UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 1)1

ACHIEVE LIFE SCIENCES, INC.

(Name

of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

004468500

(CUSIP Number)

Dialectic capital

management, lp

119 Rowayton Avenue, 2nd Floor

Norwalk, Connecticut 06853

(212) 230-3232

ANDREW FREEDMAN, ESQ.

OLSHAN

FROME WOLOSKY LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

March 1, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☒.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Dialectic Capital Management, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,494,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,494,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,494,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

19.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Dialectic Partners, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,494,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,494,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,494,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

19.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Dialectic Life Sciences SPV LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,494,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,494,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,494,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

19.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Dialectic LS Manager LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,494,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,494,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,494,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

19.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

John Fichthorn |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF; OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United States |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

55,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,494,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

55,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,494,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,549,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

19.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes Amendment

No 1. (this “Amendment No. 1”) to the Schedule 13D filed by the undersigned. This Amendment No. 1 amends the Schedule

13D as specifically set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended to add

the following:

On March 1, 2023, the Reporting

Persons entered into a Cooperation Agreement (the “Cooperation Agreement”) with the Issuer regarding certain changes

to the composition of the Issuer’s board of directors (the “Board”) and other related matters.

Pursuant to the terms of the Cooperation

Agreement: (1) the Issuer shall, no later than March 21, 2023, appoint three individuals (the “Designees”) to the Board

to fill three vacancies created by either (x) the departure of an incumbent member of the Board as designated in the Cooperation Agreement

(the “Incumbent Directors”) or (y) expanding the Board size to up to 11 directors; (2) the Board shall nominate the

Designees for election at the 2023 Annual Meeting of the Issuer’s stockholders (the “2023 Annual Meeting”); (3)

the Board shall appoint at least one of the Designees to each of the committees of the Board, other than the Chemistry, Manufacturing

and Controls Committee, as well as any new committee(s) formed prior to the Expiration Date (as defined in the Cooperation Agreement);

and (4) the Issuer shall set the Board size at eight directors no later than the date of the 2023 Annual Meeting (the “Incumbent

Director Resignation Date”) and, in the event there are more than eight directors serving on the Board as of the Incumbent Director

Resignation Date, one or all of the Incumbent Directors, as applicable, shall submit his resignation to be effective no later than the

Incumbent Director Resignation Date; provided, that in the event the resignation of any Incumbent Director as of Incumbent Director Resignation

Date would cause any violation of the applicable listing rules of The Nasdaq Stock Market LLC, the parties agree that such resignation

shall not be effective until such time as would ensure compliance with such listing rules and the parties shall work in good faith to

document and approve such necessary modification(s) to the Incumbent Director Resignation Date.

The Cooperation Agreement further

provides that if, at any time prior to the Expiration Date, any Designee (or any Replacement Designee (as defined below)) is unable or

unwilling to serve and ceases to be a director, resigns as a director or is removed as a director, or for any other reason fails to serve

or is not serving as a director, the Reporting Persons and the Issuer shall work in good faith to promptly mutually agree upon a replacement

candidate for appointment to the Board in substantially the same manner as the Reporting Persons and the Issuer agreed upon the selection

of such Designee (any such replacement nominee, when appointed to the Board, shall be referred to as a “Replacement Designee”).

The Cooperation Agreement includes

certain voting commitments, standstill, and mutual non-disparagement provisions (subject to certain carveouts and exceptions) that generally

remain in place during the period beginning upon the execution and delivery of the Cooperation Agreement and ending on the earlier of

(i) the date that is 15 business days prior to the notice deadline under the Issuer’s Sixth Amended and Restated Bylaws (and all

amendments thereto) for stockholders to submit non-proxy access stockholder nominations of director candidates for election to the Board

(the “Nomination Notice Deadline”) at the 2024 Annual Meeting of the Issuer’s stockholders (the “2024

Annual Meeting”), (ii) the date the Reporting Persons, in the aggregate, cease to own at least 10% (on a non-converted basis)

of the Issuer’s issued and outstanding common stock, (iii) any material breach of the Cooperation Agreement by any Reporting Person

or (iv) the last resignation of all three of the Designees; provided that notwithstanding anything to the contrary in the Cooperation

Agreement, if (A) the Issuer confirms in writing that it will re-nominate the Designees for election as directors at the 2024 Annual Meeting

or the 2025 Annual Meeting of the Issuer’s stockholders, as applicable (and that it will take such further actions as required by

the Cooperation Agreement with respect to the Designees with respect to such annual meeting); (B) the Designees consent to such re-nomination(s);

and (C) the Reporting Persons agree to the extension of the Expiration Date, then prong (i) shall be deemed to be automatically extended

each such time until the date that is 15 business days prior to the applicable Nomination Notice Deadline(s) applicable to each such subsequent

annual meeting of stockholders of the Issuer at which the Issuer has confirmed it will re-nominate the Designees.

The foregoing description of the

Cooperation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Cooperation

Agreement filed as Exhibit 99.1 hereto.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On March 1, 2023, the Reporting

Persons and the Issuer entered into the Cooperation agreement as defined and described in Item 4 above and attached as Exhibit 99.1 hereto.

Other than as described herein,

there are no contracts, arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and

any other person, with respect to the securities of the Issuer.

| Item 7. | Material to be Filed as Exhibits. |

| 99.1 | Cooperation Agreement, dated March 1, 2023, by and among Achieve Life Sciences, Inc., Dialectic Capital

Management, LP and the other parties set forth on the signature pages thereto |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: March 6, 2023

| |

Dialectical Capital Management, LP

Dialectic Partners, LLC

Dialectic Life Sciences SPV LLC

Dialectic LS Manager LLC

John Fichthorn |

| |

|

| |

By: |

/s/ John Fichthorn |

| |

|

Name: |

John Fichthorn |

| |

|

Title: |

Authorized Signatory |

This regulatory filing also includes additional resources:

ex991to13da107609011_030623.pdf

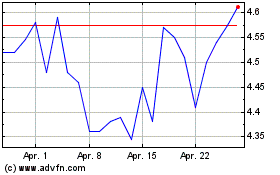

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024