UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-34656

H World Group Limited

(Registrant’s name)

No. 1299 Fenghua Road

Jiading District

Shanghai

People’s Republic of China

(86) 21 6195-2011

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F o

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

H World Group Limited |

| |

|

(Registrant) |

| |

|

|

| Date: May 8, 2024 |

By: |

/s/ Qi Ji |

| |

Name: |

Qi Ji |

| |

Title: |

Executive Chairman of the Board of Directors |

Exhibit 99.1

H WORLD GROUP LIMITED

(Incorporated in the Cayman Islands with limited

liability)

(NASDAQ Ticker: HTHT, HKEX Stock Code: 1179)

NOTICE OF ANNUAL GENERAL MEETING

to be held on June 27, 2024

(or any adjourned meeting thereof)

NOTICE IS HEREBY GIVEN that

an Annual General Meeting (“AGM”) of H World Group Limited (the “Company”) will be held at No. 1299

Fenghua Road, Jiading District, Shanghai, People’s Republic of China on June 27, 2024 at 10:00 a.m., local time, and at any

adjourned meeting thereof, for the following purposes:

AGENDA

To consider and, if thought fit, pass the following resolutions:

| 1. | Resolved, As An Ordinary Resolution: |

THAT the ratification

of appointment of Deloitte Touche Tohmatsu Certified Public Accountants LLP as auditor of the Company for 2024 and the authorization for

the directors of the Company to determine the remuneration of the auditor be and is hereby authorized and approved.

| 2. | Resolved, As An Ordinary Resolution: |

THAT the Company’s

2023 share incentive plan be and is hereby amended and restated in the form attached to the proxy statement as Exhibit A.

| 3. | Resolved, As An Ordinary Resolution: |

THAT each director

or officer of the Company or Conyers Trust Company (Cayman) Limited be and is hereby authorized to take any and every action that might

be necessary, appropriate or desirable to effect the foregoing resolutions as such director, officer or Conyers Trust Company (Cayman)

Limited, in his, her or its absolute discretion, thinks fit and to attend to any necessary registration and/or filing for and on behalf

of the Company.

ORDINARY SHARES RECORD DATE AND ADS RECORD DATE

The Board of Directors of

the Company has fixed the close of business on May 9, 2024 Hong Kong time, as the record date (the “Ordinary Shares Record

Date”) of ordinary shares of the Company, par value US$0.00001 per share (“Ordinary Shares”). Holders of

record of the Company’s Ordinary Shares as of the Ordinary Shares Record Date are entitled to attend and vote at the AGM and any

adjourned meeting thereof.

Holders of record of American

Depositary Shares (the “ADSs”) as of the close of business on May 9, 2024, New York time (the “ADS Record

Date”) who wish to exercise their voting rights for the underlying Ordinary Shares must give voting instructions to Citibank,

N.A., the depositary of the ADSs.

ATTENDING THE AGM

Only holders of record of

Ordinary Shares as of the Ordinary Shares Record Date are entitled to attend and vote at the AGM. Please note that holders of ADSs are

not entitled to attend the AGM. Any ADS holder who appears at the venue of the AGM will not be allowed to attend the AGM. Any ADS holder

that wishes to attend the AGM or vote directly must cancel their ADS(s) in exchange for Ordinary Shares and will need to make arrangements

to deliver their ADS(s) to Citibank, N.A., as depositary of the ADS(s), for cancellation with sufficient time to allow for the delivery

and exchange of them for the underlying Ordinary Shares before the Ordinary Shares Record Date.

We encourage shareholders

planning to attend the AGM in person to preregister by sending an email to chenyao002@hworld.com.

PROXY FORMS AND ADS VOTING CARDS

A holder of Ordinary Shares

as of the Ordinary Shares Record Date may appoint a proxy to exercise his or her rights at the AGM. A holder of ADSs as of the ADS Record

Date will need to instruct Citibank, N.A., the depositary of the ADSs, as to how to vote the Ordinary Shares represented by the ADSs.

Please refer to the proxy form (for holders of Ordinary Shares) or ADS voting card (for holders of ADSs), which is attached to and made

a part of this notice and also the proxy statement for further details and instructions. The proxy statement and the proxy form are also

available for viewing on the “Investor Relations—News & Events—AGM Summary” section of our website at

https://ir.hworld.com/news-and-events/agm-summary and the website of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk.

Holders of record of the

Company’s Ordinary Shares as of the Ordinary Shares Record Date are cordially invited to attend the AGM in person. Your vote is

important. You are urged to complete, sign, date and return the accompanying proxy form to us (for holders of Ordinary Shares) or your

ADS voting card to Citibank, N.A. (for holders of the ADSs) as promptly as possible and before the prescribed deadline if you wish to

exercise your voting rights. We must receive the proxy form via Computershare Hong Kong Investor Services Limited at 17M Floor, Hopewell

Centre, 183 Queen’s Road East, Wan Chai, Hong Kong by no later than 10:00 a.m., Hong Kong time, on June 25, 2024 to ensure

your representation at the AGM, and Citibank, N.A. must receive your ADS voting card by no later than 10:00 a.m., New York time, on June 18,

2024 to enable the votes attaching to the Ordinary Shares represented by your ADSs to be cast at the AGM.

