0000050863false00000508632024-11-252024-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 25, 2024

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 000-06217 | 94-1672743 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | |

2200 Mission College Boulevard, Santa Clara, California | 95054-1549 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (408) 765-8080

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On November 25, 2024, Intel Corporation (“Intel”) entered into a direct funding agreement (the “Direct Funding Agreement”) with the U.S. Department of Commerce (the “DOC”) under which the DOC agrees to award Intel funding under the Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (the “CHIPS Act”).

Under the Direct Funding Agreement, the DOC has agreed to award Intel up to $7.8 billion in direct funding and $65 million in workforce development funding (collectively, the “Awards”) related to (i) the construction, modernization, tool purchase and installation in, and operation of, twelve microchip fabrication facilities and advanced packaging facilities located in Arizona, New Mexico, Ohio and Oregon (the “Projects”) and (ii) workforce activities related to the Projects.

The DOC will disburse the Awards funding to Intel based on the achievement of various milestones, with each disbursement reimbursing Intel for eligible uses of funds already incurred and paid by Intel or its subsidiaries. Disbursements are Project-specific and subject to the achievement of various capital expenditure, facility completion, process technology development, wafer production, Intel products insourcing and external foundry customer acquisition milestones, the receipt of applicable permits and other governmental approvals, and various other conditions.

The Direct Funding Agreement contains representations, warranties and covenants applicable to Intel and its affiliates that have direct or indirect ownership of any Project (those affiliates, together with Intel, the “Recipient Parties”), including with respect to (i) restrictions on dividends and share repurchases, (ii) restrictions on the expansion of semiconductor manufacturing capacity in certain foreign countries, (iii) restrictions on joint research and technology licensing with certain foreign entities, (iv) restrictions on the use or installation of prohibited equipment that is manufactured or assembled by certain foreign entities, (v) spending at least $35 billion on research and development within the United States cumulatively from 2024 through 2028, (vi) compliance with various federal regulations and requirements and (vii) limitations on dispositions of the Projects, including through dispositions of equity interests in the Projects.

The Direct Funding Agreement contains restrictions on certain “change of control” transactions: (i) third party acquisition of 35% or more of the ownership of or voting rights with respect to Intel or otherwise acquiring control of Intel; (ii) Intel ceasing to own at least 50.1% of the ownership of or voting rights with respect to Intel Foundry if separated into a new legal entity (“Intel Foundry Corporation”) so long as Intel Foundry Corporation remains a private company; (iii) if Intel Foundry Corporation becomes a public company, third party acquisition of 35% or more of the ownership of or voting rights with respect to Intel Foundry Corporation at any time Intel is not its largest shareholder; (iv) Intel ceasing to have control of Intel Foundry Corporation; or (v) with respect to other Recipient Parties, Intel ceasing to own at least 50.1% of the ownership of or voting rights with respect to the Recipient Party equity or voting rights or otherwise ceasing to have control of the Recipient Party. Any “change of control” transaction must satisfy certain requirements as to the nature and financial resources of the counterparty, the impact to the creditworthiness of Intel and Intel Foundry Corporation, continued wafer purchases by Intel from Intel Foundry Corporation, and continuation of the Projects, the business strategy of manufacturing leading-edge semiconductors in the U.S. and the investment in U.S. semiconductor research and development, or would require DOC consent.

Under the Direct Funding Agreement, Intel may be required to share with the DOC a percentage of the total cumulative realized unlevered free cash flow achieved by a Project (the “Project Return”) if it exceeds specified thresholds (the “Excess Return Sharing Requirement”). Any payments that may be required by Intel under the Excess Return Sharing Requirement are limited to a maximum of 75% of the Awards received by Intel for the applicable Project (after taking into account any clawbacks or other repayments of such Awards). Any Excess Return Sharing Requirement is separately calculated and applicable to a Project until the end of the ninth fiscal year following the fiscal year in which the Project Return for the Project is positive.

In the event of certain significant breaches under the Direct Funding Agreement by Intel and the other Recipient Parties (e.g., CHIPS Act program requirements, change of control restrictions, bankruptcy of Intel, etc.), the DOC may have termination rights and other remedies. Such rights and remedies vary depending on the nature of such breach, but can include: (i) requiring the repayment of some or all of the Awards; (ii) imposing additional conditions on the Awards; (iii) suspending or terminating all or any portion of the Awards; (iv) withholding or suspending a disbursement of the Awards; (v) terminating the Direct Funding Agreement and the Awards; and (vi) taking other actions available to the DOC.

