Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

07 November 2022 - 11:07PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-236491

Pricing Term Sheet

November 7, 2022

eBay Inc.

$425,000,000 5.900% Notes due 2025

$300,000,000 5.950% Notes due 2027

$425,000,000 6.300% Notes due 2032

Pricing Term Sheet

This pricing term sheet supplements, and should be read in conjunction

with, eBay Inc.’s preliminary prospectus supplement dated November 7, 2022 (the “Preliminary Prospectus Supplement”)

and accompanying prospectus dated February 18, 2020 and the documents incorporated and deemed to be incorporated by reference therein.

| Issuer: |

|

eBay Inc. (the “Company”) |

| |

|

|

| Securities: |

|

5.900% Notes due 2025 (the “2025 Notes”)

5.950% Notes due 2027 (the “2027 Notes”)

6.300% Notes due 2032 (the “2032 Notes”)

The 2025 Notes, the 2027 Notes and the 2032 Notes (collectively, the “Notes”) will each constitute a separate “series” of the Company’s debt securities under the indenture governing the Notes. |

| |

|

|

| Security Type: |

|

Senior unsecured notes |

| |

|

|

| Principal Amount: |

|

2025 Notes: $425,000,000

2027 Notes: $300,000,000

2032 Notes: $425,000,000 |

| |

|

|

| Expected Ratings*: |

|

Baa1 (stable) by Moody’s Investors Service, Inc.

BBB+ (stable) by S&P Global Ratings |

| |

|

|

| Trade Date: |

|

November 7, 2022 |

| |

|

|

| Settlement Date**: |

|

November 22, 2022 (T+10) |

| |

|

|

| Maturity Date: |

|

2025 Notes: November 22, 2025

2027 Notes: November 22, 2027

2032 Notes: November 22, 2032 |

| |

|

|

| Interest Payment Dates: |

|

2025 Notes: May 22 and November 22 of each year, commencing on May 22, 2023

2027 Notes: May 22 and November 22 of each year, commencing on May 22, 2023

2032 Notes: May 22 and November 22 of each year, commencing on May 22, 2023 |

| |

|

|

| Record Dates: |

|

2025 Notes: May 7 and November 7 of each year

2027 Notes: May 7 and November 7 of each year

2032 Notes: May 7 and November 7 of each year |

| Coupon (Interest Rate): |

|

2025 Notes: 5.900% per year, accruing from November 22, 2022

2027 Notes: 5.950% per year, accruing from November 22, 2022

2032 Notes: 6.300% per year, accruing from November 22, 2022 |

| |

|

|

| Benchmark Treasury: |

|

2025 Notes: 4.250% due October 15, 2025

2027 Notes: 4.125% due October 31, 2027

2032 Notes: 2.750% due August 15, 2032 |

| |

|

|

| Benchmark Treasury Price and Yield: |

|

2025 Notes: 98-29 ¾; 4.643%

2027 Notes: 98-27+; 4.382%

2032 Notes: 88-13; 4.209% |

| |

|

|

| Spread to Benchmark Treasury: |

|

2025 Notes: 130 basis points

2027 Notes: 160 basis points

2032 Notes: 210 basis points |

| |

|

|

| Yield to Maturity: |

|

2025 Notes: 5.943%

2027 Notes: 5.982%

2032 Notes: 6.309% |

| |

|

|

| Price to Public: |

|

2025 Notes: 99.883% of Principal Amount, plus accrued interest, if any

2027 Notes: 99.863% of Principal Amount, plus accrued interest, if any

2032 Notes: 99.934% of Principal Amount, plus accrued interest, if any |

| |

|

|

| Redemption Provisions: |

|

The 2025 Notes are redeemable at the Company’s option, in whole or

in part, at any time and from time to time, prior to October 22, 2025 (the “2025 Notes Par Call Date”), the 2027 Notes are

redeemable at the Company’s option, in whole or in part, at any time and from time to time, prior to October 22, 2027 (the “2027

Notes Par Call Date”) and the 2032 Notes are redeemable at the Company’s option, in whole or in part, at any time and from

time to time, prior to August 22, 2032 (the “2032 Notes Par Call Date;” the 2025 Notes Par Call Date, the 2027 Notes Par Call

Date and the 2032 Notes Par Call Date are hereinafter sometimes called, individually, a “Par Call Date”), in each case at

a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the greater of (i) (a)

the sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date

(assuming the Notes of the applicable series matured on the applicable Par Call Date) on a semi-annual basis (assuming a 360-day year

consisting of twelve 30-day months) at the Treasury Rate plus 20 basis points, in the case of the 2025 Notes, 25 basis points, in the

case of the 2027 Notes and 35 basis points, in the case of the 2032 Notes, less (b) interest accrued to the date of redemption, and (ii)

100% of the principal amount of the Notes of the applicable series to be redeemed, plus, in the case of both clauses (i) and (ii) above,

accrued and unpaid interest thereon to the redemption date.

