TIDMBOR

RNS Number : 6118D

Borders & Southern Petroleum plc

04 March 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO ANY MEMBER STATE

OF THE EUROPEAN ECONOMIC AREA, THE UNITED STATES (OR TO ANY U.S.

PERSON), CANADA, JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, OR

ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION

OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION EU NO. 596/2014, AS

RETAINED AND APPLICABLE IN THE UK PURSUANT TO SECTION 3 OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018, UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

4 March 2022

Borders & Southern Petroleum plc

("Borders & Southern" or the "Company")

Proposed Subscription and Open Offer to raise up to

approximately US$1.8 million (GBP1.35 million)

Borders & Southern (AIM: BOR), a London-based independent

oil and gas exploration company, is pleased to announce its

intention to undertake a fundraising:

- of approximately US$600,000 (approximately GBP450,000) before

expenses by way of direct subscription (the "Subscription") for

34,702,000 new ordinary shares (the "Subscription Shares"); and

- of up to approximately US$1.2 million (approximately

GBP900,000) before expenses by way of an open offer (the "Open

Offer") of up to 69,156,926 new ordinary shares (the "Open Offer

Shares")

at an issue price of 1.3 pence per new ordinary share (the

"Issue Price") (the Subscription and Open Offer together the

"Fundraising"; the Subscription Shares and the Open Offer Shares

together the "New Ordinary Shares").

The Chairman, Harry Dobson, is the sole participant in the

Subscription and has agreed to invest approximately US$600,000

(approximately GBP450,000) in new Ordinary Shares by subscribing

for all of the Subscription Shares through the Subscription [1] .

The Chairman is a "related party" under the AIM Rules for Companies

and, accordingly, his participation in the Subscription constitutes

a related party transaction for the purposes of Rule 13 of the AIM

Rules. The other Directors, being Howard Obee, Peter Fleming and

William Hodson are not participating in the Fundraising and are

therefore deemed to be independent Directors for the purposes of

the Fundraising. Such other Directors, having consulted with Strand

Hanson Limited, the Company's nominated adviser, are of a view that

the terms of the Subscription are fair and reasonable in so far as

the Company's shareholders (the "Shareholders") are concerned.

As part of the Fundraising, the Company proposes to raise

further funds of up to US$1.2 million (approximately GBP900,000) by

the issue of up to 69,156,926 new Ordinary Shares pursuant to an

Open Offer to qualifying Shareholders at the Issue Price, thereby

implying an allocation of 1 new Ordinary Share for every 7 Ordinary

Shares held.

The New Ordinary Shares issued pursuant to the Fundraising will

be issued as fully paid and will rank pari passu in all respects

with each other and with the Company's existing ordinary shares

(the "Ordinary Shares") from their admission to trading on AIM,

assuming the Fundraising is approved by Shareholders.

In the event that the exchange rate of British Pounds Sterling

to United States Dollars fluctuates significantly before the date

of a Circular relating to the Fundraising (the "Circular"), the

number of New Ordinary Shares to be issued may change ([2]) .

The Fundraising is subject to approval by Shareholders at the

General Meeting, the details of which will be announced and the

associated circular posted to shareholders shortly. The

Subscription is conditional, inter alia, on admission of the

Subscription Shares to trading on AIM becoming effective, the

agreement governing the Open Offer not being terminated in

accordance with its terms and the passing of the Resolutions by

Shareholders at the General Meeting. The Open Offer is conditional

on admission of the shares to be issued pursuant to the Open Offer

to trading on AIM becoming effective, the Subscription having

become unconditional and the passing of the Resolutions by

Shareholders at the General Meeting.

The net proceeds of the Fundraising will be used to enable the

Company to continue to explore the best options to appraise and

develop its Darwin gas/condensate discovery, as well as for general

working capital purposes.

Assuming the Open Offer is fully subscribed for, the New

Ordinary Shares issued (pursuant to the Subscription and the Open

Offer) will represent up to approximately 21 per cent. of the

Company's currently issued share capital. The Issue Price of 1.3

pence per New Ordinary Share represents a discount of approximately

25 per cent. to the closing mid-market price of 1.73 pence per

Ordinary Share on 3 March 2022.

For further information please visit www.bordersandsouthern.com

or contact:

Borders & Southern Petroleum plc

Howard Obee, Chief Executive

Tel: 020 7661 9348

Strand Hanson Limited (Nominated & Financial Adviser and Joint Broker)

Ritchie Balmer / James Bellman

Tel: 020 7409 3494

Auctus Advisors LLP (Joint Broker)

Jonathan Wright

Tel: 07711 627449

Tavistock (Financial PR)

Simon Hudson / Nick Elwes

Tel: 020 7920 3150

Notes to Editors:

Borders & Southern Petroleum plc is an oil & gas

exploration company listed on AIM, a market operated by the London

Stock Exchange (AIM: BOR). The Company operates and has a 100%

interest in three Production Licences in the South Falkland Basin

covering an area of nearly 10,000 square kilometres. The Company

has acquired 2,517 square kilometres of 3D seismic data and has

drilled two exploration wells, making a significant gas condensate

discovery with its first well.

[1] These shares will be held in the same manner as the existing

Company shares in which the Chairman is interested.

[2] Sterling figures in this announcement are based on the daily

spot rate of 2 March 2022 of GBP1.00:US$1.33 published by the Bank

of England.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKXLFBLXLXBBQ

(END) Dow Jones Newswires

March 04, 2022 02:00 ET (07:00 GMT)

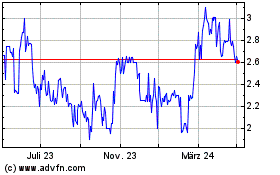

Borders & Southern Petro... (LSE:BOR)

Historical Stock Chart

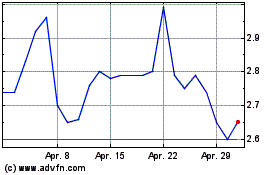

Von Mär 2024 bis Apr 2024

Borders & Southern Petro... (LSE:BOR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024