Item 7.01 Regulation FD Disclosure.

On November 26, 2024, Intel issued a press release announcing the entry into the Direct Funding Agreement. A copy of the press release is attached as Exhibit 99.1 and incorporated by this reference.

The information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are provided as part of this Report:

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | INTEL CORPORATION (Registrant) |

| | | | | |

| Date: | November 27, 2024 | | By: | | /s/ APRIL MILLER BOISE |

| | | | | April Miller Boise |

| | | | | Executive Vice President and Chief Legal Officer |

| | | | | |

Exhibit 99.1

Intel Corporation

2200 Mission College Blvd.

Santa Clara, CA 95054-1549

News Release

Intel, Biden-Harris Administration Finalize $7.86 Billion Funding Award Under US CHIPS Act

Award to support Intel’s $100 billion investment plans to expand American semiconductor manufacturing and technology leadership.

NEWS HIGHLIGHTS

•The U.S. Department of Commerce has awarded Intel up to $7.86 billion in direct funding through the U.S. CHIPS and Science Act to advance Intel’s commercial semiconductor manufacturing and advanced packaging projects in Arizona, New Mexico, Ohio and Oregon.

•This direct funding is in addition to the $3 billion contract awarded to Intel for the Secure Enclave program that is designed to expand trusted manufacturing of leading-edge semiconductors for the U.S. government.

•Today’s award, coupled with a 25% investment tax credit, will support Intel’s plans to invest more than $100 billion in the U.S.

•As previously announced, Intel’s planned U.S. investments, including projects beyond those supported by CHIPS, support more than 10,000 company jobs, nearly 20,000 construction jobs, and more than 50,000 indirect jobs with suppliers and supporting industries.

SANTA CLARA, Calif., Nov. 26, 2024 – Intel Corporation and the Biden-Harris Administration announced today that the U.S. Department of Commerce and Intel have reached agreement on terms to award the company up to $7.86 billion in direct funding for its commercial semiconductor manufacturing projects under the U.S. CHIPS and Science Act. The award will support Intel’s previously announced plans to advance critical semiconductor manufacturing and advanced packaging projects at its sites in Arizona, New Mexico, Ohio and Oregon. Intel also plans to claim the U.S. Treasury Department’s Investment Tax Credit, which is expected to be up to 25% of qualified investments of more than $100 billion.

“With Intel 3 already in high-volume production and Intel 18A set to follow next year, leading-edge semiconductors are once again being made on American soil,” said Pat Gelsinger, CEO of Intel. “Strong bipartisan support for restoring American technology and manufacturing leadership is driving historic investments that are critical to the country’s long-term economic growth and national security. Intel is deeply committed to advancing these shared priorities as we further expand our U.S. operations over the next several years.”

The announcement demonstrates the U.S. government’s confidence in Intel’s essential role in building a resilient, trusted semiconductor supply chain on domestic soil. Since the passage of the CHIPS and Science Act more than two years ago, Intel has announced plans to invest more than $100 billion in the U.S. to expand chipmaking and advanced packaging capacity and capabilities critical to economic and national security. The historic investments will support tens of thousands of jobs, strengthen U.S. supply chains, foster U.S.-based R&D, and help ensure American leadership in cutting-edge semiconductor manufacturing and technology capabilities.

“The CHIPS for America program will supercharge American technology and innovation and make our country more secure – and Intel is expected to play an important role in the revitalization of the U.S. semiconductor industry,” said U.S. Secretary of Commerce Gina Raimondo. “Thanks to the leadership of President Biden and Vice President Harris, our CHIPS award is catalyzing Intel to make one of the largest investments in semiconductor manufacturing in U.S. history.”

The award follows the previously signed preliminary memorandum of terms and the completion of Commerce’s due diligence, in addition to the announced investment tax credit. The final total award is less than the proposed preliminary award due to a congressional requirement to use CHIPS funding to pay for the $3 billion Secure Enclave program.

Press Kit: U.S. CHIPS Act Funding for Intel

U.S. Manufacturing and R&D Investments

The CHIPS Act award will directly support Intel’s investments at sites where the company develops and produces many of the world’s most advanced chips and semiconductor packaging technologies, including in Arizona, the Silicon Desert; New Mexico, the Silicon Mesa; Ohio, the Silicon Heartland; and Oregon, the Silicon Forest.

