

Inc.

400

Avenue D, Suite 10

Williston,

VT 05495

PROXY

STATEMENT

FOR

VIRTUAL SPECIAL MEETING OF STOCKHOLDERS

This

Proxy Statement is furnished to stockholders in connection with the solicitation of proxies by the Board of Directors (the “Board”)

of iSun, Inc. (“iSun,” the “Company,” “we,” “our,” or “us”) in connection

with a virtual Special Meeting of Stockholders of the Company to be held exclusively online via live audio-only webcast on January 24,

2023 at 2:00 p.m. Eastern Time (the “Meeting”).

GENERAL

INFORMATION ABOUT SOLICITATION VOTING AND ATTENDING

Who

Can Vote at the Virtual Special Meeting?

Each

share of the Company’s Common Stock has one vote on each Proposal. Only stockholders of record as of the close of business on December

12, 2022 (the “Record Date”) are entitled to receive notice of, attend and vote at the virtual Special Meeting of

Stockholders. You may attend the Meeting by visiting https://www.virtualshareholdermeeting.com/ISUN2023SM, where you will be able to

listen to the Meeting live, have an opportunity to submit questions, and vote your shares of Common Stock if you held such shares as

of the close of business on the Record Date. As of the Record Date, there were 14,712,701 shares of the Company’s Common Stock

outstanding and entitled to vote.

Counting

Votes

Consistent

with state law and our bylaws, the presence, virtually or by proxy, of at least a majority of the shares entitled to vote at the Meeting

will constitute a quorum for purposes of voting on a particular matter at the Meeting. Once a share is represented for any purpose at

the Meeting, it is deemed present for quorum purposes for the remainder of the Meeting and any adjournment thereof unless a new record

date is set for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the Meeting

virtually will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies

that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of determining whether

a quorum is present. “Broker non-votes” are proxies received from banks, brokerage firms or other nominees/agents holding

shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to matters being

voted on.

Pursuant

to our Third Amended and Restated Certificate of Incorporation the vote of: (i) a majority of the voting power of the shares of iSun

Common Stock, present or represented by proxy at the iSun Special Meeting, is required to approve the Convertible Note Proposal and the

Adjournment Proposal. The only capital stock of the Company currently outstanding is Common Stock.

We

strongly encourage you to provide instructions to your bank, brokerage firm, or other nominee/agent by voting your proxy. This action

ensures that your shares will be voted in accordance with your wishes at the Meeting.

Attending

the Meeting

You

or your authorized proxy may attend the Meeting if you were a registered or beneficial stockholder of iSun Common Stock as of the Record

Date.

To

participate in the Meeting, visit https://www.virtualshareholdermeeting.com/ISUN2023SM and enter the 16-digit control number included

on your Proxy Card. The virtual Meeting allows stockholders to submit questions during the Meeting in the question box provided at https://www.virtualshareholdermeeting.com/ISUN2023SM.

We will respond to as many properly submitted questions during the relevant portion of the Meeting agenda as time allows.

If

we experience technical difficulties during the Meeting (e.g., a temporary or prolonged power outage), we will determine whether the

Meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the Meeting will need to be reconvened on a

later day (if the technical difficulty is more prolonged). If you encounter any difficulties accessing the Virtual Meeting during the

check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

If

you are a Stockholder of Record (that is, you hold your shares through iSun’s transfer agent, Continental Stock Transfer &

Trust), you do not need to register to attend the Meeting virtually on the internet. Please follow the instructions on the Proxy Card

that you received. No proof of ownership is necessary because iSun can verify your ownership.

If

you own shares in street name through an intermediary, such as a bank, broker or other nominee/agent, please follow the voting instructions

provided to you by that nominee/agent in order to vote your shares.

SOLICITATION

AND REVOCABILITY OF PROXIES

The

enclosed proxy for the Meeting is being solicited by the Board. Stockholders of record may vote by mail, telephone, or via the Internet.

The toll-free telephone number and Internet web site are listed on the proxy. If you vote by telephone or via the Internet, you do not

need to return your Proxy Card, but you will need the control number printed on the Proxy Card to vote. If you choose to vote by mail,

please mark, date and sign the Proxy Card, and then return it in the enclosed envelope (no postage is necessary if mailed within the

United States). Any person giving a proxy may revoke it at any time prior to the exercise thereof by filing with our Secretary a written

revocation or by duly executed proxy bearing a later date. The proxy may also be revoked by a stockholder attending the virtual Meeting,

withdrawing the proxy and voting virtually, but you will need the control number printed on the Proxy Card.

The

expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by us. In

addition to solicitation by mail, proxies may be solicited by the directors, officers and our regular employees (who will receive no

additional compensation therefor) by means of personal interview, telephone or by other means of communication. It is anticipated that

banks, brokerage firms and other institutions, custodians, nominees/agents, fiduciaries or other record holders will be requested to

forward the soliciting material to persons for whom they hold shares and to seek authority for the execution of proxies; in such cases,

we will reimburse such holders for their charges and expenses.