On or after the applicable Par Call Date, the Company may redeem the Notes

of each series, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of

the Notes of the applicable series being redeemed plus accrued and unpaid interest thereon to the redemption date. For additional information,

including the definition of “Treasury Rate” and other relevant terms, see “Description of Notes—Optional Redemption”

in the Preliminary Prospectus Supplement. |

| Change of Control Triggering Event: |

|

If a Change of Control Triggering Event (as defined in the Preliminary Prospectus Supplement) occurs with respect to the Notes of any series, the Company will be required, subject to certain exceptions, to offer to repurchase the Notes of such series at a price equal to 101% of the principal amount plus accrued and unpaid interest, if any, to the applicable Change of Control Payment Date (as defined in the Preliminary Prospectus Supplement). The provisions of the Notes of each series that may require us to offer to purchase Notes of such series upon the occurrence of a Change of Control Triggering Event with respect to the Notes of such series, and what constitutes a Change of Control Triggering Event with respect to the Notes of any series, are subject to important exceptions and limitations and you should carefully review the information appearing under the headings “Risk Factors” and “Description of Notes—Change of Control Triggering Event” in the Preliminary Prospectus Supplement for additional information and for the definitions of “Change of Control Triggering Event,” “Change of Control Payment Date” and other relevant terms. |

| |

|

|

| CUSIP / ISIN: |

|

2025 Notes: 278642 BC6 / US278642BC68

2027 Notes: 278642 BA0 / US278642BA03

2032 Notes: 278642 BB8 / US278642BB85 |

| |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc.

HSBC Securities (USA) Inc.

Wells Fargo Securities, LLC |

| |

|

|

| Co-Managers: |

|

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) LLC

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC

RBC Capital Markets, LLC

Standard Chartered Bank***

Mischler Financial Group, Inc.

Penserra Securities LLC

Siebert Williams Shank & Co., LLC |

* The credit ratings

above are not a recommendation to buy, sell or hold the securities. The ratings may be subject to revision or withdrawal at any time.

Each of the ratings above should be evaluated independently of any other securities rating.

** It is expected that delivery of the Notes will be made on

or about November 22, 2022, which will be the 10th business day following the date of the Preliminary Prospectus Supplement. Under Rule

15c6-1 of the SEC under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle

in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes

on the date of the Preliminary Prospectus Supplement or either of the seven next succeeding business days will be required to specify

an alternate settlement cycle at the time of any such trade to prevent failed settlement. Purchasers of the Notes who wish to trade the

Notes on the date of the Preliminary Prospectus Supplement or any of the seven next succeeding business days should consult their own

advisors.

*** Standard Chartered

Bank will not effect any offers or sales of any notes in the United States unless it is through one or more U.S. registered broker-dealers

as permitted by the regulations of FINRA.

The issuer has filed a registration statement (including a prospectus)

and preliminary prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should

read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with

the SEC that are incorporated by reference or deemed to be incorporated by reference in such prospectus for more complete information

about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

the issuer, any underwriter or any dealer participating in the offering will arrange to send you the preliminary prospectus supplement

and the prospectus if you request it by calling BofA Securities, Inc. at 1-800-294-1322, HSBC Securities (USA) Inc. at 1-866-811-8049,

or Wells Fargo Securities, LLC at 1-800-645-3751.

Any disclaimer or other notice that may appear below is not applicable

to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication

being sent by Bloomberg or another email system.

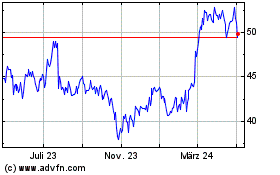

eBay (NASDAQ:EBAY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

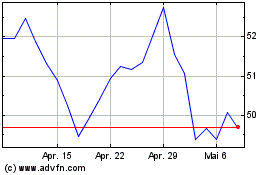

eBay (NASDAQ:EBAY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024