Pound Drops Despite Strong U.K. Inflation Data

19 Oktober 2022 - 5:54AM

RTTF2

The pound declined against its major rivals on Wednesday,

despite the release of hotter-than-expected inflation data out of

the U.K.

Data from the Office for National Statistics showed that

consumer prices rose 10.1 percent year-over-year in September,

following a 9.9 percent increase in August. The rate was forecast

to rise to 10 percent.

The CPI increased 0.5 percent month-on-month in September, the

same rate as seen in the previous month. Economists had expected an

increase of 0.4 percent.

Core inflation that excludes energy, food, alcoholic beverages

and tobacco rose to 6.5 percent in September from 6.3 percent in

the previous month. Economists had forecast prices to climb by 6.4

percent.

On a monthly basis, core inflation slowed to 0.6 percent in

September from 0.8 percent in August. The rate was forecast to ease

to 0.5 percent.

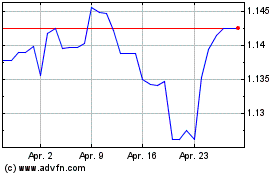

The pound slipped to 168.30 against the yen and 1.1243 against

the franc, down from its early highs of 169.38 and 1.1285,

respectively. The pound is seen finding support around 166.00

against the yen and 1.11 against the franc.

Retreating from its prior highs of 1.1358 against the greenback

and 0.8680 against the euro, the pound weakened to 1.1260 and

0.8720, respectively. The pound is likely to find support around

1.10 against the greenback and 0.90 against the euro.

Looking ahead, Eurozone final inflation data for September is

set for release in the European session.

Canada inflation data and U.S. building permits and housing

starts, all for September, as well as the Fed Beige book report

will be released in the New York session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Apr 2023 bis Apr 2024