Pound Weakens After U.K. Autumn Budget Statement

17 November 2022 - 11:26AM

RTTF2

The pound moved down against its major counterparts in the

European session on Thursday, as U.K. Chancellor of Exchequer

Jeremy Hunt unveiled a package of tax increases and spending cuts

worth £55 billion and said that the economy is already in a

recession.

In the autumn statement, Office for Budget Responsibility has

estimated that borrowing would be 7.1 percent of GDP or £177

billion in this financial year.

The threshold at which higher earners start to pay the 45

percent rate will be reduced to £125,140 from £150,000.

Hunt said that the U.K. is now in recession, but the plan could

lead to a shallower downturn, lower energy bills and higher

long-term growth.

The economy is now forecast to grow by 4.2 percent for this

year, compared to the previous outlook of 3.8 percent growth.

The gross domestic product is expected to contract by 1.4

percent next year, in contrast with a growth of 1.8 percent in the

previous outlook.

The GBP/JPY pair fell to 165.18, from a high of 166.32 seen at 4

am ET. The pound is seen locating support around the 153.00

level.

The GBP/CHF pair retreated to 1.1199, following a 6-day high of

1.1297 seen at 3:30 am ET. On the downside, 1.10 is possibly found

as its next support level.

The GBP/USD pair touched a 2-day low of 1.1763, after hitting a

2-day high of 1.1958 at 3:20 am ET. The pound may test support

around the 1.15 level, if it drops further.

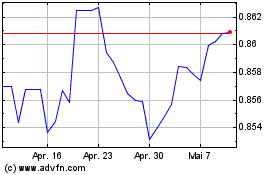

The pound dropped to 0.8769 against the euro, down from a 9-day

high of 0.8695 it logged at 3:25 am ET. The pound is likely to find

support around the 0.89 level.

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Apr 2023 bis Apr 2024