ANNUAL REPORT

You may obtain a copy of

the Company’s annual report on Form 20-F and/or Hong Kong annual report, free of charge, from the Company’s website at

https://ir.hworld.com, or from the SEC’s website at www.sec.gov (for the annual report on Form 20-F) or the website of The

Stock Exchange of Hong Kong Limited at www.hkexnews.hk (for the Hong Kong annual report).

| |

By Order of the Board of Directors, |

| |

Qi JI |

| |

Executive Chairman |

Hong Kong, May 8, 2024

Exhibit 99.2

H WORLD GROUP LIMITED

(Incorporated in the Cayman Islands with limited

liability)

(NASDAQ Ticker: HTHT, HKEX Stock Code: 1179)

Proxy Statement for Annual General Meeting

to be held on June 27, 2024

(or any adjourned meeting thereof)

GENERAL

The board of directors (the

“Board”) of H World Group Limited (the “Company” or “we”) is soliciting proxies for the annual general

meeting of shareholders of the Company (the “AGM” or the “General Meeting”) to be held on June 27, 2024 at

10:00 a.m. (local time). The AGM will be held at No. 1299 Fenghua Road, Jiading District, Shanghai, People’s Republic

of China.

You can review and download

the proxy statement and the proxy form at the “Investor Relations—News & Events—AGM Summary” section

of the Company’s website at https://ir.hworld.com/news-and-events/agm-summary, and website of The Stock Exchange of Hong Kong Limited

at www.hkexnews.hk.

RECORD DATE, SHARE OWNERSHIP AND QUORUM

Only holders of the Company’s

ordinary shares (the “Shareholders”), par value US$0.00001 per share (“Ordinary Shares”) of record as of the close

of business on May 9, 2024, Hong Kong time (the “Ordinary Shares Record Date”) are entitled to attend and vote at the

AGM.

Holders of American Depositary

Shares (“ADSs”) issued by Citibank, N.A., as depositary of the ADSs, and representing our Ordinary Shares are not entitled

to attend or vote at the AGM under the Company’s amended and restated memorandum of association (the “Memorandum”) and

second amended and restated articles of association (the “Articles”). Please note that any ADS holder who appears at the venue

of the AGM will not be allowed to attend the AGM. Holders of ADSs as of the close of business on May 9, 2024, New York time (the

“ADS Record Date”) will be able to instruct Citibank, N.A., the depositary of the ADSs and the holder of record (through a

nominee) of the Ordinary Shares represented by ADSs, as to how to vote the Ordinary Shares represented by such ADSs. Citibank, N.A., as

depositary of the ADSs, will endeavor, to the extent practicable and legally permissible, to vote or cause to be voted at the AGM the

Ordinary Shares it holds in respect of the ADSs in accordance with the instructions which it has timely and properly received from ADS

holders.

One or more Shareholders

holding no less than an aggregate one-third of all voting share capital of the Company in issue present in person or by proxy and entitled

to vote at the AGM, shall be a quorum for all purposes.

VOTING AND SOLICITATION

Each Ordinary Share issued

and outstanding as of the close of business on the Ordinary Shares Record Date is entitled to one vote at the AGM. Each resolution put

to the vote at the AGM will be decided by poll. Where required by the Rules Governing the Listing of Securities on The Stock Exchange

of Hong Kong Limited, a shareholder of the Company who has a material interest in the matter to be approved by a particular resolution

will be required to abstain from voting on such resolution.

The solicitation materials

are available on the Company’s website (https://ir.hworld.com), on the website of the U.S. Securities and Exchange Commission (www.sec.gov)

and on the website of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk).

VOTING BY HOLDERS OF ORDINARY SHARES

When proxy forms are properly

dated, executed and returned by holders of Ordinary Shares to the mailing address set forth in the proxy form before 10:00 a.m., Hong

Kong Time, on June 25, 2024 (the deadline for the return of such proxy forms), the Ordinary Shares represented by all properly executed

proxies returned to the Company will be voted at the AGM as indicated or, if no instruction is given, the holder of the proxy will vote

the Ordinary Shares in his discretion, unless a reference to the holder of the proxy having such discretion has been deleted and initialed

on this Form of Proxy. Where the chairman of the AGM acts as proxy and is entitled to exercise his discretion, he is likely to vote

the Ordinary Shares for the resolutions. As to any other business that may properly come before the AGM, all properly executed proxies

will be voted by the persons named therein in accordance with their discretion. Where any holder of Ordinary Shares affirmatively abstains

from voting on any particular resolution, the votes attaching to such Ordinary Shares will not be included or counted in the determination

of the number of Ordinary Shares present and voting for the purposes of determining whether such resolution has been passed (but they

will be counted for the purposes of determining the quorum, as described above).

VOTING BY HOLDERS OF ADSs

The nominee of Citibank,

N.A. (the Depositary of the ADSs) is the holder of record for all the Ordinary Shares represented by the ADSs and as such the nominee

is the only person who may attend and vote those Ordinary Shares at the AGM on behalf of the Depositary and the holders of ADSs.

We have requested Citibank,

N.A., as Depositary of the ADSs, to distribute to all holders of record of ADSs as of the ADS Record Date, the notice of the AGM and an

ADS Voting Card. Upon the timely receipt from any holders of record of ADSs of voting instructions in the manner specified, Citibank,

N.A. will endeavor, to the extent practicable and legally permissible, to vote or cause to be voted the number of Ordinary Shares represented

by the ADSs in accordance with such voting instructions. Under the terms of the deposit agreement for the ADSs (the “Deposit Agreement”),

Citibank, N.A. will not vote or attempt to exercise the right to vote other than in accordance with such voting instructions or such deemed

instructions as further described in the paragraphs below.

There is no guarantee that

a holder of ADSs will receive the materials described above with sufficient time to enable such holder to return voting instructions to

Citibank, N.A. in a timely manner, in which case the Ordinary Shares underlying your ADSs may not be voted in accordance with your wishes.

If an ADS voting card is

missing voting instructions, Citibank, N.A. shall deem the holder of the ADSs in question to have instructed Citibank, N.A. to vote in

favor of the items set forth in the ADS voting card. If an ADS Voting Card contains conflicting voting instructions as to any issue to

be voted on at the AGM, Citibank, N.A. shall deem the holder of the ADSs in question to have instructed Citibank, N.A. to abstain from

voting on such issue.

