Pound Falls Despite Hopes Of U-turn On U.K. Tax Cut Plan

14 Oktober 2022 - 8:04AM

RTTF2

The pound slipped against its major counterparts in the European

session on Friday, despite optimism over the likelihood of U-turn

on tax cuts in the mini-budget by the U.K. government amid a

turbulence in the markets.

There were reports on Thursday that Prime Minister Liz Truss is

likely to make changes to the mini-budget that fuelled concerns

about financial stability.

Chancellor Kwasi Kwarteng has shortened his trip to the US for

discussions on the financial plans it presented last month.

Gilts and the pound moved up on Thursday on hopes that the

government would reconsider changes to corporation tax.

Britain's trade department minister Greg Hands said that the

Prime Minister and the Chancellor are committed to stick to the

growth plan, contradicting reports that the government could change

some parts of the fiscal plan.

The pound dropped to 1.1230 against the greenback and 166.02

against the yen, off its early highs of 1.1366 and 167.21,

respectively. The pound is poised to challenge support around 1.10

against the greenback and 159.00 against the yen.

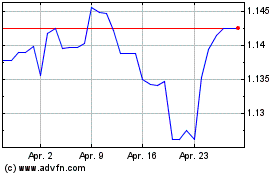

The pound reversed from its prior highs of 1.1345 against the

franc and 0.8617 against the euro, weakening to 1.1241 and 0.8671,

respectively. The pound may locate support around 1.06 against the

franc and 0.88 against the euro.

Looking ahead, Canada manufacturing and wholesale sales for

August, U.S. retail sales and import and export prices for

September, University of Michigan's preliminary U.S. consumer

sentiment index for October and business inventories data for

August are set for release in the New York session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Apr 2023 bis Apr 2024