Pound Advances As Chancellor Brings Forward Measures From Medium-Term Fiscal Plan

17 Oktober 2022 - 10:09AM

RTTF2

The pound climbed against its major counterparts in the European

session on Monday, as new finance minister Jeremy Hunt announced

that the government would withdraw almost all tax measures of

economic plan to support fiscal sustainability.

The Chancellor announced that the basic rate of income tax would

remain at 20 percent for the time being.

The plan to cut dividend tax by 1.25 percentage points from

April 2023 has been scrapped.

The government would not proceed with the introduction of a new

VAT-free shopping scheme for non-UK visitors to Great Britain.

The Chancellor said that these changes would enable the

government to raise around 32 billion pounds a year.

The pound touched 168.40 against the yen, its highest level

since June 9. The pound may test resistance around the 1.23

region.

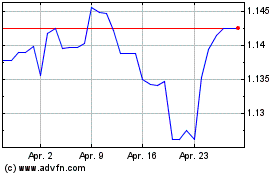

The pound rose to 1.1335 against the franc and 0.8620 against

the euro, off its prior lows of 1.1234 and 0.8686, respectively.

The currency is likely to challenge resistance around 1.22 against

the franc and 0.84 against the euro.

The pound was higher against the greenback, at 1.1331. The pound

is seen facing resistance around the 1.23 level.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Apr 2023 bis Apr 2024