•Arizona: Intel’s U.S. Manufacturing Powerhouse (Silicon Desert Fact Sheet)

•New Mexico: Intel’s U.S. Advanced Packaging Site (Silicon Mesa Fact Sheet)

•Ohio: Intel’s New Leading-Edge Manufacturing Site (Silicon Heartland Fact Sheet)

•Oregon: The Heart of Intel’s Semiconductor R&D (Silicon Forest Fact Sheet)

Intel was founded in the U.S. and has been innovating, investing and supporting global semiconductor manufacturing and R&D for more than 50 years. Intel currently employs approximately 45,000 people in the U.S.

Foundry Momentum and Technology Leadership

Intel is nearing completion of a historic pace of semiconductor node development to regain process technology leadership. Intel 18A, the company’s fifth process node in four years, is on track to launch in 2025 and continues to gain traction with customers. The company is finalizing a multiyear, multibillion-dollar commitment by Amazon Web Services to expand its existing partnership to include a new custom Intel® Xeon® 6 chip on Intel 3 and a new AI fabric chip on Intel 18A.

In September 2024, Intel won a manufacturing contract for up to $3 billion for the Secure Enclave program. This program is designed to expand the trusted manufacturing of leading-edge semiconductors for the U.S. government and builds on Intel’s relationship with the U.S. Department of Defense through the Rapid Assured Microelectronics Prototypes - Commercial (RAMP-C) and State-of-the-Art Heterogeneous Integrated Packaging (SHIP) programs.

Additionally, Intel reported key milestones in advanced semiconductor manufacturing with the completed assembly of the industry’s first commercial High Numerical Aperture (High NA) Extreme Ultraviolet (EUV) lithography scanner and receipt of an additional High NA tool installed at the company’s Hillsboro, Oregon, R&D site. This will enable Intel to lead cutting-edge advancements that will define next-generation chip manufacturing.

Workforce Development and Childcare Benefits

Alongside its manufacturing and technology investments, Intel has a long-standing history of investing in the American workforce by supporting education, training and benefits programs needed to create the jobs of the future. In 2022, for example, Intel announced a $100 million investment to expand semiconductor education, research and workforce training opportunities across the nation.

As part of Intel’s overall CHIPS award, $65 million is set aside to support the company’s efforts to create a more skilled semiconductor workforce. Intel plans to use $56 million to help train students and faculty at all education levels to support industry growth. This includes, for example, Intel’s recently launched U.S. registered apprenticeship program for manufacturing facility technicians.

The company will use $5 million of the dedicated workforce award to help increase childcare availability near Intel’s facilities. This is intended to support Intel’s recently announced plans to broaden childcare benefits and pilot innovative programs to support working families. The remaining $4 million of the $65 million award will support Intel’s participation in the CHIPS Women in Construction Framework, which Intel voluntarily committed to this year to help expand the construction workforce by increasing the participation of women and economically disadvantaged individuals.

Finally, Intel is partnering with the Midwest Microelectronics Consortium (MMEC) as its members receive funding for five technology development projects within the Microelectronics Commons initiative established under the CHIPS Act. These projects will engage more than 30 MMEC members representing organizations from industry, academia and government stakeholders to advance domestic microelectronic technology development to deliver solutions to strengthen the U.S.-based supply chain.

***

Forward-Looking Statements

This release contains forward-looking statements that involve a number of risks and uncertainties. Words such as "accelerate", "achieve", "aim", "ambitions", "anticipate", "believe", "committed", "continue", "could", "designed", "estimate", "expect", "forecast", "future", "goals", "grow", "guidance", "intend", "likely", "may", "might", "milestones", "next generation", "objective", "on track", "opportunity", "outlook", "pending", "plan", "position", "possible", "potential", "predict", "progress", "ramp", "roadmap", "seek", "should", "strive", "targets", "to be", "upcoming", "will", "would", and variations of such words and similar expressions are intended to identify such forward-looking statements, which may include statements regarding:

•our business plans and strategy and anticipated benefits therefrom, including with respect to our IDM 2.0 strategy, Smart Capital strategy, partnerships with Apollo and Brookfield, internal foundry model, updated reporting structure, and AI strategy;

•projections of our future financial performance, including future revenue, gross margins, capital expenditures, and cash flows;

•projected costs and yield trends;

•future cash requirements, the availability, uses, sufficiency, and cost of capital resources, and sources of funding, including for future capital and R&D investments and for returns to stockholders, such as stock repurchases and dividends, and credit ratings expectations;