If no timely instructions

are received by Citibank, N.A. from a holder of ADSs by 10:00 a.m., New York Time, June 18, 2024, under the terms of the Deposit

Agreement, Citibank, N.A. will deem such holder of ADSs to have instructed it to give a discretionary proxy to a person designated by

the Company to vote the Ordinary Shares represented by such holder’s ADSs, unless voting at the meeting is by show of hands and

unless the Company has informed Citibank, N.A. that (x) the Company does not wish such proxy to be given, (y) substantial opposition

exists, or (z) the rights of holders of Ordinary Shares may be materially adversely affected, in each case in accordance with the

terms of the Deposit Agreement.

REVOCABILITY OF PROXIES AND ADS VOTING CARDS

Any proxy given by a holder

of Ordinary Shares by means of a proxy form, and any voting instructions given by an ADS holder by means of an ADS voting card, pursuant

to this solicitation may be revoked: (a) for holders of Ordinary Shares or ADSs, by submitting a written notice of revocation or

a fresh proxy form or fresh ADS Voting Card, as the case may be, bearing a later date, which must be received by the deadlines for returning

the proxy forms or ADS voting cards set forth above, or (b) for holders of Ordinary Shares only, by attending the AGM and voting

in person.

PROPOSAL 1:

Ordinary Resolution

Ratification of appointment of Deloitte

Touche Tohmatsu Certified Public Accountants LLP as auditor of the Company for 2024 and the authorization for the directors of the Company

to determine the remuneration of the auditor

The Board proposes to ratify

and approve the appointment of Deloitte Touche Tohmatsu Certified Public Accountants LLP as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2024.

In the event the holders

of Ordinary Shares fail to ratify the appointment, the audit committee of the Board (the “Audit Committee”) will appoint different

independent auditors with the requisite qualifications and competence and such appointment will be ratified by the Company’s shareholders

at the next general meeting of the Company. Even if the appointment is ratified at the AGM, the Audit Committee, in its discretion, may

appoint different independent auditors at any time during the year if it determines that such a change would be in the Company’s

and its shareholders’ best interests. Such appointment of different independent auditors shall also be ratified by the Company’s

shareholders at the next general meeting of the Company.

THE BOARD RECOMMENDS A

VOTE “FOR” THE RATIFICATION OF APPOINTMENT OF DELOITTE TOUCHE TOHMATSU CERTIFIED PUBLIC ACCOUNTANTS LLP AS THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

PROPOSAL 2:

Ordinary Resolution

Authorization and approval for the amendment and restatement

of the 2023 share incentive plan (the “2023 Plan”)

The Board deems it advisable

and in the best interests of the Company that the 2023 Plan be amended and restated for purposes of promoting the success and enhancing

the value of the Company. The Board has approved and is recommending to shareholders for approval at the AGM a resolution to approve the

amendment and restatement of the 2023 Plan, which is attached hereto as Exhibit A.

THE BOARD RECOMMENDS A

VOTE “FOR” THE PROPOSED AMENDMENT AND RESTATEMENT OF THE COMPANY’S 2023 PLAN.

PROPOSAL 3:

Ordinary Resolution

Authorization and approval of each director

or officer of the Company or Conyers Trust Company (Cayman) Limited to take any and every action that might be necessary, appropriate

or desirable to effect the foregoing resolutions as such director, officer or Conyers Trust Company (Cayman) Limited, in his, her or its

absolute discretion, thinks fit and to attend to any necessary registration and/or filing for and on behalf of the Company.

THE BOARD RECOMMENDS A

VOTE “FOR” THE GENERAL RESOLUTION.

OTHER MATTERS

We know of no other matters

to be submitted to the AGM. If any other matters properly come before the AGM, it is the intention of the persons named in the form of

proxy to vote the Ordinary Shares they represent as the Board may recommend.

| |

By Order of the Board of Directors, |

| |

Qi JI |

| |

Executive Chairman |

Dated: May 8, 2024

EXHIBIT A

H WORLD GROUP LIMITED

AMENDED

AND RESTATED 2023 SHARE INCENTIVE PLAN

Section 1.

Purpose.

The purpose of this H World Group Limited Amended

and Restated 2023 Share Incentive Plan is to enhance the ability of H World Group Limited to attract and retain exceptionally qualified

individuals and to encourage them to acquire a proprietary interest in the growth and performance of the Company.

Section 2.

Definitions.

As used in this 2023 Plan, the following terms

shall have the meanings set forth below:

(a) “2023

Plan” shall mean this H World Group LimitedAmended and Restated 2023 Share Incentive Plan of H World

Group Limited, as amended from time to time.

(b) “Affiliate”

shall mean (i) any entity that, directly or indirectly, is controlled by the Company and (ii) any entity in which the Company

has a significant equity interest, in either case as determined by the Committee.

(c) “Applicable

Laws” shall mean all laws, statutes, regulations, ordinances, rules or governmental requirements that are applicable to

this 2023 Plan or any Award granted pursuant to this 2023 Plan, including but not limited to applicable laws of the People’s Republic

of China, Hong Kong, Singapore, Germany, the United States and the Cayman Islands, and the rules and requirements of any applicable

securities exchange.

(d) “Award”

shall mean any Option, award of Restricted Stock, Restricted Stock Unit or Other Stock-Based Award granted under this 2023 Plan.

(e) “Award

Agreement” shall mean any written agreement, contract or other instrument or document evidencing any Award granted under this

2023 Plan, which may, but need not, be executed or acknowledged by a Participant.

(f) “Board”

shall mean the board of directors of the Company.