QUESTIONS

AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why

did I receive these proxy materials?

We

are providing this Proxy Statement in connection with the solicitation by the Board of proxies to be voted at the Meeting, or at any

postponements or adjournments thereof. This Proxy Statement contains important information for you to consider when deciding how to vote

on the matters brought before the Meeting. You are invited to attend the virtual Meeting to vote on the proposals described in this Proxy

Statement. However, you do not need to attend the virtual Meeting to vote your shares. Instead, you may vote your shares using one of

the other voting methods described in this Proxy Statement.

Whether

or not you expect to attend the Meeting, please vote your shares as soon as possible in order to ensure your representation at the Meeting.

Can

I access these proxy materials on the Internet?

Yes.

The Notice of Annual Meeting and Proxy Statement are available for viewing, printing, and downloading at http://www.proxyvote.com.

All materials will remain posted on http://www.proxyvote.com at least until the conclusion of the Meeting.

Who

can vote at the Meeting?

Each

share of the Company’s Common Stock has one vote on each Proposal. Only stockholders of record at the close of business on December

12, 2022, the Record Date for the Meeting, will be entitled to vote at the Meeting. On the Record Date there were 14,712,701 shares

of Common Stock (each entitled to one vote) outstanding.

What

is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder

of Record. If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock Transfer &

Trust, you are considered the stockholder of record with respect to those shares, and the Notice, Proxy Statement and a Proxy Card were

sent directly to you by the Company.

Beneficial

Owner of Shares Held in Street Name. If your shares are held in an account at a bank, brokerage firm or other nominee/agent, then you

are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization

holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you

have the right to instruct that organization on how to vote the shares held in your account.

Stockholder

of Record: Shares Registered in Your Name

If

on the Record Date, your shares of iSun, Inc. Common Stock were registered directly in your name with our transfer agent, then you are

a stockholder of record. As a stockholder of record, you may vote virtually at the Meeting or vote by proxy. Whether or not you plan

to virtually attend the Meeting, we urge you to fill out and return the enclosed Proxy Card to ensure your vote is counted. When you

mail in your Proxy Card, please keep a copy of the control number printed on your Proxy Card in case you wish to revoke the proxy on

your Proxy Card, change your vote at the virtual Meeting or change your vote via the Internet or telephone as otherwise provided herein.

Beneficial

Owner: Shares Registered in the Name of a Bank, Brokerage Firm or Other Nominee/Agent

If

on the Record Date, your shares of iSun, Inc. Common Stock were held in an account at a bank, brokerage firm or other nominee/agent,

then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by

that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Meeting.

As the beneficial owner, you have the right to direct your bank, brokerage firm or other nominee/agent on how to vote the shares in your

account. You are also invited to attend the virtual Meeting. However, since you are not the stockholder of record, you may not vote your

shares virtually at the Meeting unless you request and obtain a signed letter or other valid proxy from your bank, brokerage firm or

other nominee/agent.

What

proposals am I voting on?

There

are two matters scheduled for a vote at the Meeting: (i) to approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares

of the Company’s Common Stock upon conversion of the Senior Secured Convertible Notes issued by the Company on November 4, 2022,

and (ii) to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not

sufficient votes at the time of the Special Meeting to approve the other proposals.

The

Board does not intend to bring any other matters before the Meeting and is not aware of anyone else who will submit any other matters

to be voted on. However, if any other matters properly come before the Meeting, the individuals named on the Proxy Card, or their substitutes,

will be authorized to vote on those matters in their own judgment.

How

many votes do I have?

On

each matter to be voted upon, you have one vote for each share of Common Stock you owned as of the Record Date.

What

is the quorum requirement?

A

quorum of stockholders is necessary to hold a valid Meeting. A quorum will be present if a majority of the outstanding shares of Common

Stock entitled to vote are present at the virtual Meeting.

Your

shares will be counted towards the quorum only if you submit a valid proxy, have voted via the Internet, have voted via telephone or

vote virtually at the Meeting.

If

you submit your proxy vote via the Internet or by telephone but abstain from voting or withhold authority to vote on one or more matters,

as applicable, your shares will be counted as present at the Meeting for the purpose of determining a quorum.

Broker

non-votes will be counted towards the quorum requirement.

Your

shares also will be counted as present at the Meeting for the purpose of calculating the vote on the particular matter with respect to

which you abstained from voting or withheld authority to vote, as further provided below.

If

there is no quorum, the Chairman or a majority of the votes present at the Meeting may adjourn the meeting to another date.

How

do I vote?

