Sage Group PLC Update on financial reporting (9821I)

08 Dezember 2022 - 8:00AM

UK Regulatory

TIDMSGE

RNS Number : 9821I

Sage Group PLC

08 December 2022

Update on financial reporting

8 December 2022

As announced in Sage's FY22 results on 16 November 2022, Sage

intends to evolve its financial reporting by giving greater

emphasis to underlying revenue and profit measures, and by amending

the presentation of its regional reporting. These changes will be

introduced in Sage's Q1 23 trading update, and will apply to Sage's

future financial reporting. Further details are set out below.

To facilitate comparison with prior periods, the appendix to

this announcement sets out key reporting figures for FY22

reflecting these changes. Sage's primary annual and interim

financial statements and notes to the accounts will not be

impacted.

Focus on underlying measures

In addition to statutory financial reporting measures, Sage also

provides non-GAAP Alternative Performance Measures (APMs) including

underlying and organic measures, to help assess financial

performance. Underlying measures allow management and investors to

understand the performance of the Group on a constant currency

basis excluding recurring and non-recurring items, while organic

measures also adjust for the impact of acquisitions and disposals

[1] .

Going forward, Sage will provide financial metrics and analysis

including the breakdown of revenue by category, by strategic

product portfolio and by region, together with Annualised Recurring

Revenue (ARR), on an underlying basis alongside organic growth

rates. Sage Business Cloud penetration and subscription penetration

will also be provided on an underlying basis. Previously this

information was provided primarily on an organic basis. Certain

organic revenue and profit measures including recurring and total

revenue by region will continue to be provided in the interim and

full year results.

Sage believes that these changes will enable a clearer

understanding of both the organic and inorganic performance of the

Group.

Change to regional reporting

Sage also intends to amend the presentation of its regional

reporting, to reflect recent changes to the way in which the Group

manages its operations. Going forward, Sage will report performance

across the following regions: North America, comprising the US,

Sage Intacct and Canada; UKIA, comprising Northern Europe (UK &

Ireland) and Africa & APAC; and Europe, comprising France,

Central Europe and Iberia.

Enquiries: Sage: +44 (0) 7721 599502 FGS Global: +44 (0) 20 7251 3801

James Sandford, Investor Conor McClafferty

Relations

David Ginivan, Corporate Sophia Johnston

PR

APPENDIX - FY22 underlying measures [2]

Underlying measures (GBPm) Q1 22 H1 22 Q3 22 FY 22

YTD

Recurring revenue by portfolio

[3]

Cloud native 90 191 308 435

Cloud connected 190 385 589 842

Sage Business Cloud 280 576 897 1,277

Products with potential to migrate 117 228 343 426

Future Sage Business Cloud

Opportunity 397 804 1,240 1,703

Non-Sage Business Cloud 35 70 105 142

Recurring revenue by region

North America 174 357 562 787

UKIA [4] 134 273 417 568

Europe 124 244 366 490

Recurring revenue by category

Software subscription 337 688 1,064 1,464

Other recurring 95 186 281 381

Total recurring revenue 432 874 1,345 1,845

Other revenue (SSRS) 31 61 84 104

Total revenue 463 935 1,429 1,949

Underlying operating profit 183 377

Annualised Recurring Revenue

(ARR) 1,809 2,057

of which cloud native 448 560

------ ------ ------ ------

Breakdown of revenue by region

Recurring revenue Total revenue

Underlying measures (GBPm) H1 22 FY 22 H1 22 FY 22

--------- --------- ------- -------

North America

US 305 674 323 704

o f which Sage Intacct 102 231 105 237

Canada 52 113 54 115

UKIA

Northern Europe (UK & Ireland) 208 428 212 434

Africa and APAC 65 140 72 153

Europe

France 128 258 136 273

Central Europe 56 112 71 136

Iberia 60 120 67 134

--------- --------- ------- -------

[1] APMs including underlying and organic measures are defined

in Appendix 1 (on pages 13 and 14) of Sage's FY22 full year results

announcement, dated 16 November 2022.

[2] The figures set out above are provided at FY22 exchange

rates. In line with Sage's APM definitions, they will be

retranslated at current period exchange rates when reported as

comparator figures during FY23, to enable the Group's performance

to be assessed on a constant currency basis.

[3] As Other revenue (SSRS) now accounts for only 5% of total

revenue, the breakdown of revenue by strategic product portfolio

will only be provided on a recurring revenue basis going

forward.

[4] United Kingdom, Ireland, Africa and APAC

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFFAFFLDIIF

(END) Dow Jones Newswires

December 08, 2022 02:00 ET (07:00 GMT)

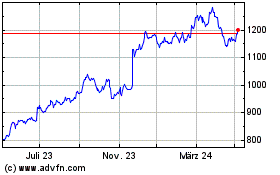

Sage (LSE:SGE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sage (LSE:SGE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024