indie Semiconductor and Thunder Bridge Acquisition II, Ltd. Announce Closing of Business Combination

10 Juni 2021 - 10:30PM

Business Wire

indie To

Begin Trading on Nasdaq June 11, 2021 as "INDI"

indie Semiconductor, an Autotech solutions innovator, and

Thunder Bridge Acquisition II, Ltd. (Nasdaq: THBR), a special

purpose acquisition company, today announced the completion of

their previously announced business combination. The combined

company will retain the indie Semiconductor name with its common

stock and warrants to commence trading on Nasdaq under the new

ticker symbols “INDI” and “INDIW”, respectively, on June 11, 2021.

The business combination was approved at a special meeting of

Thunder Bridge Acquisition II’s shareholders on June 9, 2021.

“The completion of our business combination with Thunder Bridge

Acquisition II marks an extraordinary milestone for indie,” said

Donald McClymont, indie’s Co-founder and CEO. “We founded indie

back in 2007 on the simple concept of addressing the need for

innovative semiconductor system solutions. Today we are a rapidly

growing public company focused on the automotive industry with a

global footprint and key relationships with leading Tier 1

customers and OEMs. Our advanced technologies are helping to

re-architect tomorrow’s vehicle today, solving the step function

increase in electronic performance and complexity demanded by our

customers to improve safety, facilitate seamless data connectivity,

enhance the user experience and accelerate electrification. Looking

ahead, we are well positioned to capitalize on our existing design

win pipeline, drive scale and further consolidate within Autotech

while creating shareholder value.”

“We are delighted to close our merger with the indie team,” said

Gary Simanson, President and CEO of Thunder Bridge Acquisition II.

“indie has established an industry-leading franchise, and by virtue

of our combination, will have the financial firepower to accelerate

its strategic growth initiatives and create an Autotech pureplay

powerhouse. Thunder Bridge's focus on high growth technology

businesses combined with our proven ability to provide substantial

equity capital from the SPAC sponsor, IPO investors and PIPE

participants brought significant value to this transaction. Whether

in the growing market for financial technology, such as REPAY

(Nasdaq: RPAY), or in the burgeoning market for automotive

technology such as indie Semiconductor (Nasdaq: INDI), the Thunder

Bridge SPAC team is committed to its investors and helping strong

operating companies realize their strategic objectives, access

public capital markets and create long term shareholder value.”

The business combination is expected to result in gross proceeds

of approximately $400 million to indie at closing, net of Thunder

Bridge Acquisition II’s shareholder redemptions.

In addition to Donald McClymont, following completion of the

business combination, indie will retain its experienced management

team including Ichiro Aoki, Co-founder and President; Scott Kee,

Co-founder and Chief Technology Officer; Thomas Schiller, Chief

Financial Officer and EVP of Strategy; Ellen Bancroft, General

Counsel, and Steve Machuga, Chief Operating Officer.

About indie

indie is empowering the Autotech revolution with next generation

automotive semiconductors and software platforms. We focus on edge

sensors for Advanced Driver Assistance Systems including LiDAR,

connected car, user experience and electrification applications.

These technologies represent the core underpinnings of both

electric and autonomous vehicles, while the advanced user

interfaces transform the in-cabin experience to mirror and

seamlessly connect to the mobile platforms we rely on every day. We

are an approved vendor to Tier 1 partners and our solutions can be

found in marquee automotive OEMs around the world. Headquartered in

Aliso Viejo, CA, indie has design centers and sales offices in

Austin, TX; Boston, MA; Detroit, MI; San Francisco and San Jose,

CA; Budapest, Hungary; Dresden, Germany; Edinburgh, Scotland and

several locations throughout China.

Please visit us at www.indiesemi.com to learn more.

About Thunder Bridge Acquisition II, Ltd.

Thunder Bridge Acquisition II, Ltd. is a blank check company

formed for the purpose of effecting a merger, share exchange, asset

acquisition, stock purchase, reorganization or similar business

combination with one or more businesses. In August 2019, Thunder

Bridge Acquisition II, Ltd. consummated a $345 million initial

public offering of 34.5 million units (reflecting the underwriters’

exercise of their over-allotment option in full), each unit

consisting of one Class A ordinary shares and one-half warrant,

each whole warrant enabling the holder thereof to purchase one

Class A ordinary share at a price of $11.50 per share.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include, but are not limited to, statements

regarding our future operating results and benefits of the business

combination, and other statements identified by words such as “will

likely result,” “are expected to,” “will continue,” “is

anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. Such

forward-looking statements are based upon the current beliefs and

expectations of our management and are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are difficult to predict and generally

beyond our control. Actual results and the timing of events may

differ materially from the results anticipated in these

forward-looking statements. In addition to factors previously

disclosed in Thunder Bridge Acquisition II’s reports filed with the

SEC (including those identified under “Risk Factors” therein) and

those identified elsewhere in this communication, the following

factors, among others, could cause actual results and the timing of

events to differ materially from the anticipated results or other

expectations expressed in the forward-looking statements: our

ability to develop, market and gain acceptance for new products;

the availability of semiconductors and manufacturing capacity;

competitive products and pricing pressures, and economic

instability in our target markets; indie’s future capital

requirements and sources and uses of cash; indie’s ability to

obtain funding for its operations and future growth; changes in the

market for indie’s products and services; expansion plans and

opportunities; the above-average industry growth of product and

market areas that indie has targeted; indie’s plan to increase

revenue through the introduction of new products within its

existing product families as well as in new product categories and

families; the cyclical nature of the semiconductor industry;

indie’s ability to successfully introduce new technologies and

products; the demand for the goods into which indie’s products are

incorporated; indie’s ability to accurately estimate demand and

obtain supplies from third-party producers; indie’s ability to win

competitive bid selection processes; the outcome of any legal

proceedings that may be instituted against indie or Thunder Bridge

II following the Business Combination and transactions contemplated

thereby; the inability to maintain the listing of the Class A

common stock of the Company on Nasdaq following the Business

Combination; the risk that the Business Combination disrupts

current plans and operations; the ability to recognize the

anticipated benefits of the Business Combination, which may be

affected by, among other things, competition, and the ability of

the Company to grow and manage growth profitably; costs related to

the Business Combination. indie cautions that the foregoing list of

factors is not exclusive.

All information set forth herein speaks only as of the date

hereof, and we disclaim any intention or obligation to update any

forward-looking statements as a result of developments occurring

after the date of this communication except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210610005944/en/

Media and Investor Contacts indie

Semiconductor Media Inquiries Pilar Barrigas 949-608-0854

media@indiesemi.com

Investor Relations ir@indiesemi.com

Thunder Bridge Acquisition II Gary

Simanson (202) 431-0507

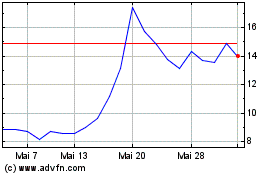

Indus Gas (LSE:INDI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

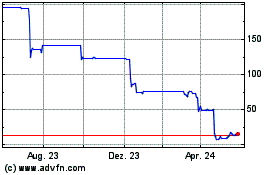

Indus Gas (LSE:INDI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024