The

procedures for voting are set forth below:

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote virtually at the Meeting, vote by proxy using the Proxy Card, vote via the Internet or

by telephone. Whether or not you plan to attend the Meeting, we urge you to vote by proxy, via the Internet or by telephone to ensure

your vote is counted. You may still attend the Meeting and vote virtually if you have already voted by proxy, via the Internet or by

telephone. You may vote as follows:

| |

● |

To

participate in the virtual Meeting, visit https://www.virtualshareholdermeeting.com/ISUN2023SM and enter the 16-digit control number

included on your Proxy Card. The virtual Meeting allows stockholders to vote and to submit questions. We will respond to as many

properly submitted questions during the relevant portion of the Meeting agenda as time allows. |

| |

● |

To

vote using the Proxy Card, simply complete, date and sign the Proxy Card and return it promptly in the envelope provided. No postage

is necessary if mailed in the United States. If you return your signed Proxy Card to us before the Meeting, we will vote your shares

as you direct. |

| |

|

|

| |

● |

To

vote through the Internet, go to http://www.isunenergy.com and follow the instructions provided on the website. In order to

cast your vote, you will be asked to provide the control number from the Proxy Card that was mailed to you. Internet voting is available

24 hours a day and will be accessible until 11:59 p.m. Eastern Time on January 23, 2023. Our Internet voting procedures are designed

to authenticate stockholders by using individual control numbers, which are located on the Proxy Card. |

| |

|

|

| |

● |

To

vote by phone, call 1-800-690-6903 from any touch-tone telephone and follow the instructions. In order to cast your vote, you will

be asked to provide the control number from the Proxy Card that was mailed to you. Telephonic voting is available 24 hours a day

and will be accessible until 11:59 p.m. Eastern Time on January 23, 2023. Our telephonic voting procedures are designed to authenticate

stockholders by using individual control numbers, which are located on the Proxy Card. |

Beneficial

Owner: Shares Registered in the Name of a Bank, Brokerage Firm or other Nominee/Agent

If

you hold your shares in “street name” and thus are a beneficial owner of shares registered in the name of your bank, brokerage

firm or other nominee/agent, you must vote your shares as provided in instructions on how to vote your shares by your bank, brokerage

firm or other nominee/agent. Your bank, brokerage firm or other nominee/agent has enclosed or otherwise provided a voting instruction

card for you to use in directing the bank, brokerage firm or nominee/agent how to vote your shares. Check the voting form used by that

organization to see if it offers internet or telephone voting.

If

you are the beneficial owner of Shares registered in the name of a bank, brokerage firm or other nominee/agent, in order to vote virtually

at the Meeting, you must first obtain a valid proxy from your bank, brokerage firm or other nominee/agent. Follow the instructions from

your bank, brokerage firm or other nominee/agent included with these proxy materials, or contact your bank, brokerage firm or other nominee/agent

to request a proxy form.

How

many votes are required to approve each Proposal, and what is the effect of withholding my vote or abstaining, or a broker non-vote?

| |

● |

Proposal

1, to approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares of the Company’s Common Stock upon conversion

of the Senior Secured Convertible Notes issued by the Company on November 4, 2022. With respect to Proposal 1, you may vote “FOR,”

“AGAINST,” or “ABSTAIN.” Adoption of this proposal requires the affirmative vote of a majority of the shares

present in person or represented by proxy at the Meeting. Abstentions will have the same effect as negative votes. Broker non-votes

are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved. |

| |

|

|

| |

● |

Proposal

2, to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not

sufficient votes at the time of the Special Meeting to approve the other proposal. With respect to Proposal 2, you may vote “FOR,”

“AGAINST,” or “ABSTAIN.” Adoption of this proposal requires the affirmative vote of a majority of the shares

present in person or represented by proxy at the Meeting. Abstentions will have the same effect as negative votes. Broker non-votes

are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved. |

Does

my bank, brokerage firm or other nominee have discretionary power to vote on the Proposals?

If

you hold your shares in street name and do not provide voting instructions to your bank, brokerage firm or other nominee/agent, it may

still be able to vote your shares with respect to certain “discretionary” (or routine) items, but it will not be allowed

to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items for which no

instructions are received, the shares will be treated as “broker non-votes.” Shares that constitute broker non-votes will

be counted as present at the meeting for the purpose of determining a quorum but will not be entitled to vote on the proposal(s) in question.

For

Proposals 1 and 2, if you ABSTAIN from voting on a proposal, your abstention has the same effect as a vote AGAINST that Proposal.