(g) “Cause”

shall mean, with respect to a Participant, the meaning defined in any employment agreement or service agreement between the Participant

and the Company then in effect or, if no such employment agreement or service agreement is then in effect, “Cause”

shall mean (i) the Participant’s or willful and continued failure substantially to perform his or her duties to the Company

(other than as a result of total or partial incapacity due to physical or mental illness), (ii) dishonesty in the performance of

the Participant’s duties to the Company, (iii) the Participant’s indictment for a crime under the laws of the jurisdiction

in which the participant is employed (or, if there is no such concept as “indictment” in the applicable jurisdiction, such

analogous procedural event following the Participant' s arrest and prior to any conviction) or (iv) any other act or omission on

the part of the Participant which is materially injurious to the financial condition or business reputation of the Company or any of its

Affiliates.

A termination for Cause shall be deemed to occur

(subject to reinstatement upon a contrary final determination by the Committee) on the date on which the Company or any of its Affiliate

first delivers written notice to the Participant of a finding of termination for Cause.

(h) “Change

of Control” shall mean the first to occur of:

(i) an

individual, corporation, partnership, group, associate or other entity or “person”, as such term is defined in Section 14(d) of

the Securities Exchange Act of 1934 (the “Exchange Act”), other than the Company or any employee benefit plan(s) sponsored

by the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly,

of 30% or more of the combined voting power of the Company’s outstanding securities ordinarily having the right to vote at elections

of directors;

(ii) individuals

who constitute the Board of Directors of the Company on the effective date of this 2023 Plan (the “Incumbent Board”)

cease for any reason to constitute at least a majority thereof; provided that any Approved Director, as hereinafter defined, shall

be, for purposes of this subsection (ii), considered as though such person were a member of the Incumbent Board. An “Approved

Director”, for purposes of this subsection (ii), shall mean any person becoming a director subsequent to the effective date

of this 2023 Plan whose election, or nomination for election by the Company’s shareholders, was approved by a vote of at least three-quarters

of the directors comprising the Incumbent Board (either by a specific vote or by approval of the proxy statement of the Company in which

such person is named as a nominee of the Company for director), but shall not include any such individual whose initial assumption of

office occurs as a result of either an actual or threatened election contest (as such terms are used in Rule 14a-11 of Regulation

14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of an individual,

corporation, partnership, group, associate or other entity or “person” other than the Board;

(iii) the

consummation of a plan or agreement providing (A) for a merger or consolidation of the Company other than with a wholly-owned subsidiary

and other than a merger or consolidation that would result in the voting securities of the Company outstanding immediately prior thereto

continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) more than

65% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such

merger or consolidation, or (B) for a sale, exchange or other disposition of all or substantially all of the assets of the Company;

or

(iv) in

addition to the events described in subsections (i), (ii) and (iii), it shall be a "Change of Control" for purposes hereof

for any Participant principally employed in the business of a Designated Business Unit, as hereinafter defined, if an event described

in subsections (i), (ii) or (iii) shall occur, except that for purposes of this subsection (iv), references in such subsections

to the "Company" shall be deemed to refer to the Designated Business Unit in the business of which the Participant is principally

employed. A Change of Control described in this subsection (iv) shall apply only to a Participant employed principally by the affected

Designated Business Unit. For purposes of this subsection (iv), "Designated Business Unit" shall mean specified subsidiaries

and any other business unit identified as a Designated Business Unit by the Committee from time to time.

(i) “Code”

shall mean the United States Internal Revenue Code of 1986, as amended from time to time.

(j) “Committee”

shall mean a committee of the Board designated by the Board to administer this 2023 Plan. Unless otherwise determined by the Board, the

compensation committee of the Board (the “Compensation Committee”) designated by the Board shall be the Committee under this

2023 Plan. In the absence of any Compensation Committee or any other related designation by the Board, the Board shall assume all of the

powers and responsibilities under this 2023 Plan.

(k) “Company”

shall mean H World Group Limited, together with any successor thereto.

(l) “Consultant”

means any individual, including an advisor, who is engaged by the Company or an Affiliate to render services and is compensated for such

services, and any director of the Company or an Affiliate whether or not compensated for such services.

(m) “Employee”

means any individual employed by the Company or an Affiliate.

(n) “Fair

Market Value” shall mean, with respect to any property (including, without limitation, any Shares or other securities) the fair

market value of such property determined by such methods or procedures as shall be established from time to time by the Committee.

(o) “Option”

shall mean an option granted under Section 6 hereof.

(p) “Other

Stock-Based Award” shall mean any right granted under Section 9 hereof.

(q) “Participant”

shall mean an individual granted an Award under this 2023 Plan.

(r) “Qualified

Exchange” shall mean the New York Stock Exchange, the NASDAQ Global Market, the Hong Kong Stock Exchange, the London Stock Exchange,

and the Singapore Stock Exchange.

(s) “Restricted

Stock” shall mean any Share granted under Section 7 hereof.

(t) “Restricted

Stock Unit” shall mean a contractual right granted under Section 7 hereof that is denominated in Shares, each of which

represents a right to receive the value of a Share (or a percentage of such value, which percentage may be higher than 100%) upon the

terms and conditions set forth in this 2023 Plan and the applicable Award Agreement.

(u) “Shares”

shall mean ordinary shares of the Company, US$0.00001 par value.

(v) “Substitute

Awards” shall mean Awards granted in assumption of, or in substitution for, outstanding awards previously granted by, or held

by the employees of, a company or other entity or business acquired (directly or indirectly) by the Company or with which the Company

combines.

Section 3.

Eligibility.

(a) Employees

and Consultants are eligible to participate in this 2023 Plan. An Employee or Consultant who has been granted an Award may, if he or she

is otherwise eligible, be granted additional Awards.

(b) An

individual who has agreed to accept employment by, or to provide services to, the Company or an Affiliate shall be deemed to be eligible

for Awards hereunder as of the date of such agreement.

Section 4.

Administration.

(a) The

2023 Plan shall be administered by the Committee, which may delegate its duties and powers in whole or in part to any subcommittee thereof.

