Adobe To Help U.S. Bank Accelerate Personalization in Consumer Banking

24 Oktober 2022 - 3:00PM

Business Wire

- U.S. Bank adopts Adobe Experience Platform to deliver

relevant, engaging experiences online and offline

- Deeper insights from data will drive personalization at

scale and in real time, while ensuring governance and

controls

- Powerful AI insights via Adobe Sensei will be used to boost

the effectiveness of marketing offers

Today, Adobe (Nasdaq:ADBE) announced it is working with U.S.

Bank (NYSE:USB) to deliver enhanced online and in-branch customer

experiences that are personalized to individuals’ needs and

interests.

The collaboration will build upon the successful digital

transformation at U.S. Bank, which allows customers to have a

consistent experience across branches and on web and mobile

platforms, empowering them to complete bank transactions in a way

that fits their needs. This could mean a conversation with a banker

to discuss a financial plan, as well as depositing a check or

checking a balance on the U.S. Bank Mobile App. Currently, more

than 80% of U.S. Bank consumer transactions and nearly 65% of loan

sales are being handled digitally.

With so many touchpoints, the Adobe Experience Platform (AEP)

will help deliver a single view of the customer, providing the

marketing organization greater precision in providing timely and

appropriate content through the right channel.

“We have made substantial investments in modernizing our

marketing technology stack, in support of the tremendous growth and

engagement in digital channels,” said Kai Sakstrup, chief strategy

and marketing officer at U.S. Bank. “It is important to us to

provide a seamless experience whether a customer is completing a

transaction in person, online or on the mobile app. The Adobe

Experience Platform underpins our goal to address the changing

needs of customers, who demand more meaningful interactions with a

financial services partner, while providing a foundation to reshape

how we engage corporate clients in the future.”

“U.S. Bank is a leader in the financial services sector, setting

an example as brands prioritize making the digital economy more

personal,” said Anjul Bhambhri, senior vice president at Adobe

Experience Cloud. “With Adobe Experience Platform, marketers at

U.S. Bank can rally around a single view of the customer, driving

an always-on personalization strategy that can evolve with consumer

expectations and be in full compliance with strict industry rules

and regulations.”

With Adobe Experience Platform, U.S. Bank has a full suite of

tools to safely activate data for large-scale personalization:

- Real-time experiences: As the digital economy grows,

personalization has become critical for financial services brands,

in an industry where trust is paramount. In fact, 72% of consumers

say that poor personalization decreases their trust in brands. With

Adobe’s Real-Time Customer Data Platform (Real-Time CDP), part of

AEP, U.S. Bank can support highly personalized experiences in

moments that matter. For example, customers can receive content and

offers that are relevant, timely and consistent across channels to

help better manage towards their financial goals.

- Enhanced governance and controls: As a central hub that

brings together online and offline data, AEP also enables better

experiences by putting consumer preferences at the core. The

platform will allow U.S. Bank to further streamline communication

by frequency, campaign and offers, through enhancing its governance

and controls for how data is used.

- AI for automation: U.S. Bank also plans to leverage

Customer AI within AEP, to support how marketing offers are

delivered to different groups of customers. Powered by Adobe

Sensei, Adobe’s AI engine, Customer AI provides deeper insights

from data and automates decision-making processes. The insights

enable U.S. Bank to customize outreach for services such as

retirement plans and bank loans, increasing both conversion and

customer retention. It helps ensure that for any major marketing

campaign, teams are automatically delivering the next best offer

for different audience segments.

About Adobe

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are

either registered trademarks or trademarks of Adobe in the United

States and/or other countries. All other trademarks are the

property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221024005079/en/

Public relations contact Kevin Fu Adobe kfu@adobe.com

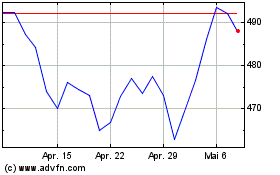

Adobe (NASDAQ:ADBE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

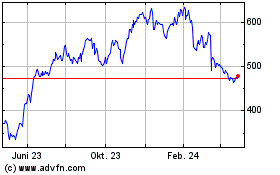

Adobe (NASDAQ:ADBE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024