Net product revenue of $40.8 million for the

third quarter of 2023; an increase of 60% over the prior year third

quarter

Total net revenue of $130.4 million for the

nine months ended September 30, 2023, an increase of 24% over prior

year

Achieved European pricing and reimbursement

milestone triggering $10 million payment from Otsuka Pharmaceutical

Co. Ltd.

Narrowing 2023 net product revenue guidance

range to $155 - $160 million from net product sales of LUPKYNIS®

(voclosporin)

Conference call to be hosted today at 8:30 a.m.

ET

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the

Company) today issued its financial results for the three and nine

months ended September 30, 2023. Amounts are expressed in U.S.

dollars.

Net product revenue was $40.8 million for the three months ended

September 30, 2023 and $25.5 million for the same period in 2022,

representing growth of approximately 60%. Net product revenue was

$116.2 million for the nine months ended September 30, 2023 and

$75.1 million for the same period ended 2022, representing growth

of approximately 55%.

Total net revenue was $54.5 million for the three months ended

September 30, 2023 and $55.8 million for the same period in 2022.

Total net revenue was $130.4 million for the nine months ended

September 30, 2023 and $105.6 million for the same period in

2022.

“We are very pleased with our overall results for the first nine

months of the year. Reporting another strong quarter of results

reinforces our ability to execute and deliver against key metrics.

Our team continues to focus on business fundamentals and steady

performance,” said Peter Greenleaf, President, and Chief Executive

Officer of Aurinia. “We continue to deliver new data on LUPKYNIS

and grow the overall LN market. In addition, we received a $10.0

million milestone from our collaboration partner outside the U.S.

as a result of securing pricing and reimbursement approvals in

three of the five major European markets.”

For the fiscal year 2023, the Company is narrowing its net

product revenue guidance to a range of $155 - $160 million for net

product sales of LUPKYNIS. This guidance range is based on

assumptions regarding PSF run rates, consistent conversion rates,

time to convert, persistency and pricing.

Third Quarter 2023 and Recent Highlights

- Full results from AURORA 2 (the long-term extension study of

the Phase 3 AURORA trial) were published in Arthritis &

Rheumatology, the official peer-reviewed journal of the American

College of Rheumatology, demonstrating kidney preservation over the

3-year study period as measured by eGFR (estimated glomerular

filtration rate) along with additional efficacy, safety, and

tolerability of LUPKYNIS over the study duration.

- A total of 14 LUPKYNIS clinical abstracts were accepted for

presentation at the upcoming American Society of Nephrology and the

American College of Rheumatology being held in November 2023. Led

by several leading experts in nephrology and rheumatology, these

presentations reinforce the long-term safety and efficacy profile

of LUPKYNIS for the treatment of adults with active lupus nephritis

(LN), a serious complication of systemic lupus erythematosus (SLE).

The robust set of data demonstrates Aurinia’s deep commitment to

sustained research in autoimmune diseases, including lupus.

- Received notification that the pricing and reimbursement

milestone was secured. As a result, this triggered a $10 million

milestone from Otsuka Pharmaceutical Co. Ltd (Otsuka).

Additionally, LUPKYNIS received marketing acceptance in Scotland by

the Scottish Medicines Consortium.

- Appointed three new directors to the Board of Directors - Dr.

Karen Smith, Jeffrey Bailey, and Dr. Robert Foster.

LUPKYNIS Product Performance Highlights

- There were approximately 1,939 patients on LUPKYNIS therapy at

September 30, 2023, compared with 1,354 at September 30, 2022,

representing an increase of approximately 43% year over year.

- Aurinia added 436 patient start forms (PSFs) during the three

months ended September 30, 2023, compared to 374 during the three

months ended September 30, 2022, representing an increase of

approximately 17% over the same period last year.

- Through the end of October 2023, the Company recorded

approximately 1,510 PSFs since January 1, 2023.

- Conversion rates remain consistent with approximately 90% of

PSFs converted to patients on therapy.

- Time to convert has improved to an all-time high with the large

majority (64%) of patients on therapy by 20 days.

- Adherence improved from 84% at September 30, 2022 to 87% at

September 30, 2023.