Proposal

1. to approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares of the Company’s Common Stock upon conversion

of the Senior Secured Convertible Notes issued by the Company on November 4, 2022. With respect to Proposal 1, you may vote “FOR,”

“AGAINST” or “ABSTAIN.” Adoption of this proposal requires the affirmative vote of the holders representing a

majority of the shares present in person or represented by proxy at the Meeting. If you “ABSTAIN” from voting with respect

to Proposal 1, your vote will have the same effect as a vote “AGAINST” the proposal. Broker non-votes will have the same

effect as a vote “AGAINST” the proposal. Your bank, brokerage firm or other nominee/agent does not have discretionary authority

to vote shares for Proposal 1.

Proposal

2. to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient

votes at the time of the Special Meeting to approve the other proposal. With respect to Proposal 2, you may vote “FOR,” “AGAINST”

or “ABSTAIN.” Adoption of this proposal requires the affirmative vote of the holders representing a majority of the shares

present in person or represented by proxy at the Meeting. If you “ABSTAIN” from voting with respect to Proposal 2, your vote

will have the same effect as a vote “AGAINST” the proposal. Broker non-votes will have the same effect as a vote “AGAINST”

the proposal. Your bank, brokerage firm or other nominee/agent does not have discretionary authority to vote shares for Proposal 2.

What

happens if I do not give specific voting instructions?

If

you are a stockholder of record and you indicate when voting that you wish to vote as recommended by the Board, or if you sign and return

a Proxy Card without giving specific voting instructions, then the proxy holders will vote your shares as recommended by the Board on

all matters presented in this Proxy Statement, and as the proxy holders may determine in their discretion with respect to any other matters

properly presented for a vote at the virtual Meeting.

If

you are a beneficial owner of shares held in street name and do not provide the bank, brokerage firm or other nominee/agent that holds

your shares with specific voting instructions, the bank, brokerage firm or other nominee/agent may generally vote in its discretion on

“discretionary” matters. However, if the bank, brokerage firm or other nominee/agent that holds your shares does not receive

instructions from you on how to vote your shares on a “non-discretionary” matter, it will be unable to vote your shares on

that matter. When this occurs, it is generally referred to as a “broker non-vote.”

Proposals

1 and 2 are considered as “non-discretionary’’ matters.

Can

I change my vote after submitting my proxy, voting via the Internet or by telephone?

Yes.

You can revoke your proxy at any time before the final vote at the Meeting. If you are a stockholder of record, you may revoke your proxy

in any one of four ways:

| |

● |

You

may submit another properly completed Proxy Card with a later date; |

| |

|

|

| |

● |

You

may vote again by Internet or telephone at a later time (prior to the deadline for Internet or telephone voting); |

| |

|

|

| |

● |

You

may send a written notice that you are revoking your proxy to: iSun, Inc., 400 Avenue, D, Suite 10, Williston, VT, 05495 |

| |

|

|

| |

● |

You

may attend the virtual Meeting and vote virtually. Simply attending the virtual Meeting will not, by itself, revoke your proxy. |

If

you hold your shares in street name, contact your bank, brokerage firm or other nominee/agent regarding how to revoke your proxy and

change your vote. Your most current Internet proxy, telephone proxy or proxy card will be the one that is counted at the Meeting. If

you send a written notice of revocation, please make sure to do so with enough time for it to arrive by mail prior to the Meeting.

How

can I find out the results of the voting at the virtual Meeting?

Preliminary

voting results will be announced at the virtual Meeting. Final voting results will be published in our Current Report on Form 8-K within

four business days after the Meeting.

What

does it mean if I receive more than one Proxy Card?

If

you receive more than one Proxy Card, your shares are registered in more than one name or are registered in different accounts. Please

complete, date, sign and return each Proxy Card, or vote your shares via the Internet or by telephone for each Proxy Card you received

to ensure that all your shares are voted.

Who

is paying for this proxy solicitation?

The

Company is paying the costs of the solicitation of proxies. In addition to mailed proxy materials, our directors, officers and employees

may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees

any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding

proxy materials to beneficial owners.

PROPOSAL

1:

TO

APPROVE, FOR THE PURPOSES OF NASDAQ LISTING RULE 5635, THE ISSUANCE OF SHARES OF THE COMPANY’S COMMON STOCK UNDER THE SENIOR SECURED

CONVERTIBLE NOTES ISSUED BY THE COMPANY ON NOVEMBER 4, 2022

General

On

November 4, 2022, the Company entered into a Securities Purchase Agreement (the “SPA”) with Anson Investments Master Fund

LP and Anson East Master Fund LP (together the “Investors”) and, pursuant thereto, the Company simultaneously consummated

the sale to the Investors of Senior Convertible Notes with an aggregate initial principal amount of $12,500,000 (the “Convertible

Notes”) in a private placement.

Pursuant

to Nasdaq Rule 5635, stockholder approval is required prior to the issuance of securities in a transaction, other than a public offering,

involving the sale, issuance or potential issuance by the Company of Common Stock (or securities convertible into or exercisable for

Common Stock), which equals 20% or more of the Common Stock or 20% or more of the voting power outstanding before the issuance, at a

price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement, or (ii) the average closing

price of the Common Stock for the five trading days immediately preceding the signing of the binding agreement for the transaction.

