Commodity Currencies Drop After Trump's New Tariff Threats

26 November 2024 - 3:01AM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, after U.S. President-elect Donald Trump

announced a 10 percent additional tariff on all Chinese goods and a

25 percent tariff on imports from Mexico and Canada, raising

concerns over global trade tensions.

This measure was to cut down migrants and illegal drugs flowing

across U.S. borders at levels never seen before, he said.

Traders also seemed reluctant to make more significant moves

ahead to the release of key U.S. economic data later in the week,

including readings on consumer price inflation preferred by the

U.S. Fed.

Weakness in financial and energy stocks amid tumbling crude oil

prices, also weighed on the investor sentiment.

Crude oil prices fell sharply, weighed down by reports that

Israel and Hezbollah are likely to reach a cease-fire agreement

within the next few days. West Texas Intermediate Crude oil futures

for January ended down $2.30 or 3.2 percent at $68.94 a barrel.

In the Asian trading today, the Australian dollar fell to nearly

a 4-month low of 0.6434 against the U.S. dollar and nearly a

2-month low of 99.08 against the yen, from yesterday's closing

quotes of 0.6502 and 100.27, respectively. If the aussie extends

its downtrend, it is likely to find support around 0.63 against the

greenback and 96.00 against the yen.

Against the euro and the NZ dollar, the aussie slipped to a

6-day low of 1.6212 and a 5-day low of 1.1088 from Monday's closing

quotes of 1.6130 and 1.1122, respectively. On the downside, 1.66

against the euro and 1.09 against the kiwi are seen as the next

support levels for the aussie.

The NZ dollar fell to a 1-yr low of 0.5797 against the U.S.

dollar, from yesterday's closing value of 0.5845. The kiwi may test

support near the 0.56 region.

Against the yen and the euro, the kiwi slid to more than a

2-month low of 89.35 and a 1-week low of 1.7997 from Monday's

closing quotes of 90.14 and 1.7951, respectively. If the kiwi

extends its downtrend, it is likely to find support around 88.00

against the yen and 1.82 against the euro.

The Canadian dollar fell to more than a 4-1/2-yr low of 1.4178

against the U.S. dollar and more than a 1-month low of 108.61

against the yen, from yesterday's closing quotes of 1.3986 and

110.24, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.42 against the greenback and 107.00

against the yen.

Against the euro and the Australian dollar, the loonie dropped

to a 6-day low of 1.4788 and a 2-week low of 0.9161 from Monday's

closing quotes of 1.4677 and 0.9094, respectively. The next

possible downside target for the loonie is seen around 1.51 against

the euro and 0.93 against the aussie.

Looking ahead, U.S. building permits for October, house price

index for September, U.S. Consumer Board's consumer confidence for

November, U.S. new home sales for October, U.S. Richmond

manufacturing index for November and Canada wholesale sales data

for October are slated for release in the New York session.

At 2:00 pm ET, the minutes from the Federal Open Market

Committee's Nov. 6-7 meeting will be published.

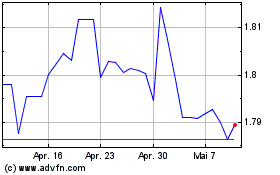

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Okt 2024 bis Nov 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Nov 2023 bis Nov 2024