- Persistency at 12 months has maintained at 54%; and remained

stable at further months on therapy: 48% at 15 months and 43% at 18

months.

Financial Results for the Three and Nine Months Ended

September 30, 2023

Total net revenue was $54.5 million and $55.8 million for the

three months ended September 30, 2023 and September 30, 2022,

respectively. Total net revenue was $130.4 million and $105.6

million for the nine months ended September 30, 2023 and September

30, 2022, respectively.

Net product revenue was $40.8 million and $25.5 million for the

three months ended September 30, 2023 and September 30, 2022,

respectively. Net product revenue was $116.2 million and $75.1

million for the nine months ended September 30, 2023 and September

30, 2022, respectively. The increase for both periods is primarily

due to an increase in product sales to our two main customers for

LUPKYNIS, driven predominantly by further penetration of the LN

market.

License, royalty and collaboration revenue was $13.7 million and

$30.3 million for the three months ended September 30, 2023 and

September 30, 2022, respectively. License, royalty and

collaboration revenue was $14.2 million and $30.5 million for the

nine months ended September 30, 2023 and September 30, 2022,

respectively. The decrease for both periods is due to the

recognition of a $30.0 million regulatory milestone from Otsuka

following the EC marketing authorization of LUPKYNIS in September

2022 partially offset by the recognition of a $10.0 million pricing

and reimbursement milestone as well as recognition of collaboration

revenue from Otsuka in the quarter ended September 2023.

Total cost of sales and operating expenses were $70.8 million

and $65.3 million for the three months ended September 30, 2023 and

September 30, 2022, respectively. Total cost of sales and operating

expenses were $192.4 million and $189.0 million for the nine months

ended September 30, 2023 and September 30, 2022, respectively.

Further breakdown of cost of sales and operating expense drivers

and fluctuations are highlighted in the following paragraphs.

Cost of sales were $6.8 million and $2.4 million for the three

months ended September 30, 2023 and September 30, 2022,

respectively. The increase is primarily due to increased sales of

LUPKYNIS, coupled with the amortization of the monoplant finance

right of use asset, which was placed into service in late June

2023.

Cost of sales were $8.8 million and $4.3 million for the nine

months ended September 30, 2023 and September 30, 2022,

respectively. The increase is primarily due to increased sales of

LUPKYNIS coupled with the amortization of the monoplant finance

right of use asset, partially offset by higher inventory reserves

in 2022 due to the write-down of FDA validation batches.

Gross margin for the three months ended September 30, 2023 and

September 30, 2022 was approximately 88% and 96%, respectively.

Gross margin for the nine months ended September 30, 2023 and

September 30, 2022 was approximately 93% and 96% respectively.

Selling, general and administrative (SG&A) expenses,

inclusive of share-based compensation, were $47.8 million and $52.2

million for the three months ended September 30, 2023 and September

30, 2022, respectively. The decrease is primarily due to a decrease

in professional fees and services (including legal fees with

respect to litigation matters that occurred during the three months

ended September 30, 2022), partially offset by an increase in

share-based compensation expense.

SG&A expenses, inclusive of share-based compensation, were

$145.0 million and $148.9 million for the nine months ended

September 30, 2023 and September 30, 2022, respectively. The

decrease was primarily due to a decrease in professional fees and

services (including legal fees) and other corporate costs

(including rent and insurance), partially offset by an increase in

share-based compensation expense.

Non-cash SG&A share-based compensation expense included

within SG&A expenses was $9.6 million and $6.6 million for the

three months ended September 30, 2023 and September 30, 2022,

respectively. Non-cash SG&A share-based compensation expense

included within SG&A expenses, was $27.0 million and $21.5

million for the nine months ended September 30, 2023 and September

30, 2022, respectively.

Research and development (R&D) expenses, inclusive of

share-based compensation, were $13.6 million and $11.0 million for

the three months ended September 30, 2023 and September 30, 2022,

respectively. The primary drivers for the increase were due to an

increase in CRO and developmental costs as the Company advances its

preclinical assets.