In

light of this rule, the Convertible Notes provide that, unless the Company obtains the approval of its stockholders as required by Nasdaq,

the Company is prohibited from issuing any shares of Common Stock pursuant to the terms of the Convertible Notes, if the issuance of

such shares of Common Stock pursuant to the Convertible Notes would exceed 19.99% of the Company’s outstanding shares of Common

Stock as of November 4, 2022, or if such issuance would otherwise exceed the aggregate number of shares of Common Stock which the Company

may issue without breaching its obligations under the rules and regulations of Nasdaq. Furthermore, the Company agreed to hold a stockholder

meeting to approve resolutions authorizing the issuance of shares of the Company’s Common Stock under the Convertible Notes for

the purposes of compliance with the stockholder approval rules of Nasdaq.

The

stockholders of the Company are being asked to approve the issuance of the Company’s Common Stock issuable upon conversion of the

Convertible Notes for purposes of Nasdaq Listing Rule 5635. Our Board of Directors believes that the transaction contemplated by the

SPA and Convertible Notes is in the best interest of the stockholders because it will enable us to restructure our debt and thereby improve

our liquidity and financial flexibility to better position the Company for growth.

The

SPA and Convertible Notes

On

November 4, 2022, the Company entered into and consummated the initial closing (the “Closing”) of the transactions contemplated

by the SPA.

At

the Closing, the Company issued and sold to the Investors the Convertible Notes in the aggregate original principal amount of $12,500,000.

The SPA provided for a six percent (6%) original issue discount resulting in gross proceeds to the Company of $11,750,000. Upon (i) the

effectiveness of a Registration Statement covering the Registrable Securities (defined below), (ii) the Stockholder Approval (defined

below), (iii) the Company’s achievement of certain revenue and EBITDA targets, (iv) the Company having sufficient authorized shares

of Common Stock, (v) the Company’s maintenance of certain balance sheet requirements, and (vi) certain other conditions, the Company

and the Investors will consummate a second closing in which the Company will issue and sell to each Investor a second Convertible Note

for an aggregate principal amount of $12,500,000 for both Notes having identical terms and conditions as the first Convertible Notes,

including a six percent (6%) original issue discount, for an aggregate principal amount of $25,000,000 in Convertible Notes that may

be issued and sold pursuant to the SPA. Interest shall accrue under the Notes at the rate of 5% per annum, payable in cash or, at the

Company’s option, in duly authorized, validly issued, fully paid and non-assessable shares of the Company’s Common Stock],

or a combination thereof. The Notes are convertible into shares of Common Stock at the election of the holder at any time at an initial

conversion price of $2.66 (the “Conversion Price”). The Conversion Price is subject to customary adjustments for stock dividends,

stock splits, reclassifications and the like, and subject to price-based adjustment in the event of any issuances of Common Stock, or

securities convertible, exercisable or exchangeable for, Common Stock at a price below the then-applicable Conversion Price (subject

to certain exceptions). Beginning on March 1, 2023 and on the first day of each month thereafter, the Company will be required to redeem

1/26th of the original principal amount of each Note, plus accrued but unpaid interest, until the maturity date of May 4,

2025, on which date all amounts that remain outstanding will be due and payable in full. Subject to certain conditions, including certain

equity conditions, the Company may pay the amount due on each monthly redemption date, and the final amount due at maturity, either in

cash, shares of Common Stock or a combination thereof. The number of shares used to pay any portion of the Notes in such event would

be calculated as 90% of the lowest daily volume weighted average price of the Common Stock during the five (5) trading days immediately

prior to the payment date. The Convertible Notes may not be prepaid by the Company, other than as specifically permitted by the Convertible

Notes.

The

Convertible Notes rank senior to all outstanding and future indebtedness of the Company and its Subsidiaries (as defined in the SPA),

subject to certain exclusions including (i) existing debt relating to bank loans to the Company’s subsidiary Peck Electric, Co.,

a Vermont corporation, secured by certain solar arrays, and (ii) existing vehicle and equipment loans to the Company’s subsidiaries,

Peck Electric Co., a Vermont corporation and SolarCommunities, Inc., a Vermont benefit corporation, secured by those vehicles and equipment,

and is secured by a first priority perfected security interest in all of the existing and future assets of the Company and each Guarantor

(as defined in the Security Agreement), as evidenced by (i) a Security Agreement entered into at the Closing (the “Security Agreement”),

(ii) a Trademark Security Agreement entered into at the Closing (the “Trademark Security Agreement”), and (iii) a Guaranty

executed by all direct and indirect subsidiaries of the Company (the “Guaranty”) pursuant to which each of them has agreed

to guaranty the obligations of the Company under the Notes and the other Transaction Documents (as defined in the SPA).

