Adobe Expects to Reduce Buybacks Ahead of $20 Billion Figma Deal

16 September 2022 - 4:50AM

Dow Jones News

By Kristin Broughton

Technology giant Adobe Inc. plans to tap the brakes on share

buybacks to save cash for its acquisition of design-software firm

Figma, said Chief Financial Officer Dan Durn.

Adobe announced the deal Thursday, saying it would fund the $20

billion transaction using roughly half stock, half cash.

The company will continue at a minimum to buy back shares to

offset dilution from issuing equity to employees, Mr. Durn said.

"We'll add a meaningful amount of cash each and every quarter," he

said. Adobe will also use cash on the balance sheet and, if

necessary, term loans, he said.

The company, which expects the deal to close in 2023, had $3.8

billion in cash and equivalents on its balance sheet as of Sept. 2,

approximately on par with the end of 2021.

During the quarter, Adobe acquired 5.1 million shares at a cost

of $1.8 billion, it said Thursday.

Write to Kristin Broughton at Kristin.Broughton@wsj.com

(END) Dow Jones Newswires

September 15, 2022 22:35 ET (02:35 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

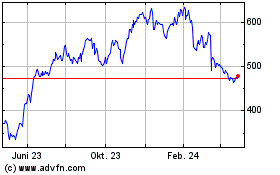

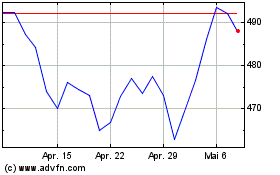

Adobe (NASDAQ:ADBE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Adobe (NASDAQ:ADBE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024