R&D expenses, inclusive of share-based compensation expense,

were $39.4 million and $35.1 million for the nine months ended

September 30, 2023 and September 30, 2022, respectively. The

increase was primarily due to an increase in costs to advance the

Company’s preclinical assets coupled with an increase in

share-based compensation expense partially offset by the decrease

in costs associated with the completion of the AURORA 2

continuation study and drug interaction study, which were

substantially completed in 2022.

Non-cash R&D share-based compensation expense included with

R&D expense was $2.0 million and $1.5 million for the three

months ended September 30, 2023 and September 30, 2022,

respectively. Non-cash R&D share-based compensation expense

included with R&D expenses was $5.7 million and $3.5 million

for the nine months ended September 30, 2023 and September 30,

2022, respectively.

Other (income) expense, net was $2.6 million and $(0.3) million

for the three months ended September 30, 2023 and September 30,

2022, respectively. The change is primarily related to expenses

incurred for shareholder matters partially offset by foreign

exchange gain related to the revaluation of the monoplant finance

lease liability.

Other (income) expense, net was $(0.7) million and $0.6 million

for the nine months ended September 30, 2023 and September 30,

2022, respectively. The change is primarily related to change in

fair value assumptions driven predominantly by rising interest

rates related to our deferred compensation liability and foreign

exchange gain on revaluation of the monoplant finance lease

liability, partially offset by expenses incurred for shareholder

matters.

Interest income was $4.5 million and $1.5 million for the three

months ended September 30, 2023 and September 30, 2022,

respectively. Interest income was $12.4 million and $2.2 million

for the nine months ended September 30, 2023 and September 30,

2022, respectively. The increase for both periods is due to higher

yields on our investments as a result of increased interest

rates.

For the three months ended September 30, 2023, Aurinia recorded

a net loss of $13.4 million or $0.09 net loss per common share, as

compared to a net loss of $9.0 million or $0.06 net loss per common

share for the three months ended September 30, 2022. For the nine

months ended September 30, 2023, Aurinia recorded a net loss of

$51.1 million or $0.36 net loss per common share, as compared to a

net loss of $82.1 million or $0.58 net loss per common share for

the nine months ended September 30, 2022.

Financial Liquidity at September 30, 2023

As of September 30, 2023, Aurinia had cash, cash equivalents and

restricted cash and investments of $338.5 million compared to

$389.4 million at December 31, 2022. The decrease is primarily

related to the continued investment in commercialization activities

and post approval commitments of our approved drug, LUPKYNIS,

inventory purchases, advancement of our pipeline and monoplant

payments, partially offset by an increase in cash receipts from

sales of LUPKYNIS.

Aurinia believes that it has sufficient financial resources to

fund its operations, which include funding commercial activities,

such as FDA related post approval commitments, manufacturing and

packaging of commercial drug supply, funding its supporting

commercial infrastructure, advancing its R&D programs and

funding its working capital obligations for at least the next few

years.

This press release is intended to be read in conjunction with

the Company’s unaudited condensed consolidated financial statements

and Management's Discussion and Analysis for the quarter ended

September 30, 2023 in the Company’s Quarterly Report on Form 10-Q

and the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, including risk factors disclosed therein, which

will be accessible on Aurinia's website at www.auriniapharma.com,

on SEDAR at www.sedarplus.ca or on EDGAR at www.sec.gov/edgar.

Conference Call Details

Aurinia will host a conference call and webcast to discuss the

quarter ended September 30, 2023 financial results today, Thursday,

November 2, 2023 at 8:30 a.m. ET. The audio webcast can be accessed

under “News/Events” through the “Investors” section of the Aurinia

corporate website at www.auriniapharma.com. In order to participate

in the conference call, please dial the corrected call-in number

for participants +1 (877) 407-9170 / + 1 201-493-6756 (Toll-free

U.S. & Canada). An audio webcast can be accessed under

“News/Events” through the Investors section of the Aurinia

corporate website at www.auriniapharma.com. A replay of the webcast

will be available on Aurinia’s website.

About Lupus Nephritis

Lupus Nephritis is a serious manifestation of systemic lupus

erythematosus (SLE), a chronic and complex autoimmune disease.