The Committee may issue rules and regulations for administration of this 2023 Plan. It shall meet at such times and places as it

may determine. A majority of the members of the Committee shall constitute a quorum.

(b) Subject

to the terms of this 2023 Plan and Applicable Law, the Committee shall have full power and authority to: (i) determine eligibility

and designate Participants; (ii) determine the type or types of Awards (including Substitute Awards) to be granted to each Participant

under this 2023 Plan; (iii) determine the number of Shares to be covered by (or with respect to which payments, rights, or other

matters are to be calculated in connection with) Awards; (iv) determine the terms and conditions of any Award; (v) determine

whether, to what extent, and under what circumstances Awards may be settled or exercised in cash, Shares, other securities, other Awards,

or other property, or canceled, forfeited or suspended, and the method or methods by which Awards may be settled, exercised, canceled,

forfeited or suspended; (vi) determine whether, to what extent, and under what circumstances cash, Shares, other securities, other

Awards, other property, and other amounts payable with respect to an Award under this 2023 Plan shall be deferred either automatically

or at the election of the holder thereof or of the Committee; (vii) interpret and administer this 2023 Plan and any instrument

or agreement relating to, or Award made under, this 2023 Plan; (viii) establish, amend, suspend or waive such rules and regulations

and appoint such agents as it shall deem appropriate for the proper administration of this 2023 Plan; (ix) determine whether and

to what extent Awards should comply or continue to comply with any requirement of statute or regulation; and (x) make any other

determination and take any other action that the Committee deems necessary or desirable for the administration of this 2023 Plan.

(c) All

decisions of the Committee shall be final, conclusive and binding upon all persons, including the Company, the shareholders of the Company

and the Participants.

Section 5.

Shares Available for Awards.

(a) Subject

to adjustment as provided below, the maximum aggregate number of Shares that may be issued pursuant to all Awards shall not exceed 20300,000,000.

(b) If,

after the effective date of this 2023 Plan, any Shares covered by an Award, or to which such an Award relates, are forfeited, cancelled

or if such an Award otherwise terminates without the delivery of Shares or of other consideration, then the Shares covered by such Award,

or to which such Award relates, to the extent of any such forfeiture or termination, shall again be, or shall become, available for issuance

under this 2023 Plan.

(c) In

the event that any Option or other Award granted hereunder (other than a Substitute Award) is exercised through the delivery of Shares,

or in the event that withholding tax liabilities arising from such Option or Award are satisfied by the withholding of Shares by the Company,

the number of Shares available for Awards under this 2023 Plan shall be increased by the number of Shares so surrendered or withheld.

(d) Any

Shares delivered pursuant to an Award may consist, in whole or in part, of authorized and unissued Shares, of treasury Shares or of Shares

purchased on the open market. Additionally, at the discretion of the Committee, any Shares distributed pursuant to an Award may be represented

by American Depository Shares.

(e) In

the event that the Committee shall determine that any dividend or other distribution (whether in the form of cash, Shares, other securities,

or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination,

repurchase or exchange of Shares or other securities of the Company, issuance of warrants or other rights to purchase Shares or other

securities of the Company, or other similar corporate transaction or event affects the Shares such that an adjustment is determined by

the Committee to be appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made

available under this 2023 Plan, then the Committee shall, in such manner as it may deem equitable, adjust any or all of (i) the number

and type of Shares (or other securities or property) which thereafter may be made the subject of Awards, including the aggregate and individual

limits specified in Section 5(a) hereof, (ii) the number and type of Shares (or other securities or property) subject to

outstanding Awards, and (iii) the grant, purchase, or exercise price with respect to any Award or, if deemed appropriate, make provision

for a cash payment to the holder of an outstanding Award; provided, however, that the number of Shares subject to any Award denominated

in Shares shall always be a whole number.

(f) Shares

underlying Substitute Awards shall not reduce the number of Shares remaining available for issuance under this 2023 Plan.

Section 6.

Options.

The Committee is hereby authorized to grant Options

to Participants with the following terms and conditions and with such additional terms and conditions, in either case not inconsistent

with the provisions of this 2023 Plan, as the Committee shall determine:

(a) The

purchase price per Share under an Option shall be determined by the Committee and set forth in the Award Agreement, but no Shares

shall be issued below par value.

(b) The

term of each Option shall be fixed by the Committee; provided, however, that the term shall be no more than ten years from the

date of grant thereof.

(c) The

Committee shall determine the time or times at which an Option may be exercised in whole or in part, and the method or methods by which,

and the form or forms, including, without limitation, cash, Shares, other Awards, or other property, or any combination thereof, having

a Fair Market Value on the exercise date equal to the relevant exercise price, in which, payment of the exercise price with respect thereto

may be made or deemed to have been made. The Committee shall also determine any conditions, if any, that must be satisfied before all

or part of an Option may be exercised.

Section 7.

Restricted Stock and Restricted Stock Units.

(a) The

Committee is hereby authorized to grant Awards of Restricted Stock and Restricted Stock Units to Participants.

(b) Shares

of Restricted Stock and Restricted Stock Units shall be subject to such restrictions on transferability and other restrictions as the

Committee may impose (including, without limitation, any limitation on the right to vote a Share of Restricted Stock or the right to receive

any dividend or other right or property), which restrictions may lapse separately or in combination at such time or times, in such installments

or otherwise, as the Committee may deem appropriate.

(c) Any

share of Restricted Stock granted under this 2023 Plan may be evidenced in such manner as the Committee may deem appropriate including,

without limitation, book-entry registration or issuance of a stock certificate or certificates. In the event any stock certificate is

issued in respect of shares of Restricted Stock granted under this 2023 Plan, such certificate shall be registered in the name of the

Participant and shall bear an appropriate legend referring to the terms, conditions, and restrictions applicable to such Restricted Stock.