Also

at the Closing, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors.

Pursuant to the terms of the Registration Rights Agreement, the Company has agreed to prepare and file with the SEC within 20 days following

the Closing (extended by the Company and the Investors to December 5, 2022) a registration statement covering the resale of the shares

of Common Stock issuable upon conversion of the Notes (the “Registrable Securities”), and to use its best efforts to cause

such Registration Statement to be declared effective under the Securities Act of 1933, as amended (the “Securities Act”),

as promptly as possible, but in any event no later than 60 days following the Closing. If the Registration Statement is not filed within

20 days after the Closing or is not declared effective by the applicable deadline set forth in the Registration Rights Agreement, or

under certain other circumstances described in the Registration Rights Agreement, then the Company shall be obligated to pay, as partial

liquidated damages, to each Investor an amount in cash equal to 2% of the original principal amount of the Convertible Notes each month

until the applicable event giving rise to such payments is cured. If the Company fails to pay any partial liquidated damages in full

within seven days after the date payable, the Company will pay interest thereon at a rate of 10% per annum.

Pursuant

to the SPA, the Company agreed to seek the approval of its stockholders for the issuance of all shares of Common Stock issuable upon

conversion of the Notes, in compliance with Nasdaq rules (the “Stockholder Approval”). In connection with such agreement,

the Company entered into Voting Agreements (the “Voting Agreements”) with each of Thomas Berry, John P. Comeau, Charles B.

Curtis, Jr., James Moore, Frederick A. Myrick, Jr., Jeffrey Peck, and Veroma, LLC (each, a “Stockholder”). Pursuant to the

Voting Agreements, each Stockholder has agreed, with respect to all of the voting securities of the Company that such Stockholder beneficially

owns as of the date thereof or thereafter, to vote in favor of the Stockholder Approval, and has agreed to lock up their shares, subject

to certain exclusions, until the record date of a Special Meeting or Annual Meeting at which the Company will seek shareholder approval

of the registration of the Registrable Securities as set out in the SPA.

The

foregoing summaries provide only a brief description of the Convertible Notes, the SPA, the Security Agreement, Trademark Security Agreement,

the Guaranty, the Registration Rights Agreement and the Voting Agreements. The summaries do not purport to be complete and are qualified

in their entireties by the full text of such documents, copies of which are attached as Exhibits 4.1, 10.1, 10.2, 10.3, 10.4, 10.5 and

10.6, respectively, to the Current Report on Form 8-K filed with the SEC on November 8, 2022, and incorporated herein by reference.

Reasons

for the Transaction and Effect on Current Shareholders

The

Board has determined that the ability to issue securities pursuant to the Convertible Notes is in the best interests of the Company and

its stockholders. The issuance of securities pursuant to the Convertible Notes will not affect the rights of the holders of outstanding

Common Stock, but such issuances will have a dilutive effect on the existing shareholders, including the voting power and economic rights

of the existing shareholders.

The

Convertible Notes provide that the holder is prohibited from converting the note to the extent the holder would beneficially own more

than 4.99% (or 9.99%, if the holder elects the higher threshold) of the Company’s outstanding shares of Common Stock after such

conversion or payment. Unlike Nasdaq Rule 5635 and the corresponding provisions of the Convertible Notes, which limit the aggregate number

of shares the Company may issue to the holder of the each Convertible Note, this beneficial ownership limitation limits the number of

shares the holder may beneficially own at any one time. Consequently, the number of shares the holder may beneficially own in compliance

with the beneficial ownership limitation may increase over time as the number of outstanding shares of Common Stock increases over time.

In addition, the holder may sell some or all of the shares it receives under the Convertible Note, permitting it to acquire additional

shares in compliance with the beneficial ownership limitation. The Company is not seeking shareholder approval to lift such ownership

limitation.

Number

of Shares Potentially Issuable

As

of December 12, 2022 14,712,701 shares of our Common Stock were issued and outstanding. The following table shows the pro forma

impact of the conversion of the Convertible Notes at the Conversion Price on the ownership of our Common Stock as of December 12,

2022:

| | |

Before Note Conversions | | |

Pro Forma for the Note Conversions | |

| | |

No. of Shares | | |

Percentage of Common | | |

No. of Shares | | |

Percentage of Common | |

| Existing Holders of Common Stock | |

| 14,712,701 | | |

| 100 | % | |

| 14,712,701 | | |

| 73.6 | % |

| Investors | |

| 0 | | |

| 0 | | |

| 5,286,654 | | |

| 26.4 | % |

| Total | |

| 14,712,701 | | |

| 100 | % | |

| 19,999,355 | | |

| 100 | % |

Necessity

of Stockholder Approval

As

a result of being listed for trading on Nasdaq, issuances of the Company’s Common Stock are subject to the Nasdaq Listing Rules,

including Nasdaq Listing Rule 5635, which requires stockholder approval in connection with a transaction other than a public offering

involving the sale or issuance by the issuer of Common Stock (or securities convertible into Common Stock) equal to 20% or more of the