About 200,000-300,000 people live with SLE in the U.S. and about

one-third of these people are diagnosed with lupus nephritis at the

time of their SLE diagnosis. About 50 percent of all people with

SLE may develop lupus nephritis. If poorly controlled, lupus

nephritis can lead to permanent and irreversible tissue damage

within the kidney. Black and Asian people with SLE are four times

more likely to develop lupus nephritis and Hispanic people are

approximately twice as likely to develop the disease compared to

White people with SLE. Black and Hispanic people with SLE also tend

to develop lupus nephritis earlier and have poorer outcomes,

compared to White people with SLE.

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical

company focused on delivering therapies to treat targeted patient

populations with a high unmet medical need that are impacted by

autoimmune, kidney and rare diseases. In January 2021, the Company

introduced LUPKYNIS® (voclosporin), the first FDA-approved oral

therapy for the treatment of adult patients with active lupus

nephritis (LN). The Company’s head office is in Edmonton, Alberta,

its U.S. commercial hub is in Rockville, Maryland, and the Company

focuses its development efforts globally.

Forward-Looking Statements

Certain statements made in this press release may constitute

forward-looking information within the meaning of applicable

Canadian securities law and forward-looking statements within the

meaning of applicable United States securities law. These

forward-looking statements or information include but are not

limited to statements or information with respect to: Aurinia’s

estimates as to annual net product revenue from sales of LUPKYNIS

in the range of $155 - $160 million in 2023; Aurinia’s estimates as

to the number of patients with SLE in the U.S. and the proportion

of those persons who have developed LN at time of SLE diagnosis;

and Aurinia’s belief that it has sufficient financial resources to

fund its operations for at least the next few years. It is possible

that such results or conclusions may change. Words such as

“anticipate”, “will”, “believe”, “estimate”, “expect”, “intend”,

“target”, “plan”, “goals”, “objectives”, “may” and other similar

words and expressions, identify forward-looking statements. We have

made numerous assumptions about the forward-looking statements and

information contained herein, including among other things,

assumptions about: the accuracy of reported data from third party

studies and reports; the number, and timing of receipt, of PSFs and

their rate of conversion into patients on therapy; assumptions

relating to pricing for LUPKYNIS and patient persistency on the

product; that Aurinia’s intellectual property rights are valid and

do not infringe the intellectual property rights of third parties;

Aurinia’s assumptions relating to the capital required to fund

operations; the assumption that Aurinia’s current good

relationships with its suppliers, service providers and other third

parties will be maintained; assumptions relating to the burn rate

of Aurinia’s cash for operations; assumptions related to timing of

interactions with regulatory bodies; and that Aurinia’s third party

service providers will comply with their contractual obligations.

Even though the management of Aurinia believes that the assumptions

made, and the expectations represented by such statements or

information are reasonable, there can be no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance, or

achievements of Aurinia to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking information. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking statements or information. Such risks,

uncertainties and other factors include, among others, the

following: Aurinia’s actual future financial and operational

results may differ from its expectations; difficulties Aurinia may

experience in completing the commercialization of voclosporin; the

market for the LN business may not be as estimated; Aurinia may

have to pay unanticipated expenses; Aurinia may not be able to

obtain sufficient supply to meet commercial demand for voclosporin

in a timely fashion; unknown impact and difficulties imposed by the

widespread health concerns on Aurinia’s business operations

including nonclinical, clinical, regulatory and commercial

activities; the results from Aurinia’s clinical studies and from

third party studies and reports may not be accurate; Aurinia’s

third party service providers may not, or may not be able to,

comply with their obligations under their agreements with Aurinia;

regulatory bodies may not grant approvals on conditions acceptable

to Aurinia and its business partners, or at all; and Aurinia’s

assets or business activities may be subject to disputes that may

result in litigation or other legal claims. Although Aurinia has

attempted to identify factors that would cause actual actions,

events, or results to differ materially from those described in

forward-looking statements and information, there may be other

factors that cause actual results, performances, achievements, or

events to not be as anticipated, estimated or intended. Also, many

of the factors are beyond Aurinia’s control. There can be no

assurance that forward-looking statements or information will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

you should not place undue reliance on forward-looking statements

or information. All forward-looking information contained in this

press release is qualified by this cautionary statement. Additional

information related to Aurinia, including a detailed list of the

risks and uncertainties affecting Aurinia and its business, can be

found in Aurinia’s most recent Annual Report on Form 10-K and its

other public available filings available by accessing the Canadian

Securities Administrators’ System for Electronic Document Analysis

and Retrieval (SEDAR) website at www.sedarplus.ca or the U.S.

