Immutep Limited (ASX: IMM; NASDAQ: IMMP) ("Immutep” or “the

Company”), a clinical-stage biotechnology company developing novel

LAG-3 immunotherapies for cancer and autoimmune disease, provides

an update on its activities for the quarter ended 30 September 2024

(Q1 FY25).

EFTI DEVELOPMENT PROGRAM FOR

CANCER

TACTI-004 (KEYNOTE-PNC91) – 1L NSCLC

Phase III Clinical Collaboration with MSD In July, Immutep

received positive feedback from the US Food and Drug Administration

(FDA) regarding its planned TACTI-004 Phase III trial of

eftilagimod alfa (efti) in combination with KEYTRUDA®

(pembrolizumab), MSD’s (Merck & Co., Inc., Rahway, NJ, USA)

anti-PD-1 therapy, and histology-based platinum doublet

chemotherapy for the treatment of first-line metastatic non-small

cell lung cancer (1L NSCLC), regardless of PD-L1 expression.

The FDA feedback builds on previously received

guidance from the Paul-Ehrlich-Institut and the Spanish Agency for

Medicines and Health Products, successfully concluding the

preparatory regulatory interactions for the design of this

registrational trial. The study will enrol ~750 patients regardless

of PD-L1 expression in order to address the entire 1L NSCLC market

eligible for anti-PD-1 therapy.

TACTI-003 (KEYNOTE-C34) – Phase IIb

clinical trial in 1L HNSCCTACTI-003 is evaluating efti in

combination with MSD’s anti-PD-1 therapy KEYTRUDA® (pembrolizumab)

as first-line treatment of recurrent or metastatic head and neck

squamous cell carcinoma patients (1L HNSCC). The randomized Cohort

A portion of the study is evaluating efti in combination with

KEYTRUDA as compared to KEYTRUDA monotherapy in patients with PD-L1

positive (Combined Positive Score [CPS] ≥1) tumours, whereas Cohort

B is evaluating efti in combination with KEYTRUDA in patients with

PD-L1 negative tumours (CPS <1).

In July, Immutep reported updated positive

efficacy and safety results from Cohort B of the TACTI-003 Phase

IIb trial at an ESMO Virtual Plenary session. In patients with

negative PD-L1 expression (CPS <1) in Cohort B, efti in

combination with KEYTRUDA® achieved a 35.5% objective response rate

(ORR). This is among the highest recorded for a treatment approach

not containing chemotherapy in patients with CPS <1. The

immuno-oncology combination with efti also attained a high complete

response rate of 9.7%, which compares favourably to a historical

control of 0% from anti-PD-1 monotherapy in 1L HNSCC patients with

a CPS <1. Additionally, durability of responses was tracking

well.

In September, further data was reported from

Cohort A of the TACTI-003 trial in a late-breaking abstract and

prestigious Proffered Paper oral presentation at ESMO Congress

2024. At ESMO, late-breaking abstracts are generally reserved for

high-quality, new research findings from randomised phase II or

phase III trials with implications for clinical practice or

understanding of disease processes. Proffered Papers are oral

presentations of original data of superior quality, followed by

expert discussion and perspectives.

In patients with PD-L1 positive tumours (CPS

≥1), efti in combination with KEYTRUDA outperformance was largest

in CPS ≥20 with 31.0% ORR (34.5% ORR including a partial response

recorded after data cut-off date) versus 18.5% ORR for KEYTRUDA

monotherapy. Efti in combination with KEYTRUDA led to a high

durability of response of 17.5 months in patients with CPS ≥1 and

the combination continues to have favourable safety profile.

Additionally, a statistically significant increase in absolute

lymphocyte count, measured as an exploratory biomarker, was seen in

the efti with KEYTRUDA arm indicating an effective efti-induced

immune response in this randomised setting.

Immutep will continue to follow the maturing

data from TACTI-003, with the most relevant endpoint of Overall

Survival expected in 2025 and engage with regulatory authorities

regarding potential paths forward.

TACTI-002 (KEYNOTE-PN798) – Phase II

clinical trial in 1L NSCLCImmutep continues to follow

patients with first-line non-small cell lung cancer (1L NSCLC), in

Part A of the TACTI-002 trial, where excellent median Overall

Survival (mOS) rates were seen across all levels of PD-L1

expression. Immutep has previously reported final data from the

other parts of the TACTI-002 trial.

AIPAC-003 – Integrated Phase II/III

trial in MBCSubsequent to quarter end, Immutep completed

patient enrolment in the randomised Phase II portion of the

AIPAC-003 trial in October. The Phase II portion enrolled 65

metastatic hormone receptor positive (HR+), HER2-negative/low or

triple-negative breast cancer patients who had exhausted endocrine

therapy including cyclin-dependent kinase 4/6 (CDK4/6) inhibitors.

The patients have been enrolled across 22 clinical sites in Europe

and the United States and have been randomised 1:1 to receive

either 30mg or 90mg dosing of efti in combination with paclitaxel

to determine the optimal biological dose of efti consistent with

the FDA’s Project Optimus initiative. Further updates will be

provided after data collection, data cleaning and analysis.

