Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

24 September 2024 - 12:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 10)

Tender Offer Statement Under Section 13(e)(1)

of the Securities Exchange Act of 1934

ASSURE HOLDINGS CORP.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

9% CONVERTIBLE DEBENTURES DUE 2023 AND 2024

(Title of Class of Securities)

|

04625J303

(CUSIP Number of Common Stock Underlying Debentures) |

| |

|

John Farlinger

Executive Chairman and Chief Executive Officer

7887 East Belleview Avenue, Suite 1100

Denver, Colorado 80111

Telephone: 720-287-3093 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person) |

| |

| |

| Copies to: |

| |

|

Jason K Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, Colorado 80202

Telephone: (303) 352-1133

Fax Number: (303) 629-3450 |

| |

| ¨ |

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| ¨ |

third

party tender offer subject to Rule 14d-1. |

| x |

issuer

tender offer subject to Rule 13e-4. |

| ¨ |

going-private

transaction subject to Rule 13e-3. |

| ¨ |

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 10 (“Amendment

No. 10”) amends the Tender Offer Statement on Schedule TO originally filed by Assure Holdings Corp., a Nevada corporation

(the “Company”, “we”, “us” or “our”), on June 21, 2024,

as amended on July 3, 2024, July 9, 2024, July 12, 2024, July 22, 2024, July 30, 2024, August 6, 2024, August 20,

2024, August 26, 2024 and September 9, 2024 (as amended through September 9, 2024, the “Ninth Amended Schedule

TO”), in connection with an offer, as amended (the “Convertible Note Exchange Offer”), by Assure to

exchange, for each $1,000 claim, consisting of principal amount, and accrued and unpaid interest through, and including, September 20,

2024, of the Company’s 9% Convertible Debentures due 2023 and 2024 (the “Assure Convertible Debentures”), 1,000

shares of the Company’s common stock (the “Common Stock”) equal to the quotient of $1,000 divided by a per share

price of $1.00.

This

Amendment No. 10 is being filed solely to amend “Item 11 - Additional Information” to reflect and report the final

results of the Convertible Note Exchange Offer. This Amendment No. 10 is intended to satisfy the disclosure requirements of Rule 13e-4(c)(4) under

the Securities Exchange Act of 1934, as amended. Except as specifically set forth herein, this Amendment No. 10 does not modify

any of the information previously reported in the Ninth Amended Schedule TO.

Item 11. Additional Information

Item 11 of the Ninth Amended Schedule TO is hereby amended and supplemented

by adding the following:

The Convertible Note Exchange Offer expired at

11:59 p.m. (Denver time) on September 20, 2024 (the “Expiration Time’).

$2,129,000 in principal amount of Assure Convertible

Debentures were validly tendered and not withdrawn pursuant to the Convertible Note Exchange Offer.

Promptly following the Expiration Time, the Company

accepted for exchange $2,129,000 in principal amount of Assure Convertible Debentures validly tendered and not withdrawn pursuant to the

terms of the Convertible Note Exchange Offer and promptly issued 2,477,082 shares of Common Stock in exchange for the tendered and accepted

Assure Convertible Notes, and including an additional $348,093 in accrued and unpaid interest through, and including, September 20,

2024, in relation to such tendered and accepted Assure Convertible Notes and will pay $11 in cash in settlement of fractional shares of

Common Stock issuable pursuant to the Convertible Note Exchange Offer.

Item 12. Exhibits.

| |

(a) |

(1) |

(i)* |

Offer Letter dated June 21,

2024 |

| |

|

|

(ii)* |

Amendment No. 1 to Offer Letter dated July 3,

2024 |

| |

|

|

(iii)* |

Amendment No. 2 to Offer Letter dated July 12,

2024 |

| |

|

|

(iv)* |

Amendment No. 3 to Offer Letter dated July 30,

2024 |

| |

|

|

(v)* |

Amendment No. 4 to Offer Letter dated September 9,

2024 |

| |

|

|

(vi)* |

Amended Letter of Transmittal dated July 3, 2024 |

| |

|

|

(vii)* |

Withdrawal Form |

| |

|

|

(viii)* |

Form of Confirmation email/letter to Holders who

Elect to Participate in the Offer |

| |

|

|

(ix)* |

Form of Cover Letter to Holders |

| |

|

|

(x)* |

Letter to Holders dated July 9, 2024 |

| |

|

|

(xi)* |

Press Release dated July 22, 2024 |

| |

|

|

(xii)* |

Press Release dated July 29, 2024 |

| |

|

|

(xiii)* |

Press Release dated August 5, 2024 |

| |

|

|

(xiv)* |

Press Release dated August 19, 2024 |

*

- Previously filed

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ASSURE HOLDINGS

CORP. |

|

| |

|

|

| By: |

/s/

John Farlinger |

|

| |

John Farlinger |

|

| |

Chief Executive Officer |

|

Dated: September 23, 2024

INDEX TO EXHIBITS

| |

(a) |

(1) |

(i)* |

Offer Letter dated June 21,

2024 |

| |

|

|

(ii)* |

Amendment No. 1 to Offer Letter dated July 3,

2024 |

| |

|

|

(iii)* |

Amendment No. 2 to Offer Letter dated July 12,

2024 |

| |

|

|

(iv)* |

Amendment No. 3 to Offer Letter dated July 30,

2024 |

| |

|

|

(v)* |

Amendment No. 4 to Offer Letter dated September 9,

2024 |

| |

|

|

(vi)* |

Amended Letter of Transmittal dated July 3, 2024 |

| |

|

|

(vii)* |

Withdrawal Form |

| |

|

|

(viii)* |

Form of Confirmation email/letter to Holders who

Elect to Participate in the Offer |

| |

|

|

(ix)* |

Form of Cover Letter to Holders |

| |

|

|

(x)* |

Letter to Holders dated July 9, 2024 |

| |

|

|

(xi)* |

Press Release dated July 22, 2024 |

| |

|

|

(xii)* |

Press Release dated July 29, 2024 |

| |

|

|

(xiii)* |

Press Release dated August 5, 2024 |

| |

|

|

(xiv)* |

Press Release dated August 19, 2024 |

| |

|

|

(xv)* |

Press Release dated August 26, 2024 |

| |

|

|

(xvi)* |

Press Release dated September 9, 2024 |

| |

|

|

(xvii) |

Form 8-K dated September 23, 2024 |

| |

(b) |

Not applicable |

| |

(d) |

(1) |

(i) Form of

Convertible Debenture (incorporated by reference to Exhibit 4.2 to the Company’s Registration Statement on Form S-1

as filed on December 30, 2020) |

| |

(g) |

Not applicable |

| |

(h) |

Not applicable |

| |

107 |

Filing Fees* |

*

- Previously filed

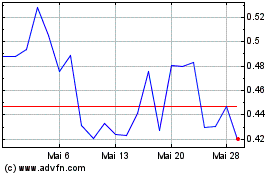

Assure (NASDAQ:IONM)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

Assure (NASDAQ:IONM)

Historical Stock Chart

Von Sep 2023 bis Sep 2024