•future products, services, and technologies, and the expected goals, timeline, ramps, progress, availability, production, regulation, and benefits of such products, services, and technologies, including future process nodes and packaging technology, product roadmaps, schedules, future product architectures, expectations regarding process performance, per-watt parity, and metrics, and expectations regarding product and process leadership;

•investment plans and impacts of investment plans, including in the US and abroad;

•internal and external manufacturing plans, including future internal manufacturing volumes, manufacturing expansion plans and the financing therefor, and external foundry usage;

•future production capacity and product supply;

•supply expectations, including regarding constraints, limitations, pricing, and industry shortages;

•plans and goals related to Intel's foundry business, including with respect to anticipated customers, future manufacturing capacity and service, technology, and IP offerings;

•expected timing and impact of acquisitions, divestitures, and other significant transactions, including the sale of our NAND memory business;

•expected completion and impacts of restructuring activities and cost-saving or efficiency initiatives;

•future social and environmental performance goals, measures, strategies, and results;

•our anticipated growth, future market share, and trends in our businesses and operations;

•projected growth and trends in markets relevant to our businesses;

•anticipated trends and impacts related to industry component, substrate, and foundry capacity utilization, shortages, and constraints;

•expectations regarding government incentives;

•future technology trends and developments, such as AI;

•future macro environmental and economic conditions;

•geopolitical tensions and conflicts and their potential impact on our business;

•tax- and accounting-related expectations;

•expectations regarding our relationships with certain sanctioned parties; and

•other characterizations of future events or circumstances.

Such statements involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied, including those associated with:

•the high level of competition and rapid technological change in our industry;

•the significant long-term and inherently risky investments we are making in R&D and manufacturing facilities that may not realize a favorable return;

•the complexities and uncertainties in developing and implementing new semiconductor products and manufacturing process technologies;

•our ability to time and scale our capital investments appropriately and successfully secure favorable alternative financing arrangements and government grants;

•implementing new business strategies and investing in new businesses and technologies;

•changes in demand for our products;

•macroeconomic conditions and geopolitical tensions and conflicts, including geopolitical and trade tensions between the US and China, the impacts of Russia's war on Ukraine, tensions and conflict affecting Israel and the Middle East, and rising tensions between mainland China and Taiwan;

•the evolving market for products with AI capabilities;

•our complex global supply chain, including from disruptions, delays, trade tensions and conflicts, or shortages;

•product defects, errata and other product issues, particularly as we develop next-generation products and implement next-generation manufacturing process technologies;

•potential security vulnerabilities in our products;

•increasing and evolving cybersecurity threats and privacy risks;

•IP risks including related litigation and regulatory proceedings;

•the need to attract, retain, and motivate key talent;

•strategic transactions and investments;

•sales-related risks, including customer concentration and the use of distributors and other third parties;

•our significantly reduced return of capital in recent years;

•our debt obligations and our ability to access sources of capital;

•complex and evolving laws and regulations across many jurisdictions;

•fluctuations in currency exchange rates;

•changes in our effective tax rate;

•catastrophic events;

•environmental, health, safety, and product regulations;

•our initiatives and new legal requirements with respect to corporate responsibility matters; and

•other risks and uncertainties described in this release, our 2023 Form 10-K, and our other filings with the SEC.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this release and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business.

Unless specifically indicated otherwise, the forward-looking statements in this release do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this release are based on management's expectations as of the date of this release, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable. We do not undertake, and expressly disclaim any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

About Intel

Intel (Nasdaq: INTC) is an industry leader, creating world-changing technology that enables global progress and enriches lives. Inspired by Moore’s Law, we continuously work to advance the design and

manufacturing of semiconductors to help address our customers’ greatest challenges. By embedding intelligence in the cloud, network, edge and every kind of computing device, we unleash the potential of data to transform business and society for the better. To learn more about Intel’s innovations, go to newsroom.intel.com and intel.com.

© Intel Corporation. Intel, the Intel logo, and other Intel marks are trademarks of Intel Corporation or its subsidiaries. Other names and brands may be claimed as the property of others.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

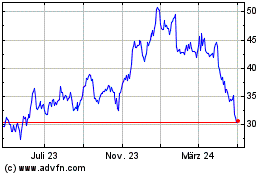

Intel (NASDAQ:INTC)

Historical Stock Chart

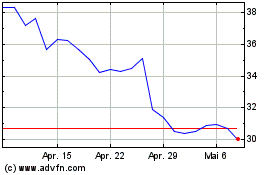

Von Nov 2024 bis Dez 2024

Intel (NASDAQ:INTC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024