Common Stock or 20% or more of the voting power outstanding before the issuance for a price that is less than the greater of book or

market value of the stock on the date we enter into a binding agreement for the issuance of such securities. Accordingly, the Convertible

Notes may not be converted into in excess of 2,927,827 shares of our Common Stock, which represents approximately 19.9% of the

Common Stock outstanding immediately prior to the issuance of the Convertible Notes. As of December 12, 2022, the conversion of

$12,500,000 principal amount of the Convertible Notes at the Conversion Price would result in the issuance of 4,699,249 shares of Common

Stock, which is more than 19.9% of our Common Stock outstanding immediately before the closing of the Acquisition Transaction and the

issuance of the Convertible Notes at a discount to the book value of our Common Stock on the date of the Convertible Notes.

Accordingly,

we are requesting in this Proposal 1 that our stockholders approve, in accordance with Nasdaq Listing Rule 5635, the issuance of shares

of Common Stock exceeding 19.9% of the number of shares outstanding on December 12, 2022 or 5,286,654 shares, upon the Note Conversion.

Consequences

of Failure to Obtain Stockholder Approval

If

this stockholder approval is not obtained and we are unable to consummate the Note Conversions, the Company will be required to

seek additional capital to repay the Convertible Notes in cash, which may include equity issuances, assets sales, alternative

debt for equity conversions or other restructuring transactions, which may not be on commercially reasonable terms and may negatively

impact stockholders at that time. If the Company elects to seek additional capital with the issuance of new shares, it is also likely

that the Company may again need to seek stockholder approval at a future special or annual meeting of stockholders for the issuance of

those shares, may need to seek alternative means to finance the payment, or may take such other actions as the Board deems advisable

and in the best interests of the Company and its stockholders at that time.

The

information set forth in this Proposal 1, including the description of certain terms and provisions of the Convertible Notes, is qualified

in its entirety by reference to the actual terms of the agreements entered into in connection with the Transaction (including, but not

limited to, the SPA and the Convertible Notes), which are included as exhibits to our Current Report on Form 8-K filed with the SEC on

November 8, 2022.

Required

Vote

The

affirmative vote of the holders representing a majority of the outstanding shares of Common Stock present at the Meeting is required

to approve, for the purposes of Nasdaq Listing Rule 5635, the issuance of shares of the Company’s Common Stock under the Senior

Secured Convertible Notes issued by the Company on November 4, 2022.

RECOMMENDATION

OF THE BOARD FOR PROPOSAL NO. 1:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE ISSUANCE OF SHARES OF THE

COMPANY’S COMMON STOCK UNDER THE SENIOR SECURED CONVERTIBLE NOTES ISSUED BY THE COMPANY ON NOVEMBER 4, 2022.

PROPOSAL

2:

ADJOURNMENT

PROPOSAL

At

the Special Meeting, if necessary, stockholders will vote on the Adjournment Proposal. If the Adjournment Proposal is adopted, the Board

will have the discretion to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies in the event

that there are not sufficient votes at the time of the Special Meeting to approve the other proposals. It is possible for the Company

to obtain sufficient votes to approve the Adjournment Proposal but not receive sufficient votes to approve the other proposals. In such

a situation, the Company could adjourn the meeting for any number of days or hours as permitted under applicable law and attempt to solicit

additional votes in favor of such other proposals.

In

addition to an adjournment of the Special Meeting upon approval of the Adjournment Proposal, if a quorum is not present at the Special

Meeting, the Company’s bylaws allow the Special Meeting to be adjourned for the purpose of obtaining a quorum. Any such adjournment

may be made without notice, other than the announcement made at the Special Meeting, by the affirmative vote of a majority of the shares

of Common Stock present in person or by proxy and entitled to vote at the Special Meeting. The Board also is empowered under Delaware

law to postpone the meeting at any time prior to the meeting being called to order. In such event, the Company would issue a press release

and take such other steps as it believes are necessary and practical in the circumstances to inform its stockholders of the postponement.

If

the stockholders approve the Adjournment Proposal, and the Special Meeting is adjourned, the Company expects to use the additional time

to solicit additional proxies in favor of the other proposals. Among other things, approval of the Adjournment Proposal could mean that,

even if a majority of the Company’s Common Stock has been voted against the other proposals, the Company could adjourn the Special

Meeting without a vote on the other proposals, and seek to convince the holders of those shares to change their votes.

