U.S. Existing Home Sales Decline For Eighth Straight Month In September

20 Oktober 2022 - 12:34PM

RTTF2

A report released by the National Association of Realtors on

Thursday showed a continued decrease in U.S. existing home sales in

the month of September.

NAR said existing home sales slid 1.5 percent to an annual rate

of 4.71 million in September after falling by 0.8 percent to a

revised rate of 4.78 million in August.

Economists had expected existing home sales to slump by 2.1

percent to a rate of 4.70 million from the 4.80 million originally

reported for the previous month.

Existing home sales declined for the eighth consecutive month,

falling to their lowest level since spring of 2020.

"The housing sector continues to undergo an adjustment due to

the continuous rise in interest rates, which eclipsed 6% for

30-year fixed mortgages in September and are now approaching 7%,"

said NAR Chief Economist Lawrence Yun. "Expensive regions of the

country are especially feeling the pinch and seeing larger declines

in sales."

The report showed decreases in existing home sales in the

Northeast, Midwest and South, while existing home sales in the West

were unchanged from the previous month.

NAR also said housing inventory at the end of September totaled

1.25 million units, down 2.3 percent from 1.28 million units at the

end of August and down 0.8 percent from 1.26 million units a year

ago.

The unsold inventory represents 3.2 months of supply at the

current sales rate, unchanged from August but up from 2.4 months in

September 2021.

Meanwhile, the report said the median existing home price in

September was $384,800, down 1.8 percent from August but up 8.4

percent year-over-year.

"Despite weaker sales, multiple offers are still occurring with

more than a quarter of homes selling above list price due to

limited inventory," Yun said.

He added, "The current lack of supply underscores the vast

contrast with the previous major market downturn from 2008 to 2010,

when inventory levels were four times higher than they are

today."

The report also showed single-family home sales fell by 0.9

percent to an annual rate of 4.22 million in September, while

existing condominium and co-op sales plunged by 5.8 percent to a

rate or 490,000.

Next Wednesday, the Commerce Department is scheduled to release

a separate report on new home sales in the month of September.

Economists currently expect new home sales to tumble by 5.0

percent to an annual rate of 651,000 in September after soaring by

28.8 percent to a rate of 685,000 in August.

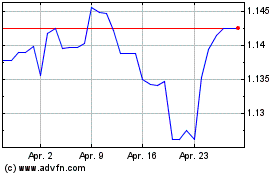

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Apr 2023 bis Apr 2024