| © 2023 FuelCell Energy 19

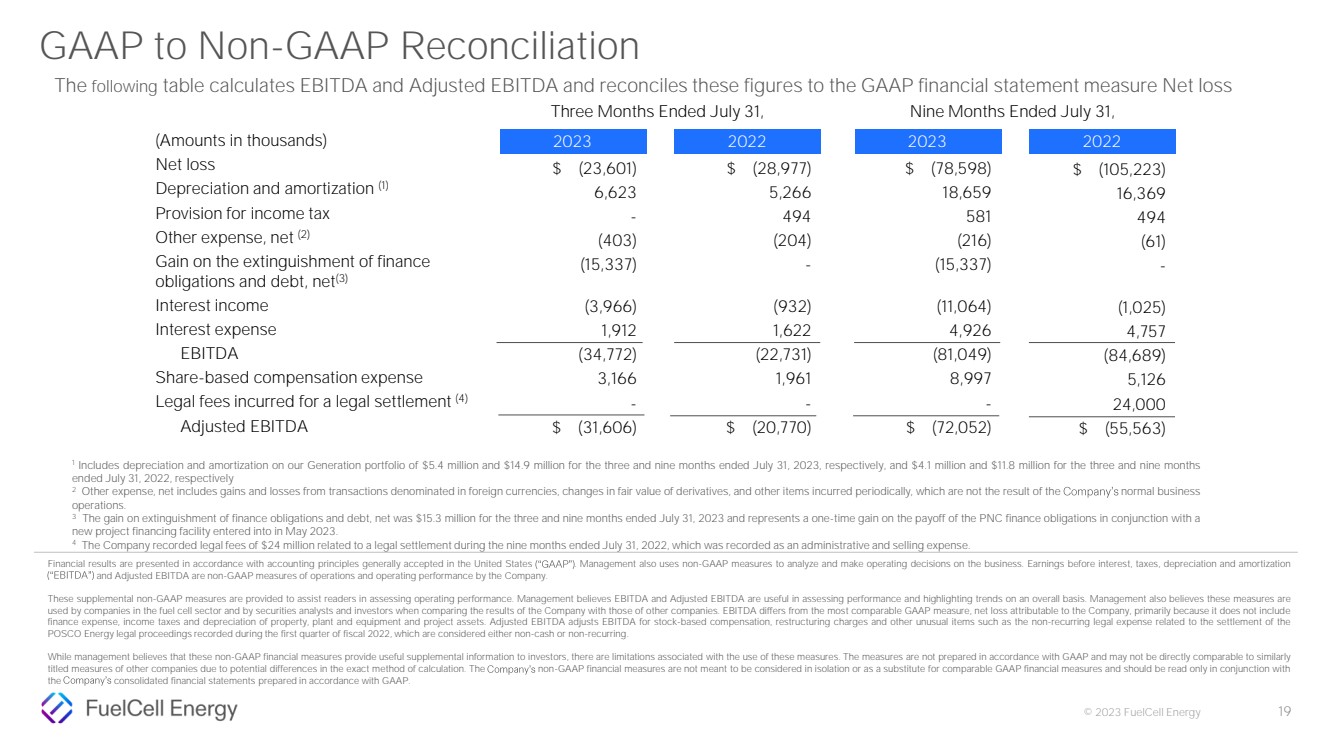

GAAP to Non-GAAP Reconciliation

Financial results are presented in accordance with accounting principles generally accepted in the United States . Management also uses non-GAAP measures to analyze and make operating decisions on the business. Earnings before interest, taxes, depreciation and amortization

and Adjusted EBITDA are non-GAAP measures of operations and operating performance by the Company.

These supplemental non-GAAP measures are provided to assist readers in assessing operating performance. Management believes EBITDA and Adjusted EBITDA are useful in assessing performance and highlighting trends on an overall basis. Management also believes these measures are

used by companies in the fuel cell sector and by securities analysts and investors when comparing the results of the Company with those of other companies. EBITDA differs from the most comparable GAAP measure, net loss attributable to the Company, primarily because it does not include

finance expense, income taxes and depreciation of property, plant and equipment and project assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation, restructuring charges and other unusual items such as the non-recurring legal expense related to the settlement of the

POSCO Energy legal proceedings recorded during the first quarter of fiscal 2022, which are considered either non-cash or non-recurring.

While management believes that these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these measures. The measures are not prepared in accordance with GAAP and may not be directly comparable to similarly

titled measures of other companies due to potential differences in the exact method of calculation. The non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with

the consolidated financial statements prepared in accordance with GAAP.

1

Includes depreciation and amortization on our Generation portfolio of $5.4 million and $14.9 million for the three and nine months ended July 31, 2023, respectively, and $4.1 million and $11.8 million for the three and nine months

ended July 31, 2022, respectively

2 Other expense, net includes gains and losses from transactions denominated in foreign currencies, changes in fair value of derivatives, and other items incurred periodically, which are not the result of the normal business

operations.

3 The gain on extinguishment of finance obligations and debt, net was $15.3 million for the three and nine months ended July 31, 2023 and represents a one-time gain on the payoff of the PNC finance obligations in conjunction with a

new project financing facility entered into in May 2023.

4 The Company recorded legal fees of $24 million related to a legal settlement during the nine months ended July 31, 2022, which was recorded as an administrative and selling expense.

(Amounts in thousands)

Net loss

Depreciation and amortization (1)

Provision for income tax

Other expense, net (2)

Gain on the extinguishment of finance

obligations and debt, net(3)

Interest income

Interest expense

EBITDA

Share-based compensation expense

Legal fees incurred for a legal settlement (4)

Adjusted EBITDA

Three Months Ended July 31,

$ (23,601)

6,623

-

(403)

(15,337)

(3,966)

1,912

(34,772)

3,166

-

$ (31,606)

2023

$ (78,598)

18,659

581

(216)

(15,337)

(11,064)

4,926

(81,049)

8,997

-

$ (72,052)

2023

$ (28,977)

5,266

494

(204)

-

(932)

1,622

(22,731)

1,961

-

$ (20,770)

2022 2022

Nine Months Ended July 31,

$ (105,223)

16,369

494

(61)

-

(1,025)

4,757

(84,689)

5,126

24,000

$ (55,563)

The following table calculates EBITDA and Adjusted EBITDA and reconciles these figures to the GAAP financial statement measure Net loss |