TIDMSGE

RNS Number : 1915N

Sage Group PLC

19 January 2023

The Sage Group plc

Trading update for the three months ended 31 December 2022

The Sage Group plc (FTSE: SGE), the leader in accounting,

financial, HR and payroll technology for small and mid-sized

businesses, today issues a trading update for the three months

ended 31 December 2022[1].

Jonathan Howell, Chief Financial Officer, commented:

"Sage has made a strong start to the year, in line with our

expectations, as Sage Business Cloud solutions help more customers

improve their productivity and resilience. While we are mindful of

the current macroeconomic environment, we remain confident in our

strategy for delivering efficient growth and we reiterate our

guidance for the full year, as set out in our FY22 results

announcement."

Organic

Underlying Revenue Performance[2] Q1 23 Q1 22 % Growth % Growth

---------

Revenue by Category

Recurring Revenue GBP517m GBP460m +12% +12%

Other Revenue (SSRS[3]) GBP23m GBP33m -29% -27%

--------- --------- --------- ----------

Total Revenue GBP540m GBP493m +10% +9%

Recurring Revenue by Region

North America GBP235m GBP198m +18% +16%

UKIA GBP151m GBP135m +12% +10%

Europe GBP131m GBP127m +3% +6%

Recurring Revenue by Portfolio

Future Sage Business Cloud Opportunity GBP479m GBP422m +14% +13%

of which Sage Business Cloud GBP390m GBP298m +31% +28%

Non-Sage Business Cloud GBP38m GBP38m 0% +1%

--------- --------- --------- ----------

Recurring revenue increased by 12% to GBP517m, underpinned by a

31% rise in Sage Business Cloud revenue to GBP390m. Software

subscription revenue grew by 18% to GBP422m (Q1 22: GBP357m),

resulting in subscription penetration of 78% (Q1 22: 73%).

Regionally, in North America recurring revenue increased by 18%

to GBP235m, with a strong performance from Sage Intacct alongside

growth in cloud connected products. In the UKIA region, recurring

revenue grew by 12% to GBP151m, driven by continued success in

cloud native solutions including Sage Intacct and Sage Accounting,

together with growth in Sage 50 cloud connected. In Europe,

recurring revenue increased by 3% to GBP131m, with growth across

the Sage Business Cloud portfolio partly offset by the disposal of

the Swiss business in FY22. Organic recurring revenue growth, which

excludes the disposal impact, was 6%.

In terms of recurring revenue by portfolio, the Future Sage

Business Cloud Opportunity (products within, or to be migrated to,

Sage Business Cloud) grew by 14% to GBP479m. This was driven by 45%

growth in cloud native recurring revenue (35% on an organic basis)

to GBP141m (Q1 22: GBP98m) primarily through new customer

acquisition, as well as further growth in cloud connected supported

by migrations. Sage Business Cloud penetration increased to 81% (Q1

22: 71%), enabling more customers to connect to Sage's digital

network.

Other revenue (SSRS) decreased by 29% to GBP23m, in line with

our strategy to transition away from licence sales and professional

services implementations.

Total revenue increased by 10% to GBP540m. On an organic basis

(excluding the impact of M&A), total revenue growth was 9%.

Foreign exchange

Sterling has weakened against the US Dollar and the Euro,

leading to an exchange rate tailwind.

Analyst and investor conference call

Jonathan Howell will host a webcast and conference call today at

8.30am UK time. The webcast can be accessed via the following link:

https://edge.media-server.com/mmc/p/vjzkrh3f . To join the

conference call, please register via:

https://register.vevent.com/register/BI5f4628e0a0484ad5935bb75b71c977a2

.

Enquiries

Sage +44 (0) 77721 599502

Jonathan Howell, Chief Financial Officer

James Sandford, Investor Relations

David Ginivan, Corporate PR

FGS Global +44 (0) 20 7251 3801

Conor McClafferty

Sophia Johnston

About Sage

Sage exists to knock down barriers so everyone can thrive,

starting with the millions of small and mid-sized businesses (SMBs)

served by us, our partners and accountants. Customers trust our

finance, HR and payroll software to make work and money flow. By

digitising business processes and relationships with customers,

suppliers, employees, banks and governments, our digital network

connects SMBs, removing friction and delivering insights. Knocking

down barriers also means we use our time, technology and experience

to tackle digital inequality, economic inequality and the climate

crisis.

[1] In line with Sage's financial reporting changes announced on

8 December 2022, all figures are on an underlying basis unless

otherwise stated. In terms of regional reporting, UKIA comprises

Northern Europe (UK & Ireland), Africa & APAC, and Europe

comprises France, Central Europe & Iberia.

[2] Underlying and organic results are presented on a constant

currency basis, while organic growth also excludes the impact of

M&A. Underlying and organic measures are defined on pages

289-290 of Sage's FY22 Annual Report.

[3] Software and software-related services.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFLFUAEDSEEF

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

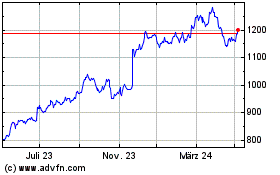

Sage (LSE:SGE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sage (LSE:SGE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024