Section 8.

Other Stock-Based Awards.

The Committee is hereby authorized to grant to

Participants such other Awards (including, without limitation, stock appreciation rights and rights to dividends and dividend equivalents)

that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to, Shares (including,

without limitation, securities convertible into Shares) as are deemed by the Committee to be consistent with the purposes of this 2023

Plan. Subject to the terms of this 2023 Plan, the Committee shall determine the terms and conditions of such Awards. Shares or other securities

delivered pursuant to a purchase right granted under this Section 8 shall be purchased for such consideration, which may be paid

by such method or methods and in such form or forms, including, without limitation, cash, Shares, other securities, other Awards, or other

property, or any combination thereof, as the Committee shall determine, the value of which consideration, as established by the Committee,

shall, except in the case of Substitute Awards, not be less than the Fair Market Value of such Shares or other securities as of the date

such purchase right is granted.

Section 9.

General Provisions Applicable to Awards.

(a) All

Awards shall be evidenced by an Award Agreement between the Company and the Participant.

(b) Awards

shall be granted for no cash consideration or for such minimal cash consideration as may be required by Applicable Laws.

(c) Awards

may, in the discretion of the Committee, be granted either alone or in addition to or in tandem with any other Award or any award granted

under any other plan of the Company. Awards granted in addition to or in tandem with other Awards, or in addition to or in tandem with

awards granted under any other plan of the Company, may be granted either at the same time as or at a different time from the grant of

such other Awards or awards.

(d) Subject

to the terms of this 2023 Plan, payments or transfers to be made by the Company upon the grant, exercise or payment of an Award may be

made in such form or forms as the Committee shall determine including, without limitation, cash, Shares, other securities, other Awards,

or other property, or any combination thereof, and may be made in a single payment or transfer, in installments, or on a deferred basis,

in each case in accordance with rules and procedures established by the Committee. Such rules and procedures may include, without

limitation, provisions for the payment or crediting of reasonable interest on installment or deferred payments or the grant or crediting

of dividend equivalents in respect of installment or deferred payments.

(e) Unless

the Committee shall otherwise determine, no Award and no right under any such Award, shall be assignable, alienable, saleable or transferable

by a Participant otherwise than by will or by the laws of descent and distribution; provided, however, that, if so determined by

the Committee, a Participant may, in the manner established by the Committee, designate a beneficiary or beneficiaries to exercise the

rights of the Participant, and to receive any property distributable, with respect to any Award upon the death of the Participant. Each

Award, and each right under any Award, shall be exercisable during the Participant’s lifetime only by the Participant or, if permissible

under Applicable Law, by the Participant’s guardian or legal representative. No Award and no right under any such Award, may be

pledged, alienated, attached, or otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance thereof shall be

void and unenforceable against the Company. The provisions of this paragraph shall not apply to any Award which has been fully exercised,

earned or paid, as the case may be, and shall not preclude forfeiture of an Award in accordance with the terms thereof.

(f) All

certificates for Shares or other securities delivered under this 2023 Plan pursuant to any Award or the exercise thereof shall be subject

to such stop transfer orders and other restrictions as the Committee may deem advisable under this 2023 Plan or the rules, regulations,

and other requirements of the United States Securities and Exchange Commission, any stock exchange upon which such Shares or other securities

are then listed, and any Applicable Laws, and the Committee may cause a legend or legends to be put on any such certificates to make appropriate

reference to such restrictions.

(g) Unless

specifically provided to the contrary in any Award Agreement, upon a Change in Control, all Awards shall become fully vested and exercisable,

and any restrictions applicable to any Award shall automatically lapse.

Section 10.

Amendment and Termination.

(a) Except

to the extent prohibited by Applicable Laws and unless otherwise expressly provided in an Award Agreement or in this 2023 Plan, the Board

may amend, alter, suspend, discontinue or terminate this 2023 Plan or any portion thereof at any time; provided, however, that

no such amendment, alteration, suspension, discontinuation or termination shall be made without (i) shareholder approval if such

approval is necessary to comply with any tax or regulatory requirement for which or with which the Board deems it necessary or desirable

to qualify or comply, or (ii) shareholder approval for any amendment to this 2023 Plan that increases the total number

of Shares reserved for the purposes of this 2023 Plan or changes the maximum number of Shares for which Awards may be granted to any Participant,

or (iii) the consent of the affected Participant, if such action would adversely affect the rights of such Participant under

any outstanding Award.

(b) The

Committee may waive any conditions or rights under, amend any terms of, or amend, alter, suspend, discontinue or terminate, any Award

theretofore granted, prospectively or retroactively, without the consent of any relevant Participant or holder or beneficiary of an Award;

provided, however, that no such action shall adversely affect the rights of any affected Participant or holder or beneficiary under

any Award theretofore granted under this 2023 Plan; and provided further that, except as provided in Section 5(e) hereof,

no such action shall reduce the exercise price of any Option established at the time of grant thereof.

(c) The

Committee shall be authorized to make adjustments in the terms and conditions of, and the criteria included in, Awards in recognition

of unusual or nonrecurring events (including, without limitation, the events described in Section 5(e) hereof affecting the

Company, or the financial statements of the Company, or of changes in Applicable Laws or accounting principles); whenever the Committee

determines that such adjustments are appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended

to be made available under this 2023 Plan.

(d) Any

provision of this 2023 Plan or any Award Agreement to the contrary notwithstanding, the Committee may cause any Award granted hereunder

to be canceled in consideration of a cash payment or alternative Award made to the holder of such canceled Award equal in value to the

Fair Market Value of such canceled Award.

(e) The

Committee may correct any defect, supply any omission, or reconcile any inconsistency in this 2023 Plan or any Award in the manner and

to the extent it shall deem desirable to carry this 2023 Plan into effect.

