Pound Rebounds As U.K. Services PMI Beats Forecast

23 August 2022 - 10:31AM

RTTF2

The pound erased its early losses against its major counterparts

in the European session on Tuesday, as U.K. service sector activity

rose more than expected in August.

Flash survey results from S&P Global showed that the

services Purchasing Managers' Index came in at 52.5 in August,

beating expectations for a score of 52. The reading was 52.6 in

July.

The improvement in the service sector is due to the greater

amounts of new orders and optimism remained that customers would

continue to buy throughout the year.

Eurozone business activity came in better than expectations in

August, further underpinning the risk sentiment.

All eyes are on the Jackson Hole Symposium in Wyoming, where

central bankers across the globe will update their views on

inflation and policy outlook.

The pound recovered to 161.80 against the yen and 1.1783 against

the dollar, from an early 1-week low of 160.80 and a 2-1/2-year low

of 1.1717, respectively. The currency may target resistance around

163.00 against the yen and 1.23 against the dollar.

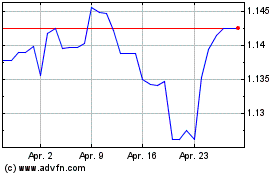

The pound climbed to a 4-day high of 1.1384 against the franc

and a 5-day high of 0.8482 against the euro, up from its early lows

of 1.1303 and 0.8529, respectively. The pound is seen locating

resistance around 1.21 against the franc and 0.82 against the

euro.

Looking ahead, U.S. new home sales for July and Eurozone

consumer sentiment index for August are scheduled for release in

the New York session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Apr 2023 bis Apr 2024