Current Report Filing (8-k)

25 Mai 2023 - 3:07PM

Edgar (US Regulatory)

false00009498580000949858dei:OtherAddressMember2023-05-252023-05-2500009498582023-05-252023-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2023

ACHIEVE LIFE SCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

|

033-80623 |

|

95-4343413 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

22722 29th Drive SE, Suite 100 Bothell, WA |

|

98021 |

1040 West Georgia, Suite 1030 Vancouver, BC, Canada |

|

V6E 4H1 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (604) 210-2217

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of exchange on which registered |

Common Stock, par value $0.001 per share |

ACHV |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

Registered Direct Offering

On May 25, 2023, Achieve Life Sciences, Inc. (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with certain purchasers for the sale of 3,000,000 shares (the “Shares”) of the Company’s common stock at a price of $5.50 per share, for gross proceeds of approximately $16.5 million before deducting the placement fees and related offering expenses. The Purchase Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company, other obligations of the parties and termination provisions.

The offering of the Shares (the “Registered Offering”) is being made pursuant to the shelf registration statement on Form S-3 (File No. 333-261811), including the prospectus dated January 5, 2022 contained therein, and the prospectus supplement dated May 25, 2023.

The Company will pay to Lake Street Capital Markets, LLC, the exclusive placement agent for the Registered Offering, a cash fee equal to an aggregate of 6.0% of the gross proceeds generated from the sale of the Shares and will reimburse the placement agent for certain of its expenses in an amount not to exceed $75,000.

The Company estimates that the net proceeds from the Registered Offering will be approximately $15.2 million, after deducting placement agent fees and related offering expenses. The Company intends to use the net proceeds from the Registered Offering to fund product development and regulatory activities, and for working capital and general corporate purposes.

The Purchase Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The above description of the terms of the Purchase Agreement is qualified in its entirety by reference to such exhibit.

A copy of the opinion of Fenwick & West LLP, relating to the validity of the Shares, is filed with this Current Report on Form 8-K as Exhibit 5.1.

Item 7.01 Regulation FD Disclosure.

On May 25, 2023, the Company issued a press release announcing that it had priced the Registered Offering. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein that do not describe historical facts, including, but not limited to, statements regarding the expected net proceeds of the Registered Offering and the anticipated use of proceeds of the Registered Offering, are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others, the risks identified in the Company’s filings with the SEC, including its Quarterly Report on Form 10-Q for the three months ended March 31, 2023, filed with the SEC on May 9, 2023, the prospectus supplement related to the Registered Offering, and subsequent filings with the SEC. Any of these risks and uncertainties could materially and adversely affect the Company’s results of operations, which would, in turn, have a significant and adverse impact on the Company’s stock price. The Company cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update publicly any forward-looking statements to reflect new information, events or circumstances after the date they were made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

ACHIEVE LIFE SCIENCES, INC. |

Date: May 25, 2023 |

/s/ John Bencich |

|

John Bencich Chief Executive Officer (Principal Executive and Financial Officer) |

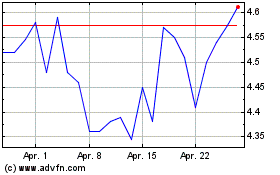

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024