Section 11.

Miscellaneous.

(a) No

employee, independent contractor, Participant or other person shall have any claim to be granted any Award under this 2023 Plan, and

there is no obligation for uniformity of treatment of employees, independent contractors, Participants, or holders or beneficiaries of

Awards under this 2023 Plan. The terms and conditions of Awards need not be the same with respect to each recipient.

(b) The

Committee may delegate to one or more officers or managers of the Company, or a committee of such officers or managers, its authority

under this 2023 Plan; provided, however, that any delegation to management shall conform with the requirements of the laws of the

Cayman Islands, as in effect from time to time.

(c) No

Shares shall be delivered under this 2023 Plan to any Participant until such Participant has made arrangements acceptable to the Committee

for the satisfaction of any income and employment tax withholding obligations under all Applicable Laws. The Company shall be authorized

to withhold from any Award granted or any payment due or transfer made under any Award or under this 2023 Plan or from any compensation

or other amount owing to a Participant the amount (in cash, Shares, other securities, other Awards, or other property) of withholding

taxes due in respect of an Award, its exercise, or any payment or transfer under such Award or under this 2023 Plan and to take such other

action (including, without limitation, providing for elective payment of such amounts in cash, Shares, other securities, other Awards

or other property by the Participant) as may be necessary in the opinion of the Company to satisfy all obligations for the payment of

such taxes.

(d) Except

as otherwise expressly authorized by the Committee, a Participant shall not be entitled to any privilege of share ownership or shareholder

rights as to any Shares not actually delivered to and held of record by the Participant.

(e) Nothing

contained in this 2023 Plan shall prevent the Company from adopting or continuing in effect other or additional compensation arrangements,

and such arrangements may be either generally applicable or applicable only in specific cases.

(f) The

grant of an Award shall not be construed as giving a Participant the right to be retained in the employ or service of the Company or any

Affiliate. Further, the Company or the applicable Affiliate may at any time dismiss a Participant from employment or terminate the services

of an independent contractor, free from any liability, or any claim under this 2023 Plan, unless otherwise expressly provided in this

2023 Plan or in any Award Agreement or in any other agreement binding the parties.

(g) If

any provision of this 2023 Plan or any Award is or becomes or is deemed to be invalid, illegal, or unenforceable in any jurisdiction,

or as to any person or Award, or would disqualify this 2023 Plan or any Award under any law deemed applicable by the Committee, such provision

shall be construed or deemed amended to conform to Applicable Laws, or if it cannot be so construed or deemed amended without, in the

determination of the Committee, materially altering the intent of this 2023 Plan or the Award, such provision shall be stricken as to

such jurisdiction, person or Award, and the remainder of this 2023 Plan and any such Award shall remain in full force and effect.

(h) Awards

payable under this 2023 Plan shall be payable in Shares or from the general assets of the Company, and no special or separate reserve,

fund or deposit shall be made to assure payment of such awards. No Participant, beneficiary or other person shall have any right, title

or interest in any fund or in any specific asset (including Shares, except as expressly otherwise provided) of the Company or one of its

Subsidiaries by reason of any award hereunder.

(i) Neither

this 2023 Plan nor any Award shall create or be construed to create a trust or separate fund of any kind or a fiduciary relationship between

the Company and a Participant or any other person. To the extent that any person acquires a right to receive payments from the Company

pursuant to an Award, such right shall be no greater than the right of any unsecured general creditor of the Company.

(j) No

fractional Shares shall be issued or delivered pursuant to this 2023 Plan or any Award, and the Committee shall determine whether cash,

other securities or other property shall be paid or transferred in lieu of any fractional Shares, or whether such fractional Shares or

any rights thereto shall be canceled, terminated or otherwise eliminated.

(k) In

order to assure the viability of Awards granted to Participants employed in various jurisdictions, the Committee may, in its sole discretion,

provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy, or custom

applicable in the jurisdiction in which the Participant resides or is employed. Moreover, the Committee may approve such supplements to,

amendments, restatements or alternative versions of this 2023 Plan as it may consider necessary or appropriate for such purposes without

thereby affecting the terms of this 2023 Plan as in effect for any other purpose; provided, however, that no such supplements,

restatements or alternative versions shall increase the share limitations contained in Section 5 hereof. Notwithstanding the foregoing,

the Committee may not take any actions hereunder, and no Awards shall be granted, that would violate any Applicable Laws.

(l) The

2023 Plan and all Award Agreements shall be governed by and construed in accordance with the laws of the Cayman Islands.

Section 12.

Effective Date of 2023 Plan.

The 2023 Plan shall be effective as of the date

of its approval by the Board of Directorsshareholders of the Company.

Section 13.

Term of this 2023 Plan.

No Award shall be granted under this 2023 Plan

after the fifteenth anniversary of the effective date as determined in Section 12 hereof. However, unless otherwise expressly provided

in this 2023 Plan or in an applicable Award Agreement, any Award theretofore granted may extend beyond such date, and the authority of

the Committee to amend, alter, adjust, suspend, discontinue, or terminate any such Award, or to waive any conditions or rights under any

such Award, and the authority of the Board to amend this 2023 Plan, shall extend beyond such date.

