Sage survey of 13,000+ businesses finds strong long-term optimism, but short-term barriers put this confidence in jeopardy

04 März 2022 - 3:00PM

Small and mid-sized businesses (SMBs) – which represent two-thirds

of global jobs and over half of global GDP – remain resilient and

confident in the face of current market challenges. However, these

companies warn of rising costs and the need for more government

support and better financing options to weather these conditions

over the next twelve months.

This is according to new research commissioned by Sage, the

leader in accounting, financial, HR, and payroll technology for

SMBs. Titled Small Business, Big Opportunity?, the

report is the largest study of its kind looking into how SMBs are

surviving and thriving despite current public health, economic, and

societal challenges – including rising costs of living and the

ongoing impact of the pandemic. Sage commissioned the study to look

at the confidence of SMBs, surveying more than 13,000 businesses

across eleven countries worldwide to understand their experience

during the COVID-19 pandemic and their outlook for the future.

Key themes that emerged from the study include:

- SMBs are a critical engine for overcoming global economic

challenges, but they are not invincible and still face

headwinds

- The majority of SMBs believe that the aftermath of the pandemic

can be an opportunity to promote more sustainable development

- COVID-19 has unleashed a new generation of toughened-up

entrepreneurs

Looking at responses from the more 2,000 U.S.-based businesses

versus the overall global average, the survey found:

- Confidence among U.S. decision-makers is higher than average

regarding the upcoming 12 months, whereby almost three quarters

(73%) feel confident about the success of their business – four

percentage points higher than the global average (69%).

- In terms of revenue over the next six months, SMB

decision-makers in the U.S. are more positive than the global

average. A majority (54%) expect their revenue to increase,

compared to just 49% on a global level.

- Moreover, 54% also expect to see their employee numbers

increase over the next year, which is significantly higher than the

global average of 46%. This includes as many as 22% who expect to

see a significant increase, while only 13% of SMBs globally expect

the same.

“The incredible contribution of SMBs to global prosperity,

recovery and growth cannot be overlooked. Similarly, their

confidence cannot be taken for granted,” said Steve Hare, Sage

Group CEO. “Governments need to keep small and mid-sized businesses

at the forefront of decision-making, and to implement policies that

knock down the barriers that stand in their way so that they can

fulfil their potential.”

“If we leave small and mid-sized businesses behind, we put the

global economic recovery at risk,” added Aziz Benmalek, Sage’s EVP

of Partners & Alliances and the interim President of Sage North

America. “Be it rising costs and inflation, skills shortages, or

lack of access to finance, we need to make sure that the businesses

at the core of the economy are given the right resources and

support to survive and thrive in the year ahead.”

Key global findings from the research include:

Rising costs and concerns about inflation are keeping

businesses up at night

- Over a third of businesses are still not operating as normal

due to the pandemic and are now facing the prospect of further

challenges

- Approximately four-in-ten businesses (39%) expect rising

inflation and cost pressures (including rising rent and utilities)

to persist as the main risks to their business in the year ahead,

significantly impacting growth prospects

- Nearly 10% of SMBs, representing more than 6.1 million jobs in

the markets surveyed, are at risk of disappearing completely

However, business confidence remains strong globally,

despite – and often because of – ongoing pandemic

pressuresMost businesses globally feel more resilient and

better prepared to overcome major barriers now than before the

pandemic because of the adaptations they have made over the period,

including investment in technology

- 69% of business decision makers feel confident that their

company will be successful 12 months from now, compared to 58% that

felt confident this time last year

- Optimism is starting to filter through into profitability, with

four in five (81%) SMBs expecting to be at least somewhat back to

pre-pandemic levels of profitability

- By sector, the businesses that are most optimistic about their

success 12 months from now are in the nonprofit, healthcare,

education, financial services, construction and technology

industries

SMBs expect to increase hiring and remain optimistic

about staffing over the next twelve months

- Nearly half (46%) of businesses surveyed expect to hire more

people in 2022 – on average, SMBs expect their workforce to

increase by 12%

- This could lead to the creation of a potential 3.8 million new

jobs, including 1.6 million jobs in the United States

- 35% of SMBs saw their workforce shrink in the previous year but

65% are confident that they will be able to meet their staffing

needs over the next 12 months

Government and financial support are crucial to business

survival

- Government support was identified as the single most important

resource to contribute to SMB growth over next 12 months (31%),

with financing (25%), including bank loans and grants, and better

management of cash flow (25%) also noted as key factors to

success

- One in five highlighted lack of government support as a key

challenge over the past twelve months

- The businesses that received government financial support (21%)

feel more resilient and better prepared than those that did not

receive funding

A majority want to seize the opportunity for more

sustainable development

- 86% of SMBs expect to make a change to become more sustainable

in the year ahead, with companies founded during COVID more likely

to make this change

- Over half of SMBs (55%) identified sustainability as being

important to their business, with 17% describing it as central to

what they do

- Around 80% are feeling pressure to reduce their environmental

impact, with pressure coming from customers (31%), the government

(25%), employees (24%) and the supply chain (22%)

- A majority of SMBs believe that the aftermath of the pandemic

can be an opportunity to promote more sustainable development in

their countries and local communities

Out of the darkness, a new generation of confident

business owners has emergedBusinesses founded during the

pandemic report larger-than-average barriers to success, but remain

more confident about the growth they can achieve in the upcoming

year

- 42% of businesses founded during the pandemic were by young

people (aged 18-34), with the principal decision makers more likely

to be men (61%)

- These ‘Generation COVID’ businesses are much more adaptable,

with less than one-third stating that the pandemic negatively

impacted their operations

- These ‘Generation COVID’ companies are more confident they will

generate revenue growth in the next six months (57%) vs. those

founded pre-pandemic (48%)

- However, in comparison to businesses founded pre-pandemic,

fewer ‘Generation COVID’ SMBs are satisfied when it comes to their

current staffing levels (56% vs. 65%), ability to recruit talent

(51% vs. 58%), and productivity (58% vs. 68%)

Survey Methodology A specialist research team

from Portland Communications conducted an online survey involving

13,118 SMB decision makers between November 25 and December 2,

2021. The markets included as part of this study are in the UK,

U.S., France, Spain, Germany, Canada, Australia, South Africa,

Portugal, Malaysia, and Singapore. In each market, decision makers

at businesses employing fewer than 250 people were targeted.

Portland Communications’ online polling studies are accredited

by the British Polling Council. All data gathered is of a

publishable quality.

Click here to access to the full report and regional

findings.

Media contact:Peter

Olsonpeter.olson@sage.com408-878-0951

About SageSage exists to knock down barriers so

everyone can thrive, starting with the millions of small- and

mid-sized businesses served by us, our partners, and accountants.

Customers trust our finance, HR, and payroll software to make work

and money flow. By digitizing business processes and relationships

with customers, suppliers, employees, banks, and governments, our

digital network connects SMBs, removing friction and delivering

insights. Knocking down barriers also means we use our time,

technology, and experience to tackle digital inequality, economic

inequality, and the climate crisis. Learn more at

www.sage.com/en-us/ and www.sageintacct.com.

Sage (LSE:SGE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

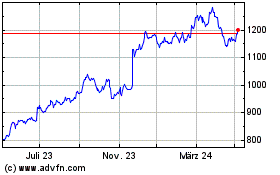

Sage (LSE:SGE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024