Pound Slides Amid Weak PMI Data

23 Mai 2023 - 11:39AM

RTTF2

The pound dropped against its major counterparts in the European

session on Tuesday, following the release of weaker-than-expected

private sector activity for May.

Flash survey results from S&P Global and Chartered Institute

of Procurement & Supply showed that the composite output index

dropped to a two-month low of 53.9 in May from 54.9 in April. The

expected score was 54.6.

Nonetheless, any reading above 50 indicates expansion in the

sector.

The Service Purchasing Managers' Index, or PMI, fell to a

two-month low of 55.1 in May from 55.9 in the previous month. The

reading was expected to fall marginally to 55.5.

The manufacturing sector continued to remain in contraction in

May and the corresponding PMI fell to 46.9 from 47.8 in April.

The pound dropped to near a 5-week low of 1.2372 against the

greenback and a 6-day low of 0.8718 against the euro, off its early

highs of 1.2446 and 0.8681, respectively. The pound is seen

challenging support around 1.21 against the greenback and 0.90

against the euro. . The pound edged down to 1.1145 against the

franc and 171.28 against the yen, from an early high of 1.1178 and

more than a 7-year high of 172.62, respectively. Next immediate

support for the currency is seen around 1.10 against the franc and

168.00 against the yen.

U.S. new home sales data for April is slated for release

shortly.

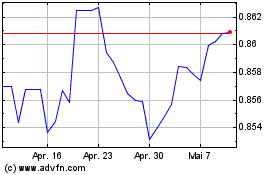

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Apr 2023 bis Apr 2024