Exhibit 99.3

H WORLD GROUP LIMITED

(Incorporated in the Cayman Islands with limited

liability)

(NASDAQ Ticker: HTHT, HKEX Stock Code: 1179)

Form of Proxy for Annual General Meeting

to be held on June 27, 2024

(or any adjourned meeting thereof)

INTRODUCTION

This Form of Proxy is

furnished in connection with the solicitation by the Board of Directors of H World Group Limited, a Cayman Islands exempted company (the

“Company”), of proxies from the holders of the issued and outstanding ordinary shares, par value US$0.00001 per share,

of the Company (the “Ordinary Shares”) to be exercised at the Annual General Meeting of the Company (the “AGM”)

to be held at No. 1299 Fenghua Road, Jiading District, Shanghai, People’s Republic of China on June 27, 2024 at 10:00

a.m. (local time), and at any adjourned meeting thereof, for the purposes set forth in the accompanying Notice of Annual General

Meeting. This Form of Proxy is not intended for use by holders of our American Depositary Shares (ADSs). Holders of ADSs who wish

to vote the Ordinary Shares represented by their ADSs must instruct Citibank, N.A., the depositary for the ADSs, on how to vote the Ordinary

Shares represented by ADSs.

Only the holders of record

of the Ordinary Shares at the close of business on May 9, 2024 are entitled to notice of and to vote at the AGM. In respect of the

matter requiring shareholders’ vote at the AGM, each Ordinary Share is entitled to one vote. The quorum of the AGM is one or more

shareholders holding no less than an aggregate of one-third of all voting share capital of the Company in issue present in person or by

proxy and entitled to vote at the AGM.

The Ordinary Shares represented

by all properly executed proxies returned to the Company will be voted at the AGM as indicated or, if no instruction is given, the holder

of the proxy will vote the Ordinary Shares in his discretion, unless a reference to the holder of the proxy having such discretion has

been deleted and initialed on this Form of Proxy. Where the chairman of the AGM acts as proxy and is entitled to exercise his discretion,

he is likely to vote the Ordinary Shares for the resolutions. As to any other business that may properly come before the AGM, all properly

executed proxies will be voted by the persons named therein in accordance with their discretion. The Company does not presently know of

any other business which may come before the AGM. However, if any other matter properly comes before the AGM, or any adjourned meeting

thereof, which may properly be acted upon, unless otherwise indicated the proxies solicited hereby will be voted on such matter in accordance

with the discretion of the proxy holders named therein. Any holder of Ordinary Shares giving a proxy has the right to revoke it at any

time before it is exercised (i) by submitting a written notice of revocation or a fresh proxy form, bearing a later date, which must

be received by the deadlines for returning the proxy forms set forth above, or (ii) by voting in person at the AGM.

To be valid, this Form of

Proxy must be completed, signed and returned to Computershare Hong Kong Investor Services Limited at 17M Floor, Hopewell Centre, 183 Queen’s

Road East, Wan Chai, Hong Kong as soon as possible no later than 10:00 a.m., Hong Kong time, on June 25, 2024 to ensure your representation

at the AGM.

H WORLD GROUP LIMITED

(Incorporated in the Cayman Islands with limited

liability)

(NASDAQ Ticker: HTHT, HKEX Stock Code: 1179)

Form of Proxy for Annual General Meeting

to Be Held at No. 1299 Fenghua Road, Shanghai,

People’s Republic of China on June 27, 2024 at 10:00 a.m.

(local time) (the “Annual General Meeting”)

(or any adjourned meeting thereof)

| being the registered holder of |

|

|

| ordinary shares1, par value US$0.00001 per share,

of H World Group Limited (the “Company”), hereby appoint the Chairman of the |

| Annual General Meeting2 or |

|

|

as my/our proxy to attend and act for me/us at the Annual General Meeting (or at any adjourned meeting thereof)

of the Company, and in the event of a poll, to vote for me/us as indicated below, or if no such indication is given, as my/our proxy

thinks fit3.

| No. |

RESOLUTIONS |

FOR3 |

AGAINST3 |

ABSTAIN3 |

|

1. |

The ordinary resolution as set out in the Notice of Annual General Meeting regarding the ratification of appointment of Deloitte Touche Tohmatsu Certified Public Accountants LLP as auditor of the Company for 2024 and the authorization for the directors of the Company to determine the remuneration of the auditor. |

|

|

|

|

2. |

The ordinary resolution as set out in the Notice of Annual General Meeting regarding the amendment and restatement of the 2023 share incentive plan of the Company. |

|

|

|

|

3. |

The ordinary resolution as set out in the Notice of Annual General Meeting regarding the authorization of each director or officer of the Company or Conyers Trust Company (Cayman) Limited to take any and every action that might be necessary, appropriate or desirable to effect the foregoing resolutions as such director, officer or Conyers Trust Company (Cayman) Limited, in his, her or its absolute discretion, thinks fit and to attend to any necessary registration and/or filing for and on behalf of the Company. |

|

|

|

* please

refer to the Notice of Annual General Meeting for full text of the resolutions.

| Dated, |

|

2024 |

|

Signature(s)4 |

|

| 1 | Please insert the number of shares registered in your name(s) to which this proxy relates. If no number is inserted, this form

of proxy will be deemed to relate to all the shares in the Company registered in your name(s). |

| 2 | If any proxy other than the Chairman of the Annual General Meeting is preferred, strike out the words “the Chairman of the

Annual General Meeting or” and insert the name and address of the proxy desired in the space provided. A shareholder may appoint

one or more proxies to attend and vote in his stead. Any alteration made to this form of proxy must be initialed by the person(s) who

sign(s) it. |

| 3 | IMPORTANT: If you wish to vote for a particular resolution, tick the appropriate box marked “for”. If you wish to vote

against a particular resolution, tick the appropriate box marked “against”. If you wish to abstain from voting on a particular

resolution, tick the appropriate box marked “abstain”. |

| 4 | This form of proxy must be signed by you or your attorney duly authorized in writing or, in the case of a corporation, must be either

under seal or executed under the hand of an officer or attorney duly authorized to sign the same. |

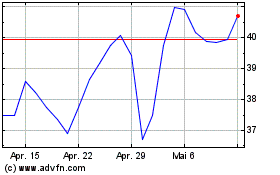

H World (NASDAQ:HTHT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

H World (NASDAQ:HTHT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024