Securities and Exchange Commission’s Electronic Document Gathering

and Retrieval System (EDGAR) website at www.sec.gov/edgar, and on

Aurinia’s website at www.auriniapharma.com.

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

September 30,

2023

December 31, 2022

ASSETS

Current assets

Cash, cash equivalents and restricted

cash

$

46,397

$

94,172

Short-term investments

291,503

295,218

Accounts receivable, net

37,946

13,483

Inventories, net

32,820

24,752

Prepaid expenses

16,158

13,580

Other current assets

1,645

1,334

Total current assets

426,469

442,539

Non-current assets

Long-term investments

591

—

Other non-current assets

1,518

13,339

Property and equipment, net

3,496

3,650

Acquired intellectual property and other

intangible assets, net

5,261

6,425

Finance right-of-use asset, net

113,069

—

Operating right-of-use assets, net

4,609

4,907

Total assets

$

555,013

$

470,860

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

52,309

39,990

Deferred revenue

4,662

3,148

Other current liabilities

2,611

2,033

Finance lease liability

13,328

—

Operating lease liabilities

980

936

Total current liabilities

73,890

46,107

Non-current liabilities

Finance lease liability

72,193

—

Operating lease liabilities

6,713

7,152

Deferred compensation and other

non-current liabilities

10,340

12,166

Total liabilities

163,136

65,425

SHAREHOLDER’S EQUITY

Common shares - no par value, unlimited

shares authorized, 143,605 and 142,268 shares issued and

outstanding at September 30, 2023 and December 31, 2022,

respectively

1,198,560

1,185,309

Additional paid-in capital

109,711

85,489

Accumulated other comprehensive loss

(947

)

(1,061

)

Accumulated deficit

(915,447

)

(864,302

)

Total shareholders' equity

391,877

405,435

Total liabilities and shareholders'

equity

$

555,013

$

470,860

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

(unaudited)

Revenue

Product revenue, net

$

40,781

$

25,502

$

116,218

$

75,142

License, royalty and collaboration

revenue

13,734

30,277

14,200

30,453

Total revenue, net

54,515

55,779

130,418

105,595

Operating expenses

Cost of sales

6,769

2,447

8,753

4,302

Selling, general and administrative

47,759

52,169

144,964

148,898

Research and development

13,605

10,973

39,413

35,118

Other (income) expense, net

2,645

(311

)

(695

)

647

Total cost of sales and operating

expenses

70,778

65,278

192,435

188,965

Loss from operations

(16,263

)

(9,499

)

(62,017

)

(83,370

)

Interest expense

(1,400

)

—

(1,465

)

—

Interest income

4,514

1,464

12,429

2,209

Net loss before income taxes

(13,149

)

(8,035

)

(51,053

)

(81,161

)

Income tax expense

298

954

92

973

Net loss

$

(13,447

)

$

(8,989

)

$

(51,145

)

$

(82,134

)

Basic and diluted loss per share

$

(0.09

)

$

(0.06

)

$

(0.36

)

$

(0.58

)

Weighted-average common shares outstanding

used in computation of basic and diluted loss per share

142,847

141,856

143,085

141,831

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102070232/en/

Investor/Media Contact: ir@auriniapharma.com

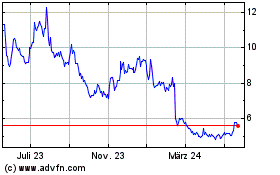

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

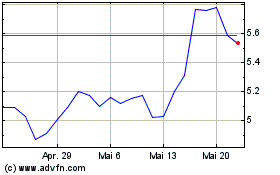

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024