The

Adjournment Proposal will only be presented at the Special Meeting if there are not sufficient votes represented in person or by proxy

for the other proposals. If the Adjournment Proposal is presented at the Special Meeting and is not approved, the Company may not be

able to adjourn the Special Meeting to a later date. As a result, the Company may be prevented from obtaining ratification and/or approval

of the other matters.

Required

Vote and Recommendation

Approval

of the Adjournment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s Common

Stock, represented in person or by proxy at the meeting and entitled to vote thereon.

RECOMMENDATION

OF THE BOARD FOR PROPOSAL NO. 2:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ADJOURNMENT PROPOSAL.

PRINCIPAL

STOCKHOLDERS OF iSUN

The

percentage ownership information shown in the table below is based upon 14,712,701 shares of Common Stock outstanding as of the Record

Date. The number of outstanding shares and the percentage ownership information shown in the table below includes shares and options

issued pursuant to the Company’s Equity Incentive Plan.

| Name and Address of Beneficial Owner(1) | |

Shares of Common

Stock | | |

Percentage Owned | |

| | |

| | |

| |

| Directors and executive officers | |

| | | |

| | |

| Jeffrey Peck | |

| 1,356,974 | (1) | |

| 9.22 | % |

| John Sullivan | |

| 58,000 | | |

| 0.39 | % |

| Frederick Myrick, Jr. | |

| 628,487 | (2) | |

| 4.27 | % |

| Andrew Matthy | |

| 3,000 | | |

| 0.02 | % |

| Stewart Martin | |

| 10,500 | | |

| 0.07 | % |

| Michael d’Amato | |

| 227,316 | (3) | |

| 1.55 | % |

| Claudia Meer | |

| 7,250 | | |

| 0.05 | % |

| All officers and directors as a group (6 persons) | |

| 2,291,527 | | |

| 15.58 | % |

| (1) |

Pursuant

to a Voting Agreement dated June 20, 2019, between iSun and Mr. Peck and certain other parties, Mr. Peck has sole voting power over

an aggregate of 867,976 shares held by the following iSun stockholders including 275,000 shares of Common Stock held

by Mooers Partners, LLC, 275,000 shares of Common Stock held by Branton Partners, LLC, 227,316 shares of Common Stock

held by Veroma, LLC, and 90,660 shares of Common Stock held by Corundum, AB. Pursuant to Irrevocable Proxies, Mr. Peck has

sole voting power over an aggregate of 298,000 shares held by the following iSun stockholders including 291,500 shares

held by Sassoon M. Peress, 2,000 shares held by Dan Cohen, 3,000 shares held by Emma Peress, and 1,500 shares held by Shoshanna Zimmerman

|

| |

|

| (2) |

These shares are held by The Mykilore Trust of which

Mr. Myrick is a trustee. |

| |

|

| (3) |

These shares are held by Veroma, LLC of which Mr. d’Amato

is a managing member. |

INCORPORATION

BY REFERENCE

We

are incorporating by reference specified documents that we file with the SEC, which means that incorporated documents are considered

part of this Proxy Statement. We are disclosing important information to you by referring you to those documents and information we subsequently

file with the SEC will automatically update and supersede information contained in this Proxy Statement and in our other filings with

the SEC. This document incorporates by reference the Company’s Annual Report on Form 10-K for the year ended December 31, 2021,

filed on April 15, 2022 and amended on Form 10-K/A, filed on May 2, 2022, the Company’s quarterly report on Form 10-Q for the quarter

ended March 31, 2022, filed on May 16, 2022, the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2022, filed

on August 15, 2022, the Company’s quarterly report on Form 10-Q for the quarter ended September 30, 2022, filed on November 14,

2022, and the Company’s Current Reports on Form 8-K and 8-K/A, as applicable, as filed with the SEC on January 5, 2022; February

2, 2022; March 14, 2022; July 25, 2022; and November 8, 2022.

The

Board knows of no other matters that will be presented for consideration at the Meeting, but if other matters properly come before the

Meeting, the persons named as proxies in the enclosed Proxy will vote according to their best judgment. Stockholders are requested to

date and sign the enclosed Proxy and to mail it promptly in the enclosed postage-paid envelope. If you attend the virtual Meeting, you

may revoke your Proxy at that time and vote virtually, if you wish. Otherwise your Proxy will be voted for you.

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

Jeffrey Peck |

| |

Jeffrey

Peck |

| |

Chairman |

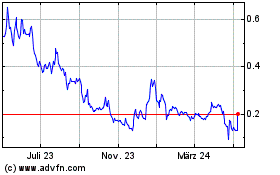

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

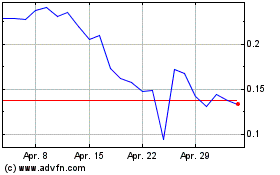

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024