INSIGHT-003 – Phase I in non-squamous 1L

NSCLCThe investigator-initiated INSIGHT-003 trial

continued to enrol patients throughout the quarter and they have

been safely dosed across six sites in Germany. Further updates from

the trial are anticipated in Q 4 CY2024.

INSIGHT-005 – Phase I trial in

Urothelial CarcinomaThe INSIGHT-005 trial is evaluating

efti and the anti-PD-L1 therapy BAVENCIO® (avelumab) in up to 30

patients with metastatic urothelial cancer. The study is jointly

funded with Merck KGaA, Darmstadt, Germany.

EFTISARC-NEO – Phase II Trial in Soft

Tissue SarcomaNew data from the EFTISARC-NEO Phase II

investigator-initiated trial of efti in combination with

radiotherapy plus KEYTRUDA® (pembrolizumab) for patients with soft

tissue sarcoma (STS) will be presented on 14 November at the

Connective Tissue Oncology Society (CTOS) 2024 Annual Meeting

taking place in San Diego, California.

IMP761 DEVELOPMENT PROGRAM FOR

AUTOIMMUNE DISEASEIn August, Immutep successfully dosed

the first participant in the first-in human Phase I trial of IMP761

after receiving regulatory clearance from the ethics and competent

authority in the Netherlands to initiate the study. Safety data

from this first-in-human study is anticipated by the end of the

calendar year 2024, with pharmacokinetics and pharmacodynamics data

in first half CY2025.

IMP761 is a first-in-class agonist LAG-3

antibody designed to restore balance to the immune system by

enhancing the “brake” function of LAG-3 to silence dysregulated

self-antigen-specific memory T cells that cause many autoimmune

diseases.

INTELLECTUAL PROPERTY During

the quarter, Immutep was granted seven new patents for efti, IMP761

and LAG525 (ieramilimab) in various territories.

Two patents were granted for efti in combination

with a PD-1 pathway inhibitor in South Korea and Brazil and one

patent was granted in Mexico for a binding assay for determining

MHC Class II binding activity. The assay is used in the

characterisation of efti in GMP-grade manufacturing.

New patents were also granted for IMP761 in

India and Israel. For LAG525, which is exclusively licensed to

Novartis by Immutep, two new patents were granted in Australia and

Taiwan.

CORPORATE & FINANCIAL

SUMMARY

Immutep enters the

ASX300Following the September quarterly review of the

S&P Dow Jones Indices, Immutep was added to the S&P/ASX 300

index. Joining the ASX300 recognises the Company's considerable

growth over the years, enhances its market visibility and supports

investor confidence.

Cash Flow SummaryDuring the

quarter, Immutep continued to advance its clinical trial programs

for efti and preclinical program for IMP761 to create value for

shareholders. The Company is well funded with a strong cash and

cash equivalent balance as at 30 September 2024 of approximately

A$120.3 million. In addition to this cash balance, Immutep has an

A$52.0 million bank term deposit, which has been recognised as a

short-term investment due to the maturity date of 5-12 months. This

aggregate position of A$172.3 million as at 30 September 2024 gives

Immutep an expected cash reach to the end of CY2026.

Cash receipts from customers in Q1 FY25 were

$20k. During the quarter, Immutep received a €2,194,918

(~A$3,602,362) research and development (R&D) tax incentive

payment in cash from the French Government under its Crédit d’Impôt

Recherche scheme and $549k from the Australian government R&D

tax rebate.

The net cash used in G&A activities in the

quarter was $961k, compared to $1.9 million in Q4 FY24. Payments to

Related Parties comprises Non-Executive Directors’ fees and

Executive Directors’ remuneration of $576 k.

The net cash used in R&D activities during

the quarter was $9.5 million, compared to $3.8 million to Q4 FY24.

The increase is mainly due to the increased level of clinical trial

activities. Payment for staff costs was $2.8 million in the quarter

compared to $2.0 million in Q4 FY24.

Total net cash outflows used in operating

activities in the quarter were $8.6 million compared to $7.4

million in Q4 FY24.

For the cash flow used in investing activities,

the company invested $32.4 million in bank term deposits with

maturity between 5 and 6 months which has been recognised as a

short-term investment.

Net cash outflow from financing activities for

the quarter was approximately $373 k including $254k for the

payment of capital raising cost.

About ImmutepImmutep is a

clinical-stage biotechnology company developing novel LAG-3

immunotherapy for cancer and autoimmune disease. We are pioneers in

the understanding and advancement of therapeutics related to

Lymphocyte Activation Gene-3 (LAG-3), and our diversified product

portfolio harnesses its unique ability to stimulate or suppress the

immune response. Immutep is dedicated to leveraging its expertise

to bring innovative treatment options to patients in need and to

maximise value for shareholders. For more information, please visit

www.immutep.com.

Australian

Investors/Media:Catherine Strong, Sodali & Co+61

(0)406 759 268; catherine.strong@sodali.com

U.S. Investors/Media:Chris

Basta, VP, Investor Relations and Corporate Communications+1 (631)

318 4000; chris.basta@immutep.com

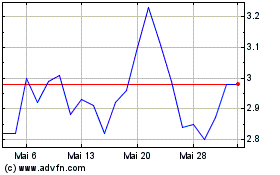

Immutep (NASDAQ:IMMP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Immutep (NASDAQ:IMMP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024